Endowment reserves, enterprise income and dowries

advertisement

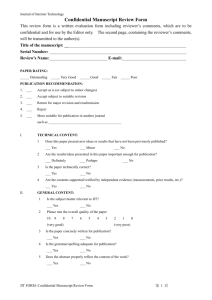

Decision Report CRT 88 MEMORANDUM TO BOARD Tuesday 17 June 2014 Report by the Finance Director Trustees’ Report and Accounts for the period ended 31st March 2014 1 Purpose 1.1 The purpose of this paper is to introduce the final draft 2014 Report and Accounts (“R&A”) and to provide an explanation of the key features and matters to be finalised and approved. The Board is invited to consider the final draft of the Report and Accounts. The chair of the Audit Committee will provide a verbal report from the meeting of the Audit Committee held on 11th June 2014. 2. Recommendation 2.1 The Board is recommended to review and comment on the Report and Accounts and subject to any requested amendments or other observations To consider and approve the Going Concern assessment; To approve the Report & Accounts including the Trustees’ Report (including Strategic Report) and the Governance Report and the current position regarding the parent company balance sheet explained in section 3; To authorise the Chairman, the Chief Executive and the Finance Director to make adjustments to the text in the accounts, as may be necessary, and to do all things that are necessary to finalise the accounts, sign the external auditor’s representation letter and file the signed accounts with Companies House, and; To authorise the Chairman, and one other director if required, to sign the accounts on behalf of the Board. 3. Changes since the draft period 12 management accounts. 3.1 There have been no significant changes to the Group results shown in the R&A as compared with the management accounts presented to the May 2014 Board meeting except for the usual minor presentational changes to the figures due to accounting standards relating to pensions (FRS17). 3.2 The presentation of the Group SoFA continues to use the dual sub-totals before and after the transfers and acquisition in 2012. This presentation is required to comply with the Companies Act in respect of the comparative year 2012/13. 3.3 There have been some changes to the figures and accounts disclosures presented to the Audit Committee arising mainly from an agreed change to the pension fund accounting (see 3.4 below) and the minor changes coming out from a technical review carried out by Grant Thornton. These include the reclassification on the balance sheet of £5.7m short term bank deposits from cash to current asset investments and a number of £0.1m roundings. Information intended for future publication removed 3.4 Information intended for future publication removed 4. Reconciliation with the period 12 management accounts 4.1 Commercially confidential information removed 4.2 Commercially confidential information removed 4.3 Commercially confidential information removed 4.4 The item relating to Donations held in restricted income funds are the historical Golden Pound funds that are awaiting application to waterway projects. This difference arises because these items are included in the management accounts. The policy for these donations has changed going forward such that donations will be part of the General Fund but designated to specific purposes. 4.5 During the year we identified £0.3m of fixed assets that should have been allocated to the protected endowment fund on acquisition from British Waterways in 2012. We have corrected this item during the year as a reclassification from the General Fund. 4.6 The movement on the General Fund in the draft accounts is a reduction of £1.4m as per note 15 in the accounts which shows the movements on Reserves and the Finance Review section in the Trustees Report. The balance on the General Fund has declined from £18.5m at the 31 March 2013 to £17.1m as at 31 March 2014, which corresponds for the £1.4m reduction shown above. 4.7 Information intended for future publication removed 4.8 The main points to note are: Information intended for future publication removed 5. Going Concern 5.1 The going concern assessment is based on the Operating Plan that was considered and approved by the Board at the March 2014 meeting. The assessment falls into two sections. 5.2 The first is the cash flow projection for the Investment cash account (Commercial Capital). That was specifically included in the May Finance Report to the Board and showed a sustainable cash flow position for the investment capital. 5.3 Commercially confidential information removed 5.4 In summary, the Trust’s income streams are very reliable and if necessary waterway expenditure can be cut back marginally to ease any foreseeable cash flow pressures. In conclusion, the going concern assessment is very positive due to the reliable nature of the income, the very strong balance sheet and the ability to control expenditure. The following statement has been included in the Governance section of the Report and Accounts. Going concern The Trust has a broad range of secure income streams that provide a reliable source of income to fund the Trust’s charitable activities. This income is supplemented by contracted grant income from Defra under a Grant Agreement dated 28 June 2012, which is for a fixed term of 15 years. A portion of the Defra grant income is subject to performance conditions. Having reviewed the operational financial projections, and associated cash flow forecasts, the Trustees have concluded that the Trust has sufficient resources to continue funding the charitable activities at the current level of operation for the foreseeable future. 6. Report & Accounts document 6.1 The Report and Accounts has been prepared partly as a Marketing and Fundraising document as well as a formal report and accounts. Printed proofs of the first section with colour photography are included with these papers. 6.2 Trustees may also wish to consider that the Marketing team are in the course of preparing a complementary ‘Impact Report’ drawing on some of the numbers and case studies in the Report & Accounts (and adding other material). It is work in progress but will be ready for publication in September. The main clients for this report are the Fundraising and Enterprise teams since it will be particularly helpful in supporting their work with corporates, trusts and public sector funders. Philip Ridal 12 June 2014 Commercially confidential information removed