Slides 4 - Farmer School of Business

advertisement

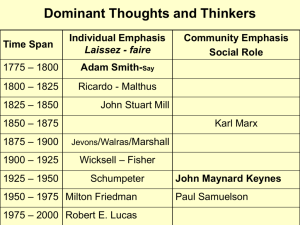

Slides 4 For the Final Exam Homework A • Budget line stays the same due to unchanged 𝑄 𝑚𝑎𝑥 • Indifference curve stays the same due to unchanged preference • Optimum stays the same • P doubles • Monetary policy has no effect on optimum since income and price both double Intertemporal Budget Constraint (IBC) • Idea: no one borrows or saves forever • Before she dies, 𝐶2 = 𝑌2 + (1 + 𝑟)(𝑌1 −𝐶1 ) • Dividing (1 + 𝑟) on both sides gives 𝐶1 + 𝐶2 1+𝑟 = 𝑌2 𝑌1 + 1+𝑟 (IBC) So what really matters is permanent income, not current income. Exercise: what happens if 𝑟 rises? Preference • Intertemporal (Total) Utility: 𝑈 𝐶1 , 𝐶2 • Instantaneous (Each Period) Utility: 𝑢 𝐶1 ), 𝑢(𝐶2 • Two properties: 𝑢′ > 0, 𝑢′′ < 0 • For example, 𝑢 𝑐 = log(𝑐) • 𝑈 𝐶1 , 𝐶2 = 𝑢 𝐶1 ) + 𝛽𝑢(𝐶2 = log 𝐶1 + 𝛽log(𝐶2 ) Dynamic Optimization • max 𝑈 𝐶1 , 𝐶2 𝑠𝑢𝑏𝑗𝑒𝑐𝑡 𝑡𝑜 𝐶1 + 𝐶2 1+𝑟 = 𝑌1 + • Constraint optimization • Can be transformed to an unconstraint optimization problem by substituting 𝐶1 = 𝑌1 𝑌2 𝐶2 + − into the utility function 1+𝑟 1+𝑟 𝑌2 1+𝑟 • Then take derivative of 𝑈 with respect to 𝐶2 and let 𝑑𝑈 𝑑𝐶2 =0 Calculus • Consider 𝑓(𝑥, 𝑦) where 𝑥 𝑎𝑛𝑑 𝑦 are both functions of 𝑧 • Then 𝑑𝑓 𝑑𝑧 = 𝜕𝑓 𝑑𝑥 𝜕𝑓 𝑑𝑦 + 𝜕𝑥 𝑑𝑧 𝜕𝑦 𝑑𝑧 • For our problem 𝑓 = 𝑈, 𝑥 = 𝐶1 , 𝑦 = 𝐶2 , 𝑧 = 𝐶2 Calculus Two 𝑑𝑈 = 𝑑𝐶2 𝜕𝑈 𝑑𝐶1 𝜕𝑈 𝑑𝐶2 + 𝜕𝐶1 𝑑𝐶2 𝜕𝐶2 𝑑𝐶2 = 𝑑𝑢 𝑑𝐶1 𝛽𝑑𝑢 𝑑𝐶2 + 𝜕𝐶1 𝑑𝐶2 𝑑𝐶2 𝑑𝐶2 = 𝑑𝑢 𝜕𝐶1 − 1 1+𝑟 𝛽𝑑𝑢 + 1 𝑑𝐶2 =0 Euler Equation (First Order Condition) 𝑑𝑢/𝑑𝐶1 = 𝛽(1 + 𝑟) 𝑑𝑢/𝑑𝐶2 This looks similar to 𝑀𝑈𝐴 𝑃𝐴 = 𝑀𝑈𝐵 𝑃𝐵 marginal rate of substitution equals relative price at optimum. Interpretation • 𝑑𝑢/𝑑𝐶1 = 𝛽(1 + 𝑟) 𝑑𝑢/𝑑𝐶2 • So at optimum a person is indifferent between two options: (I) consume one more unit now; (II) save that one unit and consume later. At optimum the two options yield the same change in utility. Log Utility Function • For log utility function 𝑢 𝑐 = log 𝑐 the Euler equation is 𝐶2 = 𝛽(1 + 𝑟) 𝐶1 or 𝐶2 = 𝛽(1 + 𝑟) 𝐶1 This shows the dynamic path of consumption Solution of Dynamic Optimization • Plugging the Euler Equation 𝐶2 = 𝛽(1 + 𝑟)𝐶1 into the IBC gives 𝛽(1 + 𝑟)𝐶1 𝑌2 𝐶1 + = 𝑌1 + 1+𝑟 1+𝑟 and we have the solution 𝑊 𝐶1 = 1+𝛽 where 𝑊 = 𝑌1 + 𝑌2 1+𝑟 denotes permanent income. Exercise • What if 𝛽 falls? • What if 𝑟 rises? • So whether a person saves or borrows in the first period does not matter. Kind of counterintuitive Ricardian Equivalence • Consider the effect of temporary tax cut. The permanent after-tax income is 𝑌2 − 𝑇2 𝑊 = 𝑌1 − 𝑇1 + 1+𝑟 • Temporary tax cut has no effect on 𝐶1 as long as the present value of tax stays the same (so 𝑊 stays the same), i.e., as long as a current tax cut will be followed by a future tax hike. Smooth Consumption • Let 𝛽 1 + 𝑟 = 1, then Euler equation implies that • 𝐶2 = 𝛽 1 + 𝑟 𝐶1 → 𝐶2 = 𝐶1 So the optimum is smooth consumption. The reason is diminishing marginal utility. Random Walk • Let’s add randomness 𝑒 to Euler equation 𝐶2 = 𝐶1 + 𝑒 This shows that consumption follows random walk (RW). • RW has the property that its change is unpredictable, i.e., 𝐸 𝐶2 − 𝐶1 𝐶1 = 𝐸 𝑒 𝐶1 = 0 New-Keynesian Theory I • Use micro foundation • IBC assumes no borrowing constraint. If borrowing constraint (market imperfection) exists, then for poor people the budget constraint is 𝐶1 ≤ 𝑌1 (IBC2) • Now current income matters again. Tax cut will be very effective in stimulating expenditure. New-Keynesian Theory II • Consider doubling money supply • But assume prices of some markets are flexible, others sticky (market imperfection) • Then 𝑃𝐴 , 𝑃𝐵 𝑎𝑛𝑑 𝑌 will