CSBS-in-Saudi-Arabia-Final-1439061610SC

advertisement

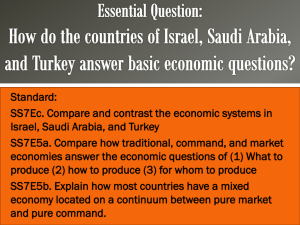

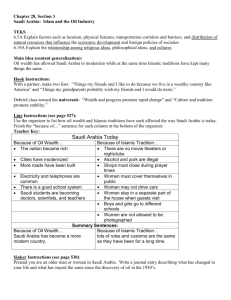

1 Customer Satisfaction of the Banking Financial Services in Saudi Arabia Table of Contents No. TOPIC 1 PAGE Abstract 2 2 1 Introduction 3 3 2 Literature Review 4 4 2.1 Women-Only-Banks 8 5 2.2 Saudi Islamic Banks 8 6 2.3 The National Commercial Bank (NCB) 9 7 3 Methodology 10 8 4 Data Processing 10 9 4.1 Demography of the Respondents 12 10 4.2 Descriptive Statistics 13 11 5 Quantitative Analysis 14 12 6 Qualitative Discussion 19 13 7 Research Findings 20 14 8 Recommendations 22 15 9 Conclusion 23 16 References 25 17 Appendix 27 Research Questionnaire Customer Satisfaction of the Banking Financial Services in Saudi Arabia 2 Abstract For over a number of decades, banking sector or banking industry in Saudi Arabia has been on a constant growth. It has been the Saudi economy’s most significant and deeply seated sector, which is represented by roughly a third of the aggregate market capitalization of all the nation’s listed companies. As a result, banks within the banking industry have been on a constant competition for customers. Banks must thereby be innovative enough to come up with a number of ideas and new systems that aid their competitive advantage. The success and/or failure of banking services, thereby depend on the quality of the relationship between service providers and customers. This is a very vital aspect in the determination of customer satisfaction with the banking services provided. In this context, we thereby define “customer satisfaction” as the evaluation of products and/or services from the customers, with regards to the ability of that product or service to fulfil their projected needs and expectation. In this research report, we reveal customer satisfaction to be resolutely founded upon the reliability and quality of products and services offered by the service providers or suppliers. This research also reveals and brings to light the most relevant determinants for describing and measuring the levels of customer satisfaction with services, from the retail banking sector in the Saudi Arabian market. In a survey conducted on different Saudi banking customers through questionnaires, the paper provides the real world data, which was analysed through a model known as SERVQUAL model. This model relies on five aspects: reliability, empathy, assurance, tangibles, and responsiveness in order to define and expose the levels of customer satisfaction with banking services in Saudi Arabia. Key Words: Banking, banking services, customer satisfaction, quality, reliability, customer, bank, service quality. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 3 1. Introduction Banking has been one of the Saudi Arabian economy’s most essential and deep-seated sectors, represented by approximately a third of the aggregate market capitalization of all the Kingdom’s listed companies. Banks in the Kingdom of Saudi Arabia trace their long history, including the large-scale ground-breaking development when oil prices soared by 1970s. Nonetheless, the success or failure of service providers commonly and largely depends on the quality of their relationship with their customers, which is quite critical in the determination of customer satisfaction. Shankar (2010) reveals that all organizations, to some degree, compete on the basis of service provisions, which are targeted at fulfilling the demands or needs of their customers. Customer satisfaction can thereby be defined as the evaluation of a product or a service by a customer in terms of the ability of the product or service to meet their intended needs and expectations (Woodruff, 1997). Customer satisfaction is resolutely founded upon the reliability and quality of the products and services offered by the product, supplier and/or service provider (Tri, 2011). Nevertheless, almost every retail bank operating within the Saudi Kingdom encounter similar problems with regards to service quality assurance and meeting of their customer service expectations and satisfaction (Shankar, 2010). The practical necessity for customer satisfaction has thereby forced several banks to participate in a number of services, such as the opening of female-only branches. This research, thereby reveals and brings to light the most relevant determinants for describing and measuring the levels of customer satisfaction with services, from the retail banking sector in the Saudi Arabian market (Shankar, 2010). Through a closer scrutiny of the Saudi National Commercial Bank (NCB)’s activities and other banks’ services, the research reveals a very close relationship between service quality and customer satisfaction. High quality bank products and services, thereby means a high level of customer satisfaction, while low quality services would mean a low customer satisfaction level, hence a dwindling customer base (Shankar, 2010). Customer Satisfaction of the Banking Financial Services in Saudi Arabia 4 2. Literature Review According to the UK Group of 20 (2009), in a relatively short duration of time, the Kingdom of Saudi Arabia has been transforming into a global economic force, as evidenced by its inclusion in the Group of 20 (G-20). By 2008, the Kingdom’s total population topped by approximately 28 million people. A close scrutiny at this number reveals that about 20 million of the total population were Saudi citizens, with the remaining approximation of 8 million being expatriate residents (United Kingdom, 2009). With the upsurge of oil extraction and majorly due to the oil revenues, the years of prosperity have resulted in a large baby boom within the country, with a the population of those under 15 years of age making about 38% of the total population; this is approximately 10.6 million. As this young generation begin to hit maturity age, they definitely require banking services for their businesses and daily activities – services that meet their needs, wants and expectations. Abdulaziz (1995) thereby confirms that the sustainability and growth of the Saudi banks clearly and completely rely on this maturing population; attracting, servicing and retaining the younger generation as their target customers, and also as skilled and productive employees. In the interest of gaining deeper insight into this domain segment’s perception, preferences, and customer satisfaction, this research undertook a survey, which investigated the banking experiences of the Saudi young and mid generations, with close regards to the levels of their satisfaction with the banking services offered to them. Nearly 17 million young citizens defined