IFI_Ch03

advertisement

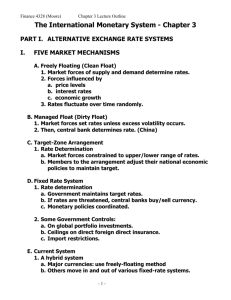

Chapter 3 The International Monetary System The Goals of Chapter 3 • Introduce the history of the international monetary system, from the gold-standard system, Bretton Woods agreement, to modern international monetary systems • Introduce the Eurocurrencies and their markets • Compare different exchange rate regimes • Introduce the capital mobility (the content in Ch 4) • Analyze the exchange rate regimes for emerging markets: currency boards and dollarization • Introduce the history of the Euros • Analyze the tradeoffs for international monetary systems over the years 3-2 History of the International Monetary System 3-3 History of the International Monetary System • The (classical) gold standard system (1876-1913) – “Rules of the game” were simple: each country sets the rate at which its currency could be converted to a weight of gold, or said to set the par value for its currency in terms of gold • For the U.S. and the U.K., $20.67 and £4.2474 can exchange for an ounce of gold, so the dollar/pound exchange rate was ($20.67/ounce of gold) / (£4.2474 /ounce of gold) = $4.8665/£ – Since each government agreed to buy or sell gold with anyone at its announced rate, so exchange rates between currencies were in effect “fixed” • Maintaining adequate reserves of gold to back its currency’s value was very important for a country under this system – The system implicitly limits the rate at which any individual country could expand its monetary supply • Any growth in the amount of money was limited to the rate at which official authorities could acquire addition gold 3-4 History of the International Monetary System – The gold standard system can adjust the balance of payments (BOP) (國際收支帳) by itself • Surplus in BOP increase of reserves of gold government increases monetary supply (expansionary monetary policy) IR↓ (international capital outflows), price level↑ (decrease of export and increase of import) decrease cash inflow to reduce the surplus in BOP • Deficit in BOP decrease of reserves of gold government decreases monetary supply (contractionary monetary policy) IR↑ (attract international capital), price level↓ (increase of export and decrease of import) increase cash inflow to decrease the deficit in BOP ※If all countries follow the above rule, it is impossible for a country to have persistent surpluses or deficits for many years – This classical gold standard system was in effect until the outbreak of WWI, since the free movement of gold was interrupted in the war 3-5 History of the International Monetary System • The Inter-War Years & WWII (1914-1944) – During WWI, many countries issue more currencies to support the war even without the increase of reserves of gold – Therefore, currencies fluctuate over a fairly wide range in terms of gold and each other – After WWI, the U.K. tried to restore the gold standard system and maintain the same exchange rate between its currency and gold as that before WWI – Since the reserves of gold did not increase for the U.K., but the outstanding amount of pound is several times than that before WWI, the pound is obviously overvalued at that rate – International speculators sold short weak currencies to gain profit, e.g., pound, which further reduced the reserves of gold of these countries. The reverse happened with strong currencies 3-6 History of the International Monetary System – Short selling means that the investor sells an asset he does not own and later buy it back and delivery it to the buyer at a future date – For overvalued currency (weak currency) short sell currency to the government for gold (with more weight) if the currency really devalues buy the currency back at the expense of gold (with less weight) and deliver the currency to the government earn gold from the government – For undervalued currency (strong currency) buy currency from the government at the expense of gold (with less weight) if the currency really revalues sell the currency back to the government and obtain gold (with more weight) earn gold from the government 3-7 History of the International Monetary System – The countries with surplus in BOP, e.g., the U.S. and France, adopted the sterilized intervene (沖銷式干預) (by issuing government bonds to offset the increased monetary supply caused by the surplus in BOP) to maintain the surplus and accumulate gold continuously – Therefore, the gold standard system cannot adjust BOP any more, which is one of the reasons for the crash of the gold standard system – In 1931, the U.K. ceased the conversion between the pound and gold and left the gold standard system – The U.S. adopted a modified gold standard in 1934, in which the U.S. Treasury traded gold only with foreign central banks, not with private citizens – During WWII and its chaotic aftermath, the US$ was the only trading currency that continued to be convertible 3-8 History of the International Monetary System • Bretton Woods and the International Monetary Fund (IMF) (1944) – As WWII drew to a close, the Allied Powers met at Bretton Woods, New Hampshire to create a post-war international monetary system – The Bretton Woods Agreement established a U.S. dollarbased international monetary system and created two new institutions, the International Monetary Fund (IMF) and the World Bank – The International Monetary Fund is a key institution in the