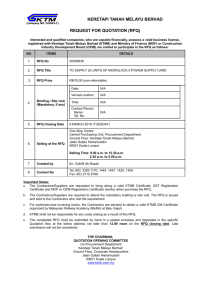

Legal representative of investor [Name, designation, sign and seal]

advertisement

![Legal representative of investor [Name, designation, sign and seal]](http://s3.studylib.net/store/data/009726829_1-ded90e01f141f8df8f09a801ceae2910-768x994.png)