under the age of 30 years, currently live within the Kingdom of Saudi Arabia. The young generation below this age bracket represent about 60% of the nation’s total population. Obviously, no entity or individual (i.e. a corporation, religious leader, educational institutions, and government segments among others) would fail to take into account or consider the influence that this young generation exerts to the nation’s economy. Alternatively, another phenomenon that exists in the modern Saudi Arabia is that despite the previous economic downturns experienced by a number of the world’s economies, the Saudi economy has been on a continuous and constant growth (Churchill & Surprenant, 1982). Many industrial segments are showing an increase in demand in products such as appliances, housing, electronics, and home furnishing. Consequently, this increase in disposable incomes within the country has resulted in an expansion and advancement in the banking industry. Research reveals that by 2008, there about 11 commercial banks operating business within the kingdom, 5 of them Customer Satisfaction of the Banking Financial Services in Saudi Arabia 5 being completely Saudi-owned and about 6 were Saudi-owned with minority foreign holders (Churchill & Surprenant, 1982). Even though the banks preferred the traditional way of cash transaction only, the Saudi citizens began to embrace the banking and purchasing practices as done in other developed nations, such as the use of credit cards, debit and charge cards, which they currently utilize to greater frequencies (Euromonitor International, 2009). Moreover, an augmenting number of Saudi banking customers currently and regularly use ATMs, as well as online services, which they greatly prefer as opposed to the common teller-based services (Euromonitor International, 2009). This rend reveals to what extent the Saudi bankers are continuously getting satisfied with the technologically improved banking services, and it is in no doubt that these trends are piloted or propelled by the younger generation who grow up with and are comfortable with the technology-based services. So, what actually does this research reveal and tries to make us understand about the impressively large group of young population in Saudi Arabia? May be, this will make us understand the banking trends and customer tastes for banking products and services in Saudi Arabia, which would satisfy their banker wants and needs. Wilson (2004) portrays the Saudi youths to be a generation with higher education and greater expectations than their preceding generations or parents. This young generation is different from their predecessors in several ways. For instance, there is a greater possibility that their higher education has not been received from non-Saudi universities. The young females are educated as well as men of their age, since they are increasingly found to be hardworking and working outside their home comforts (Churchill & Surprenant, 1982). Unlike their parents, the generation grew up engulfed by technology, such as computers and cell phones; they are more likely to have knowledge of the importance of banking, and on relationships among people from diverse cultures, which is made possible by travelling, while studying, from media exposure, and via the internet, just to mention a few. This generation has formed a market segment, which this research found to be more comfortable while using the new banking technologies of credit cards, debit cards, and charge cards (Euromonitor International, 2009). They also find it easier to utilize consumer loans in order to enable them to experience their desired living-style or lifestyle earlier in their life. Thanks to the younger generation, by 2013 Saudi National Bank Report revealed that consumer loans had hit SR 630 billion, as opposed to the 2008’s SR 240 billion. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 6 Despite this awareness of the significance of the young population segment in the banking activities, a question still persists in the best way the banks can use to completely earn the loyalty of this potential and lucrative market segment. To find out how best this question can be answered, TNS/NFO- a market research company within the Middle East region, defines the Saudi banking environment as an environment where bank customers are faced with an increasing options for products/services, as well, they are becoming highly demanding since they currently witness banks competing to offer high-level services (Woodruff, 1997). Supposing banks do not have better mechanisms for understanding their customers’ needs, targeting customers with a “segmentation approach” (the one-size-fits-all principle will no longer work) and offering superior services, they are more likely to face a dwindling customer loyalty, which may in the long run or short run, result in an increased cost of customer retention or acquisition. Furthermore, TNS/NFO stated that bank customers will start selecting which bank to attend to them, on the basis of higher order intangible and emotional benefits (Churchill & Surprenant, 1982). Taking a deeper insight, many researchers generally conceptualized customer satisfaction as the feeling of disappointment or pleasure that a person gains by comparing the perceived outcome or performance against their expectations (Babatunde & Olukemi, 2012). The two common conceptualizations of customer satisfaction are: (i) cumulative satisfaction, and (ii) transaction-specific satisfaction. The cumulative satisfaction denotes how customers evaluate their overall consumer experience, and set their personal standards that they subsequently use to gauge the service quality (Tri, 2011). Transaction-specific satisfaction, on the other hand, refers to how customers evaluate their experience, and react to their service encounters. In essence, higher service quality, thereby means higher customer satisfaction (Babatunde & Olukemi, 2012). However, there is a general global agreement that the banking sector holds no recognized or standardized scale for measuring the perception of their customers on the quality of their services (Hossain, 2009). As a result, gaining a competitive advantage through offering highquality services is currently becoming greatly essential for the survival within this sector. On the contrary, Babatunde and Olukemi (2012) argue that the unique characteristics of services such as intangibility, heterogeneity, perishability, and inseparability make it almost impossible for the banking service providers to measure their service quality. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 7 According to Wilson (2004), the provision of high-quality banking services in Saudi Arabia enhances the attraction of new customers and customer retention rates, hence increased productivity, which leads to higher market share, low costs of operation and stock turnover, and improves the profitability, financial performance, as well as morale among employees. This research, thereby asserts that if managers in the Saudi Arabian banking sector can deeply understand what underlies the service quality and its impacts on customer loyalty (Shankar, 2010), it can be able to direct all efforts on the fields that greatly contribute to customer retention in both short and long run. Since customer satisfaction is largely derived from reliability and quality, high-quality services can lead to high customer satisfaction hence increase in customer loyalty. Churchill and Surprenant (1982) found out that customers who were highly satisfied were more loyal as opposed to those who were just satisfied. In support of that statement, this research also found that a good percentage of Saudi bank customers (approximately 40%) switched banks due to what they perceived as “poor service.” An improved service quality alongside professional behaviours thereby translates to an improved customer satisfaction, and reduced customer attrition (Shankar, 2010). It is true that almost all banks globally deliver almost similar products and services, with only minimal interest rate varies, yet a number of customers still have their preferred bank choices. Therefore, bank managements tend to alternate their firms from their competitors simply through service quality (Woodruff, 1997). It is thereby clear that service quality is a very imperative element the greatly impacts customer satisfaction levels within the banking industry (Churchill & Surprenant, 1982). Within the banking sector, quality is thereby a multi-dimensional concept and variable, which involves differing forms of reliability, convenience, service portfolio, as well as the service delivering stuff. The degree of customer satisfaction by a bank, thereby determines the bank’s competitive power and survival (Woodruff, 1997). Hence, Saudi Banks pay a very close attention their customer satisfaction. In efforts to optimize their service quality and ensure customer satisfaction to their advantage, the banking sector in Saudi Arabia has introduced exclusive services such as WomenOnly banks, and Saudi Islamic banks (Khattak, 2010). The Saudi Islamic banking was established to ensure the satisfaction of Islamic customers and this explains the high-level relationships between the Islamic banks and their clients, as well as the customer satisfaction and Customer Satisfaction of the Banking Financial Services in Saudi Arabia 8 shifting behaviours at the Islamic banks in Saudi Arabia (Abdulaziz, 1995). Owing to the rising women movements and advocacy for women's rights from 1960s to 1990s, banks in Saudi Arabia saw an opportunity to establish women-only banks, which only offer banking services to women. This abated the predominant or customary situations of female misperception and gender imbalance in the Asian continent, and introduced a platform upon which the Saudi women can comfortably and easily satisfy their banking quests (Wilson, 2004). The introduction of women-only banks also helped the Saudi banking sector to eradicate the gender imbalance in banking hence everyone, both males and females, could easily find a fair platform for satisfying their banking needs or wants (Khattak, 2010). 2.1 Women-Only Banks In its edition dated: 18th December, 2012, Al Arabiya highlighted a growth in the Middle- East’s women-only bank branches and related funds. It also stated that women in Saudi Arabiathe world’s leading crude oil exporter, are believed to be sitting on about $12 billion pure cash. The nation’s NCB has about 46 women-only bank branches since 1980. As well, the Saudi, Holland Bank also plans to add more women-only branches onto the existing 22 branches. All these are targeting the satisfaction of female bankers in Saudi Arabia with banking services without any gender interruption or business. 2.2 Saudi Islamic Banks Another predominant trend in the Saudi banking is the re-structuring of bank products, so that they become aligned with the Islamic Sharia law teachings (Naser, 1999). One of the creeds of this banking philosophy is that “it prohibits interest-bearing transactions.” This banking system has resulted in the development of Sharia-compliant products and services, which encompass ‘profit-loss sharing’ arrangements rather than the outmoded principles and interest-based transactions or payments. Such services and products have proved to be extremely popular amongst large chunks of Muslim populations (Naser, 1999). As a result, even the transnational banks situated within the Kingdom of Saudi Arabia are currently offering the Shari-based product lines and services in order to meet the needs and wants of their target customers, hence customer satisfaction (Naser, 1999). Customer Satisfaction of the Banking Financial Services in Saudi Arabia 9 Service as a strong pillar of the Islamic monetary systems, the Islamic Banking sector has gained an unprecedented reputation from both Muslims and Non-Muslims over the past three decades. In Saudi Arabia, the Saudi Islamic Banking sector witnessed an average growth rate of about 22%, and approximately $1.8 trillion of the total value of assets, which was valued at $2 trillion by the fiscal year ended 2014 (Woodruff, 1997). The growing adoption of Islamic banking system shows the support for the Islamic financial systems, both for the Muslim majority and the Western nations (Naser, 1999). Its rapid growth also proves higher levels of public acceptance and customer satisfaction. 