new international monetary system and was created to: • Render temporary assistance to member countries defend their currencies against cyclical, seasonal, or random occurrences, e.g., financial crisis 3-9 History of the International Monetary System • Assist countries having structural BOP or exchange rate problems if they promise to take adequate steps to correct these problems • Each member country of IMF should deposit some reserves at the IMF, in which 25% is gold (special drawing right, SDR, 特 別提款權) and 75% is the local currency (general drawing right, GDR, 提款權) • Member countries can borrow the gold tranche freely, but need to pay interests for the GDR – Member countries may settle transactions among themselves by transferring SDRs – When a country uses the GDR to pay for the deficit of its BOP, it uses the local currency to buy other currencies. After the there is a surplus in BOP, the country buys back its local currency – The International Bank for Reconstruction and Development (World Bank) helped fund post-war reconstruction and since then has supported general economic development 3-10 History of the International Monetary System • Under the Bretton Woods Agreement – All countries fixed the value of their currencies in terms of gold but were not required to exchange their currencies for gold – Only the dollar remained convertible into gold (at $35 per ounce) (at this time point, 75% of gold is held by the U.S.) – Each currency established its exchange rate with the dollar – Participating countries agreed to maintain the value of their currencies within 1% of par by buying or selling foreign exchange or gold as needed – Devaluation was not to be used as a competitive trade policy – If a currency became too weak to defend, a devaluation of up to 10% was allowed without formal approval by the IMF – However, large devaluations required IMF approval ※This is known as the gold-exchange standard system 3-11 History of the International Monetary System • Fixed Exchange Rates (1945-1973) – The currency arrangement negotiated at Bretton Woods and monitored by the IMF worked fairly well during the postWWII era of reconstruction and growth in world trade – However, widely diverging monetary and fiscal policies, differential rates of inflation, and various currency shocks resulted in the system’s demise – In fact, among 21 industrialized countries, currencies of 12 (4) countries revalue (devalue) relative to US$ – The U.S. had consistent deficits in BOP in this period, that generates the outflow of the US$ to other countries • These outflows were partially due to the growing demand for dollars from investors, businesses, and central banks of other countries, because the US$ is the most important foreign reserve currency in that period • The U.S. did not adopt the contractionary monetary policy 3-12 History of the International Monetary System – Eventually, the large amount of dollars held by foreigners resulted in a lack of confidence in the ability of the U.S. to meet its commitment to convert dollars to gold – In 1962, France asked the U.S. to pay off its debt in gold – In 1968, the U.S. held only 25% of the gold of the world – The lack of confidence forced President Richard Nixon to suspend official purchases or sales of gold by the U.S. Treasury on August 15, 1971 (the international monetary system is from gold-exchange standard to dollar standard in nature) – This resulted in subsequent devaluations of the dollar, so in Smithsonian Agreement in Dec. 1971, ten countries agreed that the US$ is devalued to $38/oz. of gold 3-13 History of the International Monetary System – By the late February 1973, the fixed-rate system no longer appeared feasible given the speculative flows of currencies – The major foreign exchange markets were actually closed for several weeks in March 1973, and when they reopened, most currencies were allowed to float to levels determined by market forces – In June 1973, floating rates continued to drive the now freely floating US$ down by about 10% 3-14 History of the International Monetary System • An Eclectic Currency Arrangement (1973-Present) – Since March 1973, exchange rates have become much more volatile than they were during the “fixed” period – Jamaica Agreement: • In Jan. 1976, IMF meeting in Jamaica resulted in the “legalization” of the floating exchange rate system already in effect, and gold was demonetized as a reserve asset • Member countries can choose among different exchange rate regimes freely (the classifications of IMF’s exchange rate regime are introduced later) • The special drawing right is no longer defined in terms of gold. The SDR is redefined every 5 years. Today, SDR is the weighted average of four major currencies: 44% US$, 34% Euro, 11% Japanese yen, and 11% British pound • The SDR still serves as a unit of account (計價單位) for the IMF, so members can settle transactions among themselves by transferring SDRs 3-15 History of the International Monetary System • Each country’s foreign exchange reserves (外匯準備或外 匯存底) includes 1) SDR in the form of deposits at the IMF; 2) its reserve position at the IMF; 3) foreign exchange; 4) the official holdings of gold ※Foreign exchange: the foreign asset of a country, including the holdings of foreign currencies, securities, notes, and deposits by the government and private citizens (even these assets are deposited in foreign