Chapter 6: International Finance and Trade Multiple Choice 1. The

advertisement

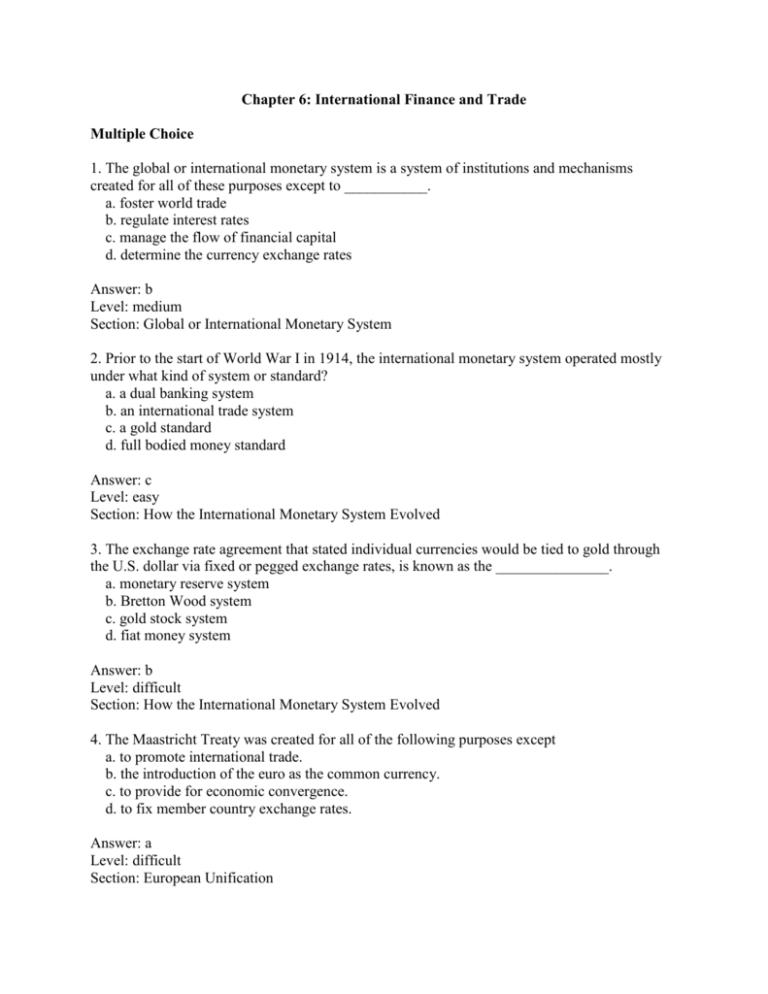

Chapter 6: International Finance and Trade Multiple Choice 1. The global or international monetary system is a system of institutions and mechanisms created for all of these purposes except to ___________. a. foster world trade b. regulate interest rates c. manage the flow of financial capital d. determine the currency exchange rates Answer: b Level: medium Section: Global or International Monetary System 2. Prior to the start of World War I in 1914, the international monetary system operated mostly under what kind of system or standard? a. a dual banking system b. an international trade system c. a gold standard d. full bodied money standard Answer: c Level: easy Section: How the International Monetary System Evolved 3. The exchange rate agreement that stated individual currencies would be tied to gold through the U.S. dollar via fixed or pegged exchange rates, is known as the _______________. a. monetary reserve system b. Bretton Wood system c. gold stock system d. fiat money system Answer: b Level: difficult Section: How the International Monetary System Evolved 4. The Maastricht Treaty was created for all of the following purposes except a. to promote international trade. b. the introduction of the euro as the common currency. c. to provide for economic convergence. d. to fix member country exchange rates. Answer: a Level: difficult Section: European Unification 5. At the beginning of 2002, individual EMU countries’ currencies began being phased out and only the __________________________ were legal tender by July 2002. a. yen and dollar b. euro coin and currency c. dinar and euro d. franc and euro Answer: b Level: easy Section: European Unification 6. As a result of the 2007-08 financial crisis, the nations of the European Union experienced all of the following except a. high unemployment b. increased government budget deficits c. no economic growth d. a steep decline in the value of the Euro relative to the dollar. Answer: d Level: difficult Section: European Union Financial Crisis 7. A country has a balance of trade when a. the country has neither an increase nor a decrease in gold reserves. b. its exports of goods and services equals its imports. c. its exports of goods (but not services) equals its imports. d. all foreign private and government investment in the United States equals U.S. investment foreign countries. Answer: b Level: difficult Section: Balance of Payments Accounts 8. _________________ indicates the number of units of a foreign currency needed to purchase one unit of the home country’s currency. a. The foreign exchange market b. Indirect quotation method c. Direct quotation method d. The economic monetary equivalent Answer: b Level: difficult Section: Currency Exchange Markets and Rates 9. _______________ is the rate for the purchase or sale of a currency where delivery will take place at a future date. a. The forward exchange rate b. EMU member demand c. The demand exchange rate d. The spot exchange rate Answer: a Level: difficult Section: Currency Exchange Markets and Rates 10. _______________ is the simultaneous or nearly simultaneous purchasing of commodities, securities, or bills of exchange in one market and selling them in another where the price is higher. a. Economic convergence b. Forward exchange c. Arbitrage d. Spot exchange Answer: c Level: medium Section: Currency Exchange Markets and Rates 11. The risk associated with the possibility of slow or negative economic growth and variability in economic growth is called a. currency risk b. political risk c. economic risk d. investor risk Answer: c Level: easy Section: Inflation, Interest Rates, and Other Factors 12. ____________________________ states that a country with a relatively higher inflation rate will have its currency depreciate relative to a country (or group of countries that use one currency) with a relatively lower inflation rate. a. The U.S. Travel Act b. Purchasing Power Parity (PPP) c. The Multinational Trade Act d. The Interstate Commerce Act Answer: b Level: medium Section: Conducting Business Internationally 13. _________________ is an unconditional written order, signed by the party drawing it, requiring the party to whom it is addressed to pay a certain sum of money to order or to a bearer. a. A sight draft b. A draft c. A documentary draft d. A visionary draft Answer: b Level: easy Section: Financing International Trade 14. The _________________ represents the written acceptance of goods for shipment by a transportation company and the terms that the goods are to be transported to their destination. a. export protection draft b. clean draft c. order bill of lading d. documentary draft Answer: c Level: difficult Section: Financing International Trade 15. Policy makers of all economies must recognize the interdependence of their actions in attempting to maintain a balance in international transactions. This is referred to as international _________________. a. financial equilibrium b. global lending symmetry c. economic balance d. administrative accountability Answer: a Level: easy Section: Balance in International Transactions Goal