2.3 The National Commercial Bank (NCB) One of the Saudi banks that this research was focused on being the National Commercial Bank (NCB). This bank served as the best research choice for a number of reasons. According to ABQ Zawya Ltd (2008), NCB was the first bank in the Kingdom of Saudi Arabia, and it remains a hundred percent Saudi-owned. Currently, it is the largest bank in the Saudi Kingdom in terms of capital. It operates at 267 branches, has over 4,600 employees and over 2 million customers. NCB is a full-service-commercial bank offering both traditional and Sharia-based personal banking services, such as debit, credit, charge cards, investments, savings, and consumer loan services. ABQ Zawya Ltd (2008) affirms that the NCB keeps up with technological advances, including the offering of thousands of ATMs and point-of-sale devices nationwide (Euromonitor International, 2009). Additionally, they offer customers with phone, SMS-based banking and online banking capabilities via electronic channels. This study, thereby supports that all these services specifically aim at the satisfaction of customer wants and needs. By 1953, approximately 20 years after the birth of the kingdom, the Saudi government established the nation’s central bank- the “Saudi Arabian Monetary Agency (SAMA).” One year later, the first commercial bank- “National Commercial Bank (NCB)” was established in Saudi Arabia. For a number of years, banking entities within the country remained Saudi Owned, not until 2003 when the government permitted the first foreign bank- Deutsche Bank to open its branch within the nation’s capital. In 2007, NCB reported an operating income of about SR 10 billion, and a net profit of over SR 6 billion. Indeed, technological reports reveal that more than 70% of the bank’s annual Customer Satisfaction of the Banking Financial Services in Saudi Arabia 10 transactions are conducted via electronic channels. The Tadawul- the bank’s free online trading platform is reportedly handling an average of 1.2 million transactions monthly. Nonetheless, regardless of all the bank’s efforts, it still struggles to hold its position and reputation within the Saudi banking industry. Even though they were ranked at the top on the basis of capitalism, NCB is indeed the second in terms of Sharia-based product selling within Saudi Arabia, as well as in terms of ATMs and POSs (Naser, 1999). Also, in 2007, the NCB was ranked the second in terms of market share when it comes to credit, debit, and charge cards in Saudi’s circulation (Euromonitor International, 2009). The key to NCB’s success in the future, thereby lies upon their ability to attract and/or retain the young generation of the Saudi’s potential banking customers to their products and services. 3. Methodology This study aimed at the evaluation of what impact service quality has on the SERVQUAL model, and on customer satisfaction in Saudi Arabia’s banking sector. It was quantitative in nature and involved the distribution of structured, self-administered, and pre-tested questionnaires that were based on convenience methods to about 300 bank customers of various bank branches within the Saudi capital city of Riyadh; the NCB being the central focus. The research survey was conducted at different bank branches within Riyadh and involve a number of NCB branches as well as other reliable local bank branches for data reliability, efficiency, and accuracy. NCB branches were the centre of focus since they are the only banks that are 100% Saudi-owned (ABQ Zawya Ltd. 2008). The 300 questionnaires were used on 300 Saudi bank customers. The respondents were picked at random, provided an individual was a bank account holder in Saudi Arabia. The data obtained was then analysed in order to come up with a conclusion about customer satisfaction in the Kingdom of Saudi Arabia. 4. Data Processing Data for this research were majorly from questionnaire responses obtained from a direct survey conducted with respondents living within the city of Riyadh in Saudi Arabia. The respondents were all bank account holders receiving banking services within Saudi Arabia. The Customer Satisfaction of the Banking Financial Services in Saudi Arabia 11 formula used to select the sample size out of the large and unknown population for the study is adapted from Israel (Israel, 1992). The formula is given as: 𝑍 2 𝑝𝑞 𝑛0 = 𝑒𝑧 Where: n0 – sample size z – Z- value of α (for this study, the value of α was assumed to be 1.484%) p – Variability (variability for this study is 0.5) q–1–p e – Level of precision or error in sampling (the sampling error tolerated in this study is 0.05). Therefore, the sample size equals; 1.4842 (0.5)(0.5)⁄ 𝑛0 = = 220 0.052 Hence, the total number of respondents was approximately 450, but only 220 questionnaires were usable, about 80 were found unusable, and the rest were never returned. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 12 4.1 Demography of the Respondents Gender Age (Years) Marital Status Education Variable Frequency Percentage % Male 188 85.5 Female 32 14.5 < 25 27 12.3 25 – 35 86 39.1 36 – 45 45 20.5 46 – 55 34 15.5 55 > 28 12.7 Married 164 74.5 Single 56 25.5 Elementary – High 22 10 Diploma 29 13.2 Undergraduate 141 64.1 Postgraduate 28 12.7 Entrepreneur 58 26.4 Government 59 26.8 Private Sectors 27 12.3 Lecturer 17 7.7 Teacher 45 20.5 Other 14 6.4 < 2 years 34 15.5 2 – 5 years 70 31.8 5 – 10 years 46 20.9 School Degree Job Type Employee Duration of Being Customer Customer Satisfaction of the Banking Financial Services in Saudi Arabia 13 Account Type Bank Ownership 10 – 15 years 48 21.8 Variable Frequency Percentage % 15 – 20 years 17 7.7 20 > years 5 2.3 Current 118 53.6 Savings 67 30.5 Credit card 18 8.2 Loan 25 11.4 Demat 0 0 Local bank 198 90 Foreign bank 22 10 Table 1: Respondents Demography 4.2 Descriptive Statistics Out of the 220 respondents considered the analysis of this study, 188 (85.5%) are males while the remaining 32 (14.5%) is female respondents. Furthermore, in terms of respondents’ ages, the majority 86 (39.1%) respondents are the youth falling under the age bracket of 25 – 35 years of age. This is followed by those who fall under the age of 35-45 years who contributed to 45 (20.5%) respondents in our data. 34 (15.5%) fall under 45-55 years, while the old and young generations contributed least with 28 (12.7%) and 27 (12.3%) respectively. The majority of the respondents are married 164 (74.5%) respondents, while the singles were 56 (25.5%) respondents. In terms of education, the majority of the bankers are undergraduates, diploma, postgraduate degree holders, and elementary-high schoolers having 64.1%, 13.2%, and 12.7%, and 10% respondents respectively. Most of the bank account holders are government employees and entrepreneurs both contributing to 53.2% of our respondents. The duration for account holding differs, with most of the account holders having been in that position, receiving the banking services for about 10 to 15 years (21.8%), followed by those who have been holding the accounts for 5 to 10 years (20.9%). Moreover, the highest number of bank account holders have current account types, contributing to about 53.6% of our respondents; those with savings accounts follow with approximately 30.5%, while the credit accounts and loan account holders Customer Satisfaction of the Banking Financial Services in Saudi Arabia 14 come after with 18% and 25% respectively. Finally, the results from our questionnaire reveals that the majority of respondents was holding accounts with Saudi local banks (90%), while only 10% have accounts with the foreign banks. 