banks) ※Since Taiwan is not the member of the IMF, the foreign exchange reserves of Taiwan means foreign exchange and the official holdings of gold 3-16 Eurocurrencies and their Markets 3-17 Introduction of Eurocurrencies and Their Markets • Eurocurrencies – These are domestic currencies of one country on deposit in a second country – Thus, “Euro” means offshore rather than European zone – In addition to Eurodollars, there are also Eurosterling, Euroyen, etc. – The Eurocurrency markets serve two valuable purposes for international corporations or corporations conducting international trade: • Eurocurrency deposits are an efficient and convenient money market device for allocating excess corporate liquidity • The Eurocurrency market is a major source of short-term bank loans to finance corporate working capital (investment in inventory and accounts receivable) needs, including export and import financing 3-18 Introduction of Eurocurrencies and Their Markets – The history of the modern Eurodollar market • During 1950s, investors or banks in communist countries, like Soviet Union and Eastern European countries, deposit their dollar holdings in Western European banks because they are afraid the deposits might be attached by the U.S. with claims against communist governments • In 1957, in order to improve the BOP, British imposed tight controls on U.K. banks lending sterling to non-UK investors or businesses. U.K. banks turned to conduct dollar lending business in order to maintain their leading position in world finance • After WWII, due to the large financial help from the U.S. to other countries and the surplus of BOP for European countries against the U.S., the amount of Eurodollars rises significantly • During 1970s, with the rise of the oil price, oil output countries obtained large amount of US$ and deposited in the Eurodollar market 3-19 Introduction of Eurocurrencies and Their Markets – Eurocurrency Interest Rates: LIBOR and LIBID • In the Eurocurrency market, the reference rate of interest is the London Interbank Offered Rate (LIBOR) and London Interbank Bid Rate (LIBID) • For example, Eurodollar LIBOR (LIBID) is the mean of 16 multinational banks’ interbank offered (bid) rates for Eurodollars sampled by the British Bankers Association (BBA) at 11 a.m. London time in London – The bid rate is a rate at which a bank needs to pay for borrowing money or accepting deposits – The offer (or ask) rate is a rate at which a bank can earn for lending money – The bid-ask spread is one source of profit for banks ※BBA also collects the data of bid and ask rates for other Eurocurrencies 3-20 Introduction of Eurocurrencies and Their Markets • The bid-ask spread for Eurodollars is smaller than the bid-ask spread for dollars – The Eurodollar LIBOR is generally smaller than the loan rates in the U.S. because the Eurodollar market is a wholesale market – The Eurodollar LIBID is generally higher than the deposit rates in the U.S. because foreign banks are not subject to the U.S. regulations of the reserves requirements and deposit insurance fees » The Fed in the U.S. asks a minimum percentage of reserves requirement for the deposits of banks » The deposit insurance is to against the liquidity risk for “run on the bank” problems, in which many depositors lose confidence in banks and want to withdraw money simultaneously » Without the cost to prepare reserves requirements and deposit insurance, foreign banks can provide a higher interest rate to borrow US$ or to accept US$ deposits – The narrower offer-bid spread is also an important reason for the booming development of the Eurodollar market 3-21 Different Exchange Rate Regimes 3-22 The IMF’s Exchange Rate Regime Classifications • The IMF classifies all exchange rate regimes into eight specific categories spanning the spectrum from rigidly fixed to independently floating – Exchange arrangements with no separate legal tender (共同法 償貨幣制度) (Ecuador, Panama, EU) • Using the currency of other country as the legal tender (Ecuador, Panama, etc.) • Sharing the same legal tender in a monetary union (EU) – Currency board arrangements (聯繫匯率制度) (HK) • Maintaining the fixed exchange rate between the domestic currency and a specified foreign currency by legislation • In addition, issuing more domestic currencies only when acquiring the specified foreign currency • HK maintains about 7.8 HK dollars/US$ since 1983 3-23 The IMF’s Exchange Rate Regime Classifications – Other conventional fixed peg arrangements (固定釘住匯率制度) (China) • The country pegs its currency at a fixed rate to a major currency or a basket of currencies • In addition, the exchange rate fluctuates within 1% around the central rate – Pegged exchange rates within horizontal bands (匯率目標區制度) (Denmark, Hungary) • Similar to the conventional fixed peg arrangements, but the margin of fluctuation is wider than ±1% – Crawling pegs (爬行釘住匯率制度) (Nicaragua, Costa Rica) • The country pegs its currency at a fixed, preannounced rate to a major currency or a basket of currencies within a small fluctuation range (usually smaller than 1%) • The exchange rate is adjusted periodically or in response to changes in selective quantitative indicators (e.g., the inflation rates in the local country and in the major trading partners) 3-24 The IMF’s Exchange Rate Regime Classifications – Exchange rates within crawling pegs (爬行目標區制度) • Similar to the crawling