derivatives in india-PROJECT

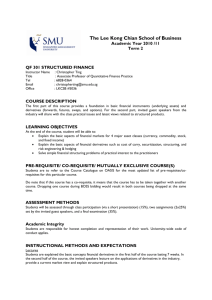

advertisement

1

DERIVATIVES IN INDIA

PROJECT REPORT ON

DERIVATIVES IN INDIA

SUBMITTED BY

SACHIN YADAV

THIRD YEAR B.COM. [FINANCIAL MARKETS]

SEMESTER – Vth

ACADEMIC YEAR: 2010-2011

PROJECT CO-ORDINATOR

PROF. VIKRAM TRIVEDI

ST.GONSALO GARCIA COLLEGE VASAI (W)

THANE-401201

SUBMITTED TO

THE UNIVERSITY OF MUMBAI

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

2

DERIVATIVES IN INDIA

ACKNOWLEDGMENT.

It is indeed a matter of great pleasure and pride to be able to present this project on

“DERIVATIVES IN INDIA”

Throughout the writing of this project the influence of my Prof. Vikram Trivedi has

been a guiding light. I have been greatly benefited by her guidance, profound knowledge and her

continued interest in my work. I shall ever remain indebted & grateful to her, for her deep sense

of personal attachment & the ever increasing encouragement which she has given to me.

This is special pleasure in acknowledging her under whom I have initiated my work.

Her intense accuracy in respect of the subject had provided the impetus for the commencement

of the study.

My professors and friends have inevitable played a crucial role in helping me while

preparing the project. I do not have words to thanks them enough. I can only extend my sense of

deep hearted affection to all of them.

I am highly obliged to acknowledge

principal “Fr. Solomon Rodrigues” for giving

me an opportunity to conduct a detail study & analysis of my desirable topic relevant to my full

of interest.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

3

DERIVATIVES IN INDIA

DECLARATION.

I Mr. SACHIN YADAV of Third Year B. Com. [ Financial Markets]

ST. GONSALO GARCIA COLLEGE hereby declare that I have completed this project on

“DERIVATIVES IN INDIA” in the Academic Year 2010-2011. The information submitted is

true and correct to the best of my knowledge.

Signature of Student

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

4

DERIVATIVES IN INDIA

ST. GONSALO GARCIA COLLEGE OF ARTS AND

COMMERCE

VASAI [W] 401201

CERTIFICATE.

I, hereby certify that Mr. SACHIN YADAV student of St. Gonsalo Garcia college of Arts

& commerce, Vasai (w), Third Year Bcom [Financial Markets] Vth Semester, has completed her

project on “DERIVATIVES IN INDIA”, During the Academic Year 2010-2011. The

information submitted is true and correct to the best of our knowledge.

Signature of Principal

[Fr. (Dr.) Solomon Rodrigues]

Signature of coordinator

[ Prof. Jose George]

Signature of Project Guide

[ Prof. Vikram Trevedi]

Signature of External Examiner

Date:

Place

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

5

DERIVATIVES IN INDIA

INDEX

Sr. no.

Particulars

Page no.

EXECUTIVE SUMMARY

6

Objectives Of The Study

7

1

CHAPTER 1

8-18

1.1

Introduction

9

1.2

Definition of Derivatives

11

1.3

History of Derivatives

12

1.4

Derivatives in India

15

2

CHAPTER 2

19-33

2.1

Development of Derivatives Market in India

20

2.2

23

2.3

Factors Contributing to the growth of

Derivatives

Types of Derivatives

2.4

Futures VS. Forward Markets

32

3

CHAPTER 3

34-45

3.1

Participants in Derivatives market

35

3.2

Role of Derivatives

40

3.3

How Banks use Derivatives

43

Conclusion

46

Bibliography

47

27

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

6

DERIVATIVES IN INDIA

EXECUTIVE SUMMARY

In the following project, you are going to have chance to review and understand

virtually every aspect of DERIVATIVES IN INDIA and its important role and functions. It also

provides you with various departments which help DERIVATIVES IN INDIA to provide better

service, departments such as Research department, Risk Management Department, Accounts

Department.

This project also highlights various important concepts of finance sector of India. This

project explains the why DERIVATIVES IN INDIA was formed and the development that has

taken place in market due to DERIVATIVES MARKET its role and objectives. It will give you

knowledge about the requirement of market sector of India. Each concept in this project has been

briefly explained and in an understandable and easier way and has been put in simplistic way.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

7

DERIVATIVES IN INDIA

OBJECTIVES OF THE STUDY

1. To know what is Derivatives Trading In India.

2. To study Derivatives Market as Financial Intermediary.

3. To study recent trends in Derivatives Market

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

8

DERIVATIVES IN INDIA

CHAPTER 1

1.1

INTRODUCTION TO DERIVATIVES

1.2

DEFINITION OF DERIVATIVES

1.3

HISTORY OF DERIVATIVES

1.4

DERIVATIVES IN INDIA

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

9

DERIVATIVES IN INDIA

CHAPTER 1

1.1 INTRODUCTION :

Derivatives are one of the most complex instruments. The word derivative

comes from the word ‘to derive’. It indicates that it has no independent value. A derivative is

a contract whose value is derived from the value of another asset, known as the underlying

asset, which could be a share, a stock market index, an interest rate, a commodity, or a

currency. The underlying is the identification tag for a derivative contract. When the price of

the underlying changes, the value of the derivative also changes. Without an underlying

asset, derivatives do not have any meaning. For example, the value of a gold futures contract

derives from the value of the underlying asset i.e., gold. The prices in the derivatives market

are driven by the spot or cash market price of the underlying asset, which is gold in this

example.

