Gasoline

advertisement

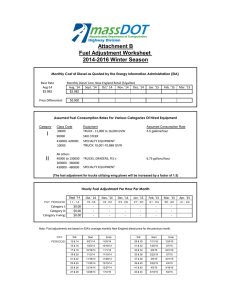

49 86 142 0 20 40 60 80 100 120 140 160 180 200 220 US-¢ per litre Red Benchmark Line: Price of Crude Oil on World Market = 49 US-Cents/Litre (= US$ 78/Barrel) Cat. 3 Cat. 4 giz.de/fuelprices Data as of mid-November 2014 Grey Benchmark Line: Retail Price of Gasoline in Poland = 142 US-Cents/Litre Gasoline Note: At these levels, countries are effectively using taxes to generate revenues and to encourage energy efficiency in the transport sector. The retail price of Gasoline is at least as high as the price level of Poland. High Taxation (142 and more US-Cents) Country Category 4 **) Indonesia: Price refers to unsubsidised Premium (11 300 Rupiah). Subsidised Gasoline is available at a price of 8 500 Rupiah (70 US-Cents/liter). Green Benchmark Line: Retail Price of Gasoline in the United States = 86 US-Cents/Litre Note: In November 2014, Gasoline prices in Poland were the lowest in EU-28. Prices in EU countries are subject to VAT, specific fuel taxes as well as other country specific duties and taxes. The EU sets minimum taxation rates for fossil fuels. Retail price of Gasoline is at least as high as the price of the United States and below the price level of Poland. Country Category 3 Taxation (86–141 US-Cents) *) Iran: Price refers to unsubsidised, free-market regular Gasoline (10 000 IRR). Subsidised Gasoline is available at a price of 7 000 IRR (26 US-Cents/liter). Cat. 1 Cat. 2 The retail price of Gasoline is below the price for crude oil on the world market. Country Category 1 High Subsidies (up to 48 US-Cents) Note: The fuel prices of the United States are average cost-covering retail prices incl. industry margin, VAT/sales tax and incl. appr. 10 US-Cents for the 2 road funds (federal and state). This fuel price may be considered as the international minimum benchmark for a non-subsidised road transport policy; though not yet covering external costs for health and environmental damages. The retail price of Gasoline is at least as high as the price for crude oil on the world market and below the price level of the United States. Country Category 2 Subsidies (49–85 US-Cents) 1.5 Venezuela Saudi Arabia 16 22 Kuwait Turkmenistan 22 23 Qatar Algeria 27 31 Oman Iran 37* 41 Brunei Darussalam Iraq 43 47 United Arab Emirates Nigeria 56 60 Ecuador Malaysia 68 70 Bolivia Yemen 70 76 Angola Kazakhstan 81 81 Russian Federation Sudan 82 83 Syria United States of America 86 88 Egypt Chad 90 91 Liberia Tunisia 91 93 Indonesia** Korea, North (D.R.) 94 94 Kyrgyzstan Pakistan 94 96 Lebanon Panama 96 98 Taiwan (China) Ethiopia 99 101 Guatemala Mongolia 101 102 Gabon Uzbekistan 102 103 Benin Lesotho 103 103 Mexico Bhutan 104 104 Sierra Leone Vietnam 104 105 Bahamas Philippines 105 106 Belarus Botswana 106 106 Ghana Afghanistan 107 108 Colombia Namibia 108 109 Niger India 110 112 El Salvador Congo, R. (Brazzaville) 113 114 Jamaica Myanmar (Burma) 114 114 Swaziland Guyana 115 116 Haiti Canada 117 117 China, P. R. East Timor 117 117 Ukraine Nicaragua 118 119 South Africa Honduras 120 121 Azerbaijan Kenya 121 121 Moldova Australia 123 124 Cameroon Georgia 124 125 Togo Brazil 127 127 Jordan Sri Lanka 127 129 Suriname Tanzania 129 129 Thailand Armenia 130 130 Bangladesh St. Lucia 130 131 Nepal Tajikistan 132 134 Cambodia Fiji 134 135 Madagascar Papua New Guinea 136 137 Belize Gambia 137 138 Japan Morocco 138 140 Burkina Faso Cuba 140 140 Lao PDR Uganda 140 141 Djibouti Dominican Republic 141 141 Rwanda Ivory Coast 142 142 Poland Costa Rica 144 144 Marshall Islands Guinea 145 146 Estonia Peru 146 147 Mali Latvia 148 149 Bulgaria Macedonia 149 151 Andorra Bosnia and Herzegovina 151 152 Argentina Chile 152 152 Luxembourg Burundi 153 153 Mauritania Kosovo 154 155 Korea, South (R.) Mozambique 155 155 Serbia Cape Verde 156 156 Zimbabwe Lithuania 157 158 Hungary Singapore 158 159 Paraguay Romania 159 160 Austria Montenegro 160 161 Cyprus, South Maldives 163 163 Spain Mauritius 165 166 Croatia Czech Republic 167 168 Congo, D.R. (Kinshasa) Zambia 168 169 Central African Republic Senegal 170 171 New Zealand Liechtenstein 174 174 Switzerland Albania 176 177 Palestine (West