5 Quantitative Analysis The SERVQUAL (service quality) model is used to measure the performance versus expectation gaps across ten dimensions: competence, access, communication, courtesy, credibility, reliability, responsiveness, security, tangibles, and customer understanding (Herbig & Customer Satisfaction Genestre, 1996). The elements of the SERVQUAL theoretical model are summarized as: Asurance Employee knokledge, courtesy and ability to convey convidence and tust Reliability Extent to which the service can perform reliably and accurately Tangibles How the physical equipment, facilities, communication and personnel materials appear Empathy Company's individualized attention and care to its customers Responsiveness Willingness to provide helpful and prompt service to customers Fig. 1: SERVQUAL Model. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 15 In this data processing method, we propose five hypotheses, which are given in their objective form as follows: H1: Assurance holds a significant positive effect on customer satisfaction. H2: Reliability holds a significant positive impact on customer satisfaction. H3: Tangibles hold a significant impact on customer satisfaction. H4: Empathy holds a significant impact on customer satisfaction. H5: Responsiveness hold a significant impact on customer satisfaction. An exploratory factor analysis (EFA) is then used here to identify the construct dimensions in order to select the higher factor loadings, as well as results that are shown in the Table 2. The high KMO measures of the factor analysis meet the required statistical assumptions: Component SERVQUAL Items 1 Bank equipment looks modern 2 Excellent banks are visually appealing physical facilities. 3 Staff at professional bank look professional 4 Tangible Reliability Responsiveness Assurance Empathy .753 .782 .800 Materials associated with the services are visually appealing .651 at excellent banks. 5 Excellent banks keep promises to do things in a certain time. 6 .731 Excellent banks show sincere interests in solving customer related problems. .591 Customer Satisfaction of the Banking Financial Services in Saudi Arabia 16 SERVQUAL Items 7 Excellent banks Tangible Reliability Responsiveness Assurance Empathy perform services correctly the first time 8 .642 Excellent banks offer services within the promised or .791 indicated time frame. 9 Excellent banks insist on errorfree records. .686 10 Staff at excellent banks inform customers exactly when certain .613 services are performed. 11 Staff at excellent banks deliver prompt service .620 12 Staff of highly performing banks are always willing to .631 help customers. 13 Staff excellent banks are never too busy to respond to request .625 from customers. 14 Staff working at an excellent bank behave in a way that instils confidence amongst .729 customers. 15 Customers banks using feel safe excellent while .712 conducting their transactions. 16 Staff working in excellent banks is extremely cautious while handling or dealing with customers. Customer Satisfaction of the Banking Financial Services in Saudi Arabia .732 17 SERVQUAL Items Tangible Reliability Responsiveness Assurance Empathy 17 At excellent banks, the staff has the knowledge and skills required to handle customers .731 and answer their questions well. 18 Excellent banks offer individual and close attention .781 to their customers. 19 The hours of operation at excellent banks are convenient .731 for their customers. 20 Staff at leading banks offer their customers personal .821 attention. 21 Excellent customers’ banks hold best their interest at .636 heart. 22 At excellent understands banks, the staff specific .835 customer needs. Table 2: Rotated Component Matrix. All the items we found were loaded onto the dimension which they were designed for. All the factor loadings were higher than 0.5, meaning that every item was loaded higher on its associated construct as opposed to any other construct. As suggested by Johnson and Fornell (1995), we considered a factor loading that is higher than 0.34 to be statistically significant at alpha level 0.05. This finding thereby provides support for the “measurement’s discriminate validity.” Customer Satisfaction of the Banking Financial Services in Saudi Arabia 18 A reliability test can thereby examine how consistent individuals were in their responses. Hence, Cronbach’s alpha measures the study’s internal consistency and variables are based on sample estimations (Israel, 1992). Construct Reliability Test α No. of Items Tangible 4 0.912 Reliability 5 0.760 Responsiveness 4 0.894 Assurance 4 0.885 Empathy 5 0.868 Table 3: SERVQUAL Scale Reliability Analysis For the above five SERVQUAL dimensions, the Cronbach’s alpha reliability co-efficient are similar to those obtained from some of the previous studies. Even though we suggested 0.7 to be the accepted cut-off point, any value greater than 0.6 was considered satisfactory. The reliability test and analysis, thereby measures the stability on various conditions. Model R 𝑹𝟐 Adjusted Std. Err F change 𝑹𝟐 1 0.782 a. 0.698 0.671 Change Sig St. df 3.8042 34.813 5 0.000 Predictors: (constant) - Responsiveness 1, Reliability 1, Tangible 1, Assurance 1, Empathy 1. b. Dependant Variable: Customer Satisfaction 1 c. P < 0.01 Table 4: Model Summary. The table 4 above indicates that altogether, reliability, assurance, tangibles, responsiveness, and empathy had approximately 75% influence on customer satisfaction. The 𝑅 2 Customer Satisfaction of the Banking Financial Services in Saudi Arabia 19 For the five dimensions designates that these variables exhibit a strong influence on customer satisfaction. The changes in F value (34.813) are essential, implying that the model is fit and robust for this study. 