Derivatives are very similar to insurance. Insurance protects against specific

risks, such as fire, floods, theft and so on. Derivatives on the other hand, take care of market

risks - volatility in interest rates, currency rates, commodity prices, and share prices.

Derivatives offer a sound mechanism for insuring against various kinds of risks arising in the

world of finance. They offer a range of mechanisms to improve redistribution of risk, which

can be extended to every product existing, from coffee to cotton and live cattle to debt

instruments.

In this era of globalisation, the world is a riskier place and exposure to risk is

growing. Risk cannot be avoided or ignored. Man, however is risk averse. The risk averse

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

10

DERIVATIVES IN INDIA

characteristic of human beings has brought about growth in derivatives. Derivatives help the

risk averse individuals by offering a mechanism for hedging risks.

Derivative products, several centuries ago, emerged as hedging devices

against fluctuations in commodity prices. Commodity futures and options have had a lively

existence for several centuries. Financial derivatives came into the limelight in the post-1970

period; today they account for 75 percent of the financial market activity in Europe, North

America, and East Asia. The basic difference between commodity and financial derivatives

lies in the nature of the underlying instrument. In commodity derivatives, the underlying

asset is a commodity; it may be wheat, cotton, pepper, turmeric, corn, orange, oats, Soya

beans, rice, crude oil, natural gas, gold, silver, and so on. In financial derivatives, the

underlying includes treasuries, bonds, stocks, stock index, foreign exchange, and Euro dollar

deposits. The market for financial derivatives has grown tremendously both in terms of

variety of instruments and turnover.

Presently, most major institutional borrowers and investors use derivatives.

Similarly, many act as intermediaries dealing in derivative transactions. Derivatives are

responsible for not only increasing the range of financial products available but also fostering

more precise ways of understanding, quantifying and managing financial risk.

Derivatives contracts are used to counter the price risks involved in assets and

liabilities. Derivatives do not eliminate risks. They divert risks from investors who are risk

averse to those who are risk neutral. The use of derivatives instruments is the part of the

growing trend among financial intermediaries like banks to substitute off-balance sheet

activity for traditional lines of business. The exposure to derivatives by banks have

implications not only from the point of capital adequacy, but also from the point of view of

establishing trading norms, business rules and settlement process. Trading in derivatives

differ from that in equities as most of the derivatives are market to the market.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

11

DERIVATIVES IN INDIA

1.2 DEFINITION OF DERIVATIVES :

Derivative is a product whose value is derived from the value of one or more

basic variables, called bases (underlying asset, index, or reference rate), in a contractual

manner. The underlying asset can be equity, forex, commodity or any other asset.

According to Securities Contracts (Regulation) Act, 1956 {SC(R)A},

derivatives is

A security derived from a debt instrument, share, loan, whether secured or unsecured,

risk instrument or contract for differences or any other form of security.

A contract which derives its value from the prices, or index of prices, of underlying

securities.

Derivatives are securities under the Securities Contract (Regulation) Act and

hence the trading of derivatives is governed by the regulatory framework under the Securities

Contract (Regulation) Act.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

12

DERIVATIVES IN INDIA

1.3 HISTORY OF DERIVATIVES :

The history of derivatives is quite colourful and surprisingly a lot longer than

most people think. Forward delivery contracts, stating what is to be delivered for a fixed

price at a specified place on a specified date, existed in ancient Greece and Rome. Roman

emperors entered forward contracts to provide the masses with their supply of Egyptian

grain. These contracts were also undertaken between farmers and merchants to eliminate risk

arising out of uncertain future prices of grains. Thus, forward contracts have existed for

centuries for hedging price risk.

