The Production, Property and Power Model

advertisement

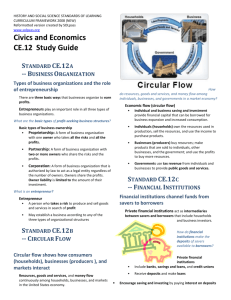

The Production, Property and Power Model A Visual Model of the Semi-Free-Market Economy Gordon C. Boronow, FSA, Ph.D. Associate Professor of Economics Nyack College Managing Director, Pol-Econcepts gordon.boronow@nyack.edu The Venerable Circular Flow Diagram Source: Internet Image Shortcomings of the Circular Flow Diagram • • • • • Ignores Government Role in the Economy Cannot Explain Capital Accumulation Stagnant/Equilibrium Present Oriented Consumption-only Model A More Complete Teaching Model • Retain as much simplicity as possible • Include the essential decision makers • Bring out the human behavior aspect of economics • Bring out the future orientation of the economy • Reveal the tension and balance in all aspects of the economy Presenting: Production, Property, And Power A Model of a semi-free market economy The Economic Decision Makers • • • • Who are they? What factors into their decisions? What tensions are balanced? What motivates them? Production, Property, and Power Household Decision Maker Concepts: Enjoyment of Consumption Security in Property (Savings) Forward-looking Cares about Future Households Balances need for income and security against enjoyment of leisure and consumption now and in the future Motivated by Desire for a Good Life and Avoidance of Insecurity Production, Property, and Power Entrepreneur Concepts: Innovation, improvements, and growth Risk-taking, success and failure Forward-looking Essential uncertainty of the future Creative destruction Balances the cost of money and effort against the likelihood of sufficient future profits to make the venture worthwhile Motivated by Opportunity for Future Profits Production, Property, and Power The Financial Intermediary Concepts: The Bank Aggregates Savings The Banker Allocates Capital (Performs Due Diligence) “Animal Spirits” Balances the cost of funds against the potential for a profitable loan transaction Motivated to Earn Profits for the Bank Production, Property, and Power Politicians (Government) Concepts: Authorized to provide security and control risk through legislation and regulation Enforced with police power Constrained by behavioral effects on tax revenues (Laffer curve) Short-sighted (next election) “Public Servants” (with Self Interests) Balances the urge to control against the discontent and tax avoidance of taxpayers Motivated by an Urge to Control and to Use Power to “do good” (i.e., to implement their “Vision”) The Production Cycle • Households: – Own the resources of the economy (land, labor, capital, ability) – Receive income (wages, rents, interest, profits and welfare) which they save or spend on consumption – Allocate time to work or leisure • Firms: – Produce consumer goods and/or capital goods – Maximize profits by adjusting prices and quantities of production Property Loop: The Head of Household • Chooses how much to spend or save • Savings are converted to property which stores purchasing power for a future household • More property increases the feeling of security for the future • The opposite of saving is borrowing, which transfers purchasing power from the future • Debt reduces net holdings of property, and increases feelings of insecurity Property Loop: The Entrepreneur • The Entrepreneur envisions a new idea for a product, a process or a new market • The idea requires resources that the entrepreneur must acquire from retained earnings or from financial markets (e.g. bank) • The resources are used to purchase capital goods in the production cycle • Factor income from the production of capital goods flows back to the households Combined Property Cycle • • • • Savings Leave the Production Cycle Investments Enter the Production Cycle There is a Gap in the Property Cycle! “Mind the Gap” A Financial Intermediary: The Banker • Allocates savings to the most profitable (to the bank) projects of the entrepreneurs • Performs “Due Diligence” (a process of risk analysis on each project to protect the bank-and by extension the household-from too much risk) • Affected by “animal spirits” The Power Loop • Government power is necessary to protect life and property in the economy • Politicians are the embodiment of government • They tax the economy (households, since any tax ultimately affects some household) • They spend the tax, which returns it to the production and property cycles The Power Loop: Budget Deficits • Politicians routinely spend more than they collect in taxes • They borrow current resources: – Funded by household savings (assuming no money or credit creation by government is going on) – Reduces resources available to entrepreneurs • Transfers purchasing power from future government to the present government Forces in the Economy Market, Psychological and Political Motives • Forces exert Pressure in the Economy • Without Pressure, there is Slack in the Economy • Under Market, Psychological and Political Forces, Slack Gives Way to Pressure, which Tends to Balance • That Unstable Stability is “Equilibrium” Equilibrium: Negatively Defined • Firms are unable to further increase profits • Households are unwilling to work longer hours at the going wages • Households are unwilling to spend or save more at current prices and interest rates • Entrepreneurs do not want to make investments at the current cost of capital • Government is unwilling to increase taxes • Government is unwilling to increase debt Equilibrium: Positively Defined • Firms have maximized profits • Households have maximized the pleasure of consumption and enjoyment of security • Entrepreneurs can finance all the projects they want to implement at the current cost of capital • Government Controllers have provided the maximum degree of security possible given the resources at their disposal The Production, Property and Power Model A Visual Model of the Semi-Free-Market Economy The End.