Transition to Management

advertisement

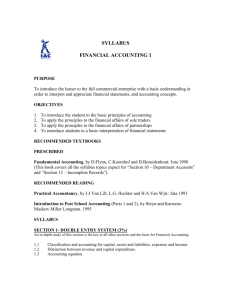

BACCT1201 • Financial Accounting LECTURE 1 Accounting For Single Entry and Incomplete Records Issah Hamdu Faculty of Business Management and Globalization Tel : 603 8317 8833 (Ext 8403) Email: issah@limkokwing.edu.my Objectives In this chapter, you will learn about the explanations and Illustrations of: • • • • • the principles underlying the Cash Basis versus Accrual Basis of Accounting. How profit can be ascertained from incomplete financial records Draw up the income statement and balance sheet from records not kept on a double entry system Deduce the figures for cash and purchase from incomplete records Deduce cash drawings when all other cash receipts and cash payments are known BACCT1201 Financial Accounting 2 Cash Basis vs. Accrual Basis: • The Cash Basis accounting is used when revenue is recognized based on cash actual received. Under this method, an expenses is recognized only when payment is made. This method is commonly used by small and petty traders who are unable to advance credit for goods sold. • Accrual basis accounting on the other hand is a method of accounting whereby revenue is recognized (earned) once goods are delivered or services rendered to a customer. Expenses are incurred once benefits is derived or services provided by another party. This method is widely used by most businesses and all corporations. BACCT1201 Financial Accounting 3 Examining Accounts & Accounting Systems : Single Entry vs. Double Entry.. Any set of accounts needs to be prepared on double-entry lines. However, in the majority of cases (especially so with small traders) this does not mean that the records will have been kept on a double-entry basis. Where records are incomplete the accounts may only balance because of the introduction of estimates and balancing figures. However, if a more comprehensive accounting system is Maintained But falls short of double entry the accountant may 'complete' the double entry after the end of the year, either in the client's own nominal ledger or in his or her own papers. There may be a full set of sales and purchases ledgers in such a system, but the lack of a nominal ledger means it is single-entry. BACCT1201 Financial Accounting 4 Examining Accounts & Accounting Systems : Single Entry vs. Double Entry.. • The fact that an accounting system is double-entry and every transaction is recorded twice as a debit and a credit in the records does not necessarily guarantee its accuracy. There will be more books to maintain than in a simple single-entry cash book system and it may therefore require more ingenuity to circumvent. However, the vital factor is the integrity of the figures recorded, no matter how allegedly comprehensive the accounting system. This is true of a computerized accounting system too. • The lack of complete financial records based on double entry principles is mainly faced by small business majority of who cannot afford to invest enough resources to take care of their accounting needs. BACCT1201 Financial Accounting 5 Why Double Entry is Not Used • Generally, for small business such as ‘pasar malam traders’, small shop keeper or internet cafe owner, using a complete double entry system is just unthinkable. Operators of such businesses may either not have accounting knowledge at that level or simply because they can have all the information they need about their business without the need to maintain double entry principles. • In some cases records of small business operations might have been lost either through fire or theft. • Small businesses will generally record one entry for almost all transactions, usually in the form of a cash journal. This will include all information on cash and sales. BACCT1201 Financial Accounting 6 Preparation of Financial Statements from Incomplete Records • Financial statements of small businesses have to be prepared at least once in a while at least to compute their profit, sales or purchases. This is usually necessary for tax computational purposes. • To find out the trading results from an incomplete record, it is necessary to compare the trader’s capital at the start of the trading period with the capital at the end of the trading period. • This analysis can be derived from your knowledge of the accounting from studied in Business Accounting (BACCT1101). BACCT1201 Financial Accounting 7 Preparation of Financial Statements from Incomplete Records • The Effect of Profit on Capital: Where there is no injection of additional cash or resources into a business by the owner(s), any increase in capital (from the opening balance) is the result of a ‘profit’ made by the business. • Example: - 1.1.08 Open balance of capital 50,000.00 • 31.12.0 Closing balance of capital 120,000.00 Profit for 2008 70,000.00 The above computed is directly derived from the accounting equation BACCT1201 Financial Accounting 8 Preparation of Financial Statements from Incomplete Records Identifying profit from a list of opening and closing balances of Assets and liabilities: Statement of affairs: This is prepared using the opening balances of assets and liabilities to determine the opening balance of capital. The opening capital is then used (in the statement of affairs prepared at the end of the financial year) to help compute the profit at the end of the period. BACCT1201 Financial Accounting 9 Preparation of Financial Statements from Incomplete Records Where cash drawings is provided, that will be used along side The opening capital computed to derive the profit for the period. The next slide demonstrate this concept with an illustration BACCT1201 Financial Accounting 10 Preparation of Financial Statements from Incomplete Records Below are the opening and closing balances of SUKA HATI Enterprise, a trade at a night market in Gombak for 2006 and 2007: As at 31.12.2006 As at 31.12.2007 Van RM18,000 Furniture RM5,400 Debtors RM12,300 Stock RM9,000 Cash & Bank RM15,000 Creditors RM3600 Loan from Orang Kaya RM10,500 BACCT1201 Van (net of depreciation) RM15,000 Furniture (net of deprec.) RM4,800 Debtors RM18,600 Stock RM11,400 Cash & Bank RM23,400 Creditors RM5400 Loan from Orang Kaya RM6,000 Drawings RM15,600 Financial Accounting 11 Preparation of Financial Statements from Incomplete Records • Prepare a statement of affairs for 2006 and compute profit for 2007 • See Excel File for proposed solution BACCT1201 Financial Accounting 12 Preparation of Financial Statements from Incomplete Records Small businesses usually keep records of their cash transactions. This makes the preparation of the financial possible. The following steps can be used as a guide in the preparation of financial statements from incomplete records: 1. Compute the opening capital (using the statement of affairs template) 2. Ascertain credit sales (using debtors control account) 3. Ascertain credit purchase (using creditors control account) 4. Ascertain the expenses chargeable to the profit and loss account 5. Prepare trading, profit and loss account 6. Computing unknown figure such as Sales, Cost of sales or Gross profit using the following formulas: Gross profit margin Mark-up BACCT1201 = Gross profit/Sales = Gross profit/Cost of sales Financial Accounting 13 Preparation of Financial Statements from Incomplete Records – an example As a professional accountant, you have been hired by Mr. Bright, owner of Zombi Enterprise, a sole proprietorship selling toiletries in Zango to help prepare his business’s final account for the year ending 31.12.2007. After a thorough check on his books you have obtain the following information about his business: a. No record of sales has been kept (most of which is usually on credit). A payment of RM61,500 (RM48,000 by cheque) has been received from a customer for credit sale earlier. b. A total of RM31,600 was paid to suppliers during the period by cheque. c. Expenses paid during the period (by cheque): rent RM3,800; general expenses RM310; rent (by cash) RM400 d. Mr. bright took RM250 on a weekly basis as drawings. e. Additional information on Zombi enterprise are as follows: BACCT1201 Financial Accounting 14 Preparation of Financial Statements from Incomplete Records – an example Debtors Creditors Rent owing Bank Cash Stock 31.12.2006 RM 5,500 1,600 5,650 320 6,360 31.12.2007 RM 6,600 2,600 350 17,940 420 6,800 F. Zombi enterprise only fixed asset was some fixtures valued at 31.12.2006 at RM3,300. This assets is depreciated annually at 10%. See the step-by-step preparation of the income statement of Zombi enterprise in excel sheet. BACCT1201 Financial Accounting 15 Preparation of Financial Statements from Incomplete Records: Statement of affairs Zombi Enterprise Statement of Affairs as at 31.12.2006 Fixed Assets Fixture Current Assets Stock Debtors Cash Bank Current liability Creditors RM 6360.00 5,500.00 320.00 5650.00 17,830.00 1,600.00 16,230.00 19,530.00 ________ 19,530.00 Financed by: Capital BACCT1201 RM 3,300.00 Financial Accounting 16 Preparation of Financial Statements from Incomplete Records: Cash Book Cash Book as at 31.12.2007 Cash Bank Cash Bal. b/d 320 5650 Creditors Debtor 13500 48000 Rent 31600 400 General exp. Balance b/d BACCT1201 13820 53650 420 17940 Bank 3800 310 Drawings 13000 Balance c/d 420 17940 13820 53650 Financial Accounting 17 Preparation of Financial Statements from Incomplete Records – Computing credit purchase Creditors Control Account RM RM Cash 31600 Balance b/d 1600 Balance c/d 2600 Purchases* 32600 34200 34200 * Missing figure BACCT1201 Financial Accounting 18 Preparation of Financial Statements from Incomplete Records – Computing credit purchase Debtors Control Account RM Balance b/d 5500 Sales* 62600 RM Cash Received: Cash 13500 Bank 48000 Balance c/d 6600 68100 68100 * Missing figure BACCT1201 Financial Accounting 19 Preparation of Financial Statements from Incomplete Records – Computing credit purchase Rent Account RM Cash 400 Bank 3800 Balance c/d 350 RM P&L* 4550 4550 4550 * Missing figure BACCT1201 Financial Accounting 20 Preparation of Financial Statements from Incomplete Records Zombi Trading Account for the Year Ending 31.12.2007 RM Sales RM 62600 Less: Cost of sales Opening stock 6360 Purchases 32600 Closing stock (6800) Cost of sales 32160 Gross profit c/d 30440 BACCT1201 Financial Accounting 21 Preparation of Financial Statements from Incomplete Records Zombi Profit & Loss Accounts for the Year Ending 31.12.2007 RM Gross profit b/d RM 30440 Less: expenses Rent 4550 General expenses 310 Depreciation 330 5190 Net profit BACCT1201 25250 Financial Accounting 22 Preparation of Financial Statements from Incomplete Records Zombi Balance Sheet as at 31.12.2007 Fixed Assets Fixtures (net) Depreciation RM Current Assets Stock Debtors Cash Bank Current liability Creditors Rent accrued RM 6800 6600 420 17940 31760 (2600) (350) (2950) BACCT1201 RM 3300 (330) 2970 Financial Accounting (28810) 31780 23 Preparation of Financial Statements from Incomplete Records Financed By: RM 19530 25250 44780 Capital Net profit Drawings BACCT1201 (13000) 31780 Financial Accounting 24 Preparation of Financial Statements from Incomplete Records Incomplete Records and Missing Figures: 1. Drawings/Cash Received/Cash Paid: Sometimes one of these may be missing from the cash receipts and payments. Where the missing amount is in respect of payments, then its normal to assume that the missing figure is the amount required to make both totals agree in the cash column of the cash book (note that for bank related transactions a copy of all transactions can always be obtained from the bank). 2. Where payments are less than receipts, it is likely that the missing figure is cash receipts from customers BACCT1201 Financial Accounting 25 Preparation of Financial Statements from Incomplete Records 1. Note that in using the ‘balancing figure’ to identify the missing figures one must ensure that all the other variables have been verified. 1. Cash sales and credit sales (cash purchase and credit purchase): Where there is cash purchase or cash sales, upon computing credit sales or credit purchase the two should be added as the TOTAL is the correct figure to use. BACCT1201 Financial Accounting 26 The End End of Lecture 1 BACCT1201 Financial Accounting 27