pegs, but the margin of fluctuation is wider than ±1% – Managed floating with no pre-announced path (管理浮動匯率 制度) (Taiwan) • The monetary authority attempts to influence the exchange rate without specifying or pre-announcing exchange rate target • Indicators for managing the rate includes the balance of payments position, foreign reserves, parallel market developments, etc. • It is also called the dirty float – Independent floating (獨立浮動匯率制度) (U.S., Japan, Australia) • The exchange rate is market-determined, with any official foreign exchange market intervention aimed at moderating the rate of change and preventing undue fluctuations in the exchange rate, rather than at establishing a level for it 3-25 Fixed Versus Flexible Exchange Rates • A nation’s choice as to which currency regime to follow reflects national priorities about all facets of the economy, including inflation, unemployment, interest rate levels, trade balances, and economic growth • The choice among different exchange rate regimes may change over time as priorities change • Next I will compare the advantages and disadvantages for the fixed and float exchange rate regimes 3-26 Fixed Versus Flexible Exchange Rates • Fixed rate regime – Advantages: • Provide stability in international prices, which helps the growth of international trade and reduces risks for all businesses • Fixed exchange rates are inherently anti-inflationary as long as the country follows the policy to increase the monetary supply only when acquiring additional foreign exchange reserves – Problems: • The restrictiveness is a burden for a country to pursue policies to alleviate internal economic problems, such as high unemployment or slow economic growth • Need for central banks to maintain large quantities of hard currencies and gold to defend the fixed rate • Fixed rates could be maintained at rates that are inconsistent with economic fundamentals • The fixed rates must be changed administratively or by legislation, usually with late response and at a too large a one-time cost 3-27 Fixed Versus Flexible Exchange Rates • Float exchange rate regime – Advantages • The change of the exchange rate can adjust the balance of payments automatically (this issue is discussed in Ch 4) • Central banks can maintain the independency about the monetary policy, i.e., the associated decisions are independent about foreign currencies • It is not necessary for central banks to maintain large quantities of foreign exchange reserves – The reduction of foreign exchange reserves can be used to help the economic development of the country 3-28 Fixed Versus Flexible Exchange Rates – Disadvantages • The fluctuation of the exchange rate may impede the international trade and investment • Central banks abuse the monetary independency to issue too many currencies, which may result in serious inflation • All nations incline to adopt the expansionary monetary policy and the depreciation policy – An expansionary monetary policy can stimulate the economic growth – A depreciation policy can maintain the competitive ability of export ※If all nations adopt these strategies, the international economy and monetary system will be in disorder • The foreign impact could affect the economic operation of the local country through the exchange rate 3-29 Exchange Rate Volatility under Different Exchange Rate Regimes ※ At first glance, it is surprised that currencies that are pegged had higher volatilities than those within limited flexibility regimes. Please note that the declaration of a peg does not necessarily mean that the currency’s value never changed ※ Not surprisingly, the freely floating regime currency volatilities were the highest ※ The freely falling classification is for those specific countries that suffered severe crisis (usually these countries adopt the pegged or managed floating regime) ※ Volatilities in the 1991-2001 period is not higher than those in other periods, although there were many exchange rate crises in the 1990s (Mexico in 1994, Asia in 1997, Russia in 1998, Brazil in 1999) ※ Possible reasons: 1) the US$ problem in 1981-1985; 2) the weighted average method3-30 Attributes of the “Ideal” Currency • Possesses three attributes, often referred to as the Impossible Trinity: – Exchange rate stability • As the exchange rate is more stable, the investors and businesses suffer less exchange rate risk – Full financial integration • Complete freedom of moving funds from one country and currency to another in response to possible economic opportunities or risks – Monetary independence • Domestic monetary and interest rate policies can be set by individual country to pursue policies to limit inflation, combat recession, and enhance employment ※The forces of economics can not allow the simultaneous achievement of all three. A country must give up one of the above three goals 3-31 Attributes of the “Ideal” Currency Malaysia 1998-2002 US EU • In 1998-2002, Malaysia maintained very tight controls over the capital flow, so it retained it monetary independence and a stable exchange rate, but lack the integration with global financial and capital market • The force of the need of increased capital mobility pushes more countries toward full financial integration such that their business can attract international capital and their domestic economy can be stimulated • Therefore, these countries are forced to adopt either purely floating (like the U.S.) or integrated with other countries in monetary unions (like the EU) 3-32 Capital Mobility (the content in Ch 4) 3-33 Capital Mobility • The degree to which capital moves freely across borders is critically important to a country’s balance of payments • The high capital mobility sometimes can help a country, but sometimes will hurt a country – The financial account surplus has probably been one of the major reasons that the U.S. dollar has been able to maintain its value over the past 20 years – Other countries, e.g., Brazil in 1998-1999 and Argentina in 2001-2002, have experienced massive financial account outflows, which were major components of their economic and financial crisis 3-34 Capital Mobility • Some researchers argue that the post-1860 era can be divided into four distinct periods with regard to capital mobility – 1860-1914: continuously increasing capital mobility as the gold standard system was adopted and international trade relations were expanded (gold standard system) – 1914-1945: global economy was destructed, many isolationist economic policies, negative effect on capital movement between countries (WWI-WWII) – 1945-1971: Bretton Woods era causes a great expansion of international trade, but only the slow and steady recovery of capital markets (Bretton Woods Agreement) – 1971-2002: due to floating exchange rates and economic volatility, cross-border capital flows expand rapidly (Eclectic Currency Arrangement) 3-35 Exhibit 4.9 A Stylized View of Capital Mobility in Modern History 3-36 Capital Movements • Capital can be moved via international bank transfers (legal), with physical currency, collectables or precious metals, money laundering (the cross-border purchase of assets in a way that hides the movement of money and its ownership), or false invoicing of international trade transactions (underinvoicing or overinvoicing of imports and exports, where the difference is another kind of capital movement) • Although no single accepted definition of capital flight exists, it can be characterized as serious capital movement occurring when residents lose confidence in the government due to political or financial problems – Many heavily indebted countries have suffered capital flight, deteriorating their debt service problems 3-37 Exchange Rate Regimes for Emerging Markets 3-38 Emerging Markets and Regime Choices • During 1997-2005, the increased mobility pressures push emerging market countries to choose among more extreme types of exchange rate regimes 3-39 Emerging Markets and Regime Choices • A currency board exists when a country’s central bank commits to back its monetary base–its monetary supply–entirely with foreign reserves at all times • This means that a unit of domestic currency cannot be introduced into the economy without an additional unit of foreign exchange reserves being obtained first – Argentina moved from a managed exchange rate system to a currency board regime in 1991 • The currency board structure fixed the Argentine peso’s value to the US$ on a one-to-one basis • Only after Argentina had earned these dollars through trade, its money supply could be expanded 3-40 Emerging Markets and Regime Choices • The advantage of this requirement eliminated the possible of the nation’s money supply growing too rapidly and causing inflation • There was substantial doubt in the market that the Argentine government could maintain the fixed exchange rate • One explicit signal is that the Argentine banks paid slightly higher interest rates on peso-denominated accounts than on dollardenominated accounts, which reflects the risk for investors to keep their money in peso – After three years of economic recession and months of economic and political chaos, in 2002, Argentina ended the currency board exchange rate system – The Argentine crisis is presented in detail in Ch 10 3-41 Emerging Markets and Regime Choices • Dollarization is the use of the US dollar as the official currency of the country • One attraction of dollarization is that sound monetary and exchange-rate policies no longer depend on the intelligence and discipline of domestic policymakers – Panama has used the U.S. dollar as its official currency since 1907 – Ecuador case: • During 1999, Ecuador suffered a rising inflation rate and a “run on the bank” crisis, i.e., a series of unexpected withdrawals caused by a sudden decline in depositors’ confidence or fear that the bank will close • Ecuador replaced its domestic currency with the US dollar in September 2000 and became the largest dollarization nation • Solved the “run on the bank” crisis immediately and controlled the inflation rate after 3 years 3-42 Emerging Markets and Regime Choices • Advantages for dollarization – Removes any currency volatility against the U.S. dollar – Eliminate the possibility of future currency crises if there is no problem for the U.S. dollar – Provide greater economic integration with the U.S. and other dollar-based markets, both in product and finance • Disadvantages for dollarization – Lose independency over monetary polices, which obtains a byproduct to share similar inflation rates in the U.S. • Ironically, this byproduct is a desired feature for many countries to adopt the dollarization regime – Lose the power of seigniorage (鑄幣權) – Due to the inability to create money, the central bank cannot serve the role of the lender