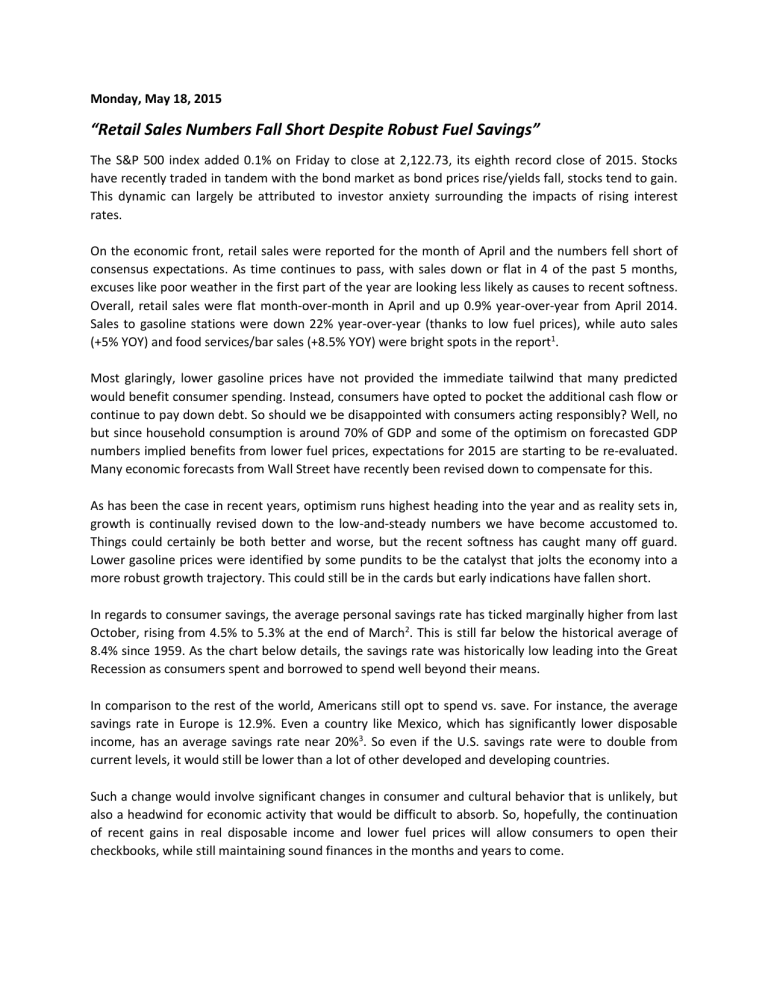

Retail Sales Numbers Fall Short Despite Robust Fuel Savings

Monday, May 18, 2015

“Retail Sales Numbers Fall Short Despite Robust Fuel Savings”

The S&P 500 index added 0.1% on Friday to close at 2,122.73, its eighth record close of 2015. Stocks have recently traded in tandem with the bond market as bond prices rise/yields fall, stocks tend to gain.

This dynamic can largely be attributed to investor anxiety surrounding the impacts of rising interest rates.

On the economic front, retail sales were reported for the month of April and the numbers fell short of consensus expectations. As time continues to pass, with sales down or flat in 4 of the past 5 months, excuses like poor weather in the first part of the year are looking less likely as causes to recent softness.

Overall, retail sales were flat month-over-month in April and up 0.9% year-over-year from April 2014.

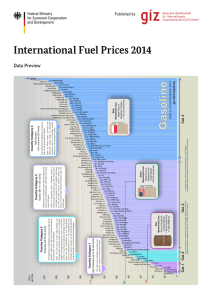

Sales to gasoline stations were down 22% year-over-year (thanks to low fuel prices), while auto sales

(+5% YOY) and food services/bar sales (+8.5% YOY) were bright spots in the report 1 .

Most glaringly, lower gasoline prices have not provided the immediate tailwind that many predicted would benefit consumer spending. Instead, consumers have opted to pocket the additional cash flow or continue to pay down debt. So should we be disappointed with consumers acting responsibly? Well, no but since household consumption is around 70% of GDP and some of the optimism on forecasted GDP numbers implied benefits from lower fuel prices, expectations for 2015 are starting to be re-evaluated.

Many economic forecasts from Wall Street have recently been revised down to compensate for this.

As has been the case in recent years, optimism runs highest heading into the year and as reality sets in, growth is continually revised down to the low-and-steady numbers we have become accustomed to.

Things could certainly be both better and worse, but the recent softness has caught many off guard.

Lower gasoline prices were identified by some pundits to be the catalyst that jolts the economy into a more robust growth trajectory. This could still be in the cards but early indications have fallen short.

In regards to consumer savings, the average personal savings rate has ticked marginally higher from last

October, rising from 4.5% to 5.3% at the end of March 2 . This is still far below the historical average of

8.4% since 1959. As the chart below details, the savings rate was historically low leading into the Great

Recession as consumers spent and borrowed to spend well beyond their means.

In comparison to the rest of the world, Americans still opt to spend vs. save. For instance, the average savings rate in Europe is 12.9%. Even a country like Mexico, which has significantly lower disposable income, has an average savings rate near 20% 3 . So even if the U.S. savings rate were to double from current levels, it would still be lower than a lot of other developed and developing countries.

Such a change would involve significant changes in consumer and cultural behavior that is unlikely, but also a headwind for economic activity that would be difficult to absorb. So, hopefully, the continuation of recent gains in real disposable income and lower fuel prices will allow consumers to open their checkbooks, while still maintaining sound finances in the months and years to come.

Jack Holmes, CFA® & Todd Feltz, CFP

®

, CFS

®

Sources:

1.

April 2015 Retail Sales Report https://www.census.gov/retail/marts/www/marts_current.pdf

2.

St. Louis Fed Personal Savings Rate - https://research.stlouisfed.org/fred2/series/PSAVERT

3.

http://www.tradingeconomics.com/country-list/personal-savings

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

The Standard & Poor’s 500 Index is a capitalization weighted Index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Stock Investing involves risk including loss of principal.

Statements of forecast and trends are for informational purposes, and are not guaranteed to occur in the future.