Comparable Companies and Precedent Transactions

advertisement

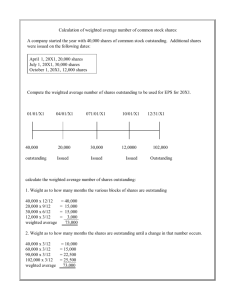

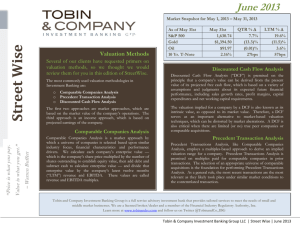

Chapters 1 and 2 Learn as much as possible about the target and then complete the following steps: 1. Select the universe of comparable firms 2. Locate the necessary financial information 3. Calculate key statistics, ratios, and trading multiples 4. Benchmark the comparable firms 5. Determine valuation MV = Stock Price * Fully Diluted Shares Outstanding FD Shares Outstanding = Basic Shares Outstanding + In-the-Money Options and Warrants + In-the-Money Convertible Securities options and warrants – Treasury Stock Method current share price = $35 basic shares outstanding = 500 in-the-money options = 15 weighted average strike = $25 assumptions for convertible: amount outstanding = $300 conversion price = $20 need relevant trading multiples for comparables universe ◦ measure of market valuation in the numerator ◦ measure of financial performance in the denominator EV/EBITDA – independent of capital structure and taxes ◦ also free from problems that come from differences in D&A Pros: ◦ ◦ ◦ ◦ market-based relativity quick and convenient current Cons: ◦ ◦ ◦ ◦ market-based absence of relevant comparables potential disconnect from cash flow company-specific issues employs a multiples based approach to derive an implied valuation range for a given firm transaction comps may provide higher multiple range than trading comps ◦ Why? considerations when selecting comparable transactions ◦ Was acquirer a strategic buyer or a financial sponsor? ◦ What were the buyer’s and seller’s motivations for the transaction? ◦ Was the target sold through an auction process or a negotiated sale? Was the nature of the deal friendly or hostile? ◦ What was the purchase consideration (mix of cash and stocks) ? form of payment and financing practices vary with economic cycle form of payment matters choice of form of payment is influenced by factors outside the firm links exist between form of payment, financing, and price financing choice decisions benefit from viewing from perspective of investor, creditor, and competitor returns to target shareholders ◦ payment in cash – target returns significantly higher ◦ payment in stock – target returns significantly positive but lower than ones in cash deals returns to buyer shareholders ◦ payment in cash – returns are zero to positive ◦ payment in stock – returns are significantly negative tender offers amplify cash versus stock effect ◦ with tender offers paid in cash, returns to buyers are even higher and returns from offers paid in stock are even lower some shareholders prefer cash over stock because of “guaranteed” value while others prefer the opposite to participate in upside potential of combined firms primary types of consideration ◦ all cash ◦ stock-for-stock fixed exchange ratio floating exchange ratio ◦ cash and stock Pros: ◦ ◦ ◦ ◦ ◦ market-based current relativity simplicity objectivity ◦ ◦ ◦ ◦ ◦ market-based time lag existence of comparable acquisitions availability of information acquirer’s basis for valuation Cons: