Taxation and Income Distribution

advertisement

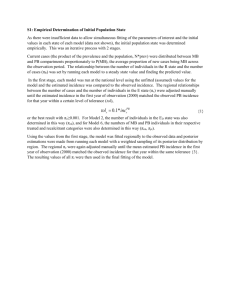

Chapter 12: Taxation and Income Distribution Econ 330: Public Finance Dr. Reyadh Faras Dr. Reyadh Faras 1 Taxation and Income Distribution Tax Incidence Statutory Incidence: who is legally responsible for paying the tax. Economic Incidence: the change in the distribution of private real income induced by a tax. Size Distribution of Income: how taxes affect the way in which total income is distributed among people. Dr. Reyadh Faras 2 Sources and Uses Should be Considered For example, a sales tax not only reduces demand but also reduces incomes received by factors of production. Both producers and consumers are affected, but the overall incidence depends on how both sources and uses of income are affected. In practice, economists ignore effects on sources (inputs) when considering a tax on a commodity and ignore uses (consumers) when considering a tax on an input. Dr. Reyadh Faras 3 Incidence Depends on How Prices are Determined Determining who bears the burden of the tax depends on how the tax changes prices. An important determinant is time; because price changes take time. In most cases, responses are larger in the long run than the short run, implying that the tax incidence may differ according to time. Dr. Reyadh Faras 4 Incidence Depends on the Disposition of Tax Revenues Balanced Budget Incidence: Computes the combined effects of levying taxes and government spending financed by those taxes. In general, the distributional effect of a tax depends on how the government spends the money. Tax revenues are usually not assigned for particular expenditures. Differential tax incidence: Examines how incidence differs when one tax is replaced with another, holding the government budget constant. Because DTI looks at changes in taxes, a hypothetical reference tax system is used in comparison between different taxes. Dr. Reyadh Faras 5 Lump Sum Tax: A tax which does not depend upon individual’s behavior. Absolute Tax Incidence: Examines the effects of a tax when there is no change in either; other taxes or government expenditure. Measuring Progressiveness of Taxes Average Tax Rate: the ratio of tax liability to income. Proportional: average tax rate is constant regardless of income level. Progressive: average tax rate increases with income. Regressive: average tax rate falls with income. Marginal Tax Rate: the change in taxes with respect to a change in income. Dr. Reyadh Faras 6 Tax liabilities under a hypothetical tax system Income $ 2,000 Tax Liability Average Tax Rate Marginal Tax Rate $ -200 3,000 0 5,000 400 10,000 1,400 30,000 5,400 7 First: the greater the increase in average tax rates as income increases, the more progressive is the system. Algebraically: v = _________ Second: A tax system with higher elasticity of tax revenues with respect to income is more progressive. Algebraically: v = _________ Dr. Reyadh Faras 8 Partial Equilibrium Models They are models that look only at the market in which the tax is imposed and ignore the ramifications in other markets. A. Unit Taxes on Commodities A unit tax is a fixed amount per unit of a commodity sold. Dr. Reyadh Faras 9 Implications of the analysis of a unit tax 1. The incidence is independent of whether it is levied on consumers or producers. 2. The incidence depends on the elasticities of supply and demand. Dr. Reyadh Faras 10 B. Ad Valorem Taxes An ad valorem tax is a tax with a rate given as a proportion of the price. The analysis similar to that of the unit tax. The only difference is that the demand curve does not shift by the same absolute amount for each quantity, instead it shifts downward proportionally. Dr. Reyadh Faras 11 C. Taxes on Factors 1. The Payroll Tax These are taxes imposed on workers as percentage of their incomes. The incidence is determined by the difference between what employers pay and what employees receive. Dr. Reyadh Faras 12 2) Capital Taxation These are taxes imposed on owners of capital. D. Profits Taxes These are taxes imposed on firms profits. In a perfectly competitive market, firm’s output is determined by the intersection of its marginal cost and marginal revenues schedules. A proportional profit tax changes neither marginal cost nor marginal revenue. Dr. Reyadh Faras 13 Therefore, no firm has the incentive to change its output decision, which means that the price remains constant; consumers are not worse off. The tax is completely absorbed by the firm. Profit taxes seem attractive because they distort no economic decisions. Dr. Reyadh Faras 14