Company overview

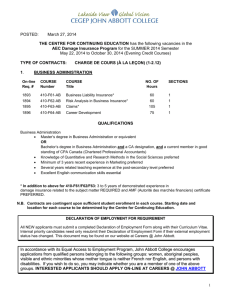

advertisement

Abbott Laboratories Shih-Yi Chang, Richie Hartz, Anastasia Sutjahjo Nov.27,2012 Agenda • • • • • • Introduction Company Overview Macroeconomic & Industry Review Equity Performance Financial Analysis & Projections Recommendation Current Holding April 2011 Acquired 200 shares @ $52.10 November 2011 Acquired 100 shares @ $52.91 November 23, 2012 Current position: 300 shares @ $64.47/share Market value: $19,341 15% of the total portfolio Company overview Abbott Laboratories Abbott Laboratories is a diversified pharmaceuticals and healthcare products company. Abbott was founded in 1900 and went public in 1929. Major operations in the US, the Netherlands, Germany, Japan, Italy, France, Canada, the UK and Spain. The company primarily operates in five segments: proprietary pharmaceutical products, nutritional products, established pharmaceutical products, diagnostic products, and vascular products. Proprietary pharmaceutical The proprietary pharmaceutical division is composed of a variety of branded pharmaceutical products currently covered by patents. These products are sold under various brands that include Humira,TriCor, TriLipix, Simcor, Niaspan, Synagis, AndroGel, Creon, Synthroid, Zemplar, Lupron, Ultane and Kaletra Management has announced that this segment will be its own publically traded company by the end of 2012, named AbbVie. Company overview Established Pharmaceuticals The established pharmaceutical products segment includes a broad line of branded generic products. These products are no longer protected by patents and face increased competition from generic manufacturers. Vascular Products The vascular products segment manufactures, markets, and sells a wide range of coronary, endovascular, vessel closure, and structural heart devices for the treatment of vascular diseases. Nutritionals Manufactures and markets a line of pediatric and adult nutritional products. These products are distributed to wholesalers, retailers, health care facilities, and government agencies under a variety of names. Diagnostic Products The diagnostic products segment is engaged in manufacturing, marketing, and selling of diagnostic systems and tests Industry overview Aging population and increasing incidence of chronic disease will increase the demand of pharmaceutical industry. The percentage of world population over the age of 60 is projected to grow from 11% in 2010 to 21.8% in 2050. Source: US Bureau of the Census Industry overview US unemployment rate As the economy has improved, the unemployment rate has continue to drop, reaching 7.9% in October 2012 Nearly 60% of US workers receive health insurance from their employers, and as unemployment rate drops, more individuals become covered. As the number of the US workers and families with health insurance increases, the demand for pharmaceutical products and nutritional products increase. Source: US Bureau of Labor Statistics Industry overview New Geographic bases: “Pharmerging markets” –China, India, Brazil, Russia, Turkey, Mexico, and South Africa are forecast to drive industry growth to 2020. Chinese government implement its policy to significant expand healthcare system and will replace Japan as the world’s second-biggest market for drugs after the US by 2016 Source: http://www.imshealth.com/ims/Global/Content/Corporate/Press%20Room/IMS%20i n%20the%20News/emerging_markets_seven_keys_to_kingdom2.pdf Industry overview By 2014, IMS predicts the “pharmerging 17” will match the size of Europe and Japan combined, adding $140 billion of incremental sales Emerging markets represent a great opportunity for Abbott Source: http://www.imshealth.com/ims/Global/Content/Corporate/Press%20Room/IMS%20i n%20the%20News/emerging_markets_seven_keys_to_kingdom2.pdf Industry overview Federal funding for Medicare and Medicaid The patent cliff in 2011 began hurting is expected to decrease during 2012 revenue in 2012 and threatens future sales. Healthcare reform is expected to boost sales Funding for prescription drugs is expected to increase by 2013, representing an as more individuals gain prescription