Mineral and Petroleum Resources Royalty (Administration) Bill

advertisement

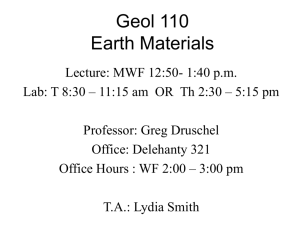

Mineral and Petroleum Resources Royalties Bill September 2008 Contents 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Background, MPRDA, Royalty Bill consultation process Why mineral royalties – economic rationale Refined and Unrefined minerals Tax base: Gross Sales Mineral royalty rates: Formulae EBIT, with 100% capital expensing Estimated mineral royalty rates Rollover relief & Unincorporated bodies Small business relief Fiscal stability Transitional measures Administration International examples Mining Value Chain: Exploration, Mining, Mineral Processing, Refining: First saleable point 2 Mineral and Petroleum Resources Royalty Bill (B 59 – 2008) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. Definitions Imposition of royalty Determination of royalty Royalty formulae Earnings before interest and taxes (EBIT) Gross sales Small business exemption Exemption for sampling Rollover relief for disposal involving going concerns Transfer involving body of unincorporated persons Arm’s length transactions General anti-avoidance rule Conclusion of fiscal stability agreements Terms and conditions of fiscal stability agreements Foreign currency Transitional rules Act binding on State and application of other laws Short title and commencement 3 Ownership of Land and Minerals • • • • • Surface rights Mineral rights Land restitution and land reform Indigenous communities State 4 Background • • • • • • • • • • • • Mineral and Petroleum Resources Royalty Bill (MPRRB) follows on the Mineral and Petroleum Resources Development Act (MPRDA), (Act 28 of 2002) 1st draft Mineral and Petroleum Royalty Bill released for public comment on 20 March 2003 2nd draft of Royalty and Petroleum Resources Royalty Bill released for public comment on 11 October 2006 May / June 2007 - Consultation, workshops 3rd draft of Royalty and Petroleum Resources Royalty Bill released for public comment on 6 December 2007 4 March 2008 - Briefing by National Treasury to PCOF, 3rd draft 11 & 19 March 2008 - PCOF public hearings, 23 April 2008 – Consultation, workshop, preparation for 4th draft 13 May 2008 - PCOF briefing policy changes, basis for 4th draft 03 June 2008 - 4th draft published for technical comments only 17 June 2008 - PCOF briefing, 4th draft 24 June 2008 – Parliament, Minister of Finance - Introduction of Bill 5 Mineral and Petroleum Resources Development Act (Act No. 28 of 2002) (MPRDA) The “MPRDA” provides for: – All mineral rights to vest with the State – Conversion of “old order” mineral rights into “new order” rights by 1 May 2009 – Imposition of mineral royalties by the State: Section 3 (2): As the custodian of the nation’s mineral and petroleum resources, the State, acting through the Minister may: (b) in consultation with the Minister of Finance, determine and levy, any fee or consideration payable in terms of any relevant Act of Parliament. 6 Mineral and Petroleum Resources Development Act (Act No. 28 of 2002): Community royalties • The MPRDA Act reserves the right of communities to receive a consideration or royalty. • Item 11 of Schedule II of the Act states: (1) Notwithstanding the provisions of item 7(7) and 7(8), any existing consideration, contractual royalty, or future consideration, including any compensation contemplated in section 46(3) of the Minerals Act, which accrued to any community immediately before this Act took effect, continues to accrue to such community.” (2) The community contemplated in (1) must annually, and at such other time as required to do so by the Minister, furnish the Minister with such particulars regarding the usage and disbursement of the consideration or royalty as the Minister may require. 