Kotieno_The effect of investor psychology

advertisement

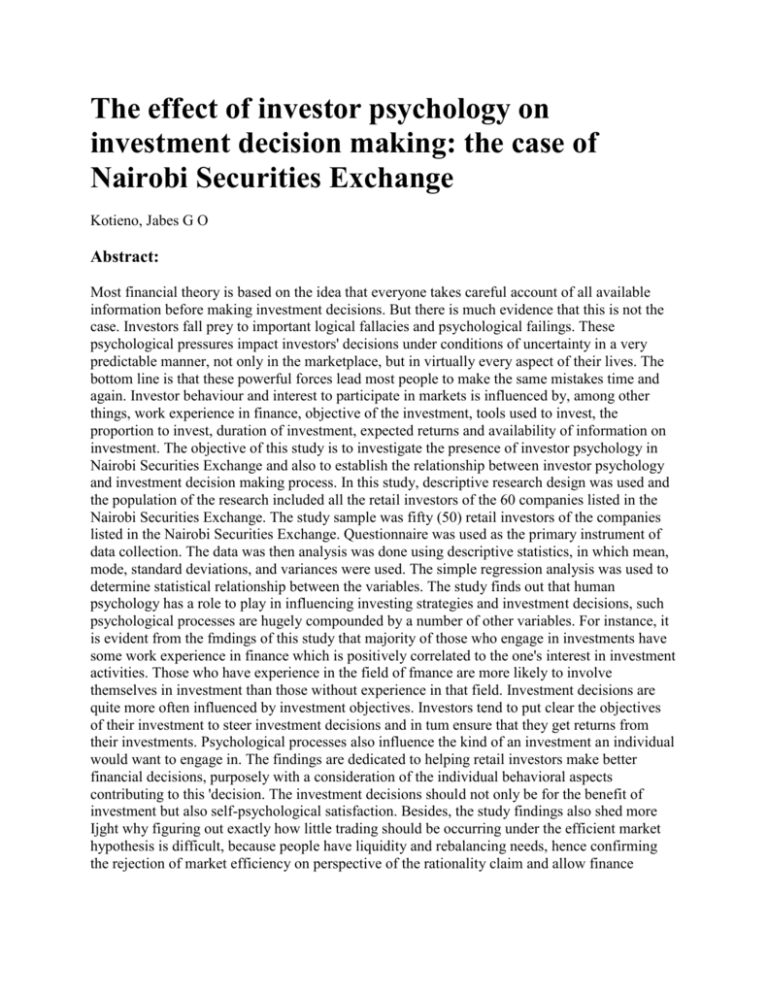

The effect of investor psychology on investment decision making: the case of Nairobi Securities Exchange Kotieno, Jabes G O Abstract: Most financial theory is based on the idea that everyone takes careful account of all available information before making investment decisions. But there is much evidence that this is not the case. Investors fall prey to important logical fallacies and psychological failings. These psychological pressures impact investors' decisions under conditions of uncertainty in a very predictable manner, not only in the marketplace, but in virtually every aspect of their lives. The bottom line is that these powerful forces lead most people to make the same mistakes time and again. Investor behaviour and interest to participate in markets is influenced by, among other things, work experience in finance, objective of the investment, tools used to invest, the proportion to invest, duration of investment, expected returns and availability of information on investment. The objective of this study is to investigate the presence of investor psychology in Nairobi Securities Exchange and also to establish the relationship between investor psychology and investment decision making process. In this study, descriptive research design was used and the population of the research included all the retail investors of the 60 companies listed in the Nairobi Securities Exchange. The study sample was fifty (50) retail investors of the companies listed in the Nairobi Securities Exchange. Questionnaire was used as the primary instrument of data collection. The data was then analysis was done using descriptive statistics, in which mean, mode, standard deviations, and variances were used. The simple regression analysis was used to determine statistical relationship between the variables. The study finds out that human psychology has a role to play in influencing investing strategies and investment decisions, such psychological processes are hugely compounded by a number of other variables. For instance, it is evident from the fmdings of this study that majority of those who engage in investments have some work experience in finance which is positively correlated to the one's interest in investment activities. Those who have experience in the field of fmance are more likely to involve themselves in investment than those without experience in that field. Investment decisions are quite more often influenced by investment objectives. Investors tend to put clear the objectives of their investment to steer investment decisions and in tum ensure that they get returns from their investments. Psychological processes also influence the kind of an investment an individual would want to engage in. The findings are dedicated to helping retail investors make better financial decisions, purposely with a consideration of the individual behavioral aspects contributing to this 'decision. The investment decisions should not only be for the benefit of investment but also self-psychological satisfaction. Besides, the study findings also shed more Ijght why figuring out exactly how little trading should be occurring under the efficient market hypothesis is difficult, because people have liquidity and rebalancing needs, hence confirming the rejection of market efficiency on perspective of the rationality claim and allow finance researchers to ask questions about the roles of investment professionals that go beyond the role of beating the market.