and Notes

advertisement

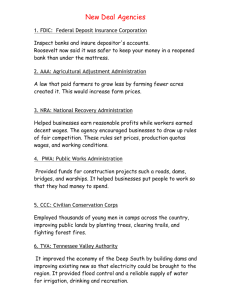

Brought to you by: • Credit Union and Farm Credit System Tax Exemptions date back 80 and 100 years • Tax Code should not create winners and losers – like businesses should be treated the same • South Dakota Bank Franchise Tax Tax Policy Fundamentals Credit Unions Pay No Tax • Federal Income Tax • South Dakota Bank Franchise Tax • State or Local Sales Tax Farm Credit Services – pays only a nominal amount Banks pay Federal Income, SD Bank Franchise and Sales Tax Federal Law Protects Some Providers • Credit Unions – $1 trillion tax exempt industry • Net Income of $9 billion in 2012 • Evolution of Credit Unions to a “Community Charter” - growth focus – with limited interest in people of modest means • Farm Credit – $250 billion arm of Federal Government • Net Income of $4.3 billion in 2012 • Return on Assets of 1.74% • Limited interest in serving young, small, beginning producers • New Revenue Would Help Reduced Federal Deficit • Credit Union Exemption = $2 billion • Farm Credit System Exemption = $1.3 billion Why should Congress Repeal the Exemptions? 49% 41% 40% 31% Banks Credit Unions Percentage of Customers with Low-to-Moderate Income Banks Credit Unions Percentage of Customers with Upper Incomes Banks Serve More People of Modest Means • 80 to 90 % of loans are to older, well-established larger farmers • 1,714 South Dakota Farm Service Guaranteed loans 99% were underwritten by Banks (as of 7/31/13) • FCS – financed luxurious vacation home for Hollywood producer in Black Hills Farm Credit – Mission Challenged! FARM CREDIT: Mission Challenged. • National Stakeholder • You pay income taxes, Credit Unions don’t – Farm Credit Pays a minimal amount • Local Stakeholder • South Dakota’s Bank Franchise Tax benefits important programs - state and local Why is this important to you? SD Bank Franchise Tax $80,000,000 $70,000,000 $60,000,000 $50,000,000 Local $40,000,000 State $30,000,000 $20,000,000 $10,000,000 $FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 8 year avg. - $485,800 8 year avg. - $203,300 8 year avg. - $64,400 8 year avg. - $59,500 Annual Cost of Tax Exemptions for South Dakota • Credit Unions • Farm Credit $1 Million $4 Million • TOTAL $5 million* • Local Government Share = $3.7 million (*Doesn’t include lost sales and use tax revenue on products and services purchased by federal credit unions) Cost of Protecting Status Quo - South Dakota • Bipartisan Congressional Focus on writing a simpler, more efficient, fairer tax code. • “Blank Slate Approach” – replace current policies that benefit special interest groups • Eliminate exemptions & increase taxable income • Lower rates across the board Tax Reform • Sign petition of support • Contact Senator Thune, Johnson and Representative Noem • Support tax reform, including repeal of tax exemptions for Farm Credit & Credit Unions. • Contact our your local Legislators • Support 2014 SD Legislature Resolution of support THE TIME TO ACT IS NOW It’s time to take action • 44 South Dakota Credit Unions • Assets = $2.6 billion Income = $21 million (2012) • Black Hills Federal Credit Union nearing $1 billion • SD’s Community Chartered Credit Unions • 28 Charters (63%) and $2.4 billion assets (93%) • SD’s Multiple Bond Credit Unions • 12 Charters (28%) and $118 million assets (5%) • SD’s Original Single Bond CU’s • 4 Charters (9%) and $55 million assets (2%) South Dakota’s Credit Unions