The first organized commodity exchange came into existence in the early

1700’s in Japan. The first formal commodities exchange, the Chicago Board of Trade

(CBOT), was formed in 1848 in the US to deal with the problem of ‘credit risk’ and to

provide centralised location to negotiate forward contracts. From ‘forward’ trading in

commodities emerged the commodity ‘futures’. The first type of futures contract was called

‘to arrive at’. Trading in futures began on the CBOT in the 1860’s. In 1865, CBOT listed the

first ‘exchange traded’ derivatives contract, known as the futures contracts. Futures trading

grew out of the need for hedging the price risk involved in many commercial operations. The

Chicago Mercantile Exchange (CME), a spin-off of CBOT, was formed in 1919, though it

did exist before in 1874 under the names of ‘Chicago Produce Exchange’ (CPE) and

‘Chicago Egg and Butter Board’ (CEBB). The first financial futures to emerge were the

currency in 1972 in the US. The first foreign currency futures were traded on May 16, 1972,

on International Monetary Market (IMM), a division of CME. The currency futures

traded on the IMM are the British Pound, the Canadian Dollar, the Japanese Yen, the Swiss

Franc, the German Mark, the Australian Dollar, and the Euro dollar. Currency futures were

followed soon by interest rate futures. Interest rate futures contracts were traded for the first

time on the CBOT on October 20, 1975. Stock index futures and options emerged in 1982.

The first stock index futures contracts were traded on Kansas City Board of Trade on

February 24, 1982.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

13

DERIVATIVES IN INDIA

The first of the several networks, which offered a trading link between two

exchanges, was formed between the Singapore International Monetary Exchange

(SIMEX) and the CME on September 7, 1984.

Options are as old as futures. Their history also dates back to ancient Greece

and Rome. Options are very popular with speculators in the tulip craze of seventeenth

century Holland. Tulips, the brightly coloured flowers, were a symbol of affluence; owing to

a high demand, tulip bulb prices shot up. Dutch growers and dealers traded in tulip bulb

options. There was so much speculation that people even mortgaged their homes and

businesses. These speculators were wiped out when the tulip craze collapsed in 1637 as there

was no mechanism to guarantee the performance of the option terms.

The first call and put options were invented by an American financier, Russell

Sage, in 1872. These options were traded over the counter. Agricultural commodities options

were traded in the nineteenth century in England and the US. Options on shares were

available in the US on the over the counter (OTC) market only until 1973 without much

knowledge of valuation. A group of firms known as Put and Call brokers and Dealer’s

Association was set up in early 1900’s to provide a mechanism for bringing buyers and

sellers together.

On April 26, 1973, the Chicago Board options Exchange (CBOE) was set up

at CBOT for the purpose of trading stock options. It was in 1973 again that black, Merton,

and Scholes invented the famous Black-Scholes Option Formula. This model helped in

assessing the fair price of an option which led to an increased interest in trading of options.

With the options markets becoming increasingly popular, the American Stock Exchange

(AMEX) and the Philadelphia Stock Exchange (PHLX) began trading in options in 1975.

The market for futures and options grew at a rapid pace in the eighties and

nineties. The collapse of the Bretton Woods regime of fixed parties and the introduction of

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

14

DERIVATIVES IN INDIA

floating rates for currencies in the international financial markets paved the way for

development of a number of financial derivatives which served as effective risk management

tools to cope with market uncertainties.

The CBOT and the CME are two largest financial exchanges in the world on

which futures contracts are traded. The CBOT now offers 48 futures and option contracts

(with the annual volume at more than 211 million in 2001).The CBOE is the largest

exchange for trading stock options. The CBOE trades options on the S&P 100 and the S&P

500 stock indices. The Philadelphia Stock Exchange is the premier exchange for trading

foreign options.

The most traded stock indices include S&P 500, the Dow Jones Industrial

Average, the Nasdaq 100, and the Nikkei 225. The US indices and the Nikkei 225 trade

almost round the clock. The N225 is also traded on the Chicago Mercantile Exchange.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

15

DERIVATIVES IN INDIA

1.4 DERIVATIVES IN INDIA :

India has started the innovations in financial markets very late. Some of the

recent developments initiated by the regulatory authorities are very important in this respect.

Futures trading have been permitted in certain commodity exchanges. Mumbai Stock

Exchange has started futures trading in cottonseed and cotton under the BOOE and under the

East India Cotton Association. Necessary infrastructure has been created by the National

Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) for trading in stock index

futures and the commencement of operations in selected scripts. Liberalised exchange rate

management system has been introduced in the year 1992 for regulating the flow of foreign

exchange. A committee headed by S.S.Tarapore was constituted to go into the merits of full

convertibility on capital accounts. RBI has initiated measures for freeing the interest rate

structure. It has also envisioned Mumbai Inter Bank Offer Rate (MIBOR) on the line of

London Inter Bank Offer Rate (LIBOR) as a step towards introducing Futures trading in

Interest Rates and Forex. Badla transactions have been banned in all 23 stock exchanges

from July 2001. NSE has started trading in index options based on the NIFTY and certain

Stocks.

