Using Financial Modeling Techniques to Value and

Using Financial Modeling

Techniques to Value and

Structure Mergers &

Acquisitions

Tact is for people not witty enough to be sarcastic.

--Anonymous

Course Layout: M&A & Other

Restructuring Activities

Part I: M&A

Environment

Part II: M&A

Process

Motivations for

M&A

Regulatory

Considerations

Takeover Tactics and Defenses

Business &

Acquisition

Plans

Search through

Closing

Activities

M&A Integration

Part III: M&A

Valuation &

Modeling

Public Company

Valuation

Private

Company

Valuation

Financial

Modeling

Techniques

Part IV: Deal

Structuring &

Financing

Payment &

Legal

Considerations

Accounting &

Tax

Considerations

Financing

Strategies

Part V:

Alternative

Strategies

Business

Alliances

Divestitures,

Spin-Offs &

Carve-Outs

Bankruptcy &

Liquidation

Cross-Border

Transactions

Learning Objectives

• Primary learning objective: Provide students with a basic understanding of how to use financial models to value and structure M&As

• Secondary learning objectives: Provide students with a knowledge of

– How to estimate the value of synergy;

– Commonly used relationships in building M&A valuation models; and

– How to use models to estimate the purchase price range, initial offer price for a target firm, and to evaluate the feasibility of financing the proposed offer price.

M&A Model Building Process

• Step 1: Value acquirer and target as standalone firms

• Step 2: Value acquirer and target firms including synergy

• Step 3: Determine initial offer price for target firm

• Step 4: Determine the combined firms’ ability to finance the transaction

Step 1: Value Acquirer & Target as

Standalone Firms

• Use the 5-forces model to understand determinants of profits and cash flow, i.e., bargaining strength of

– Customers (size, number, price sensitivity)

– Current competitors (market share, differentiation)

– Potential entrants (entry barriers, relative costs)

– Substitutes (availability, prices, switching costs)

– Suppliers (size, number, uniqueness) relative to industry participants.

• Normalize 3-5 years of historical financial information

• Project normalized cash flow based on expected market growth and changes in profits/cash flow determinants.

Applying the 5-Forces Model to Project Acquirer and

Target Firm Financial Performance

• How have the following factors affected revenue growth and profit margins in the acquirer and target firms’ industry historically?

– Customers (size, number, price sensitivity)

– Current competitors (market share, differentiation)

– Potential entrants (entry barriers, relative costs)

– Substitutes (availability, prices, switching costs)

– Suppliers (size, number, uniqueness)

Key questions:

• How will these factors change (if at all) to impact future revenue growth and profit margins of these firms?

– Customers (size, number, price sensitivity)

– Current competitors (market share, differentiation)

– Potential entrants (entry barriers, relative costs)

– Substitutes (availability, prices, switching costs)

– Suppliers (size, number, uniqueness)

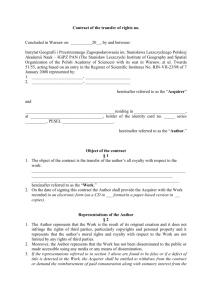

1.

How might changes in the bargaining power of customers and suppliers relative to the acquirer and target firms impact product pricing, costs, and profit margins?

2.

How might substitutes and new entrants affect product pricing and profit margins?

Step 2: Value Acquirer & Target Firms

Including Synergy

• Estimate

– Sources and destroyers of value

– Implementation costs incurred to realize synergy

• Consolidate acquirer and target projected financials including the effects of synergy

• Estimate net synergy (consolidated firms less values of target and acquirer)

Adjusting Combined Acquirer/Target Company

Projections For Estimated Synergy

Year 1 Year 2 Year 3 Year 4 Year 5

Net Sales 1 $200 $220 $242 $266 $293

Cost of sales

Direct labor

Indirect labor

2

Purchased materials

Selling expenses

$160 $176 $194 $213 $234

$2

$1

$2

$1

Anticipated Cost Savings

$4 $6 $8

$2

$3

$3

$4

$5

$5

$4

$5

$5

$8

$4

$5

$5

Total $6 $12 $20 $22 $22

Cost of sales (incl. synergy) $154 $164 $174 $191 $212

Cost of sales/Net sales 77.0% 74.6% 71.9% 71.8% 72.4%

1 Combined company net sales projected to grow 10% annually during forecast period.

2 Cost of sales before synergy assumed to be 80% of net sales during forecast period.

Discussion Questions

1. How would you adjust the combined firm’s income statement for cost savings due to improved worker productivity? (Hint: Determine the line item most directly affected by the improvement in productivity.)

