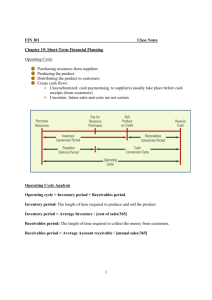

Chapter 5: Sources of Short

advertisement

Chapte 5 Slides Developed by: Terry Fegarty Seneca College Sources of Short-Term Financing Chapter 5 – Outline (1) • Sources of Short-term Financing • Spontaneous Financing Trade Credit The Prompt Payment Discount Abuses of Trade Credit • Bank Operating Loans Short Term Bank Credit Line of Credit or Revolving Credit Agreement Interest Rates on Loans Annual Interest Rate Cleanup Requirements © 2006 by Nelson, a division of Thomson Canada Limited 2 Chapter 5 – Outline (2) • Short-Term Credit Secured by Current Assets Receivables Financing Pledging Accounts Receivable Factoring Accounts Receivable Inventory Financing Types of Inventory Financing • Money Market Instruments Commercial Paper Bankers’ Acceptances Securitization of Receivables © 2006 by Nelson, a division of Thomson Canada Limited 3 Sources of Short-term Financing • Spontaneous financing Accounts payable and accruals • Bank operating loans Revolving credit agreement, line of credit • Secured loans for accounts receivable and inventory • Money market instruments Commercial paper Bankers’ acceptances Securitization of receivables © 2006 by Nelson, a division of Thomson Canada Limited 4 Spontaneous Financing • Accruals For example, money you owe employees for work they have performed but not yet been paid • Tend to be very short-term • Accounts payable (AKA: trade credit) Money you owe suppliers for goods you bought on credit Attractive source of financing • No security required • Interest-free Credit Terms: Terms of trade specify when you are to repay the debt © 2006 by Nelson, a division of Thomson Canada Limited 5 Trade Credit • Seller lends buyer purchase price from time of shipment to time of payment • No security and no interest • Seller may offer cash discount for early payment • Cost of forgoing a cash discount: % discount 365 APR = × 100% - % discount Final payment date - Last discount date © 2006 by Nelson, a division of Thomson Canada Limited 6 The Prompt Payment Discount Q: Vendor offers a discount of 2% if payment is made within ten days. If the discount is not taken, full payment is due in 30 days. What is the annual cost of not accepting the 2% discount? Example A: % discount 365 = × 100% - % discount Final payment date - Last discount date 2 365 = × 100 - 2 30 - 10 = 37.24% © 2006 by Nelson, a division of Thomson Canada Limited 7 Abuses of Trade Credit • Abuses of Trade Credit Terms Trade credit is now expected in many businesses • Companies offer it because they have to Stretching payables—a common abuse of trade credit • Paying payables beyond the due date (AKA: leaning on the trade) • Slow paying companies receive poor credit ratings in credit reports issued by credit agencies © 2006 by Nelson, a division of Thomson Canada Limited 8 Bank Operating Loans • Represent primary source of short-term loans for most companies • Provide financing for working capital and expenses • Advanced against value of receivables and inventory • Repaid from collections on receivables • May be arranged for specific transactions or as revolving credit agreement or line of credit © 2006 by Nelson, a division of Thomson Canada Limited 9 Line of Credit or Revolving Credit Agreement • Line of credit Non-binding agreement to borrow up to predetermined limit at any time • Revolving credit Legally commits the bank Usually secured Requires commitment fee on unborrowed funds © 2006 by Nelson, a division of Thomson Canada Limited 10 Interest Rates on Loans • Interest Rates on Loans Prime rate is rate that bank charges its largest and most creditworthy corporate customers. Interest rates on operating loans are usually based on bank’s prime rate plus a risk premium © 2006 by Nelson, a division of Thomson Canada Limited 11 Interest Rates on Loans • Loan rates will depend upon such factors as: How intense is competition among lenders for loan business? How large is the loan? Does borrower have good credit history? Does borrower have adequate and reliable cash flow? Does borrower have adequate security? Is loan guaranteed under a government program? What is term of the loan? What is debt-to-equity ratio? © 2006 by Nelson, a division of Thomson Canada Limited 12 Annual Interest Rate I 365 r= × P d where: r = Annual rate I = Interest paid (dollars) P = Principal d = Number of days loan is outstanding © 2006 by Nelson, a division of Thomson Canada Limited 13 Example Example 5.1: Revolving Credit Agreement Q: The Arcturus Company has a $10 million revolving credit agreement with its bank at prime plus 2.5%. Prior to June, the company had borrowed $4 million that was outstanding for the entire month. On June 15, it took borrowed $2 million. Prime is 9.5% and the bank’s commitment fee is 0.25% annually. What bank charges will Arcturus incur for the month of June? © 2006 by Nelson, a division of Thomson Canada Limited 14 Example 5.1: Example A: Revolving Credit Agreement Arcturus will have to pay both interest on the money borrowed and a commitment fee on the unused balance of the revolving agreement. Monthly interest rate: (Prime + 2.5%) 12 = 1% Monthly commitment fee: 0.25% 12 = 0.0208% $4 million was outstanding for the entire month of June and $2 million was outstanding for 15 days of June, so the total dollar interest charges are: $4,000,000 15 0.01 + $2,000,000 $50,000 30 The commitment fee must be paid on an average of $5,000,000 that was unused during June, or: • $5,000,000 .000208 = $1,040 • Total bank charges = $51,040 © 2006 by Nelson, a division of Thomson Canada Limited 15 Clean Up Requirements • Theoretically a firm can constantly rollover its short-term debt Borrow on a new note to pay off an old note • Risky for