7 Why mineral royalties (1) “Although the structure and rates of mineral royalties vary internationally, most are collected for the same reason, that is payment to the owner of the mineral resource in return for the removal of the mineral from the land. The royalty, as the instrument for compensation, is payment in return for the permission that, first, gives the mining company access to the minerals and second, gives the company the right to develop the resource for its own benefit”. (James Otto, et al – The World Bank, page 42) 8 Why mineral royalties (2) “Another way in which a mine differs from other businesses is that it exploits a non-renewable resource that, in most cases, the taxpayer does not own. In the majority of nations, minerals are owned by the state, by the people generally, or by the crown or ruler”. (James Otto, et al – The World Bank, page 16) 9 Tax base - mineral royalties “Across the globe, no type of tax on mining causes as much controversy as a royalty tax. It is a tax that is unique to the natural resources sector and on that has manifested itself in a wide variety of forms, sometimes based on measures of profitability but commonly based on the quantity of material produced or its value”. (James Otto, et al – The World Bank, page 1) 10 Tax base = Gross Sales less transport costs (clause 6) • Gross Sales = – Proceeds of a transferred mineral resource at its readily saleable condition (i.e., refined or unrefined (“concentrate”) state of mineral as specified) – Disregard transportation costs of “final product” (including insurance and handling charges) 11 Refined and Unrefined minerals (clause 1, and Schedules 1 and 2) 1. Refined (Schedule 1): • • • • • • 2. Gold; 99.5% PGM – refined; 99.9% Copper; 99.0% Zinc; 98.5%, Etc; & Oil & Gas Unrefined (Schedule 2): • • • • • • • • • • • • Diamonds PGM – concentrate Iron ore; (between 61% to 64% Fe) Coal – various grades Manganese (between Mn37% to Mn48%) Chrome (between 37% to 46% Cr2O3) Mineral Sands Zinc concentrate; 27% Zn Uranium (80% concentrate) Aggregates; Bulk Etc. Other; Concentrate or Bulk 12 Gross Sales - Refined: Schedule 1 (clause 6) • • • General Rule: – Gross sales of refined minerals equal amounts received or accrued (use spot rate if foreign currency is involved) – However, an override exists to ensure that all transactions occur at arm’s length Different Condition: – If a refined mineral is sold above the refined Schedule 1 condition, (unlikely event) the gross sales price is reduced to a hypothetical refined condition price – If a refined mineral is sold below the refined Schedule 1 condition, the gross sales price is increased to a hypothetical refined condition price (or schedule 2 – unrefined formula) Stolen, Destroyed or Lost: – A deemed sales price applies at the proper condition so a royalty is always charged even if no proceeds are obtained – Rationale: Prevents evasion plus Government should not incur the risk of a permanent loss (e.g. stolen) of a non-renewable resource 13 Gross Sales – Unrefined: Schedule 2 (clause 6) • • • General Rule: – Gross sales of unrefined minerals equal amounts received or accrued (use spot rate if foreign currency is involved) – However, an override exists to ensure that all transactions occur at arm’s length Different Condition: – If an unrefined mineral is sold above the unrefined Schedule 2 condition, the gross sales price is reduced to a hypothetical refined condition price – If an unrefined mineral is sold below the unrefined Schedule 2 condition, the gross sales price is increased to a hypothetical refined condition price Stolen, Destroyed or Lost: – A deemed sales price applies at the proper condition so a royalty is always charged even if no proceeds are obtained – Rationale: Prevents evasion plus Government should not incur the risk of a permanent loss of a non-renewable resource 14 Dual Schedule Minerals • Some minerals fall under both schedules (e.g. platinum) • In these circumstances, the mineral will be viewed as refined if developed to or above the refined condition; otherwise, view as unrefined • Example: – Platinum 99,9% or above view as refined – All other conditions view as unrefined 15 Tax rates – formula (clause 4) (X = EBIT/Gross Sales *100) 1. Y (r) = 0.5 + X/12.5 (Max = 5.0) Refined metal (e.g. refined Gold, refined PGM, etc.), and Oil and Gas 2. Y (c) = 0.5 + X/9.0 (Max = 7.0) Unrefined; Concentrate Coal, Rough Diamonds, Iron Ore, etc. 16 EBIT: Basic Calculation (clause 5) • EBIT = “taxable income” before interest and taxes • EBIT: Additions – Gross sales (slides 13 and 14) – Recoupment / recapture of depreciable mining equipment • EBIT: Subtractions – All operating expenses – All depreciation/CAPEX for machinery employed to extract/upgrade/refine the mineral • If EBIT < zero, assumed to be zero. 17 EBIT: Adjustments (clause 5) • No deductions for financial instruments (other than hedges against mineral sales) • No deduction for the royalty itself (to avoid