CET Capital Partners For internal use only

advertisement

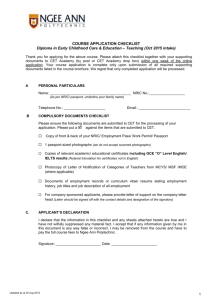

Central Europe Trust Budapest International Business Center Conference Management Consulting 22 March 2013 Financial Advisory Alternative Investments www.cet.co.uk Central Europe Trust Company Limited London - Bucharest - Budapest - Kiev - Moscow - Prague - Warsaw - Zagreb Introduction to Central Europe Trust (CET) •Founded in 1989 as one of the first independent advisory firms in Emerging Europe (CEE) by: • Lord Lawson (UK/Latvian descent): Member House of Lords, Formerly Chancellor of the Exchequer, Secretary of State for Energy, Financial Secretary to the Treasury and Member of Parliament. Author: The View from No.11: Memoirs of a Tory Radical (Bantam). • Charles Jonscher (UK/Polish): President. Formerly head of Booz Allen TMT practice in Europe; co-founder, CSP (acquired by Booz Allen); research, BT Labs and IBM Labs and co-director, Telecom Research, MIT. Author: The Evolution of Wired Life -- How Information Technologies Change Our World (Wiley). • Tom Lampl (UK/Czech): Managing Director. Formerly JP Morgan (London), SG Warburg (London), American Express Bank (Athens, acquired RIB) and Rothschild Intercontinental Bank (London). •Three business lines • Management consulting: 650+ engagements • Strategic: market entry (into and within Emerging Europe), development and implementation • Operational: Cost optimization, business process optimization, and post-M&A integration and consolidation • Corporate restructuring: Pre- / post-privatization and privately-owned underperforming/operationally distressed firms • Transaction advisory: 135+ transactions throughout Emerging Europe with exceptionally closure rate of • M&A: Mergers & acquisitions, sales & dispositions, joint ventures & franchise agreements: strategy, structuring,, execution & closing • Corporate finance: preparation, structuring and placing public and private equity and debt as well as project finance • Transaction services: Due diligence, financial modeling and valuation • Alternative investments: $550m via 4 advised/co-managed institutional funds and 1 in-house PE program • Funds: New Europe Fund, Slovak Post-Privatisation Fund, National Investment Fund 14, East European Food Fund, CET Capital • Planned New Fund: rescue & recovery investment in stressed & distressed firms operational HQ in Budapest www.cet.co.uk P1 CET Network: Eight Offices and 40+ Staff Unique positioning • World-class expertise • Leading consulting firms, investment banks and universities • Bi-cultural executive team together since 1989 • Avg of 17+ years at CET Prague, Czech Republic • Established 1990 • Also covers Slovakia • Staff: 3 Warsaw, Poland • Established 1989 • Also covers the Baltics • Staff: 20 London, UK Established 1989 • Secretariat • Staff: 2 Budapest, Hungary • Established 1989 • Staff: 2 • Local knowledge, presence & insight: Kiev, Ukraine • Established 2002 • Staff: 2 • Embedded in business, finance and policy communities with contact network developed since 1989 • Integrity & commitment to our clients • Relationship-driven approach based on mutual respect, honesty and trust www.cet.co.uk Moscow, Russia • Established 1991 • Covers FSU • Staff: 5 Zagreb, Croatia • Established 2002 • Also covers Slovenia, Bosnia & Herzegovina, Serbia • Staff: 2 P2 Bucharest, Romania • Established 1995 • Also covers Bulgaria • Staff: 4 CET: Selected Multinational Clients www.cet.co.uk P3 CET: Selected CEE Clients www.cet.co.uk P4 CET Alternative Investments: $550m 4 PE Funds & 1 In-house Program www.cet.co.uk P5 CEE: Deepest Recessions of all Emerging Markets During 2008/9 Crisis 13 of 15 deepest recessions in CEE hSource: UBS www.cet.co.uk P6 CEE: Fastest Private-sector Credit Growth of all EMs in Run-up to Crisis • Supply side •Demand side • Driven by foreign banks: Austrian, German, French, •Local firms overleveraged before crisis: debt-based growth Nordic, Portuguese, Italian, Irish, Greek and Spanish –Poor risk management: first debt-driven crisis in memory –Increased competition in CEE: eroded lending standards –Inappropriate capital structures –Foreign bank funding: partially via wholesale markets –asset/liability mismatch, debt maturity schedules –Foreign currency-denominated loans: forex risk –Overreliance on banks: capital markets underdeveloped hSource: UBS www.cet.co.uk P7 CEE Banks/Corporates Highly Mutually-Reliant vs Western