6 Qualitative Discussion Assurance: The assurance, which implies the customers’ feeling of account safety, holds a positive relationship with customer satisfaction. However, there is no significant effect on it. Basing on the responses obtained from bank customers (the respondents), customers hardly consider assurance as an important aspect of service quality (Herbig & Genestre, 1996). A number of customers report security at branches, perhaps on the phone banking and internet banking- this is often due to customer carelessness. Banks must thereby enhance the levels of their customer assurances in their services in order to retain the existing loyal customers and attract new customers. Reliability: This concern the timeliness and accuracy of services. Holding to the responses to our questionnaires, reliability shows no significant impression on customer satisfaction, perhaps due to the augmenting popularity of internet and phone banking, which offer customers various alternative face-to-face customer services (Julian & Ramaseshan, 1994). The full day (24/7) nature of the internet and phone banking implies that retail banks are capable of reducing their operational costs by limiting the hours of branch operations and employing a few numbers of staff. As a result, customers place their demands upon the reliability of machines as opposed to humans while dealing with banks. Tangibles: These include an organization or company’s equipment, facilities and representatives. This study, thereby identifies a positive correlation and high-level significance between tangibles and the overall customer service. For instance, when Saudi retail banks reduce their hours of operation to five days a week, their customers find it impossible to visit bank branches in person, hence they resolve to use the internet and telephone banking instead. Empathy: Our results and hypotheses suggest that there is very little or no significant or positive relationship existing between empathy and customer satisfaction with banking services Customer Satisfaction of the Banking Financial Services in Saudi Arabia 20 in Saudi Arabia. Nonetheless, several customers still enjoy using new bank facilities, while others prefer face-to-face customer service. Responsiveness: This refers to how timely and efficient a bank reacts to its customers’ demands and needs. In our study, responsiveness hold a great significance and better relationship with customer satisfaction, though with little effect on it. We thereby conclude that responsiveness is a positive aspect of quality service and customer satisfaction (Herbig & Genestre, 1996). In essence, we found machines to have an averagely shorter time for response and can constantly be improved upon, while human responsiveness may be affected by moods and emotions, hence reducing the banks’ productivity in line with responsiveness. 7 Research Findings In Saudi Arabia, the practical necessity for customer attraction and retention has forced the banks to “up their game” in service provision and customer handling. Consequently, this has also seen Saudi banks open up more Islamic (Sharia) banks, as well as Women-Only Banks, which are services introduced with the sole aim of satisfying the banks’ target customers. Keeping in view the objectives of this research, the SERVQUAL model has been used and it proves that there are indeed five factors (empathy, responsiveness, reliability, assurance, and tangibles) which truly affect and explains (up to 65%) the ways of business in the daily routines of banking sector in Saudi Arabia. The introduction and implementation of customer satisfaction models and theories in banking will thereby create a room for customer satisfaction and change them to have positive perceptions towards banking services in Saudi Arabia. To draw the conclusion from the findings, three hypotheses were stated and justified out of the proposed five hypotheses: i) There is a substantial relationship between customer satisfaction and bank service quality and efficiency. ii) There is a significant reliability and assurance, and the satisfaction of bank customer needs and wants. iii) There is a significant relationship between responsiveness, tangibles, and the banking system and customer satisfaction, (see Table 5) Customer Satisfaction of the Banking Financial Services in Saudi Arabia 21 Hypothesis Service Aspect Customer Satisfaction Level (High, Medium, Low) H1 Assurance holds a significant positive effect on Assurance High customer satisfaction. H2 Reliability holds a significant positive impact Reliability High on customer satisfaction H3 Tangibles hold a significant impact on Tangible Medium customer satisfaction H3 Empathy holds a significant impact on Empathy Medium customer satisfaction H5 Responsiveness hold a significant impact on Responsiveness High customer satisfaction Table 5: Questionnaire Hypotheses. In Saudi Arabia, the banking sector have realized the need for customer satisfaction. As a result, the banking sector has come up with a number of banking alternatives, systems and programs that help them build a broad platform for satisfying their customers. For instance, the Saudi banking industry came up with the Saudi Islamic Banks and Women-Only Banks by 1990s, which operate under certain regulations, all with a central goal of satisfying a given group of customers. The Saudi Islamic banks operate under Sharia laws, which commonly embrace the Islamic norms. On the other hand, the Women-Only banking systems were introduced in order to cater for female banking needs, without the exploitation of their vulnerability. Our research has also revealed that a good number of Saudi bankers are the young population between the age brackets of 25 – 45 years. This population is very significant to the Customer Satisfaction of the Banking Financial Services in Saudi Arabia 22 Saudi Arabian banking sector since it provides a large number of bankers. As well, the young population in Saudi Arabia is the central focus and the source of bank employees, who are creative and innovative when it comes to the generation of new banking ideas. The Saudi banking industry, thereby grabs the opportunity and utilizes the potentiality in knowledge and skills of the youth in order to come up with quality services which satisfies their customer needs and wants (Herbig & Genestre, 1996). Moreover, the research results reveal that customer satisfaction is highly dependent upon the quality of services offered – high service quality allows for customer retention and as well attracts more new customers, hence an evidence of customer satisfaction (Herbig & Genestre, 1996). On the contrary, low quality of services would scare customers away and even lead to the collapse of the business. This research also found that: i) Respondents’ feeling of banking service quality is positive. ii) The bank customers feel much more secure with their bank accounts of the Saudi banks offer timely and prompt banking services. iii) We also found that in order to maintain their customers and attract new customers, the Saudi banks must enhance their banking technologies and introduce new programs that improve service quality (Iymperopoulous, Chaniotakis & Soureli, 2006). iv) Finally, our study reveals that majority of Saudi bank customers feel comfortable, secure, and satisfied with current services offered by their banks, and they would easily acknowledge their banks to their friends, relatives, job colleagues or business partners. 