CONSTRUCTIVE FEDERATION OPERATIVES PENSION SCHEME

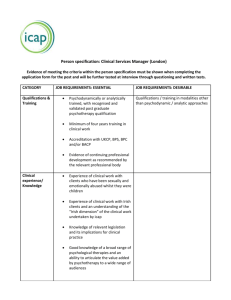

advertisement

3rd PUBLIC PENSION FUND MANAGEMENT CONFERENCE Transparency and Accountability: The Case for Ireland Anne Maher Chief Executive The Pensions Board Ireland September 20-22, 2004 Washington DC AGENDA Background to Irish Fund Progress of Irish Fund Transparency and Accountability Importance Key Components Transparency and Accountability in Irish Fund 2 BACKGROUND TO IRISH FUND Fund Establishment Fund recommended by Reports of: Commission on Public Service Pensions National Pensions Policy Initiative Department of Finance Budget Strategy for Ageing Group July 1999: Minister for Finance announced Government decision December 1999: Temporary Holding Fund for Superannuation Liabilities Act, 1999 set up February 2000: National Pensions Reserve Fund Act, 2000 passed into law April 2000: Establishment Day and National Pensions Reserve Fund Commission appointed 3 BACKGROUND TO IRISH FUND National Pensions Reserve Fund Act, 2000 Fund to be controlled, managed and invested by National Pensions Reserve Fund Commission Independent of Government Fund to receive annual Exchequer contribution of 1% GNP Commission mandate: to generate commercial return National Treasury Management Agency (NTMA) to be Manager for 10 years Payments from Fund to Exchequer from 2025 4 PROGRESS OF IRISH FUND Started with clear objective and agreed Mission Statement Decision on investment strategy and portfolio construction Appointment of service providers Competition Selection process Decision on market entry strategy Market entry and subsequent performance 5 PROGRESS OF IRISH FUND Mission Statement “To meet as much as possible, within prudent risk parameters to be agreed by the Commission, of the cost to the Exchequer of social welfare and public service pensions to be paid from the year 2025 until the year 2055 as provided for in the National Pensions Reserve Fund Act, 2000.” 6 PROGRESS OF IRISH FUND Investment Strategy 20% 40% Eurozone Equities Non-Eurozone Equities 50% hedged Eurozone Bonds 40% 7 IRISH FUND Commission decided on heavy equity investment strategy for four reasons Very long-term view given Fund’s drawdown profile The Fund’s strong cash flow The nature of the pensions to be partly prefunded An assumed average equity risk premium of 3% p.a. 8 PROGRESS OF IRISH FUND Competition for Service Providers Restricted Procedure under Public Services Directive 92/50/EEC Phase I: Notice published in the Official Journal of the EU inviting service providers to submit request to participate in tendering process Phase II: Limited number of applicants invited to reply to request proposal (‘RFP’) within 40 days; site visits by Agency; presentations (‘beauty parade’) by further short list. Award Criteria: The most economically advantageous tender. 9 PROGRESS OF IRISH FUND Market Entry Strategy Average-in (spread market risk over time) or Fully invest (increased risk – Fund retains upside) or A hybrid insurance (options based) approach Commission decision = average-in 10 PROGRESS OF IRISH FUND Asset Allocation 26.1% 14.5% 13.0% 14.0% 12.8% 20.0% 17.3% Cash* 56.6% 71.5% 74.2% 80.0% Bonds Equities End 2002 End 2003 End June 2004 Benchmark *Includes other net current assets 11 PROGRESS OF IRISH FUND Fund’s Appetite for Alternative Assets Commission recently decided to allocate 10% of Fund in 5 new asset classes Small cap equities – 2% Corporate bonds – 2% Property – 4% PPPs - €200m. initially Private Equity – not determined Why? Potential for improved risk adjusted returns Fund has no medium term liquidity needs Can live with J curve effect To be decided - Hedge/Absolute Return Funds/ Emerging Market Equities 12 PROGRESS OF IRISH FUND Tactical Asset Allocation (TAA) Fund has made TAA decisions Market entry – averaging-in: effectively TAA Currently underweight bonds 12.8% compared with 20% benchmark Fund’s strong cashflow would facilitate TAA But does TAA skill exist so as to add meaningful value? 13 PROGRESS OF IRISH FUND Overall Performance Summary 2003 2002 Since Inception (cumulative) Since Inception (annualised) Irish Fund 12.8% -16.1% -2.2% -0.8% Benchmark 16.6% -21.6% -11.8% -4.5% Relative Return -3.8% 5.5% 9.6% 3.7% 2004 Fund Performance 1 January to 30 June 2004 4.5% 14 TRANSPARENCY & ACCOUNTABILITY Importance Greatly increased focus arising from corporate and accounting scandals, for example Enron New legislation and regulation affecting accounting and corporate disclosure and governance, for example, Sarbanes-Oxley Act 2002 in US and Higgs and Smith reports together with new accountancy regulation in UK OECD guidelines for Pension Fund Governance, EU Pensions Directive, national pensions regulators and supervisors all have disclosure and accountability requirements for private pension funds General climate change also affects public funds 15 TRANSPARENCY & ACCOUNTABILITY IMPORTANCE Accountability is essential part of good governance Public awareness and understanding is best discipline Some evidence that good mechanisms to understand and communicate with plan stakeholders is a driver of organisational