November 9 - International Monetary System

advertisement

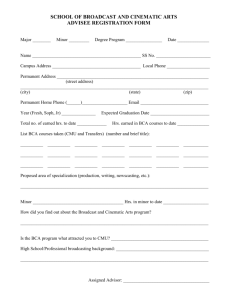

The International Monetary System Evolution of the International Monetary System • Bimetallism: Before 1875 • Classical Gold Standard: 1875-1914 • WWI • Inter-war failures • Post-war policy •Bretton Woods and the dollar standard Price-Specie-Flow Home Foreign Net Flow of Goods and Services The ABCs of International Financial Institutions INTERNATIONAL FINANCIAL INSTITUTIONS IMF International Monetary Fund IBRD International Bank for Reconstruction & Development 1944 IFC International Finance Corporation IDA International Development Association IDB Inter-American Development Bank AFDB African Development Bank ADB Asian Development Bank EBRD European Bank for Reconstruction & Development BIS Bank for International Settlements OECD Org. for Economic Cooperation & Development 1961 UNDP United National Development Program EDF European Development Fund 1944 1956 1961 1960 1964 1966 1991 1930 1945 1975 International Monetary Fund CAD DEM .9250 GBP 2.40 JPY .0028 Par OTHERS .2732 US DOLLAR $35 = 1 oz. GOLD FRF .1800 .0016 ITL Movements in Parities of Currencies of Selected Industrial Countries 120 USD, CHF, JPY 100 DEM BEF 80 NLG DKK 60 GBP ITL 40 FRF 20 0 1947 1950 1955 1960 1965 1970 Conditionality • Explicit commitment that members make to implement remedial measures in return for the IMF's support. • Requires: – Structural adjustment – Government spending & revenue • debts and deficits • military expenditures – Pricing system • exchange & interest rates, wages, commodity prices – Medium-term, credible – Periodic monitoring Post-Bretton Woods Exchange Rate Trends Washington Consensus • Fiscal discipline • A redirection of public expenditure priorities to improving income distribution, such as primary health care, primary education, and infrastructure • Tax reform (to lower marginal rates and broaden the tax base) • Interest rate liberalization • A competitive exchange rate • Trade liberalization – export promotion policies • Liberalization of inflows of foreign direct investment • Privatization • Deregulation (to abolish barriers to entry and exit) • Secure property rights Williamson, John, ed. 1990. Latin American Adjustment: How Much Has It Happened? Washington, D.C.: Institute for International Economics. The Balance of Payments HOME GOODS AND SERVICE SERVICES S FOREIGN Gains from trade GOODS AND SERVICES Inter-temporal trade FDI ASSETS (Currency) ASSETS (Currency) Portfolio diversification Balance of Payments Accounting • The Balance of Payments is the statistical record of a country’s international transactions over a certain period of time presented in the form of double-entry bookkeeping. Balance of Payments • Current Account – measure of the value of imports and exports of goods and services • Capital Account – measure of the value of international purchases and sales of assets – money, stocks, bonds, land, factories Balance of Payments Identity BCA + BKA + BRA = 0 Where: BCA = balance on current account BKA = balance on capital account BRA = balance on the reserves account Under a pure flexible exchange rate regime, BCA + BKA = 0 Balance of Payments • Credit – any transaction resulting in a receipt to a domestic resident from a foreign resident • Debit – any transaction resulting in a payment to a foreign resident from a domestic resident U.S. Balance of Payments Data 2006 Credits Debits Current Account 1 Exports 2 Imports 3 Unilateral Transfers Balance on Current Account Capital Account 4 5 6 7 Direct Investment Portfolio Investment Other Investments Balance on Capital Account Statistical Discrepancies Overall Balance Official Reserve Account $2,096.3 ($2,818.0) $24.4 ($114.0) ($811.3) $180.6 $1,017.4 $690.4 $826.9 ($18) ($235.4) ($426.1) ($400) ($2.4) $2.4 US Balance of Payments (billions $) CURRENT ACCOUNT 1) Exports Merchandise Services Income receipts 2) Imports Merchandise Services Income Payments 3) Net Unilateral Transfers CREDITS DEBITS +1414.9 +773.3 +296.2 +345.4 -1797.1 -1,222.8 -215.2 -359.1 -53.2 Balance on Current Account (1+2+3) -435.4 CAPITAL ACCOUNT 4) US Assets Held Abroad (increase = negative sign) Official reserve assets Other private assets -523.3 -0.3 -523.0 5) Foreign Assets Held in the US (increase = positive sign) +953.1 Official reserve assets +35.9 Other private assets Balance on Financial Account (4+5) +429.8 Statistical Discrepancy - (1+2+3+4+5) +5.6 +917.2 US Official Settlements Balance (billions $) CREDITS CURRENT ACCOUNT 1) Exports 2) Imports 3) Net Unilateral Transfers 4) Balance on Current Account (1+2+3) DEBITS +1,414.9 -1,797.1 -53.2 -435.4 CAPITAL ACCOUNT Non-reserve Financial Account 5) Private US Assets Held Abroad (increase - ) 6) Private Foreign Assets Held in US (increase + ) 7) Balance on Non-reserve Financial Account (5+6) 8) Statistical Discrepancy 9) Official Settlements Balance (4+7+8) -523.0 +917.2 +394.2 +5.6 -35.6 Official Reserve Transactions 10) US Official Assets Held Abroad (increase - ) Gold, SDRs, IMF reserves, Foreign currencies 11) Foreign Official Assets Held in US (increase + ) -0.3 +35.9 US govt securities and liabilities 12) Balance of Official Reserve Transactions (10+11) +35.6 Balance of Payments Trends in Major Countries 1982-2006 Balance of Payments 1000 China BCA China BKA 500 0 1982 Japan BCA Japan BKA Germany BCA 1987 1992 1997 -500 2002 2007 Germany BKA UK BCA UK BKA -1000 U.S. BCA Year Source: IMF International Financial Statistics Yearbook, various issues U.S. BKA