circularity) • Transport between buyer/seller (and beyond the refined/unrefined condition) • No carryover of excess operating expenses (but unredeemed mineral CAPEX can be carried over) • Oil and gas also 100% write-off: deny additional allowances in terms of the Tenth Schedule 18 Composite Minerals (clause 5) • When an ore body contains a combination of minerals • General Rule: Allocate EBIT deductions (refined versus unrefined) according to a reasonable method consistently applied • De minimis: Less than 10% portions can be viewed as the dominant portion if desired (and if consistently applied) 19 Estimated Mineral Royalty Rates Y = 0.5 + X/12.5 (Refined) Y = 0.5 + X=/9 (Unrefined) Profitability EBIT/ Gross Sales (%) Refined Min = 0.5 B = 12.5 Unrefined / Concentrate Min = 0.5 B= 9.0 0 0.5 0.5 10 1.3 1.6 15 1.7 2.2 20 2.1 2.7 25 2.5 3.3 30 2.9 3.8 40 3.7 4.9 50 4.5 6.1 56 5.0 6.7 58.5 5.2 7.0 70 6.1 8.3 20 Mining: R million: StatsSA, P0044: 28 March 2008 1 Turnover received 2 2006 2007 203,467 291,737 Interest paid 5,398 6,794 3 Depreciation 15,358 19,667 4 Net profit before taxation 42,271 82,161 5 Total capital expenditure 36,090 33,777 6 Book value of assets 192,607 216,116 % Gross revenue: 7 Net profit before taxation 20.8% 28.2% 8 EBIT ( Depreciation ) 23.4% 30.5% 9 EBIT ( Capital expensing ) 13.2% 25.7% EBITDA 31.0% 37.2% 10 21 Mining: R million: StatsSA, P0044 Financial ratios Est. Royalty Rates 2006 2006 Estimated Royalty Rates Financial ratios 2007 Rate Est. Royalty Rates 2007 Rate Refined: Y = 0.5 +X/12.5 11 EBIT ( Depreciation ) 23.43 2.37 30.5 2.94 12 EBIT ( Capital expensing ) 13.24 1.56 25.7 2.55 Unrefined: Y = 0.5 = X/9.0 13 EBIT ( Depreciation ) 23.43 3.10 30.5 3.9 14 EBIT ( Capital expensing ) 13.24 1.97 25.7 3.4 22 Rollover relief and Unincorporated Bodies (clauses 9 &10) • Rollover Relief: – If minerals are sold pursuant to the sale of a going concern (e.g. the whole mining business or a severable part), rollover relief applies – If rollover relief applies, the transfer is ignored and the transferee assumes the royalty liability upon subsequent sale • Unincorporated Bodies (e.g. Partnerships): – An election can be made to tax the body (and not the members on their proportionate share) – The body is effectively viewed as a separate “extractor” with the members being jointly and severally liable 23 Miscellaneous (clauses 7,8,12,13, &14) • Small Business Relief: – Relief applies if the royalty otherwise imposed does not exceed R100 000 (and if gross sales do not exceed R10.0 million) – Rules against dividing-up big companies into small businesses • Sampling Relief: – Exemption for sampling/testing (linked to section 20 of the MPRDA) – Up to R100 000 of gross sales • General Anti-Avoidance Rule: – Standard for most tax acts • Fiscal Stability: – Fixed parameters of formulae guaranteed 24 Transitional Rules (clause 16) • Effective Date: – Transfers occurring on or after 1 May 2009 – Applies even if parties only lodge for conversion as of 1 May 2009 (i.e. the royalty cannot be delayed further) • Transitional Credits: – Previous consideration paid to the State for old order rights (State Lease Payments) to be offset (i.e. a credit) against the royalty – Might be of importance in the case of minerals won/recovered before 1 May 2009 (and State lease paid) and transferred afterwards – Also important for parties that only have lodgings but not yet converted on 1 May 2008 (and hence both State Lease Payments and new Royalties are due) – No credit for certain profit sharing arrangements (i.e. Diamonds) and considerations to communities 25 Mineral and Petroleum Resources Royalty (Administration) Bill (B 60 – 2008) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Definitions Registration Cancellation of registration Election for unincorporated body of persons Payments in respect of estimated royalty Submission of return and final payment Form, manner and place determined by Commissioner Maintenance of records Notice of assessment Reduced assessments Withdrawal notice of assessment Time limit for notice of assessment Refunds Penalty for underestimation of royalty payable Adjustment if estimated royalty Interest Administration of Act Applicability of Income tax Act Reporting Regulations Short title and commencement 26 Administration (Administration Bill, clauses 1 to 20) • SARS the collecting agent • Two 6-monthly