Govt & FE notes

advertisement

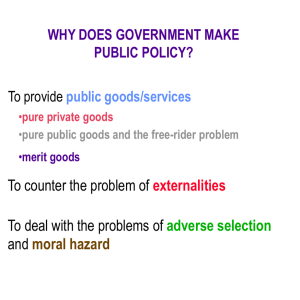

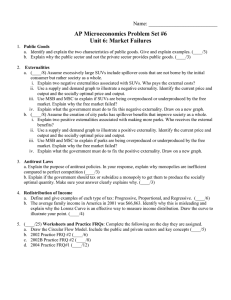

3-3: Government and Free Enterprise Providing Public Goods • How do we decide which sector of the economy should produce a good or service? ▫ Free enterprise will produce a good if all benefits go to the buyers and sellers Market Failure • Definition: Occurs when people who are not part of a marketplace interaction benefit from it or pay part of its costs What are public goods? • Goods and services that are provided by the public as a group Characteristics of Public Goods • People cannot be excluded from the benefits of the product even if they don’t pay for it • One person’s use of the product does not take away from its usefulness to others Examples of Public Goods • City street lighting • National defense Free Rider • Definition: person who avoids paying for a good or service but is able to benefit from that good/service • Free rider is an example of market failure Example of a Free Rider • Example: fireworks display Public and Private Sector— Shared Responsibilities • One shared responsibility: infrastructure—all goods and services necessary for society to function • Examples: highways, bridges, airports Externalities • Another type of market failure • Definition: side effect of a product that affects someone other than the producer/buyer Negative Externality • Definition: externality that has a negative effect, or cost, on people who were not involved in the original economic activity • Example: pollution Limiting Negative Externalities • Can be eliminated by the government through taxes and fines Positive Externality • Definition: externality that creates benefits for people who were not involved in the original economic activity • Example: a park, rose garden, etc Spreading Positive Externalities • A subsidy is one way to increase a positive externality ▫ Definition: a government payment that helps cover the cost of an economic activity that has the potential to benefit the public as a whole Public Transfer Payments • A government program designed to protect people from economic hardship is known as a safety net Redistributing Income • One way to redistribute income is through transfer payments— transfer of income from one person to another even though the person receiving the payment does not give something in return • Example: money received as a gift Public Transfer Payment • Definition: a transfer payment in which the government transfers income from taxpayers to recipients (who do not provide anything in return) Social Security • An example of a transfer payment • Taxes are taken out of our paychecks and used to fund the retirement of those eligible for Social Security benefits