A.} EQUITY DERIVATIVES IN INDIA –

In the decade of 1990’s revolutionary changes took place in the institutional

infrastructure in India’s equity market. It has led to wholly new ideas in market design that

has come to dominate the market. These new institutional arrangements, coupled with the

widespread knowledge and orientation towards equity investment and speculation, have

combined to provide an environment where the equity spot market is now India’s most

sophisticated financial market. One aspect of the sophistication of the equity market is seen

in the levels of market liquidity that are now visible. The market impact cost of doing

program trades of Rs.5 million at the NIFTY index is around 0.2%. This state of liquidity on

the equity spot market does well for the market efficiency, which will be observed if the

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

16

DERIVATIVES IN INDIA

index futures market when trading commences. India’s equity spot market is dominated by a

new practice called ‘Futures – Style settlement’ or account period settlement. In its present

scene, trades on the largest stock exchange (NSE) are netted from Wednesday morning till

Tuesday evening, and only the net open position as of Tuesday evening is settled. The future

style settlement has proved to be an ideal launching pad for the skills that are required for

futures trading.

Stock trading is widely prevalent in India, hence it seems easy to think that

derivatives based on individual securities could be very important. The index is the counter

piece of portfolio analysis in modern financial economies. Index fluctuations affect all

portfolios. The index is much harder to manipulate. This is particularly important given the

weaknesses of Law Enforcement in India, which have made numerous manipulative episodes

possible. The market capitalisation of the NSE-50 index is Rs.2.6 trillion. This is six times

larger than the market capitalisation of the largest stock and 500 times larger than stocks such

as Sterlite, BPL and Videocon. If market manipulation is used to artificially obtain 10%

move in the price of a stock with a 10% weight in the NIFTY, this yields a 1% in the NIFTY.

Cash settlements, which is universally used with index derivatives, also helps in terms of

reducing the vulnerability to market manipulation, in so far as the ‘short-squeeze’ is not a

problem. Thus, index derivatives are inherently less vulnerable to market manipulation.

A good index is a sound trade of between diversification and liquidity. In

India the traditional index- the BSE – sensitive index was created by a committee of

stockbrokers in 1986. It predates a modern understanding of issues in index construction and

recognition of the pivotal role of the market index in modern finance. The flows of this index

and the importance of the market index in modern finance, motivated the development of the

NSE-50 index in late 1995. Many mutual funds have now adopted the NIFTY as the

benchmark for their performance evaluation efforts. If the stock derivatives have to come

about, the should restricted to the most liquid stocks. Membership in the NSE-50 index

appeared to be a fair test of liquidity. The 50 stocks in the NIFTY are assuredly the most

liquid stocks in India.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

17

DERIVATIVES IN INDIA

The choice of Futures vs. Options is often debated. The difference between

these instruments is smaller than, commonly imagined, for a futures position is identical to an

appropriately chosen long call and short put position. Hence, futures position can always be

created once options exist. Individuals or firms can choose to employ positions where their

downside and exposure is capped by using options. Risk management of the futures clearing

is more complex when options are in the picture. When portfolios contain options, the

calculation of initial price requires greater skill and more powerful computers. The skills

required for pricing options are greater than those required in pricing futures.

B.} COMMODITY DERIVATIVES TRADING IN INDIA –

In India, the futures market for commodities evolved by the setting up of the “Bombay

Cotton Trade Association Ltd.”, in 1875. A separate association by the name "Bombay

Cotton Exchange Ltd” was established following widespread discontent amongst leading

cotton mill owners and merchants over the functioning of the Bombay Cotton Trade

Association. With the setting up of the ‘Gujarati Vyapari Mandali” in 1900, the futures

trading in oilseed began. Commodities like groundnut, castor seed and cotton etc began to be

exchanged.

Raw jute and jute goods began to be traded in Calcutta with the establishment

of the “Calcutta Hessian Exchange Ltd.” in 1919. The most notable centres for existence of

futures market for wheat were the Chamber of Commerce at Hapur, which was established in

1913. Other markets were located at Amritsar, Moga, Ludhiana, Jalandhar, Fazilka, Dhuri,

Barnala and Bhatinda in Punjab and Muzaffarnagar, Chandausi, Meerut, Saharanpur,

Hathras, Gaziabad, Sikenderabad and Barielly in U.P. The Bullion Futures market began in

Bombay in 1990. After the economic reforms in 1991 and the trade liberalization, the Govt.

of India appointed in June 1993 one more committee on Forward Markets under

Chairmanship of Prof. K.N. Kabra. The Committee recommended that futures trading be

introduced in basmati rice, cotton, raw jute and jute goods, groundnut, rapeseed/mustard

seed, cottonseed, sesame seed, sunflower seed, safflower seed, copra and soybean, and oils

and oilcakes of all of them, rice bran oil, castor oil and its oilcake, linseed, silver and onions.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

18

DERIVATIVES IN INDIA

All over the world commodity trade forms the major backbone of the economy. In India,

trading volumes in the commodity market have also seen a steady rise - to Rs 5,71,000 crore

in FY05 from Rs 1,29,000 crore in FY04. In the current fiscal year, trading volumes in the

commodity market have already crossed Rs 3,50,000 crore in the first four months of trading.