of last resort to save financial institutions during financial crisis 3-43 History of the Euros 3-44 The Euro: Birth of a European Currency • The pioneer of the Euro is from the European Monetary System (EMS) in 1979 • The original 15 members of the European Union (EU) are also members of the EMS • The members in EMS tried to maintain stable exchange rates among themselves because they rely heavily on trade with each other and realize the benefits of fixed exchange rates among themselves are great • The different goals in different countries caused the failure of this system – For example, Germany adopted the contractionary policy to stabilize the inflation, but France adopted the expansionary monetary policy to alleviate the unemployment problem 3-45 The Euro: Birth of a European Currency • The disorder in EMS generates the demand for a common currency • In December 1991, the members of the European Union met in Maastricht, Netherlands to finalize a treaty that changed Europe’s currency future • This treaty set out a timetable and a plan to replace all individual currencies with a single currency called the Euro, that leads to a full European Economic and Monetary Union (EMU) 3-46 The Euro: Birth of a European Currency • To prepare for the EMU, a strong central bank, called the European Central Bank (ECB), was established in Frankfurt, Germany – The ECB is responsible for financial market intervention and the issuance of the euro, and the corresponding goals for each action are to stabilize the euro and prevent the inflation undermining the purchasing power of the euro, respectively – The ECB is free of political pressures for stimulating economies that have historically bothered monetary authorities 3-47 The Euro: Birth of a European Currency • The following convergence criteria are needed to meet before each member country in the EU becomes a full member of the EMU – Nominal inflation should be no more than 1.5% above the average for the three members of the EU with the lowest inflation rates during the previous year (a high degree of price stability) – Long-term interest rates should be no more than 2% above the average for the three members with the lowest interest rates (convergence in long-term interest rates) (The above two criteria help to stabilize the exchange rate) – Fiscal deficits should be no more than 3% of gross domestic product (GDP) – Government debt should be no more than 60% of GDP (The above two criteria ensure sustainable government finance) ※The criteria were so tough that only 11 countries managed to do so before the launch of the Euro in 1999 3-48 Effects of the Euro • The Euro affects markets in following ways: – EMU (16 member countries now) is a single-currency area within the EU (27 member countries now), now known as the euro zone – The euro zone is integrated as one market for both consumers and companies since the launch of the euro – Cheaper transaction costs in the euro zone, e.g., Philips saves 0.3 billion US$ currency transaction cost per year – Currency risks and costs related to exchange rate uncertainty are reduced – All consumers and businesses both inside and outside the euro zone enjoy price transparency and increased price-based competition 3-49 Effects of the Euro – It help to create deeper capital markets and make bigger deals possible – The Euro is becoming a popular reserve currency, representing 19.7% of central banks’ holding in Feb. 2004 – Strong euro deadly for exporter who face competition from China and Japan • After three-year decline of the euro, the euro started to appreciate from 2001 to 2008 – Enhance the probability that a financial crisis in one nation will infect whole zone • The problems for Greece and Spain starting from 2009 could hurt the whole EMU – The unified monetary policy causes a limit for slow-growth countries because they cannot solve their domestic economic problems by monetary policies 3-50 Tradeoffs for International Monetary Systems over the Years 3-51 International Monetary System: The Past and the Future • All international monetary systems must deal with the tradeoff between rules and discretion (vertical), as well as between cooperation and independence (horizontal) Governments intervene little Governments act on their own Governments consult and act in unison with other countries Governments intervene the market discretionarily 3-52 International Monetary System: The Past and the Future • The pre WWII Gold Standard required adherence to rules and allowed independence • The Bretton Woods agreement also required adherence to rules, and countries were required to cooperate to maintain the dollar-based system • The EMS from 1979 to 1999 is a hybrids of these cooperative and rule regimes • U.S. dollars for 1981 to 1985 – The U.S. dollar was the most important currency in that time period – From 1981 to 1985, the U.S. concentrated on solving its domestic economic problems, that causes the exchange rates to be become too volatile 3-53 International Monetary System: The Past and the Future – In 1985, ten countries met at the Plaza Hotel in NY to sign an international cooperative agreement to control the volatility of world currency markets • Many believe that a new international monetary system could succeed only if it combined cooperation among nations with individual discretion to pursue domestic social, economic, and financial goals 3-54