8 Recommendations Based on the results obtained from the questionnaires of this study, we recommend the following to the Saudi banks for the satisfaction of their customers hence their projected success in banking: i) Banks must enhance the levels of their customer assurances in their services in order to retain the existing loyal customers and attract new customers. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 23 ii) We recommend the Saudi banks to work on the quality of their service offering in order to meet the expectations of their customers, hence customer satisfaction. iii) The Saudi banks should pay close attention and prioritize their customers’ satisfaction through looking deep into the satisfying aspects such as assurance, responsiveness, reliability, empathy, as well as the tangibles. iv) We recommend that Saudi banks should continue offering prompt and timely services in order to create a positive competitive advantage within the Saudi banking industry. v) We also recommend that Saudi banks ought to continue making their customers feel important and highly valued, have experienced staff personnel, as well as an equipped customer service unit. This will enable them to provide customers with prompt service and proper solutions to customers’ complaints, challenges and problems. 9 Conclusion This study examined customer satisfaction, switching behaviour, and the relevant determinants for describing and measuring the levels of customer satisfaction with services from the retail banking sector in the Saudi Arabian market. The model used herein for data analysis reveals these determinants to be empathetic, responsive, tangibles, reliability, and assurance. The model is known as SERVQUAL model, which relied on the data obtained from the distributed questionnaires and descriptive analyses. The results from this research further indicate that the factors for keeping up the good service offering in the Saudi banking market include the adoption of new technologies in the market, alternative service offering, sharia compliance, bank and account type, confidentiality, security, bank statement and data accuracy, and bank staff friendliness. Alternatively, ATM and credit card services, explanation, clarity, promptness in giving a response, staff understanding of their roles and customer needs, complaint or issue handling are very vital for the operation of retail and commercial banks in Saudi Arabia. Since these factors are very essential to customer retention and attraction of new customers, it is advisable for the Saudi banks to pay more attention and high priority to these factors and customer needs and/or wants (Julian & Ramaseshan, 1994). In order to enhance the discussion on banking activities and customer satisfaction, and to test the strength of further findings in other customer satisfaction and banking related studies, Customer Satisfaction of the Banking Financial Services in Saudi Arabia 24 further researches are recommended for the following: (i) Replication of similar studies in other countries, (ii) The use of diverse approaches and methods in order to find out whether the approach employed and the model we proposed and used in this study is robust, applicable and suitable. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 25 References 1. Abdulaziz, M. (1995). The banking system and its performance in Saudi Arabia. Al Saqi, 34(5), 42-56. 2. ABQ Zawya Ltd. (2008). Profile: National Commercial Bank. Retrieved, 15th November, 2015 from:http://www.zawya.com/cm/profile.cfm/cid412191/National%20Commercial%20Bank. 3. Babatunde, A. & Olukemi, L. (2012). Customers’ satisfaction and its implications for bank performance in Nigeria. British Journal of Arts and Social Sciences, 5(1), 13-29. 4. Churchill, G. A. & Surprenant, C. (1982). An investigation into the determinants of customer satisfaction. Journal of Marketing Research (JMR), 19(4), 47-67. 5. Euromonitor International (2009). ATM Card-Saudi Arabia. Retrieved on 20th June, 2015, from:http://www.portal.euromonitor.com.ezroxy.rit.edu/PORTAL/TextSearch.aspx 6. Euromonitor International (2009) Charge Cards-Saudi Arabia. Retrieved on 20th June, 2015, from:http://www.portal.euromonitor.com.ezroxy.rit.edu/PORTAL/TextSearch.aspx 7. Euromonitor International (2009) Credit Cards-Saudi Arabia. Retrieved on 20th June, 2015, from: http://www.portal.euromonitor.com.ezroxy.rit.edu/PORTAL/TextSearch.aspx 8. Hossain, M. (2009). Customer perception on service quality in retail banking in Middle East: The case of Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 2(4), 338- 350. 9. Khattak, N. A. (2010). Customer satisfaction and awareness of Islamic Banking System in Pakistan. African Journal of Business Management, 4(5), 662-671. 10. Naser, K. J.-K. (1999). Islamic banking: a study of customer satisfaction and preferences in Jordan. International Journal of Bank Marketing, 17(3), 135-150. 11. Shankar, C. (2010). Service quality delivery and its impact on customer satisfaction in the banking sector in Malaysia. International Journal of Innovation, Management and Technology, 1(4), 398-404. 12. Tri, W. (2011). Quality tools and customer satisfaction in banking sector. International Journal of Business and Management Tomorrow, 1(2) 1-18-29. 13. United Kingdom (2009). The Group of Twenty (G-20). Retrieved, 17th June, 2015 from http://www.g20.org/research-data.htl 14. Wilson, R. (2004). Economic development in Saudi Arabia. New York: Routledge Curzon. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 26 15. Woodruff, R. B. (1997). Customer value: The next source of competitive advantage." Journal of the Academy of Marketing Science, 25(2), 139-153. 16. Herbig, P. & Genestre, A. (1996). An examination of the cross-cultural differences in service quality: The example of Mexico and the USA. Journal of Consumer Marketing, 13(3), 43-53. 17. Israel, G. (1992). Determining sample size. Agricultural Education and Communication Department Series. Institute of Food and Agricultural Sciences, University of Florida. 18. Iymperopoulous, C., Chaniotakis, I. E. & Soureli, M. (2006). The importance of service quality in bank selection for mortgage loans. Managing Service Quality, 16(4), 365-379. 19. Johnson, M. D. & Fornell, C. (1995). A Framework for comparing customer satisfaction across individuals and product categories. Journal of Economic Psychology, 12(2), 267- 286. 