Blenkarn v. MNR (1963)

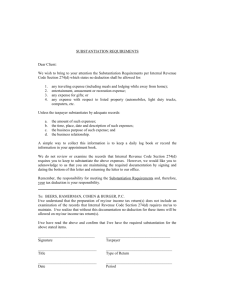

advertisement