Bank and Gaza) Slovakia 177 178 Malawi Slovenia 178 179 France Germany 180 180 Malta Uruguay 180 181 Barbados Sweden 182 185 Iceland Israel 188 189 Finland Portugal 189 190 Belgium Ireland 192 192 United Kingdom Niue 197 198 Greece Sudan, South 198 200 Monaco Denmark 201 206 China, Hong Kong Turkey 206 214 Italy Netherlands 215 227 Norway Eritrea 333 Data Preview International Fuel Prices 2014 Published by Our 2014 survey at a glance Super gasoline and diesel retail prices in 174 countries, conducted mid-November 2014 World market US-¢ per litre Country Category 4 Country Category 3 200 180 160 139 140 High Taxation (139 and more US-Cents) Country Category 2 Taxation (97–138 US-Cents) The retail price of Diesel is at least as high as the price level of Poland. Subsidies (49–96 US-Cents) Retail price of Diesel is at least as high as the price of the United States and below the price level of Poland. Note: At these levels, countries are effectively using taxes to generate revenues and to encourage energy efficiency in the transport sector. 0.8 Venezuela Saudi Arabia 7 16 Algeria Iran 19* 19 Kuwait Turkmenistan 20 25 Egypt Ecuador 29 38 Oman Qatar 41 47 Syria Angola 51 54 Bolivia Sudan 55 64 United Arab Emirates Kazakhstan 64 65 Malaysia Tunisia 68 70 Yemen Lebanon 73 75 Russian Federation Kyrgyzstan 76 77 Azerbaijan Indonesia 80** 82 Philippines Jordan 82 Bhutan 84 84 Nigeria 85 Panama Ethiopia 89 90 Bangladesh Congo, R. (Brazzaville) 90 90 Gabon Guatemala 90 90 Sri Lanka Thailand 90 91 India Vietnam 91 93 Myanmar (Burma) Haiti 94 94 Liberia Mongolia 96 97 United States of America Maldives 98 98 Taiwan (China) Chad 99 101 Pakistan Brazil 102 102 El Salvador Mexico 102 103 Ghana Honduras 103 103 Niger Colombia 104 104 Nepal Nicaragua 104 104 Sierra Leone Belarus 106 106 Jamaica Botswana 107 107 Kenya Lesotho 107 108 Lao PDR Chile 109 109 China, P. R. Madagascar 109 110 Benin Japan 110 111 Guyana Morocco 111 111 New Zealand Uganda 111 112 Namibia Papua New Guinea 113 114 Cameroon Armenia 116 116 Canada Moldova 116 116 Paraguay Singapore 116 116 Swaziland Ukraine 116 117 Ivory Coast Peru 117 117 South Africa Fiji 118 118 Tajikistan Afghanistan 119 120 Cuba Mozambique 120 120 Tanzania Costa Rica 121 121 Djibouti Dominican Republic 121 124 Cambodia Georgia 124 125 Burkina Faso Macedonia 127 128 Australia Gambia 129 129 Mali Togo 129 131 Cape Verde Argentina 133 134 Suriname Andorra 135 135 Mauritania Korea, South (R.) 137 138 Mauritius Luxembourg 139 139 Poland Rwanda 141 143 Burundi Barbados 144 145 Guinea Marshall Islands 147 148 Zimbabwe Latvia 149 149 Montenegro Lithuania 150 151 Bulgaria Estonia 151 151 Senegal Bosnia and Herzegovina 154 155 Austria Kosovo 155 155 Spain China, Hong Kong 156 158 Germany Croatia 159 159 Zambia Czech Republic 160 160 East Timor Slovakia 161 163 France Greece 163 163 Palestine (W. Bank + Gaza) Portugal 164 165 Cyprus, South Hungary 165 166 Central African Rep. Serbia 166 167 Congo, D.R. (Kinshasa) Slovenia 168 169 Belgium Malta 170 171 Albania Romania 171 172 Uruguay Finland 178 178 Monaco Liechtenstein 179 179 Switzerland Denmark 180 180 Malawi Netherlands 180 182 Sweden Ireland 184 186 Iceland Turkey 190 193 Uzbekistan Sudan, South 198 199 United Kingdom Italy 201 201 Niue Israel 208 211 Norway 220 Eritrea 300 Crude oil price (Brent) on reference day: USD 78.20 per barrel (49 US cents per litre). The oil price had decreased by 29 % (- 0.20 per litre) compared to November 2012. USD–EUR exchange rate: USD 1 = EUR 0.80. The retail price of Diesel is at least as high as the price for crude oil on the world market and below the price level of the United States. Note: The fuel prices of the United States are average cost-covering retail prices incl. industry margin, VAT/sales tax and incl. appr. 10 US-Cents for the 2 road funds (federal and state). This fuel price may be considered as the international minimum benchmark for a non-subsidised road transport policy; though not yet covering external costs for health and environmental damages. Note: In November 2014, Diesel prices in Poland were the lowest in EU-28. Prices in EU countries are subject to VAT, specific fuel taxes as well as other country specific duties and taxes. The EU sets minimum taxation rates for fossil fuels. Country Category 1 High Subsidies (up to 48 US-Cents) The retail price of Diesel is below the price for crude oil on the world market. 