Europe/US Source: UniCredit www.cet.co.uk P8 International Ownership of Banking Assets by Country of Assets Averages - CIS & Turkey: c. 22%, Central & Southeast Europe: c. 80% Source: Raiffeisen Bank., Unicredit,. Date for Emerging Europe banks as of 31 Dec 2011. Data for France, Germany, OECD, UK, US, Africa and Latin America as of 31 Dec 2009. P9 www.cet.co.uk Deleveraging: Vicious Circle www.cet.co.uk P10 Foreign Banks Have Continued to Withdraw Funds from CEE External positions of BIS reporting banks: 2011Q4-2012Q3 (change as % of full-year 2012 GDP) Vis-à-vis all sectors, gross Source: BIS. www.cet.co.uk P11 Decomposition of Cross-border Bank Flows to Emerging Markets (Q-on-Q %) Decline primarily due to: 2009: host country (CEE) factors: lower borrower demand 2011/12: home country (Western Europe) factors: eurozone crisis, deleveraging, home bias, etc Source: BIS www.cet.co.uk P12 CEE Credit Growth Likely to be Capped by Deposit Growth Due to deleveraging in general and lower use of wholesale financing Source: UniCredit www.cet.co.uk P13 Total Net Private Capital Flows to CEE •FDI: after a substantial declines in 2009 and 2010, FDI stabilized and is projected to grow in 2013 •Portfolio: after turning negative in 2008 and net zero and 2009, portfolio flows rebounded in 2010 and remain positive •Other (Bank, Private Individuals): after significant growth 2004 -2007, reversed dramatically in 2008 - 2009 and remains negative Source: International Monetary Fund World Economic Outlook September 2012 www.cet.co.uk P14 Non-performing Loans Trend in CE & SEE: stable to higher Trend in Baltics, CIS & TK: stable to lower Source: IMF www.cet.co.uk P15 Default Risk: Generally Increases to the South and East • CEE lags Western Europe in terms of credit, liquidity and solvency conditions. • Corporate default probability in most CEE countries is Significant, High or Very High Corporate Default Probability Very Low, Low, Acceptable, Quite Acceptable (Ratings A1 to A4) Significant (Rating B) High (Rating C) Very High (Rating D) Emerging Europe: Emerging Europe: Emerging Europe: Emerging Europe: Czech Republic Slovakia Estonia Slovenia Lithuania Turkey Poland Developed Europe: Austria Belgium Denmark Finland France Germany Iceland Ireland Luxembourg Malta Netherlands Norway Sweden Switzerland United Kingdom Bulgaria Hungary Kazakhstan Latvia Romania Russia Developed Europe: Croatia Italy Portugal Spain Moldova Belarus Tajikistan Bosnia Herzegovina Turkmenistan Ukraine Kyrgyzstan Uzbekistan Developed Europe: Greece Cyprus Source: Coface, January 2013. www.cet.co.uk Albania Armenia Montenegro Azerbaijan Serbia Georgia Macedonia 16 Developed Europe: - Opportunity: “Good Company, Bad Balance Sheet” Companies having a fundamentally sound business model (ie, generate economic value) but in financial trouble • Typically cash generative (after servicing capital structure) in normalized operating environment • Generally cash generative (before servicing capital structure) in current environment Stressed or distressed due to inappropriate capital structure (overleveraged) and/or external factors such as: • Unable to access capital from customary sources due to tighter credit standards, deleveraging or home bias –Particularly for mid-market and independent (not multinational subsidiary having links to home country banks) • Working capital squeeze due to supplier debt knock-on effects throughout economy • Overcapacity due to expansion/capital expenditure programs put in place prior to crisis • Government policy, labor action, court ruling/fine, environmental liabilities, accounting improprieties, etc • Key supplier/customer issues (stress/distress or bankruptcy) • Change in market demand/cyclicality (declining revenue, operating income and cash flow) • Increasing input prices and/or exchange rate volatility • Increase in competition: macro (Asian manufacturing, internet) or micro (new entrant, sector consolidation) • Internal conflicts between existing shareholders and/or creditors or motivated/forced sellers Financial restructuring immediately unlocks value and is the catalytic event that sparks return to growth mode • Partnership with management to add value by implementing best practice and drive organic/acquisitive growth • Distinct from deep operational turnarounds where the business model itself requires transformation www.cet.co.uk 17 Opportunity: Little Competition, New Money & Consensual • Very few rescue & restructuring investors active in CEE • Alternative capital sources (banks, mezzanine firms, PE firms, hedge funds) unable or unwilling to consider • Rescue lending-led approach: new to CEE • “One-stop shop”: ability to provide BOTH debt and/or equity enables expedited process, higher certainty of completion • Transactions requiring restructuring of old debt AND new money (generally the catalyst to a deal) • Banks/owners unlikely to provide new money alone (but may maintain/increase exposure in externally-driven process) • Banks and other stakeholders generally lack internal resources to manage restructurings and own/operate companies • Not reliant on bank “fire sales” of assets at steep discounts • Creative “win-win” solutions that align interests and motivate creditors, shareholders and stakeholders to consent • All parties better off than status quo via “shared pain” • Consensual out-or-court deals • Not dependent on local bankruptcy law/courts, which are underdeveloped and less reliable than in the West • Relevant local legislation the same as for PE/mezzanine firms • Restructuring enables proper capitalization, operational rejuvenation and avoids low-recovery liquidation • Add-on acquisition in a consolidation play where incremental assets can be integrated into existing platform • Particularly compelling special situations having clear and highly certain legal path to emergence from administration www.cet.co.uk 18 Opportunity: Illustrative Situation Range Stressed Distressed Capital Constraint Liquidity Constraint Illiquid Insolvent Problem Unable to access capital Problem Unable to service debt comfortably Problem Temporarily unable to service debt Problem Indefinitely unable to service debt Causes Tightening credit standards Causes Tightening credit standards Business cycle, overcapacity Causes Tightening credit standards Business cycle Peak in debt maturities Causes Tightening credit standards Business cycle Peak in debt maturities Overleveraged Consequences Unable to pursue growth Capacity utilization threatened Consequences Unable to pursue growth Unable to operate at capacity Liquidity threatened Consequences Unable to pursue growth Unable to operate at capacity Illiquid Solvency threatened Consequences Unable to pursue growth Unable to operate at capacity Illiquid Insolvent Solution New debt Solution Partial refinancing New equity (negative controls) Solution Refinancing Write-down/purchase at discount New equity (blocking minority) Solution Write-down/purchase at discount Debt-equity swap New equity (control) Instruments Working capital with warrants Instruments Debt with warrants Equity Instruments Debt with warrants Equity Instruments Debt with warrants Equity Elements of return Coupon Warrants Elements of return Coupon Warrants Equity upside Elements of return Coupon Significant warrants Equity upside Elements of return Coupon Significant warrants Significant equity upside www.cet.co.uk 19 Opportunity: Downside Protection, Upside Potential • Flexibility to invest throughout capital structure and develop bespoke solutions • Typically both debt and equity-type exposure in each portfolio company Potential instruments and characteristics Debt Downside protection: Exit 3-5 years by amortization or refinancing (reduced exit risk) Senior secured Cash coupon, amortization/refinance, documentation, covenants, asset coverage, perfection Senior unsecured Cash coupon, amortization/refinance, documentation, covenants, asset coverage Working capital Cash coupon, revolving, documentation, covenants, asset coverage Subordinated Cash coupon, amortization/refinance, documentation, limited covenants Hybrid Enables performance-related adjustment during holding period Convertibles Cash coupon/dividend, liquidation preference Equity Upside potential: Exit 4-6 years by trade sale, IPO, secondary or MBO Preferred Dividend, redemption, liquidation preference Warrants/options Equity kicker attached to subordinated debt Common Alignment of interests, board presence, shareholders agreement, minority protection www.cet.co.uk 20 Stressed/Distressed Investment Advice • Interviewer: When do you know it’s time to buy? • Lord Rothschild: When there’s blood in the streets. Even if it’s your own. www.cet.co.uk P21

![[#BPIDEA-13] Give the option to show `View` count by unique views](http://s3.studylib.net/store/data/007700494_2-3911615de654a0135ad82f55710606d1-300x300.png)