drug opportunity for the industry. coverage in 2014. Source: IBIS, Brand name pharmaceutical manufacturing in the US Industry overview In the next few years, numerous patents on blockbuster drugs will expire. The brand name pharmaceutical manufacturing will face the loss of patent protection and competition from generic drugs manufacturing firms. When faced with potential revenue decrease from loss of patent protection, majors players in the industry started to adopt new business models: 1. Cost down 2. Use of new technology 3. Product diversification 4. Strategic alliance. Source: http://www.pppmag.com/documents/V6N9GenericDrugsSupp/p8_9.pdf Industry overview Unit: USD, thousand Company 2011 Revenue 2011 R&D Cost R&D/Revenue(%) Abbot Laboratories 38,851,259 4,129,414 10.63% Johnson& Johnson 65,030,000 7,548,000 11.61% Pfizer 67,425,000 9,112,000 13.51% Merck 48,047,000 8,467,000 17.62% Brand name pharmaceutical manufacturers’ expenditure on research and development (R&D) correlates to the number of new drugs released. As R&D increases, the industry has more opportunities to discover products that generate revenue. This driver is expected to increase slowly during 2012. Source: IBIS, Brand name pharmaceutical manufacturing in the US Industry overview High and increasing globalization: During the past five years, the level of globalization has increased, with a number of cross-border M&A transactions and a growing trend toward collaborative alliance in R&D and marketing On going consolidation: Pharmaceutical companies continue to face several key restrictions to growth in their markets. M&A is a necessary strategic tool for industry companies to lower the impact of these restrictors to revenue and margins. Health care reform: Healthcare reform will support the revenue growth of pharmaceutical industry as it extends coverage to more people. However, reform will reduce profit margins by lowering drug costs for consumers. Industry overview Moderate High price during the life of patents Retail drug store have little bargaining power while hospitals and government have more bargaining power Obamacare cause uncertainty Low Chemical inputs as well as labeling and packaging products are relatively homogeneous. High High cost of R&D and capital expenditure pose a substantial obstacle for new companies High Severe competition from generic drugs manufacturers after patent protection expires High R&D cost and highly regulated clinical trial process Low Brand name drug protected by patent Alternative medical treatment are not widely used. Equity Snapshot Source: Bloomberg Equity Snapshot Source: Bloomberg Company overview Pharmaceuticals represent a majority of Abbott’s revenue, with proprietary and established products generating $17 billion and $5.4 billion in 2011, respectively. Abbott’s largest product is Humira, an anti-arthritis medicine, with nearly $8 billion in revenue for 2011, account for 21% of the total sales Source: Abbott, Annual report 2011 Company overview Source: Abbott, Annual report 2011 The United States generated 41% of Abbott’s revenue in 2011, compared to 43% in 2010 and 47% in 2009. Abbott has increasingly relied on international markets, and emerging markets in particular, to grow revenue. Company overview 2012 EPS forecast: $3.83-3.85 Management announced a 51 cent dividend for Q3 2012 - the 355th quarterly dividend since 1924 Company overview Major acquisition: Increase product lines through acquisition Year Company Strategic Fit 2001 Knoll Acquired the right of drug Humira, which treats rheumatoid arthritis and a highly profitable drug 2004 Therasense Acquired products for diabetes treatment 2005 Guidant Acquired several vascular products 2009 Advanced Medical Optics Started vision eye care division 2009 Solvay pharmaceuticals Expanding its presence in emerging markets and enhancing its portfolio of pharmaceutical products 2010 Piramal Healthcare (India) Expanded pharmaceutical portfolio abroad and become India’s largest drug company Company overview SWOT Analysis Strength: Acquisitions strengthened Abbott's presence in diverse healthcare segments and territories Increased focus on