Fringe Benefits Tax (FBT)

advertisement

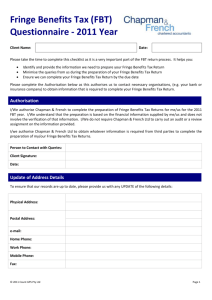

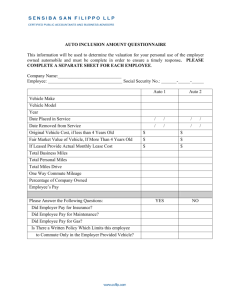

Fringe Benefits Tax (FBT) Questionnaire - 2010 Year Client Name: Date: Please take the time to complete this checklist as it is a very important part of the FBT return process. It helps you: Identify and provide the information we need to prepare your Fringe Benefits Tax Return Minimise the queries from us during the preparation of your Fringe Benefits Tax Return Ensure we can complete your Fringe Benefits Tax Return by the due date Please complete the Authorisation below as this authorises us to contact necessary organisations, (e.g. your bank or insurance company) to obtain information that is required to complete your Fringe Benefits Tax Return. Authorisation I/We authorise Nicol & Nicol Pty Ltd to complete the preparation of Fringe Benefits Tax Returns for me/us for the 2010 FBT year. I/We understand that the preparation is based on the financial information supplied by me/us and does not involve the verification of that information. I/We do not require Nicol & Nicol Ltd to carry out an audit or a review assignment on the information provided. I/we authorise Nicol & Nicol Pty Ltd to obtain whatever information is required from third parties to complete the preparation of my/our Fringe Benefits Tax Returns. Person to Contact with Queries: Client Signature: Date: Update of Address Details To ensure that our records are up to date, please provide us with any UPDATE of the following details: Physical Address: Postal Address: e-mail: Home Phone: Work Phone: Mobile Phone: Fax: © 2010 Count GPS Pty Ltd Page 1 1. First Time Fringe Benefits Tax Returns Yes No N/A Yes No N/A Yes No N/A Yes No N/A Yes No N/A Yes No N/A Yes No N/A If we are preparing your FBT for the first time, please provide copies of your last FBT return lodged with the Australian Taxation Office. 2. Computerised Accounts Please provide a copy of your computerised data file reconciled to 31 March 2010. Name of Program: (i.e. MYOB or QuickBooks) Version Number: Password (if applicable): NOTE: The FBT year runs from 1 April 2009 to 31 March 2010. Note: Minor or infrequent benefits of less than $300 provided to employees do not need to be included with any of the below information as they are exempt from Fringe Benefits Tax. 3. Motor Vehicle Benefits Did you provide any motor vehicles to employees (including directors), that were used for private use? Please complete the attached Motor Vehicle Schedule (make additional copies if needed) 4. Entertainment Benefits Have you provided any entertainment to employees (including directors)? Please complete the attached Entertainment Schedule; OR Please provide a print out from your computerised accounts with the following additional information noted: Details of entertainment (e.g. meal, recreation activity) Where entertainment was provided Who entertainment was provided to (e.g. employee name, or client) Number of people attended function If a meal, was it during business travel? 5. Loan Benefits Please provide details of any loans or advances provided to employees throughout FBT year: Date loan commenced Interest rate Repayments made Draw downs made 6. Debt Waiver Benefits Please provide details of any loans provided to employees that were waived throughout the FBT year: Date loan commenced Interest rate Date and amount waived 7. Housing Benefits Please provide details of any long term accommodation provided to your employees: Employee names Address of accommodation Type of accommodation (e.g. caravan, hotel, mobile home, apartment) Market Value Rent for similar properties in the location Period employee occupied property © 2010 Count GPS Pty Ltd Page 2 Rent paid by employee 8. Living Away From Home Allowance (LAFHA) Yes No N/A Yes No N/A Yes No N/A Yes No N/A Yes No N/A Yes No N/A Please provide details of any LAFHA payments to any employees above the market rate accommodation plus a food component over the statutory allowances (i.e. $42/week for adults and $21 for children under 12yrs old): Employee’s name and family Accommodation Allowance Paid Market rate accommodation for the area Total Food Allowance Paid Other amounts paid as part of the LAFHA 9. Board Benefits Please provide details of any board provided to employees: Employee names Number of days board provided Number of meal provided Any payments employees made towards board 10. Car Park Benefits Please provide details of any car parking benefits provided to employees (including directors): Employee name Date and place vehicle parked Nature of journey to and from car park (e.g. to and from work) (Not required if your business income is less than $10 million and the car park provided is not a commercial car park station) 11. Airline Transport Benefits Please provide details of any free or discounted airline travel provided to employees. (Only applies to businesses in the Travel Industry) 12. Property Benefits Please provide details of any business stock provided to employees free or at a discount price: Employee name Details of product Details of usual sale price Please provide details of any other property provided to employees free or at a discount price: Employee name Details of product Details of cost 13. Other benefits Please provide details of any other benefits provided to employees outside the course of usual employment (e.g. payments of bills on their behalf) 14. Other Information – Please list below © 2010 Count GPS Pty Ltd Page 3 MOTOR VEHICLE SCHEDULE If you have more than 2 motor vehicles, please make additional copies of this Form. Motor Vehicle 1 Motor Vehicle 2 Vehicle Description If vehicle purchased through year: Date purchased Purchase Price (including GST) (please enclose a copy of the invoice) Method of purchase (e.g. Hire purchase, lease, cash) (please provide a copy of the contract if a lease, HP or Chattel Mortgage) If vehicle sold through year: Date sold Sale Price (including GST) (please enclose a copy of the invoice or trading in document) Odometer Reading as at 1 April 2009 Odometer Reading as at 31 March 2010 Business Use Percentage (as per log book) Days unavailable for use (overseas, etc) Operating Expenses for period 1 April 2009 to 31 March 2010 (Including GST)* Lease Payments Fuel Costs Repairs and Maintenance Registration Insurance Other Expenses Please provide details of expenses paid personally by employee/director. Are the expenses incurred by the employee/director personally included in the above operating costs listing? (Yes/No) * No need to complete this if you provided computerised accounting records that include all vehicle costs and it is clearly shown what vehicle the costs relate to. © 2010 Count GPS Pty Ltd Page 4 ENTERTAINMENT SCHEDULE Date © 2010 Count GPS Pty Ltd Description of function/entertainment No. of employees /directors that attended No. of clients that attended Page 5 Cost of Function Was it incurred while travelling (Yes/No)