Some of the commodities traded in India include Agricultural Commodities like Rice Wheat,

Soya, Groundnut, Tea, Coffee, Jute, Rubber, Spices, Cotton, Precious Metals like Gold &

Silver, Base Metals like Iron Ore, Aluminium, Nickel, Lead, Zinc and Energy Commodities

like crude oil, coal. Commodities form around 50% of the Indian GDP. Though there are no

institutions or banks in commodity exchanges, as yet, the market for commodities is bigger

than the market for securities. Commodities market is estimated to be around Rs 44,00,000

Crores in future. Assuming a future trading multiple is about 4 times the physical market, in

many countries it is much higher at around 10 times.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

19

DERIVATIVES IN INDIA

CHAPTER 2

2.1

DEVELOPMENT OF DERIVATIVES MARKET IN INDIA

2.2

FACTORS CONTRIBUTING TO THE GROWTH OF

2.3

TYPES OF DERIVATIVES

2.4

FUTURES VS. FORWARD MARKETS

DERIVATIVES

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

20

DERIVATIVES IN INDIA

CHAPTER 2

2.1 DEVELOPMENT OF DERIVATIVES MARKET IN INDIA :

The first step towards introduction of derivatives trading in India was the

promulgation of the Securities Laws (Amendment) Ordinance, 1995, which withdrew the

prohibition on options in securities. The market for derivatives, however, did not take off, as

there was no regulatory framework to govern trading of derivatives. SEBI set up a 24–member

committee under the Chairmanship of Dr.L.C.Gupta on November 18, 1996 to develop

appropriate regulatory framework for derivatives trading in India. The committee submitted its

report on March 17, 1998 prescribing necessary pre–conditions for introduction of derivatives

trading in India. The committee recommended that derivatives should be declared as ‘securities’

so that regulatory framework applicable to trading of ‘securities’ could also govern trading of

securities. SEBI also set up a group in June 1998 under the Chairmanship of Prof.J.R.Varma, to

recommend measures for risk containment in derivatives market in India. The report, which was

submitted in October 1998, worked out the operational details of margining system,

methodology for charging initial margins, broker net worth, deposit requirement and real–time

monitoring requirements. The Securities Contract Regulation Act (SCRA) was amended in

December 1999 to include derivatives within the ambit of ‘securities’ and the regulatory

framework was developed for governing derivatives trading. The act also made it clear that

derivatives shall be legal and valid only if such contracts are traded on a recognized stock

exchange, thus precluding OTC derivatives. The government also rescinded in March 2000, the

three decade old notification, which prohibited forward trading in securities. Derivatives trading

commenced in India in June 2000 after SEBI granted the final approval to this effect in May

2001. SEBI permitted the derivative segments of two stock exchanges, NSE and BSE, and their

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

21

DERIVATIVES IN INDIA

clearing house/corporation to commence trading and settlement in approved derivatives

contracts. To begin with, SEBI approved trading in index futures contracts based on S&P CNX

Nifty and BSE–30 (Sense) index. This was followed by approval for trading in options based on

these two indexes and options on individual securities.

The trading in BSE Sensex options commenced on June 4, 2001 and the

trading in options on individual securities commenced in July 2001. Futures contracts on

individual stocks were launched in November 2001. The derivatives trading on NSE

commenced with S&P CNX Nifty Index futures on June 12, 2000. The trading in index

options commenced on June 4, 2001 and trading in options on individual securities

commenced on July 2, 2001. Single stock futures were launched on November 9, 2001. The

index futures and options contract on NSE are based on S&P CNX Trading and settlement in

derivative contracts is done in accordance with the rules, byelaws, and regulations of the

respective exchanges and their clearing house/corporation duly approved by SEBI and

notified in the official gazette. Foreign Institutional Investors (FIIs) are permitted to trade in

all Exchange traded derivative products.

The following are some observations based on the trading statistics provided

in the NSE report on the futures and options (F&O):

•

Single-stock futures continue to account for a sizable proportion of the F&O segment. It

constituted 70 per cent of the total turnover during June 2002. A primary reason

attributed to this phenomenon is that traders are comfortable with single-stock futures

than equity options, as the former closely resembles the erstwhile badla system.

•

On relative terms, volumes in the index options segment continues to remain poor. This

may be due to the low volatility of the spot index. Typically, options are considered more

valuable when the volatility of the underlying (in this case, the index) is high. A related

issue is that brokers do not earn high commissions by recommending index options to

their clients, because low volatility leads to higher waiting time for round-trips.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

22

DERIVATIVES IN INDIA

•

Put volumes in the index options and equity options segment have increased since

January 2002. The call-put volumes in index options have decreased from 2.86 in January

2002 to 1.32 in June. The fall in call-put volumes ratio suggests that the traders are

increasingly becoming pessimistic on the market.

•

Farther month futures contracts are still not actively traded. Trading in equity options on

most stocks for even the next month was non-existent.