change disproportionally. • Then optimum will change since budget line shifts. • Monetary policy can be very effective. Let’s Summarize • http://www.youtube.com/watch?v=GTQnarz mTOc • http://www.youtube.com/watch?v=3u2qRXb4 xCU History of Macroeconomics • Classical model (Adam Smith, David Ricardo, Thomas Malthus) • Markets clear by themselves • Key assumption: prices are flexible • Policies (and government) are not needed • Policies can create inefficiency, e.g., tax, minimum wage, tariff What’s Wrong? Great Depression • Widespread and sustained unemployment (surplus in labor market) • Signal for market failure • Classical model cannot explain • Here comes Keynesian theory which focuses on insufficient demand (after stock market crash) Model of Sticky Prices • Keynes believes that one reason for unemployment is sticky nominal wage • Keynes believes more spending is needed to raise the price level and lower real wage • Can you draw a graph? World War II • Keynes believes WWII cut short of great depreciation • Government expenditures rises • Through multiplier effect, income rises more than the increase in G • So broken window can be good. In long run we are all dead. Phillips Curve • Keynes ignores the role of expectation • Therefore he believes in a negative relation between inflation and unemployment, i.e., a fixed Phillips curve • Can you draw a graph? • Then here comes stagflation in 1970s What’s Wrong? Stagflation • In 1970 both unemployment rate and inflation rate rose • can be explained by expectation-augmented Phillips curve • Lucas critique: econometrics cannot be used to estimate Phillips curve because we cannot assume fixed expectation Micro Foundation • Hayek and Lucas emphasize the microeconomic foundation for macroeconomics, Keynes does not. • The basic model is a two-period utility maximization problem New Classical Theory • • • • • Permanent income hypothesis Random walk hypothesis for consumption Ricardian equivalence Smooth consumption The new classical theory indicates very small multiplier effect. Real Business Cycle Theory • is built upon the new classical theory • Emphasizes that markets clear by themselves, economy can be self-correcting • Unemployment (intertemporal labor substitution) is voluntary • Fluctuation in income (business cycle) is a Pareto Efficient. Government had better do nothing. Dynamic Stochastic General Equilibrium (DSGE) models • The simple two-period model can be generalized • Multiple periods • Random variables • General equilibrium • To much for this course New Keynesian Theory • • • • • Keynesian school is fighting back Micro foundation is used Market can still fail due to various reasons Borrowing constraints, sticky prices, etc So policy is needed to fix market failure Who are they? • Classical approach: Friedrich Hayek*, Robert Lucas*, Robert Barro, Edward Prescott* • Keynesian approach: John Keynes, Paul Krugman*, Larry Summers, Ben Bernanke, Joseph Stiglitz*, Gregory Mankiw • Extreme Keynesian approach: ? Yeah. It’s Me! Marxian Economics • People are greedy • Income gap and social instability are inevitable • Widespread market failure (e.g., no health insurance market for the poor, great depression) • Government needs to do everything (planned economy) • Fatal drawback: incentives are ignored (Most) People are Thin • in Planned Economy • http://www.youtube.com/watch?v=UMLtkp4 AFkc Truth? • • • • Somewhere in middle. Macroeconomics is still a growing baby. There are many unsettled issues For example, introduce game theory to Macro?