4028-0-Introduction

advertisement

Get Folder

Network

Neighbourhood

Tcd.ie

•Ntserver-usr

•Get

• richmond

Econophysics

Physics and Finance

(IOP UK)

Socio-physics

(GPS)

Molecules > people

Physics World October 2003

http://www.helbing.org/

Complexity

Arises from interaction

Disorder & order

Cooperation & competition

Stochastic Processes

Random movements

Statistical Physics

cooperative phenomena

Describes complex, random behaviour in terms of basic elements and

interactions

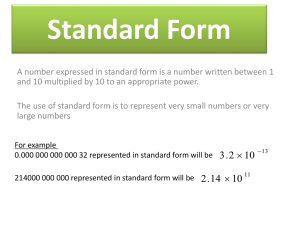

Physics and Finance-history

Bankers

Gamblers

Pascal, Bernoulli

Actuaries

Newton

Gauss

Halley

Speculators, investors

Bachelier

Black Scholes >Nobel prize for economics

Books –

Econophysics

• Statistical Mechanics of Financial Markets

• J Voit Springer

• Patterns of Speculation; A study in

Observational Econophysics

• BM Roehner Cambridge

• Introduction to Econophysics

• HE Stanley and R Mantegna Cambridge

• Theory of Financial Risk: From Statistical

Physics to Risk Management

• JP Bouchaud & M Potters Cambridge

• Financial Market Complexity

• Johnson, Jefferies & Minh Hui Oxford

Books – Financial math

Options, Futures & Other

Derivatives

• JC Hull

Mainly concerned with solution of

Black Scholes equation

• Applied math (HPC, DCU, UCD)

Books –

Statistical Physics

Stochastic Processes

•

•

•

•

•

•

Quantum Field Theory (Chapter 3) Zimm Justin

Langevin equations

Fokker Planck equations

Chapman Kolmogorov Schmulochowski

Weiner processes; diffusion

Gaussian & Levy distributions

Random Walks & Transport

• Statistical Dynamics, chapter 12, R Balescu

Topics also discussed in Voit

Read the business press

Financial Times

Investors Chronicle

General Business pages

Fundamental & technical analysis

Web sites

• http://www.digitallook.com/

• http://www.fool.co.uk/

Motivation

Perhaps you want to become an

actuary.

Or perhaps you want to learn about

investing?

What

happened

next?

5000000

0

20/09/04

20/09/01

20/09/98

20/09/95

20/09/92

20/09/89

20/09/86

20/09/83

23/09/04

23/09/01

20/09/80

23/09/98

23/09/95

20/09/77

23/09/92

23/09/89

20/09/74

23/09/86

23/09/83

20/09/71

23/09/80

10000000

23/09/77

20/09/68

20000000

23/09/74

30000000

23/09/71

23/09/68

DJ Closing Price

12000

10000

8000

6000

Volume of stock traded

4000

25000000

2000

15000000

0

FTSE Closing Price

8000

7000

6000

5000

4000

3000

2000

1000

0

1990-05- 1993-01- 1995-10- 1998-07- 2001-04- 2004-01- 2006-1007

31

28

24

19

14

10

Date

Questions

Can we earn money during both upward and

downward moves?

• Speculators

What statistical laws do changes obey? What is

frequency, smoothness of jumps?

• Investors & physicists/mathematicians

What is risk associated with investment?

What factors determine moves in a market?

• Economists, politicians

Can price changes (booms or crashes) be

predicted?

• Almost everyone….but tough problem!

Why physics?

Statistical physics

• Describes complex behaviour in terms of

basic elements and interaction laws

Complexity

• Arises from interaction

• Disorder & order

• Cooperation & competition

Financial Markets

Elements = agents (investors)

Interaction laws = forces governing

investment decisions

• (buy sell do nothing)

Trading is increasingly automated using

computers

Social Imitation

Theory of Social Imitation Callen & Shapiro Physics Today July 1974

Profiting from Chaos Tonis Vaga McGraw Hill 1994

buy

Hold

Sell

Are there parallels with statistical physics?

E.g. The Ising model of a magnet

Focus on spin I:

Sees local force field,

Yi, due to other spins

{sj}

plus external field, h

I

yi J ij s j h

j

si sgn[ yi ]

V ( si ) yi si

h

Mean Field theory

Gibbsian statistical mechanics

si si

e

yi / kT

e

yi / kT

tanh

s p(s )

s ,

e

i

i

yi / kT

yi / kT

e

J ij s j h

j

kT

yi J ij s j h

j

sgn[ x] tanh[ x]

Jij=J>0 Total alignment

(Ferromagnet)

Look for solutions <σi>= σ

σ = tanh[(J σ + h)/kT]

+1

-h/J

y= tanh[(J σ+h)/kT]

σ*>0

y= σ

-1

Orientation as function of h

y= tanh[(J σ+h)/kT] ~sgn [J σ+h]

+1

Increasing h

-1

Spontaneous orientation (h=0)

below T=Tc

Suppose h ~ 0; K J / kT

1

tanh x x x 3 / 3! ...