2.

How would you adjust the combined firm’s income statement for additional revenue generated from crossselling (i.e., Acquirer selling its products to the target’s customers and vice versa)?

3.

How would you reflect the expenses incurred in implementing the worker productivity improvement and crossselling programs on the combined firm’s income statement?

Step 3: Determine Initial Offer Price for Target Firm

• Estimate minimum and maximum purchase price range

• Determine amount of synergy willing to share with target shareholders

• Determine appropriate composition of offer price

1.

2.

3.

Calculating Initial Offer Price (PV

IOP

)

PV

MIN

= PV

T or PV

MV

, whichever is greater for a stock purchase (liquidation value of net acquired assets for an asset purchase)

PV

PV

MAX

IOP

= PV

MIN

= PV

MIN

+ PV

NS

+

αPV

NS

, where PV

NS

= PV

, where 0 ≤ α ≤ 1

SOV

– PV

DOV

Offer price range = (PV

T or MV

T

) < PV

IOP

< (PV

T or MV

T

) + PV

NS

Where PV

MIN

PV

T

PV

MV

PV

MAX

PV

NS

= PV minimum purchase price

= PV standalone value of target firm

= Market value target firm

= PV maximum purchase price

= PV of net synergy

PV

SOV

= PV of sources of value

PV

α

DOV

= PV of destroyers of value

= Portion of net synergy shared with target company shareholders

Offer price per share = PV

IOP

/ Target’s fully diluted shares outstanding 1

How is “α” determined?

1 Fully diluted shares outstanding includes basic shares plus shares resulting from exercising “in the money” options and conversion of convertible debt and preferred stock.

Calculating Offer Price Per Share and Target’s Equity

Value Under Alternative Payment Scenarios

All Stock Transaction:

Offer Price Per Share = Share Exchange Ratio 1 x Acquirer’s Share Price

= Offer Price Per Target Share x Acquirer’s Share Price

Acquirer’s Share Price

Equity Value = Offer Price Per Share x Target’s Fully Diluted Shares Outstanding

All Cash Transaction:

Offer Price Per Share = Cash Offer Per Target Share

Equity Value = Cash Offer Per Target Share x Target’s Fully Diluted Shares

Outstanding

Cash and Stock Transaction:

Offer Price Per Share = Cash Offer Per Share + (Share Exchange Ratio x Acquirer’s

Share Price)

Equity Value = [Cash Offer Per Share + (Share Exchange Ratio x Acquirer’s Share

Price)] x Target’s Fully Diluted Shares Outstanding

1 When share exchange ratios (SERs) are fixed, the value of the transaction can change due to fluctuations in the acquirer’s share price. Assume the

SER is 2 and the acquirer’s share price is $50, the offer price per share is $100. However, if the acquirer’s share price falls to $40 or increases to

$60 before closing, the offer price is $80 and $120, respectively. Under a floating SER, the dollar value of the offer price per share is fixed and the number of shares exchanged varies with the value of the acquirer’s share price. Acquirer share price changes require re-estimating the SER.

For example, if the acquirer’s share price falls to $40, the number of new acquirer shares issued to preserve the $100 offer price is 2.5 (i.e.,

$100/$40); if the acquirer’s share price rises to $60, the new SER would be 1.6667 (i.e., $100/$60). Fixed SERS are most common because the risk of changes in the offer price is shared equally by the acquirer (i.e., if acquirer’s share price rises) and the target (i.e., if the acquirer’s share price falls).

Calculating the Target’s Fully Diluted Shares Outstanding and Adjusting Equity Value (If Converted Method)

Assumptions about Target Comment

Basic Shares Outstanding

In-the-Money Options 1

Convertible Debt (Face value = $1000; convertible into 50 shares of common stock)

Preferred Stock (Par value = $20; convertible into one share of common at

$24 per share

2,000,000

150,000

$10,000,000

$5,000,000

Exercise Price = $15/share

Implied conversion price = $20 (i.e.,

$1000/50)

Preferred shares outstanding =

$5,000,000 / $20 = 250,000

Offer Price Per Share $30 Purchase price for each target share outstanding

Total Shares Outstanding 2 = 2,000,000 + 150,000 + ($10,000,000/$1000) x 50 + 250,000

= 2,000,000 + 150,000 + 500,000 +250,000

= 2,900,000

Adjusted Target Equity Value 3 = 2,900,000 x $30 -150,000 x $15

= $87,000,000 - $2,250,000

= $84,750,000

1 An option whose exercise price is below the market value of the firm’s share price.

2 Total shares Outstanding = Issued Shares + Shares from “in the money” options and convertible securities.

3 Purchase price adjusted for new acquirer shares issued for convertible shares or debt less cash received from “in the money” option holders.

Step 4: Determine Combined Firms’

Ability to Finance Transaction

• Estimate impact of alternative financing structures (e.g., debt/ratio ratios)

• Select financing structure that

– Meets acquirer’s required financial returns and desired financial structure;

– Meets target’s primary financial and nonfinancial needs;

– Does not raise borrowing costs; and

– Is supportable by the combined firms’ operating cash flows.

Calculating Post-Merger

Earnings Per Share (EPS)

Will the transaction be transaction be dilutive or accretive to the acquirer’s

EPS?

Acquirer is considering the acquisition of Target in which

Target would receive $84.30 for each share of its common stock. Acquirer wishes to assess the impact of alternative forms of payment on post-merger EPS.

Acquirer believes that any synergies in the first year following closing would be fully offset by costs incurred in combining the two businesses. Selected data are presented as follows:

Pre-Merger

Data

Net

Earnings

Acquirer Target

$281,500,000 $62,500,000

Shares

Outstanding

EPS

Market

Price Per

Share

112,000,000 18,750,000

$2.51

$56.25

$3.33

$62.50

Calculating Post-Merger EPS in a

Share for Share Exchange

1

1 . Share exchange ratio = Price per share offered for Target /

Price per share for Acquirer = $84.30 / $56.25 = 1.5

2. New shares issued by Acquirer = 18,750,000 (shares of

Target) x 1.5 (share exchange ratio) = 28,125,000

3. Total shares outstanding of the combined firms =

112,000,000 + 28,125,000 = 140,125,000

4. Post-merger EPS of the combined firms = ($281,500,000

+ $62,500,000) / 140,125,000 = $2.46 (versus $2.51 for

Acquirer prior to the merger)

Implication: EPS for the combined firms is diluted $.05 during the first full year following closing.

1 Target has no convertible preferred stock or debt outstanding, and its employees have no “in the money” options..

Calculating Post-Merger EPS in an All Cash Transaction

1. Purchase price = $84.30 x 18,750,000 = $1,580,625,000

2. Assume Acquirer borrowed the entire purchase price at

8% interest with the principal repaid in 10 years

3. Annual interest expense = .08 x $1,580,625,000 =

$126,450,000

4. Post merger EPS of the combined firms = ($281,500,000

+ $62,500,000 - $126,450,000 (1 - .4)) / 112,000,000 =

$2.39 (versus $2.51 for Acquirer before the merger)

Implication: EPS of the combined firms is diluted by $.12 during the first full year following closing due to the annual interest expense

1 Assumes the firm’s marginal tax rate is 40 percent.

Calculating Post-Merger EPS in a Cash & Stock Transaction

Assume purchase price equals 1 share of Acquirer stock (@

$56.25) and $28.05 ($84.30 offer price - $56.25) in cash and that the cash portion of the purchase price is financed at 8% annual interest with the principal due in 10 years 1

1. New shares issued by Acquirer = 18,750,000 (shares of

Target)

2. Total shares outstanding of the combined firms =

112,000,000 + 18,750,000 = 130,750,000

3. Post-merger EPS of the combined firms = ($281,500,000

+ $62,500,000 - $42,075,000 (1 - .4)) / 130,750,000 =

$2.44 (versus $2.51 for Acquirer before the merger)

Implication: EPS of the combined firms is diluted by $.07 during the first full year following closing. Therefore, under these assumptions, EPS dilution is smallest in an all stock deal.

1 Annual interest is computed as follows: .08 x $28.05 x 18,750,000 (Target shares) = $42,075,000

Model Worksheet Layout

1

Assumptions Section

Historical Period Forecast Period

1 Refers to model template contained on CDROM accompanying textbook.

Using M&A Model Template

1

• Model worksheet layout: Assumptions (top panel); historical period data (lower left panel); forecast period data (lower right panel).