20. Julian, C. C. & Ramaseshan, B. (1994). The role of customer-contact personnel in the marketing of a retail bank's services. International Journal of Retail & Distribution Management, 21. The 22(5), 29-34. case of Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 2(4), 338- 350. Customer Satisfaction of the Banking Financial Services in Saudi Arabia 27 Appendix Research Questionnaire Dear Sir/Madam, I am a student at Al Yamamah University, doing MBA (Masters in Business Administration). I am preparing a project report on Customer Satisfaction of the Banking, Financial Services in Saudi Arabia,” studying the most relevant determinants for describing and measuring the levels of customer satisfaction with banking services from the retail banking sector in the Saudi Arabian banking market. For this reason, I have designed a questionnaire to seek for your views on the banking services. Please, kindly fill in the information required and answer the questions provided below according to your thinking and experience! I will be so much grateful and thankful to you for this. Instructions: The research survey questionnaires that were used to obtain information from the involved bank customers (the respondents) was categorized into two parts, and they were as follows: Part A: This sectioned included optional questions, which the respondents were to answer at own discretion. They were majorly personal details which included: i. Name: ii. Gender: iii. Occupation: iv. Annual Income: Part B: The questions in this section intended to obtain the information for the major research concern. They included: i) What is the name of your bank? ii) Do you feel or think that your bank caters for all your banking needs? Customer Satisfaction of the Banking Financial Services in Saudi Arabia 28 a) Agree b) Strongly agree c) Disagree d) Strongly disagree e) Not certain iii) For how long have you been a customer of your bank and their services? a) Less than 2 years b) Between 2 to 5 years c) Between 5 to 10 years d) Between 10 to 15 years e) Between 15 to 20 years f) Over 20 years iv) What kind of account do you hold in this bank? a) Savings b) Current c) Credit card d) Loan account e) Demat v) Which facilities are given the higher concentration at your bank? a) Loan facilities b) O/D facilities c) ATM facilities vi) Whenever you think of your bank, what comes to your mind? a) Insecurity b) Security c) Wide branch network and customer base d) Good customer service e) Digital banking (computerized) and responsible banking f) Personalized services, or g) Any other, specify). vii) Do you think your bank offers a competitive service for interest rates? Customer Satisfaction of the Banking Financial Services in Saudi Arabia 29 a) Yes I strongly agree b) Agree c) Disagree d) Strongly disagree e) Not certain viii) Does your bank charge unnecessarily for maintaining a minimum balance in your account? a) Yes, it does b) No, it doesn’t c) Not certain ix) Does your bank keep money safe while allowing for withdrawals whenever needed? a) Keep money safe and allow for withdrawal at any time b) Money not safe and withdrawals allowed at any time c) Keep money safe, but limits the number of withdrawals done d) Money not kept safe and withdrawals are also limited x) Does your bank hold a documented list of its shares in stock exchange stock market portfolio, domestic, international or both? a) Domestic only b) International only c) Both domestic and international d) Not sure xi) Issuance of check books so that bills can be paid and other forms of payments can be delivered by post: a) Check books issued for bill payments, but other forms of payment not delivered by post b) Check books issued for bill payments and other types of payments delivered by post c) Check books not issued, but other forms of bill payments delivered by post d) Check books not issued and other forms of payment also not delivered by post. xii) Have you ever at any time interacted with your bank branch manager on a special bank issue or concern? Customer Satisfaction of the Banking Financial Services in Saudi Arabia 30 a) Yes, I have b) No, I have never c) If yes, how did he/she address you; were you satisfied with his support? xiii) In a five-star rating, how can you rate the willingness of your bank to respond to customer concerns? a) 1 star b) 2 stars c) 3 stars d) 4 stars e) 5 stars xiv) Have you applied for credit (line of credit, a loan or mortgage) in the past few years? a) Yes, I have applied b) No, I have never applied c) If yes, how satisfied were you with the service? (Rate in terms of five stars). xv) Do you receive a monthly bank statement? What is your stand about it? a) Bank statements issued monthly b) Bank statement not issued c) Bank statements issued but with a lot of errors d) Bank statements issued with higher accuracy and exact account details e) Bank statement issued but not reliable xvi) Do you use services for alternative banks? a) Yes, I do b) No, I don’t xvii) Are you generally satisfied by the way your bank offers you services? a) Highly satisfied b) Satisfied c) Not satisfied d) Undecided xviii) Provide personal loans, mortgage loans, commercial loans (typically loans to purchase a property, home, or business)? a) Offer all forms of loans or loan services a customer would need Customer Satisfaction of the Banking Financial Services in Saudi Arabia 31 b) Only provides personal loans and mortgages c) Offers loans, but in limited amounts that can't purchase lucrative properties, homes or businesses d) No loan services offered xix) Issuance of debit cards and processing of credit card billings and transactions a) Debit cards issued and debit card billings and transaction processes conducted b) Debit cards not issued and debit card transactions and billings not offered c) Debit cards issued, but debit card billings not performed d) Debit cards issued only for customer transactions (withdrawals and deposit) xx) Use of debit cards for use as a substitute for cheques a) Debit cards used as substitutes for cheques b) Debit cards not issued c) Debit cards issued but not used as substitutes for cheques xxi) Allow financial transactions at branches or by using Automatic Teller Machines (ATMs). a) Financial transactions or use of ATMs at branches allowed b) Financial transactions or use of ATMs at branches not allowed c) Financial transactions of use of ATMs only allowed at the main branch or headquarters d) Financial transactions at branches allowed, but no use of ATMs xxii) Would you recommend this bank or branch to a friend, relative, or business associate? a) Yes b) No c) If No, give reason. xxiii) What do you feel about the overall service quality of your bank? a) Excellent b) Very good c) Good d) Average e) Poor Customer Satisfaction of the Banking Financial Services in Saudi Arabia 32 f) Very poor Customer Satisfaction of the Banking Financial Services in Saudi Arabia