•

Daily option price variations suggest that traders use the F&O segment as a less risky

alternative (read substitute) to generate profits from the stock price movements. The fact that

the option premiums tail intra-day stock prices is evidence to this. If calls and puts are not

looked as just substitutes for spot trading, the intra-day stock price variations should not have

a one-to-one impact on the option premiums.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

23

DERIVATIVES IN INDIA

2.2 FACTORS CONTRIBUTING TO THE GROWTH OF

DERIVATIVES :

Factors contributing to the explosive growth of derivatives are price volatility,

globalisation of the markets, technological developments and advances in the financial

theories.

A.} PRICE VOLATILITY –

A price is what one pays to acquire or use something of value. The objects

having value maybe commodities, local currency or foreign currencies. The concept of price

is clear to almost everybody when we discuss commodities. There is a price to be paid for the

purchase of food grain, oil, petrol, metal, etc. the price one pays for use of a unit of another

persons money is called interest rate. And the price one pays in one’s own currency for a unit

of another currency is called as an exchange rate.

Prices are generally determined by market forces. In a market, consumers

have ‘demand’ and producers or suppliers have ‘supply’, and the collective interaction of

demand and supply in the market determines the price. These factors are constantly

interacting in the market causing changes in the price over a short period of time. Such

changes in the price is known as ‘price volatility’. This has three factors : the speed of price

changes, the frequency of price changes and the magnitude of price changes.

The changes in demand and supply influencing factors culminate in market

adjustments through price changes. These price changes expose individuals, producing firms

and governments to significant risks. The break down of the BRETTON WOODS

agreement brought and end to the stabilising role of fixed exchange rates and the gold

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

24

DERIVATIVES IN INDIA

convertibility of the dollars. The globalisation of the markets and rapid industrialisation of

many underdeveloped countries brought a new scale and dimension to the markets. Nations

that were poor suddenly became a major source of supply of goods. The Mexican crisis in the

south east-Asian currency crisis of 1990’s have also brought the price volatility factor on the

surface. The advent of telecommunication and data processing bought information very

quickly to the markets. Information which would have taken months to impact the market

earlier can now be obtained in matter of moments. Even equity holders are exposed to price

risk of corporate share fluctuates rapidly.

These price volatility risk pushed the use of derivatives like futures and

options increasingly as these instruments can be used as hedge to protect against adverse

price changes in commodity, foreign exchange, equity shares and bonds.

B.} GLOBALISATION OF MARKETS –

Earlier, managers had to deal with domestic economic concerns ; what

happened in other part of the world was mostly irrelevant. Now globalisation has increased

the size of markets and as greatly enhanced competition .it has benefited consumers who

cannot obtain better quality goods at a lower cost. It has also exposed the modern business to

significant risks and, in many cases, led to cut profit margins

In Indian context, south East Asian currencies crisis of 1997 had affected the

competitiveness of our products vis-à-vis depreciated currencies. Export of certain goods

from India declined because of this crisis. Steel industry in 1998 suffered its worst set back

due to cheap import of steel from south east asian countries. Suddenly blue chip companies

had turned in to red. The fear of china devaluing its currency created instability in Indian

exports. Thus, it is evident that globalisation of industrial and financial activities necessitiates

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

25

DERIVATIVES IN INDIA

use of derivatives to guard against future losses. This factor alone has contributed to the

growth of derivatives to a significant extent.

C.} TECHNOLOGICAL ADVANCES –

A significant growth of derivative instruments has been driven by

technological break through. Advances in this area include the development of high speed

processors, network systems and enhanced method of data entry. Closely related to advances

in

computer

technology

are

advances

in

telecommunications.

Improvement

in

communications allow for instantaneous world wide conferencing, Data transmission by

satellite. At the same time there were significant advances in software programmes without

which computer and telecommunication advances would be meaningless. These facilitated

the more rapid movement of information and consequently its instantaneous impact on

market price.

Although price sensitivity to market forces is beneficial to the economy as a

whole resources are rapidly relocated to more productive use and better rationed overtime the

greater price volatility exposes producers and consumers to greater price risk. The effect of this

risk can easily destroy a business which is otherwise well managed. Derivatives can help a firm

manage the price risk inherent in a market economy. To the extent the technological

developments increase volatility, derivatives and risk management products become that much

more important.

D.} ADVANCES IN FINANCIAL THEORIES –

Advances in financial theories gave birth to derivatives. Initially forward

contracts in its traditional form, was the only hedging tool available. Option pricing models

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

26

DERIVATIVES IN INDIA

developed by Black and Scholes in 1973 were used to determine prices of call and put options.

In late 1970’s, work of Lewis Edeington extended the early work of Johnson and started the

hedging of financial price risks with financial futures. The work of economic theorists gave rise

to new products for risk management which led to the growth of derivatives in financial markets.

The above factors in combination of lot many factors led to growth of derivatives

instruments.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

27

DERIVATIVES IN INDIA

2.3 TYPES OF DERIVATIVES :

There are mainly four types of derivatives i.e. Forwards, Futures, Options and swaps.