120 97 100 80 60 49 40 20 0 Grey Benchmark Line: Retail Price of Diesel in Poland = 139 US-Cents/Litre Green Benchmark Line: Retail Price of Diesel in the United States = 97 US-Cents/Litre Red Benchmark Line: Price of Crude Oil on World Market = 49 US-Cents/Litre (= US$ 78/Barrel) Diesel Data as of mid-November 2014 giz.de/fuelprices Cat. 1 Cat. 2 *) Iran: Price refers to unsubsidised Diesel (5 000 IRR). Subsidised Diesel is available at a price of 2 500 IRR (9 US-Cents/liter). Cat. 3 Cat. 4 **) Indonesia: Price refers to unsubsidised Diesel (9 700 Rupiah). Subsidised Diesel is available at a price of 7 500 Rupiah (62 US-Cents). Policy Recommendations The pricing of transport fuels is a major concern in many countries – often associated with high financial burdens, social unrest and concerns over macroeconomic stability. A sound fuel pricing policy would aim at mitigating these effects. Further, it would help shift people and goods to more sustainable modes, encourage dense and smart 2 cities, and foster more efficient vehicles. This would, inter alia, result in less reliance on fossil energy resources, improved air quality and reduced congestion. The following principles can guide the development of more sustainable fuel price policies: 1. Pricing Principles Apply cost coverage. Fuel prices should cover the full costs of production, import, transport and refining, including depreciation and external costs of production (e.g. environmental costs) in order to maintain a viable up- and downstream industry. Countries are increasingly employing this pricing principle, to a bigger extent toward gasoline, less for diesel: margins, levies and taxes represent a considerable share of the retail price in most countries today. However, exchange rate fluctuations pose an increasing challenge to many countries. Apply fuel taxes. Fuel taxes contribute to the development of the transport sector (e.g. for financing road maintenance, public transport subsidies, technology innovation programmes), and can also be applied to the general state budget (e.g. for financing health services, education and security). Rule of thumb for financing road maintenance: prices should include a minimum added tax of 10 US-cents per litre. As fuel taxes are straightforward to collect, they are a major source of revenue in many countries. Additionally, fuel should be subject to full VAT as any other good. Internalise external effects of the transport sector. Fuel pricing should reflect the costs of external effects of the transport sector (e.g. CO2 emissions, noise, accidents, congestion) by implementing measures such as an Eco-tax or Road Safety Cent. The inclusion of external costs increases fuel prices, which generally shifts driving behaviour towards more sustainable transport modes. 2. Price Regulation Principles Reflect changes in costs and inflation. Fuel prices adjustments should reflect changes in cost of production/ import, transport and refinery, including depreciation and external costs of production (e.g. environmental costs) and changes in exchange rates. Fuel pricing schemes should also allow for adjustment to inflation. Ad-hoc pricing schemes lack a proper legal framework, information and monitoring, and are often associated with fuel subsidies. The implementation of an automatic, statutorily regulated pricing/adjustment mechanism that fully reflects all costs is a useful tool to provide transparent and depoliticized fuel pricing. Automatic pricing can be used as a transitory mean, e.g. on the way to deregulation. Deregulated prices require a mature market with a sufficient number of players in the market, strong regulatory oversight and alert media/civil society. Limit budgetary consequences. Regular fuel price adjustments limit budgetary impacts. Properly applied price adjustments or an automatic pricing mechanism limits the impact of external price shocks. Additionally, in the case of subsidisation of selected products, the provision of “smart cards” helps to better administer and regulate individual fuel consumption, and thus, to better manage the total amount of fuel subsidies. 