estimated payments • Final payment (6 months after the close of the financial year) • A potential 10% penalty exists if both estimates fall short by 20% of the final amount • Treasury has the power to request individual taxpayer information 27 Thank you Mining and Mineral processing THE FOUR STAGE BENEFICIATION PROCESS (Chamber of Mines) Stage 1 2 3 4 Mineral beneficiation process category The action of mining and producing an ore or concentrate (primary product) The action of converting a concentrate into a bulk tonnage intermediate product (such as a metal or alloy) The action of converting the intermediate goods into a refined product suitable for purchase by both small & sophisticated industries (semis) The action of manufacturing a final product for sale Process flow-chart Run-of-mine ores Washed & sized concentrates Labour Capital intensity intensity High High Industry Clu ster Mining Mining Mattes/slags/ bulk chemicals Ferro alloys/ pure metals Low High Mining Steel/ alloys Worked shapes & forms Low High Refining / Manufacturing Worked shapes & forms Worked shapes & forms Manufacturing Medium to Medium to high high Manufacturing 30 Mineral Beneficiation Value Chain (Mintek / DME) Capital requirements & Services • Exploration – – – • • – – – – • Crushing Hdyro-met. Plant Material handling Furnaces • Smelter Furnaces Electro-winning cells, Casters Value addition – – – Rolling & moulding Machining Assembling Comminution Grinding, media Chem / reagents Refining – – – • Mine planning Consumables Sub-contracting Mineral processing – – – • GIS Analytical Data processing Mining – – – Refining – – – • • Drilling Cutting Hauling Mineral processing Exploration – – – Geophysics Drilling Survey Mining – – – • Reductants Chemicals Assaving Value addition – – – Design Marketing Distribution 31 Estimated royalty rates – Refined / Metal EBIT (“accounting” depreciation) /Gross revenue = X Y = 0.5 + X/12.5 (Max = 5.0) 2002 2003 2004 2005 2006 Average PGM - metal (refined) 3.4 2.2 2.1 2.2 3.6 2.7 GOLD - metal (refined) 3.7 2.7 1.5 0.5 2.2 2.0 32 Unrefined EBIT (“accounting” depreciation) /Gross revenue = X Y = 0.5 + X/9.0 (Max = 7.0) 2002 2003 2004 2005 2006 Average DIAMONDS 5.3 3.1 3.3 4.8 5.7 4.4 MANGANESE 5.3 4.8 3.3 5.4 4.5 4.7 IRON ORE 4.2 3.0 2.5 5.1 6.0 4.1 MINERAL SANDS 5.1 3.6 2.2 2.3 3.3 3.3 PGM - Concentrate 4.6 2.8 2.8 2.8 4.8 3.6 COAL 3.0 2.0 2.0 2.4 2.0 2.3 CHROME 1.0 2.1 2.2 1.6 1.2 1.6 BASE METALS 0.7 0.5 0.5 0.5 2.6 0.7 33 Mineral Range Unit Sold at Ratio Chrome Ore 37% 46% Cr2O3 48% 95.8% Manganese 37% 48% Mn 50% 96.0% 61 64 Fe 66 97.0% Iron Ore Mineral Range Unit Sold at Ratio Chrome Ore 37% 46% Cr2O3 34% 108.8% Manganese 37% 48% Mn 35% 105.7% 61 64 Fe 59 103.4% Iron Ore 34 Mineral Royalties International comparison Australia – New South Wales • An ad valorem royalty of 4% the “ex-mine” value (value less allowable deductions) of minerals (except coal) is applied to highvalue minerals. • The rate of coals is as follows: • 7% of the value of coal recovered by open cut mining • 6% of the value of coal recovered by underground mining • 5% of the value of coal recovered by deep underground mining 36 Australia – Western Australia (1) • Under the Mining Act, royalties are payable on all “minerals”. A mineral is defined as a naturally occurring substance including evaporites, limestone, rock, gravel, sand and clay. • Rates: • Bulk material (subject to limited treatment) (Including Diamonds): 7.5% of the royalty value • Concentrate material: 5.0% of the royalty value • Metal: 2.5% of the royalty value • “concentrate” means the product of a process of extraction of metal or a metallic mineral from mineral ore that result in substantial enrichment of the metal or metallic mineral concerned” 37 Australia – Western Australia (2) • “royalty value”, in relation to a mineral other than gold, means the gross value of the mineral less any allowable deductions for the mineral” • “gross invoice value”, in relation to a mineral, means the amount, in Australian currency, obtained by multiplying the quantity of the mineral, in the form in which it is first sold, for which payment is to be made (as set out in invoices relating to the sale) by the price for the mineral in that form (as set out in those invoices). 38 Australia – Western Australia (3) • “allowable deductions”, in relation to a mineral means – (a) the amount, in Australian currency, of any reasonable costs incurred in transporting the mineral, in the form in which it is first sold, where those costs – * are included after the shipment date by the person liable to pay the royalty for the mineral; and * relate to transport of the mineral by a person other than the person liable to pay the royalty for the mineral, and (b) the price, in Australian currency, paid or to be paid by the person liable to pay the royalty for the mineral, for packaging materials used in transporting the mineral, in the form in which it is first sold; 39 Australia – Western Australia (4) • The royalty rate for gold metal produced after 30 June 2000 is 2.5% of the royalty value of the gold metal produced. • The royalty value of gold metal produced shall be calculated for each month in the relevant quarter by multiplying the total gold metal produced during that month by the average of the gold sport prices for that month. • “gold metal” means gold that is at least 99.5% pure. 40 Tanzania • • Mineral royalties are payable on gross revenue, less transport and sales costs (called the netback value) The rates are: – – • – • • 5% 3% “net back value” means the market value of minerals FOB at the point of export from Tanzania, less – – • Diamonds All other The cost of transport, including insurance and handling charges, from the mining area to the point of export or delivery; and The cost of smelting and refining or other processing costs unless other processing costs relate to processing normally carried out in Tanzania in the mining area. “market value” means the realized price adjusted if necessary for a sale FOB at point of export from Tanzania or point of delivery within Tanzania There are provisions for adjustment of this value when, in the opinion of the Minister, such value does not meet the arm’s- length standard. The Act also makes provision for reduction, remission or deferment of mineral royalties when the cash operating margin (gross sales minis operating costs) falls below zero. 41 Ghana • • The Mineral (Royalties) Regulations of 1986 provide for a sliding-scale type royalty that starts at three per cent for low grade ore with a maximum of twelve per cent for high grade ore. These percentages are based on the gross value of the minerals. The final royalty is determined by a mining company’s Operating Ratio (OR). This ratio is based on the quotient obtained by dividing the operating margin (i.e. working profit) by the value of minerals extracted during the relevant fiscal period: • Operating ratio (%) • 0 to 30 • 31 to 70 • 71 to 100 • 3% (minimum) 3 + 0.225 * (OR), maximum 12% (B = 4.45) 12% (maximum) It is important to note that the statutory royalty rate is not influenced by either mineral type or mine size, but rather determined by mine profitability. This method typically results in a 3 per cent royalty rate for gold. 42 Ghana • Where in any yearly period the operational ratio is less than thirty per centum then the difference between the actual operational cost and the operational cost that would make the operating ratio exactly equal to thirty per centum shall be added to the operational cost of the following yearly period for the purpose of calculating that periods’ operating ratio; provided that the difference to be carried forward shall not exceed the permissible capital allowance for the year of account. • A Minerals Development Fund was created to return part of government income from mining to the communities who are affected by such activities. • Twenty per cent of collected mineral royalties are paid into the fund that is shared between the local government authority, the land-owning authority and other communities which are affected adversely by the miming activity. 43 USA - Nevada • The gross yield must include the value of any mineral extracted which was: • Sold; • Exchanged for any thing or service; • Removed from the State in a form ready for use or sale; or • Used in a manufacturing process or in providing a service, during that period. • Net proceeds are ascertained and determined by subtracting from gross yield the following deductions for costs incurred during that periods, and none other: 44 USA - Nevada Net proceeds / Gross Proceeds (%) • Less than 10 • 10 to < 18 • 18 to < 26 • 26 to < 34 • 34 to < 42 • 42 to < 50 • 50 or more Rate • • • • • • • 2.0 2.5 3.0 3.5 4.0 4.5 5.0 45