Derivatives

Forwards

Futures

Options

Swaps

1. FORWARDS A contract that obligates one counter party to buy and the other to sell a

specific underlying asset at a specific price, amount and date in the future is known as a

forward contract. Forward contracts are the important type of forward-based derivatives.

They are the simplest derivatives. There is a separate forward market for multitude of

underlyings, including the traditional agricultural or physical commodities, as well as

currencies and interest rates. The change in the value of a forward contract is roughly

proportional to the change in the value of its underlying asset. These contracts create credit

exposures. As the value of the contract is conveyed only at the maturity, the parties are

exposed to the risk of default during the life of the contract. Forward contracts are

customised with the terms and conditions tailored to fit the particular business, financial or

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

28

DERIVATIVES IN INDIA

risk management objectives of the counter parties. Negotiations often take place with respect

to contract size, delivery grade, delivery locations, delivery dates and credit terms.

2. FUTURES A future contract is an agreement between two parties to buy or sell an asset at a

certain time the future at the certain price. Futures contracts are the special types of forward

contracts in the sense that are standardized exchange-traded contracts.

Equities, bonds, hybrid securities and currencies are the commodities of the

investment business. They are traded on organised exchanges in which a clearing house

interposes itself between buyer and seller and guarantees all transactions, so that the identity

of the buyer or the seller is a matter of indifference to the opposite party. Futures contract

protect those who use these commodities in their business.

Futures trading are to enter into contracts to buy or sell financial instruments,

dealing in commodities or other financial instruments for forward delivery or settlement on

standardised terms. The futures market facilitates stock holding and shifting of risk. They act as a

mechanism for collection and distribution of information and then perform a forward pricing

function. The futures trading can be performed when there is variation in the price of the actual

commodity and there exists economic agents with commitments in the actual market. There must

be a possibility to specify a standard grade of the commodity and to measure deviations from this

grade. A futures market is established specifically to meet purely speculative demands is possible

but is not known. Conditions which are thought of necessary for the establishment of futures

trading are the presence of speculative capital and financial facilities for payment of margins and

contract settlement. In addition, a strong infrastructure is required, including financial, legal and

communication systems.

3. OPTIONS -

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

29

DERIVATIVES IN INDIA

A derivative transaction that gives the option holder the right but not the

obligation to buy or sell the underlying asset at a price, called the strike price, during a period

or on a specific date in exchange for payment of a premium is known as ‘option’.

Underlying asset refers to any asset that is traded. The price at which the underlying is traded

is called the ‘strike price’.

There are two types of options i.e., CALL OPTION AND PUT OPTION.

a. CALL OPTION :

A contract that gives its owner the right but not the obligation to buy an

underlying asset-stock or any financial asset, at a specified price on or before a

specified date is known as a ‘Call option’. The owner makes a profit provided he

sells at a higher current price and buys at a lower future price.

b. PUT OPTION :

A contract that gives its owner the right but not the obligation to sell an

underlying asset-stock or any financial asset, at a specified price on or before a

specified date is known as a ‘Put option’. The owner makes a profit provided he buys

at a lower current price and sells at a higher future price. Hence, no option will be

exercised if the future price does not increase.

Put and calls are almost always written on equities, although occasionally

preference shares, bonds and warrants become the subject of options.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

30

DERIVATIVES IN INDIA

4.

SWAPS Swaps are transactions which obligates the two parties to the contract to exchange

a series of cash flows at specified intervals known as payment or settlement dates. They can be

regarded as portfolios of forward's contracts. A contract whereby two parties agree to exchange

(swap) payments, based on some notional principle amount is called as a ‘SWAP’. In case of

swap, only the payment flows are exchanged and not the principle amount. The two commonly

used swaps are:

a. INTEREST RATE SWAPS :

Interest rate swaps is an arrangement by which one party agrees to

exchange his series of fixed rate interest payments to a party in exchange for his

variable rate interest payments. The fixed rate payer takes a short position in the

forward contract whereas, the floating rate payer takes a long position in the forward

contract.

b. CURRENCY SWAPS :

Currency swaps is an arrangement in which both the principle amount

and the interest on loan in one currency are swapped for the principle and the interest

payments on loan in another currency. The parties to the swap contract of currency

generally hail from two different countries. This arrangement allows the counter

parties to borrow easily and cheaply in their home currencies. Under a currency swap,

cash flows to be exchanged are determined at the spot rate at a time when swap is

done. Such cash flows are supposed to remain unaffected by subsequent changes in

the exchange rates.

c. FINANCIAL SWAP :

Financial swaps constitute a funding technique which permit a borrower

to access one market and then exchange the liability for another type of liability. It

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

31

DERIVATIVES IN INDIA

also allows the investors to exchange one type of asset for another type of asset with a

preferred income stream.

The other kind of derivatives, which are not, much popular are as follows :

5.

BASKETS -

Baskets options are option on portfolio of underlying asset. Equity Index Options are

most popular form of baskets.