both firm and bank • Banks require that borrowers clean up short-term loans once a year Remain out of short-term debt for certain time period © 2006 by Nelson, a division of Thomson Canada Limited 16 Short-Term Credit Secured by Current Assets • Debt is secured by the current assets being financed ( accounts receivable and inventory) • Common in seasonal businesses such as retail © 2006 by Nelson, a division of Thomson Canada Limited 17 Receivables Financing • Receivables Financing: Lenders may extend credit backed by the value of accounts receivable Receivables may make excellent collateral: • Fairly liquid • Easy to recover in event of default • Collectibility of accounts is key issue Common arrangements • Pledging–Firm retains title • Factoring–Firm sells A/R © 2006 by Nelson, a division of Thomson Canada Limited 18 Pledging Accounts Receivable Borrower uses A/R as collateral for a loan Accounts Receivable still belong to borrower, which still collects the accounts Borrower promises to use collected accounts to pay off loan Lender can provide • General line of credit tied to all receivables • Specific line of credit tied to individual accounts receivable Lender generally charges interest at rates over prime, plus an administrative fee. © 2006 by Nelson, a division of Thomson Canada Limited 19 Example Example 5.2: Pledging Accounts Receivable Q: The Kilraine Quilt Company has an average receivables balance of $100,000 which turns over once every 43 days. It generally pledges all of its receivables to the Cooperative Finance Company, which advances 75% of the total at 4% over prime plus a 1.5% administrative fee. If prime is 5%, what total financing rate is Kilraine effectively paying for its receivables financing? © 2006 by Nelson, a division of Thomson Canada Limited 20 Example Example 5.2: Pledging Accounts Receivable A: Average Receivables balance: $100,000 Average loan outstanding: 75% x $100,000 = $75,000 Interest rate: 5% + 4% = 9% Receivables pledged in year: $100,000 x 365 / 50 = $730,000 Administrative fee: 1.5% x $730,000 = $10,950 % of the average loan balance:$10,950 / $75,000 = 14.6% Annual financing cost: 9% + 14.6% = 23.6% © 2006 by Nelson, a division of Thomson Canada Limited 21 Factoring Accounts Receivable • Firm sells Accounts Receivable to lender (at a severe discount) and lending firm (factor) takes control of the accounts Accounts receivable are now paid directly to factor Factor usually reviews accounts and only accepts accounts it deems creditworthy © 2006 by Nelson, a division of Thomson Canada Limited 22 Factoring Accounts Receivable • Factors offer wide range of services Perform credit checks on potential customers Advance cash on accounts it accepts or remit cash after collection Collect cash from customers Assume bad-debt risk when customers don’t pay © 2006 by Nelson, a division of Thomson Canada Limited 23 Inventory Financing • Use firm’s inventory as collateral for a short-term loan • Popular but subject to number of problems Lenders aren’t usually equipped to sell inventory Specialized inventories and perishable goods are difficult to market © 2006 by Nelson, a division of Thomson Canada Limited 24 Types of Inventory Financing • Blanket liens—lender has a lien (claim) against all inventories of borrower • Borrower remains in physical control of inventory • Trust receipt (chattel mortgage agreement)— collateralized inventory is identified by serial number and can’t be sold without lender’s permission • Borrower remains in physical control of inventory • Warehousing—collateralized inventory is removed from borrower’s premises and placed in a warehouse (borrower’s access controlled by third party) • When inventory is sold, lender is informed to expect money from borrower soon © 2006 by Nelson, a division of Thomson Canada Limited 25 Money Market Instruments • Larger corporations may sell short-term debt instruments in the money market • Another method to borrow to meet temporary cash needs • Instruments include commercial paper, bankers’ acceptances and securitization of receivables © 2006 by Nelson, a division of Thomson Canada Limited 26 Commercial Paper • Notes issued by large, financially-strong firms and sold to investors Unsecured (usually) Buyers are usually other corporations and financial institutions Maturity is less than 270 days Considered very safe investment, therefore pays a relatively low interest rate (sold at a discount) No flexibility in repayment terms © 2006 by Nelson, a division of Thomson Canada Limited 27 Commercial Paper • Annual Interest Rate on Discounted Money Market Security (M-P) r= P 365 d where M = Maturity (face) value of the security P = Discounted price (net proceeds on issue) d = Number of days to maturity r = Annual interest rate © 2006 by Nelson, a division of Thomson Canada Limited 28 Bankers’ Acceptances bankers’ acceptance—created when a bank adds guarantee of payment to the promissory note or draft of the issuer (corporate borrower) Issuer receives money from bank. Bank then sells the bankers’ acceptance in the money market to an investor. At maturity, bank repays face value to the investor and the issuer repays bank Traded on a discount basis to yield interest rate slightly lower than that of commercial paper Usual terms are 30, 60, and 90 days. © 2006 by Nelson, a division of Thomson Canada Limited 29 Securitization of Receivables • Sale of receivables by large firms in public offerings arranged by securities dealers • The issuing firm thus receives immediate cash for future cash flows • Financing is raised at a relatively low cost, often lower than prime or commercial paper rate, because the issue is asset-backed. © 2006 by Nelson, a division of Thomson Canada Limited 30