• Displaying Microsoft Excel formula results on a worksheet:

– On Tools menu, click Options, and then click the View Tab.

– To display formulas in cells, select the formulas check box; to display the formula’s results, clear the check box.

• In place of existing historical data, fill in the data in cells not containing formulas. Do not delete existing formulas in “historical period” unless you wish to customize the model.

• Do not delete or change formulas in the “forecast period” cells unless you wish to customize the model. To replace existing data, change the forecast assumptions at the top of the spreadsheet.

1 Refers to model template found on CDROM accompanying textbook.

Model Balance Sheet Adjustment

Mechanism Methodology

• Separate current assets into operating and non-operating assets.

• Operating assets include minimum operating cash balances and other operating assets (e.g., receivables, inventories, and assets such as prepaid items).

1

• Current non-operating assets are investments (i.e., cash generated in excess of minimum operating balances invested in short-term marketable securities).

• The firm issues new debt whenever cash outflows exceed cash inflows.

• The firm’s investments increase whenever cash outflows are less than cash inflows.

1 Minimum cash balances determined by analyzing the firm’s cash conversion cycle or by computing the average ratio of cash balances to net revenue over some prior period times current net revenue..

Model Balance Sheet Adjustment

Mechanism Illustration

Assets Liabilities

Current Operating Assets

Cash Needed for Operations (C)

Other Current Assets (OCA)

Total Current Operating Assets (TCOA)

Short-Term (Non-Oper.) Investments (I)

Net Fixed Assets (NFA)

Other Assets (OA)

Total Assets (TA)

Current Liabilities (CL)

Other Liabilities (OL)

Long-Term Debt (LTD)

Existing Debt (ED)

New Debt (ND)

Total Liabilities (TL)

Shareholders’ Equity (SE)

Cash Outflows Exceed Cash Inflows: If (TA – I)>(TL – ND) + SE, ΔND > 0 (i.e., the firm must borrow), otherwise ΔND = 0

Cash Outflows Less Than Cash Inflows: If (TA – I) < (TL – ND) + SE, ΔI > 0 (i.e., the firm’s non-operating cash increases), otherwise ΔI = 0

Cash Outflows Equal Cash Inflows: If (TA

– I) = (TL – ND) + SE = 0, ΔND=ΔI= 0

Estimating Interest Expense

I

EXP

= ((D

EOY

+ D

BOY

)/2) x i, where D

EOY

= D

BOY

- D

PRP where

D

EOY

= End of year debt balance

D

BOY

= Beginning of year debt balance

D

PRP

= Annual principal repayment

I

EXP

= Dollar value of annual interest expense i = Weighted average interest rate

Debt Repayment Schedule

2006 Total Debt

12/31/05

Maturity

Schedule

Long-Term

Debt

$690,710

Medium Term $540,500

0

Maturing

Amount

$30,500

0

Interest Rate Maturing

Amount

$190,710

7.5% $30,000

2007

Interest Rate

5.5%

7.5%

Mortgage Debt $42,380

Total $1,273,590

Remaining

Balance

Long-Term

Debt

1/1/06

$690,710

Medium Term $540,500

Mortgage Debt $42,380

Total $1,273,590

$694

$31,194

Ending

Balance

$690,710

$510,000

$41,686

$1,242,396

10.15%

7.559%

$767

$221,477

Interest Rate Ending

Balance

5.5% $500,000

7.5%

10.150%

6.477%

$480,000

$40,919

$1,020,919

10.15%

5.787%

Interest Rate

5.5%

7.5%

10.15%

6.627%

Hints on Using Financial Models

• Ensure Excel’s Iteration Command is “on” to accommodate “circular references” inherent in financial models.

– For example

,

Cash & Investments x Interest Rate Affects Net Income

Net income Affects Cash & Investments

• To turn on the iteration command,

– On the menu bar, click on Tools >>> Options >>> Calculations

– Select Automatic and Iteration

– Set maximum number of iterations to 100 and the maximum amount of change to .01.

Things to Remember…

• Financial modeling facilitates the process of valuation, deal structuring, and selection of the appropriate financing plan.

• The process entails the following four steps:

– Valuing the acquirer and target firms as standalone businesses using multiple valuation methods

– Valuing consolidated acquirer and target firms including the effects of net synergy

– Determining the initial offer price for the target firm from within the price range defined by the minimum and maximum purchase prices

– Determining the combined firms’ ability to finance initial offer price