Introduction to Accounting

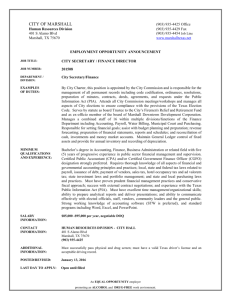

advertisement

Concepts, Bases and Policies Ms Marshall 5th Year Accounting 1 80% of the accounting paper is based on financial accounting. The remaining 20% is management accounting. On the exam Sections 1 & 2 are financial accounting and Section 3 is management. Ms Marshall 5th Year Accounting 2 By the end of Chapter One of your textbook, you should be able to: Understand the objectives of financial information List and explain the different users of financial information. List and explain the four fundamental accounting concepts. List and explain other accounting concepts. Distinguish between an accounting base and an accounting policy. Ms Marshall 5th Year Accounting 3 Financial accounting focuses on past events. Past transactions are recorded to show the performance and financial position of a business during an accounting period. Financial Statements consist of: A trading account, a profit & loss a/c, a balance sheet and a cash flow statement. Ms Marshall 5th Year Accounting Financial Accounting Objectives: To provide information for the purpose of assessing the organisation and making decisions. To meet the rules and regulations as laid down by accounting regulatory bodies. 4 Management Accounting is concerned with the future financial decisions as well as past transactions. It provides information so that the organisation can plan, control and make decisions. Ms Marshall 5th Year Accounting 5 Who do you think would be interested in financial information? Why? Ms Marshall 5th Year Accounting 6 Going Concern: when preparing accounts it is assumed the business will continue in its present form for the foreseeable future, i.e. they are not going into liquidation. Accruals: This means that all items of income and expenditure that belong to a given accounting period must be included in the financial statements regardless of whether they are paid or not. Ms Marshall 5th Year Accounting Consistency: This means that accounting items must be treated in exactly the same way from one accounting period to the next. This enables the business to compare like with like. Prudence: When preparing accounts, caution should be exercised. This means that losses can be anticipated but gains cannot. The prudence concept overrides the accruals concept in cases where they may clash. 7 Entity: the business exists in its own right. The capital of a business is owed to the owners. Money measurement: items included must have monetary value. Realisation: profit is earned when goods/services are sold to consumers. Double Entry: for every debit there is a corresponding credit. Period of Account: consistent length of accounting period. Objectivity: accounts prepared without any personal bias and figures are backed up with documents. Ms Marshall 5th Year Accounting 8 There are different procedures and policies for preparing accounts. The different ways in which items can be treated are known as accounting bases. E.g. depreciating using the straight line method or the reducing balance method. When a firm decides which base they are going to use, this becomes the accounting policy of the firm. These are included in the notes to the accounts. Ms Marshall 5th Year Accounting 9