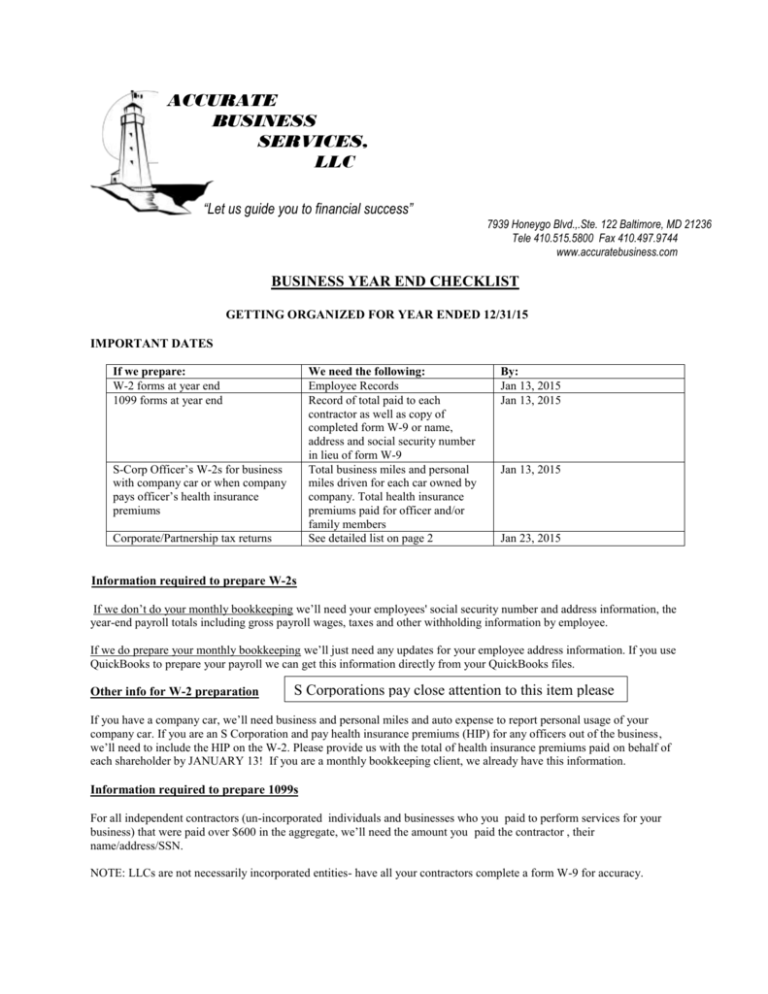

2015 Year End Checklist for Businesses

advertisement

ACCURATE BUSINESS SERVICES, LLC “Let us guide you to financial success” 7939 Honeygo Blvd.,.Ste. 122 Baltimore, MD 21236 Tele 410.515.5800 Fax 410.497.9744 www.accuratebusiness.com BUSINESS YEAR END CHECKLIST GETTING ORGANIZED FOR YEAR ENDED 12/31/15 IMPORTANT DATES If we prepare: W-2 forms at year end 1099 forms at year end We need the following: Employee Records Record of total paid to each contractor as well as copy of completed form W-9 or name, address and social security number in lieu of form W-9 Total business miles and personal miles driven for each car owned by company. Total health insurance premiums paid for officer and/or family members See detailed list on page 2 S-Corp Officer’s W-2s for business with company car or when company pays officer’s health insurance premiums Corporate/Partnership tax returns By: Jan 13, 2015 Jan 13, 2015 Jan 13, 2015 Jan 23, 2015 Information required to prepare W-2s If we don’t do your monthly bookkeeping we’ll need your employees' social security number and address information, the year-end payroll totals including gross payroll wages, taxes and other withholding information by employee. If we do prepare your monthly bookkeeping we’ll just need any updates for your employee address information. If you use QuickBooks to prepare your payroll we can get this information directly from your QuickBooks files. Other info for W-2 preparation S Corporations pay close attention to this item please If you have a company car, we’ll need business and personal miles and auto expense to report personal usage of your company car. If you are an S Corporation and pay health insurance premiums (HIP) for any officers out of the business, we’ll need to include the HIP on the W-2. Please provide us with the total of health insurance premiums paid on behalf of each shareholder by JANUARY 13! If you are a monthly bookkeeping client, we already have this information. Information required to prepare 1099s For all independent contractors (un-incorporated individuals and businesses who you paid to perform services for your business) that were paid over $600 in the aggregate, we’ll need the amount you paid the contractor , their name/address/SSN. NOTE: LLCs are not necessarily incorporated entities- have all your contractors complete a form W-9 for accuracy. Information required to prepare year-end corporate/partnership business tax returns Bank statements for January through December and final month’s bank reconciliation, for both checking and savings accounts including check copies or cancelled checks. If you reconcile the bank statements in QuickBooks, we’ll only need the final statement that included December 31. Credit card statements that include transactions from January 1 through December 31. If you reconcile the credit card statements in QuickBooks, we’ll need the final statement that included December 31. Copies of payroll tax returns and info regarding payments made in January 2015 for December 2015 payroll tax payments. List of assets acquired during the year (furniture, machinery, equipment or vehicles over $500) including date of purchase and purchase price. Please provide copies of invoices for any items purchased over $500. Total inventory on hand (resale items only) at December 31, 2015. Copies of year-end statements confirming ending balances for any loans or credit card accounts not included in the above information. Bookkeeping Records If you use QuickBooks in house to do your own bookkeeping, please create an Accountants Copy of your QuickBooks file (this option can be found on the File Menu in QuickBooks – contact our office for specific instructions on how to do this). You can continue to use your copy of QuickBooks to process your current transactions; once we complete your work we’ll send you an update to integrate into your QuickBooks file that includes any adjustments we made to your records. Please note-- in order to ensure the accuracy of your records, all your bank statements and credit card accounts should be reconciled. If they are not, please provide copies of your monthly statements, and we will reconcile the accounts for you. If using other software, please provide the following documents or reports (we won’t need these items if you use QuickBooks) Print out of check register for 2015 A 12 month detailed transaction report (general ledger) Copies of Balance Sheet and Income Statements at 12/31/14 and 12/31/15 Copies of monthly Bank Statements and Credit Card Statements for the year (whether you use QuickBooks or not). Please call us at 410-515-5800 if you have any questions on the above. We will be happy to answer any questions or concerns you may have.