ExamTutorials.Com-ECO-450-Week-2-DQ-2

advertisement

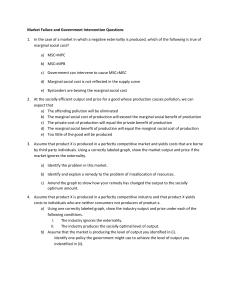

"Externalities" Please respond to the following: •Assess the impact of transaction costs as they apply to the Coase Theorem. Evaluate how government assignment of property rights impacts free market exchanges. Transactions costs are the costs associated with making a deal that are lost in the transaction (not transferred from one party of the transaction to the other). The Coase Theorem works only when these costs are very low, which appear to be very rare circumstances. In this theorem the government will give one party (the emitter or the receptor) the right to either emit the externality or be free from the externality. Either way, the Marginal External Cost of the externality gets added on to the Marginal Private Cost to set the new price and quantity in line with Marginal Social Cost. One issue with this (of many) is that the party who receives the initial rights is made artificially better off at the expense of the other (though society over all can be said to have benefited). The Coase Theorem implies that if transactions costs are low, the efficient rate of output will be reached, regardless of who initially owns the property rights. The theorem does not imply that people are indifferent about who has the rights; indeed, people do care, because the initial distribution of rights implicitly determines the distribution of wealth. When the fishers have the rights, the operators must bribe them; when the tanker operators start off with the rights, they are recipients, rather than the payers, of the bribe. Thus, whoever receives the rights initially is wealthier than they otherwise would be. Nevertheless, although a change in the allocation of property rights changes the distribution of wealth, as long as transactions costs are low, such a change will have no impact on how productive resources are used. As the Coase Theorem explicitly notes, for the allocation of productive resources to be completely independent of their initial ownership, transaction costs must be sufficiently low. Exactly how low will depend on the potential value of the transactions that might take place. If the resources are not very valuable, than even small transaction costs may influence the outcome; alternatively, if the resources are extremely valuable, then even transaction costs that are quite large may be insufficient to prevent the efficient exchanges from taking place. Nevertheless, because the existence of positive transaction costs can impede the movement of resources to their highest-valued uses, it is important to see how their presence can affect the analysis. The political pressures that dominate government also work against taking the long view. Government officials are legally barred from personally capturing any value that they help create; correspondingly, they pay no financial penalty for property that deteriorates. By contrast, a private owner will see its value change immediately after a major investment, because the value reflects future benefits and costs stemming from his action. Since no such capitalized value exists in the government setting, government officials are more interested in maximizing political power than economic value. The biggest issue I have with this idea is that it does not factor in temporal justice, the idea that we have an obligation to avoid passing costs on to future generations. For example, let's take the farmers' use of land for runoff vs homeowners' use for housing. According to this concept we should assign rights to one party and let them negotiate price and output. If we were to assign rights to the homeowners they would receive compensation for the damage done to the land and water, making them okay with this pollution. However, much pollution takes a long time dissipate and can even cause permanent damage to the ecosystem. In this situation the current, and maybe some future, homeowners will receive compensation and will allow a level of pollution that equates to their personal compensation. Future generations, however, will experience the cost of the negative externality (in poor water quality, higher propensities for flooding, lack of diversity in wildlife and the accompanying damage to ecosystems, etc.) but will not receive compensation for this since the polluting has stopped (though not the effect of that pollution). •Describe the corrective measures the government could take to internalize an externality and how these measures would affect individual behavior. Provide an example to support your response. Ans: A corrective tax is designed to adjust the marginal private cost of a good or service in such a way as to internalize the externality. The tax must equal the marginal external cost per unit of output to achieve this objective. In effect, a corrective tax is exactly like a charge for emitting wastes. A corrective tax on the emission of carbon wastes is one possible way to reduce the economic costs associated with global warming. The coase theorem says that that government by simply establishing the rights to use resources can internalize externalities when transaction costs of bargaining are zero. It makes no difference which party can use a resource after a property right is assigned the parties have to bargain to achieve efficiency. In the example in our text the wheat farmer’s farm is being damaged because of the neighborhood cattle rancher’s cattle straying into farm. As a result more beef is being produced, but wheat production is suffering. Government authorities can allow the wheat produced the right to a cattle free land and thus the cattle rancher is liable to pay for the damages done to the farm. The wheat farmer will choose an option that will give home the most profit. The corrective measure that the government could take is to impose a corrective tax. A corrective tax is used to adjust the marginal private cost of a good or service in such a way as to internalize the externality. The tax is like charge for emitting waste that causes pollution. Sellers of the producer pay a fee equal to the marginal external costs per unit of output sold. As a result of the cost the price to produce a good will increase and may result in a decrease demand of the good or the method of producing the good may also be eliminated and alternatives may be used. A situation in which the private costs or benefits to the producers or purchasers of a good or service differs from the total social costs or benefits entailed in its production and consumption. An externality exists whenever one individual's actions affect the well being of another individual, whether for the better or for the worse in ways that need not be paid for according to the existing definition of property rights in the society. An external diseconomy, external cost or negative externality" results when part of the cost of producing a good or service is born by a firm or household other than the producer or purchaser. An external economy, external benefit, or positive externality results when part of the benefit of producing or consuming a good or service accrues to a firm or household other than that which produces or purchases it. Externalities of either the positive or the negative sort create a problem for the effective functioning of the market to maximize the total utility of the society. The external portions of the costs and benefits of producing a good will not be factored into its supply and demand functions because rational profit-maximizing buyers and sellers do not take into account costs and benefits they do not have to bear. Hence a portion of the costs or benefits will not be reflected in determining the market equilibrium prices and quantities of the good involved. The price of the good or service producing the externality will tend toward equality with the marginal personal cost to the producer and the marginal personal utility to the purchaser, rather than toward equality with the marginal social cost of production and the marginal social utility of consumption. Thus, normal market incentives for the buyer and seller to maximize their personal utilities will lead to the over- or under-production of the commodity in question from the point of view of society as a whole, not the socially optimal level of production. A corrective tax is designed to internalize a negative externality by making sellers of the product pay a fee equal to the marginal external costs per unit of output. A corrective tax causes the following effects: 1. An increase in the prices of goods or services and a reduction in the quantity demanded, to the efficient level, where the marginal social cost equals the marginal social benefit of paper. 2. A decrease in the output of goods or services. 3. A reduction in, but not the elimination of the pollution