R&D enhances medical devices and nutritional portfolios Humira drives Abbott’s proprietary pharmaceutical business growth Weakness: Alleged illegal marketing practices resulting in costly settlement Weak launch portfolio increasing reliance on Humira Opportunity: Abbott’s proposed split into two healthcare companies Alliances likely to help Abbott in strengthening its product pipeline Successful launch of approved products in major markets Threat: Healthcare reform in the US could negatively impact the company's profitability Regulatory hurdles may affect intended benefits from proposed split into two companies Company overview Mid- to Late-Stage Programs Source: http://www.abbottinvestor.com/phoenix.zhtml?c=94004&p=irol-presentations Company overview Spin-Off: Two Independent, public traded Companies AbbVie: The research-based pharmaceutical company Product Mix Annual Sales: Nearly $18 billion Portfolio: Numerous leading medicines, including: Humira, Lupron, Synagis, Zemplar, Kaletra, Creon, Duodopa, Synthroid, Androgel and others. Pipeline: more than 20 new compounds or indications in Phase 2 or 3 Strategy focus: • Continuing growth of leading brands • Advancing specialty-focused pharmaceutical pipeline • Strong margins and robust cash flow Source: http://www.abbottinvestor.com/phoenix.zhtml?c=94004&p=irol-presentations Company overview Spin-Off: Two Independent, public traded Companies Abbott: The diversified medical products company Product Mix Annual Sales: Approximately $22 billion Portfolio: Market-leading positions in established pharmaceuticals, adult and pediatric nutritionals, core laboratory diagnostics, point of care and molecular diagnostics, and medical devices. Strategy focus: • Global and emerging markets presence. Expanding geographically: products in more than 130 countries with nearly 40% of sales in emerging markets today. Abbott is the leading pharmaceutical company in India. • Developing new technologies Source: http://www.abbottinvestor.com/phoenix.zhtml?c=94004&p=irol-presentations Financial Analysis Financial Analysis Discounted Cash Flow Conclusion: DCF Enterprise Value Plus Excess Cash Interest Bearing Debt Assumptions $121,814.12 8,097.00 15,501.00 Discount Rate 9.93% ROE Market Capitalization Shares Outstanding $114,410.12 1,580.00 17.50% Beta 0.325 Value Per Share $72.41 Comparable Analysis millions Enterprise Value Market Capitalization EBIT Pfizer Inc. $ 192,658 $ 177,953 $ 19,548 $ 26,843 $ 62,225 $ 50,069 Merck & Co. Inc. $ 137,923 $ 133,915 $ 11,196 $ 17,880 $ 47,824 $ 31,578 Johnson & Johnson $ 194,278 $ 193,628 $ 16,860 $ 20,259 $ 65,921 $ 45,015 Abbott Laboratories $ 107,356 $ 102,491 24,512 Price/ Company Sales Book Value Pfizer Inc. 18.88 x 2.88 x 2.2 x Merck & Co. Inc. 19.78 x 2.79 x 2.4 x Johnson & Johnson 22.77 x 2.9 x 3.29 x $ ABT Price 64.72 Low Earnings/Share $ Sales Gross Profit 8608.7 $ 11,452 $ 39,414 $ Metrix Earnings Implied Price EBITDA Median Weight Applied to Median Price High 4.09 $ 77.22 $ 80.90 $ 93.13 33% Sales/Share $ 25.08 $ 69.97 $ 72.23 $ 72.73 33% BV/Share $ 17.09 $ 37.60 $ 41.02 $ 56.23 33% Comparable Analysis New Abbott Price/ Company Earnings Sales Book Value Baxter International Inc. 14.13 x 2.69 x 5.3 x Merck & Co. Inc. 19.78 x 2.79 x 2.4 x Johnson & Johnson 22.77 x 2.9 x 3.29 x ABT Price Low Metrix Earnings/Share $ Median High Weight Applied to Median Price 2.31 $ 32.59 $ 45.62 $ 52.52 33% Sales/Share $ 13.93 $ 37.46 $ 38.85 $ 40.39 33% BV/Share $ 20.80 $ 28.51 $ 45.93 33% 8.67 $ Implied Price $ 37.66 Comparable Analysis AbbVie Price/ Company Earnings Sales Book Value Pfizer Inc. 18.88 x 2.88 x 2.2 x Bristol-Myers Squibb 17.54 x 2.85 x 3.87 x 12.5 x 4.07 x 3.38 x Amgen AbbVie Price Metrix Low Median High Weight Applied to Median Price Earnings/Share $ 2.38 $ 29.80 $ 41.81 $ 45.01 33% Sales/Share $ 14.39 $ 41.02 $ 41.45 $ 58.57 33% BV/Share $ 8.96 $ 19.70 $ 30.27 $ 34.66 33% Implied Price $ 37.84 Recommendation Buy 100 Shares @ Market Price Undervalued based on both multiples and DCF Artificial pullback represents buying opportunity Diversification of the portfolio is less, given increased position, but deemed worth the risk