3. Transparency Principles Institutional stakeholders in price setting are known. Information on institutional stakeholders involved in determination of price levels and elaboration of price adjustments should be made available. Principles of price setting are transparent. Information on pricing determinants, update frequency and the underlying formula (if automatic mechanisms are applied) should be publicised. Information on price composition is available. Information on taxation levels and composition of fuel prices should be made available. Information on prices and price setting is made easily available to public. Comprehensive and easy-to-access information should be displayed on the web, including: current price data for all fuel products; timelines of prices; price components (production and/or import prices, taxation levels, and other charges); description of structure and modus operandi of pricing mechanisms (if applied); and underlying legislation. Since fuel prices and fuel subsidies rank high on political agendas and are deeply embedded in the public interest, increased transparency and the provision of information in terms of price setting, composition, adjustment and level of subsidisation not only contributes to the discussion, but also improves public awareness and understanding of this issue. 4. Enforcement Principles Application and realisation of pricing policy must be monitored, supervised and enforced. Regulated prices or transparency regulations should be enforced; complementary measures should be taken to prevent black markets, smuggling and adulteration (e.g. kerosene and diesel). Smuggling and adulteration is often present in countries with drastic price differences between various products (e.g. significantly different pricing of diesel and kerosene can encourage adulteration). 3 More Information International Fuel Prices: www.giz.de/fuelprices Sustainable Urban Transport including Sustainable Transport: Sourcebook for Policy-makers in Developing Cities: www.sutp.org GIZ Transport and Mobility: www.giz.de/transport Transport and Climate Change: www.transport2020.org Find trainings, webinars and e-learning on sustainable urban transport worldwide here: www.capsut.org German Partnership for Sustainable Mobility: www.german-sustainable-mobility.de Our Resources GIZ Fuel Price News Monthly collection of global fuel price news Recommended reading on related publications Subscribe here: armin.wagner@giz.de Factsheets Compact information on two pages Available for more than 130 countries Price in USD and local currency (some since 1991) Price composition Pricing policy Transparency evaluation International Fuel Prices 2010/2011 Learn more here: https://energypedia.info/index.php/International_Fuel_Prices 7th Edition Report “International Fuel Prices” Overview and data on retail prices of gasoline and diesel in more than 170 countries Detailed information on price levels, pricing dimension, subsidies, taxation, regulation and transparency Published every two years Published by Download here: www.giz.de/fuelprices Published by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH Dag-Hammarskjöld-Weg 1-5 65760 Eschborn, Germany T +49 61 96 79-2650 F +49 61 96 79-80 2650 www.giz.de 4 Manager Armin Wagner As at April 2015 Contact Armin Wagner, armin.wagner@giz.de On behalf of Federal Ministry for Economic Cooperation and Development (BMZ) Disclaimer Findings, interpretations, and conclusions expressed in this document are based on information gathered by GIZ and its consultants, partners, and contributors from reliable sources. GIZ does not, however, guarantee the accuracy or completeness of information in this document, and cannot be held responsible for any errors, omissions, or losses which emerge from its use. This page contains links to third-party web sites. The linked sites are not under the control of GIZ and GIZ is not responsible for the contents of any linked site or any link contained in a linked site.