6(1 K )

K

~ [Tc T ]1/ 2 T Tc

T<Tc

+1

T>Tc

0 T Tc

σ*

Increasing T

Social imitation

Herding – large number of agents

coordinate their action

Direct influence between traders

through exchange of information

Feedback of price changes onto

themselves

Cooperative phenomena

Non-linear complexity

Opinion changes

K Dahmen and J P Sethna Phys Rev B53 1996 14872

J-P Bouchaud Quantitative Finance 1 2001 105

magnets si

field h

trader’s position φi (+ -?)

time dependent random

a priori opinion hi(t)

• h>0 – propensity to buy

• h<0 – propensity to sell

• J – connectivity matrix

Confidence?

hi is random variable

<hi>=h(t); <[hi-h(t)]2>=Δ2

h(t) represents confidence

• Economy strong: h(t)>0

• expect recession: h(t)<0

• Leads to non zero average for pessimism or

optimism

Need mechanism for

changing mind

Need a dynamics

• Eg G Iori

N

i (t 1) sgn[hi (t ) J ij j (t )]?

i 1

Basic concepts of stocks and investors

Stochastic dynamics

Topics

• Langevin equations; Fokker Planck equations; Chapman,

Kolmogorov, Schmulochowski; Weiner processes;

diffusion

Bachelier’s model of stock price dynamics

Options

Risk

Empirical and ‘stylised’ facts about stock

data

• Non Gaussian

• Levy distributions

The Minority Game

• or how economists discovered the scientific method!

Some simple agent models

• Booms and crashes

Stock portfolios

• Correlations; taxonomy

Basic material

What is a stock?

• Fundamentals; prices and value;

• Nature of stock data

• Price, returns & volatility

Empirical indicators used by

‘professionals’

How do investors behave?

Normal v Log-normal

distributions

Probability distribution density

functions p(x)

characterises occurrence of random variable, X

For all values of x:

p(x) is positive

p(x) is normalised, ie: -/0 p(x)dx =1

p(x)x is probability that x < X < x+x

a

b

p(x)dx is probability that x lies between a

and b

Cumulative probability function

C(x) = Probability that x<X

x

= - P(x)dx

= P<(x)

P>(x) = 1- P<(x)

C() = 1; C(-) = 0

Average and expected

values

For string of values x1, x2…xN

average or expected value of any function

f(x) is

N

1

f x Lt f ( xn) f ( x) p( x)dx

N N n 1

f ( x)dC ( x)

In statistics & economics literature, often

find E[ f x ] instead of f x

Moments and the ‘volatility’

m

n > = p(x) x

<

x

n

Mean: m 1 = m

n

dx

Standard deviation, Root mean square (RMS)

variance or ‘volatility’ :

2 = < (x-m)2 > = p(x) (x-m)2dx

= m2 – m 2

NB For mn and hence to be meaningful, integrals

have to converge and p(x) must decrease

sufficiently rapidly for large values of x.

Gaussian (Normal) distributions

PG(x) ≡ (1/ (2π)½σ) exp(-(x-m)2/22)

All moments exist

For symmetric distribution

m=0; m2n+1= 0

and

m2n = (2n-1)(2n-3)…. 2n

Note for Gaussian: m4=34 =3m22

m4 is ‘kurtosis’

Some other Distributions

Log normal

PLN(x) ≡ (1/(2π)½ xσ) exp(-log2(x/x0)/22)

mn = x0nexp(n22/2)

Cauchy

PC (x) ≡ /{1/(2 +x2)}

Power law tail

(Variance diverges)

Levy distributions

NB Bouchaud uses

instead of

Curves that have

narrower peaks

and fatter tails

than Gaussians

are said to exhibit

‘Leptokurtosis’

Simple example

Suppose orders arrive sequentially at random with mean waiting

time of 3 minutes and standard deviation of 2 minutes. Consider

the waiting time for 100 orders to arrive. What is the approximate

probability that this will be greater than 400 minutes?

Assume events are independent.

For large number of events, use central limit theorem to obtain m and .

Thus

• Mean waiting time, m, for 100 events is ~ 100*3 = 300 minutes

• Average standard deviation for 100 events is ~ 2/100 = 0.2 minutes

Model distribution by Gaussian, p(x) = 1/[(2)½] exp(-[x-m]2/22)

Answer required is

•

•

•

•

P(x>400) = 400 dx p(x) ~ 400 dx 1/((2)½) exp(-x2/22)

= 1/()½ z dy exp(-y2)

where z = 400/0.04*2 ~ 7*10+3

=1/2{ Erfc (7.103)} = ½ {1 – Erf (7.103)}

Information given: 2/ * z dy exp(-y2) = 1-Erf (x)

and tables of functions containing values for Erf(x) and or Erfc(x)