performance 16 TRANSPARENCY & ACCOUNTABILITY KEY COMPONENTS Focus of liability on a governing body or person accountable to someone Good governance of governing body/person Effective accounts and audit requirements Effective custody requirements Public transparency and reporting to all stakeholders Independent oversight 17 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Responsible party Commission consisting of Chairperson and 6 Commissioners Commission is body corporate who can sue and be sued Eligibility requirements Disclosure of interest requirements Commission control, manage and invest Fund Commission accountable to Parliament 18 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND The National Pensions Reserve Fund Act, 2000 provides for: Preparation of accounts and audit by the Comptroller & Auditor General (senior auditor in State) of the accounts The publication by the Commission of an annual report of its activities and of the audited accounts of the Fund The chairperson of the Commission to appear before and give evidence to the Committee of Public Accounts on the policies of the Commission in relation to the Fund The Chief Executive Officer of the Fund Manager to give evidence to the Committee of Public Accounts on the regularity and propriety of all transactions on the Fund and on the economy and efficiency of the Commission and the Manager in regard to the expenses of operation of the Fund 19 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Accounts and Audit Must keep all proper and usual accounts of moneys and other assets Must include separate account of administration fees and expenses incurred by Commission Audited Accounts of NTMA (the Fund Manger) must note record of expenses incurred by NTMA as Fund Manager Accounts signed by CEO of Fund Manger and a Commissioner must be formally adopted by the Commission and submitted to the Comptroller & Auditor General for audit not later than 4 months from end of financial year Copy of audited account must go to Minister and be laid before each House of Parliament 20 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Report and Information to Minister Not later than 6 months after end of financial year Commission must make report to Minister of its activities for the year This report must be laid before each House of Parliament Each report must include: Information on investment strategy Report on investment return Valuation of net assets and detailed list of assets Information about investment management and custodianship Information on fees, commission and other expenses incurred by Commission and Fund Manager Report shall also include any other information the Minister may direct 21 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Chairperson of Commission to appear before Committee of Public Accounts (PAC) PAC is parliamentary committee responsible for examining and reporting on departmental expenditure PAC holds public hearings and conducts tough examinations Chairperson of Commission must appear before and give evidence to PAC at such times as PAC reasonably request Evidence given relates to policies of Commission, subject to confidentiality of commercially sensitive information 22 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND CEO of Fund Manager to appear before Committee of Public Accounts (PAC) CEO must give evidence to PAC on Regularity and propriety of transactions recorded in any record subject to audit Economy and efficiency of Commission and Fund Manager Systems, procedures and practices employed by Commission to evaluate its effectiveness Any matter affecting the Commission referred to in any report of Comptroller & Auditor General CEO must not question or express opinions on policy of Commission 23 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Other Requirements for Accountability Minister may appoint person to examine any aspect of Fund and Commission – Fund Manager must assist this and give access to all records Independent valuations of assets Independent assessment of investment performance Public Procurement procedures must be used for appointment of all service providers including EU Procedures under Public Services Directive 92/50/EEC Appointment of custodians Commitment to open and transparent reporting subject to preserving confidentiality on commercially sensitive information 24 TRANSPARENCY & ACCOUNTABILITY IN IRISH FUND Other ways of accounting to public Fund Manager website www.ntma.ie Press briefings Conference presentations New Additions National Pensions Reserve Fund Review (between year end and publication of statutory Annual Report) Quarterly performance statements 25 CONCLUSION Transparency and Accountability Are part of good governance Are strong features of funds which work well Growing in importance globally No one ideal model as it must be country specific based on: Capacity to regulate Standards of accounting Trust law General governance quality Must be there in legislation and in practice 26 CONCLUSION In the case of Ireland We have good legislative requirements We need to work harder at making them be ‘seen’ to work in practice 27