6. LEAPS Normally option contracts are for a period of 1 to 12 months. However, exchange may

introduce option contracts with a maturity period of 2-3 years. These long-term option contracts

are popularly known as Leaps or Long term Equity Anticipation Securities.

7.

WARRANTS Options generally have lives of up to one year, the majority of options traded on options

exchanges having a maximum maturity of nine months. Longer-dated options are called

warrants and are generally traded over-the-counter.

8.

SWAPTIONS Swaptions are options to buy or sell a swap that will become operative at the expiry of the

options. Thus a swaption is an option on a forward swap. Rather than have calls and puts, the

swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an

option to receive fixed and pay floating. A payer swaption is an option to pay fixed and

receive floating.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

32

DERIVATIVES IN INDIA

2.4

Futures Market

Forward Market

Margin deposits are to be required of Typically, no money changes hands

all participants.

until delivery, although a small margin

deposit might be required of non-dealer

customers on certain occasions.

Contract terms are standardised with all All contract terms are negotiated

buyers and sellers negotiating only with privately by the parties.

respect to price.

Non-member participants deal through Participants

brokers

(exchange

members

deal

typically

on

a

who principal-to-principal basis.

represent them on the exchange floor)

Participants

corporations,

include

financial

banks, Participants are primarily institutions

institutions, dealing with one other and other

individual investors, and speculators.

interested parties dealing through one

or more dealers.

The clearing house of the exchange A participant must examine the credit

becomes the opposite side to each risk and establish credit limits for each

cleared

credit

transactions;

risk

for

a

therefore,

futures

the opposite party.

market

participant is always the same and there

is no need to analyse the credit of other

market participants.

Settlements are made daily through the

Settlement occurs on date agreed upon

exchange clearing house. Gains on

between the parties to each transaction.

open positions may be withdrawn and

losses are collected daily.

Long and short positions are usually Forward positions are not as easily

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

33

DERIVATIVES IN INDIA

liquidated easily.

offset or transferred to the other

participants.

Settlements are normally made in cash, Most transactions result in delivery.

with only a small percentage of all

contracts resulting actual delivery.

A single, round trip (in and out of the No commission is typically charged if

market) commission is charged. It is the transaction is made directly with

negotiated

between

broker

and another dealer. A commission is

customer and is relatively small in charged to born buyer and seller,

relation to the value of the contract.

however, if transacted through a broker.

Trading is regulated.

Trading is mostly unregulated.

The delivery price is the spot price.

The delivery price is the forward price.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

34

DERIVATIVES IN INDIA

CHAPTER 3

3.1

PARTICIPANTS IN DERIVATIVES MARKET

3.2

ROLE OF DERIVATIES

3.3

HOW BANKS USE DERIVATIVES

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

35

DERIVATIVES IN INDIA

CHAPTER 3

3.1 PARTICIPANTS IN THE DERIVATIVES MARKET :

The participants in the derivatives market are as follows:

A.} TRADING PARTICIPANTS :

1.] HEDGERS –

The process of managing the risk or risk management is called as hedging.

Hedgers are those individuals or firms who manage their risk with the help of derivative

products. Hedging does not mean maximising of return. The main purpose for hedging is to

reduce the volatility of a portfolio by reducing the risk.

2.] SPECULATORS –

Speculators do not have any position on which they enter into futures and

options Market i.e., they take the positions in the futures market without having position in

the underlying cash market. They only have a particular view about future price of a

commodity, shares, stock index, interest rates or currency. They consider various factors like

demand and supply, market positions, open interests, economic fundamentals, international

events, etc. to make predictions. They take risk in turn from high returns. Speculators are

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

36

DERIVATIVES IN INDIA

essential in all markets – commodities, equity, interest rates and currency. They help in

providing the market the much desired volume and liquidity.

3.] ARBITRAGEURS –

Arbitrage is the simultaneous purchase and sale of the same underlying in two

different markets in an attempt to make profit from price discrepancies between the two

markets. Arbitrage involves activity on several different instruments or assets simultaneously

to take advantage of price distortions judged to be only temporary.

Arbitrage occupies a prominent position in the futures world. It is the

mechanism that keeps prices of futures contracts aligned properly with prices of underlying

assets. The objective is simply to make profits without risk, but the complexity of arbitrage

activity is such that it is reserved to particularly well-informed and experienced professional

traders, equipped with powerful calculating and data processing tools. Arbitrage may not be

as easy and costless as presumed.

B.} INTERMEDIARY PARTICIPANTS :

4.] BROKERS –

For any purchase and sale, brokers perform an important function of bringing

buyers and sellers together. As a member in any futures exchanges, may be any commodity

or finance, one need not be a speculator, arbitrageur or hedger. By virtue of a member of a

commodity or financial futures exchange one get a right to transact with other members of

the same exchange. This transaction can be in the pit of the trading hall or on online

computer terminal. All persons hedging their transaction exposures or speculating on price

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

37

DERIVATIVES IN INDIA

movement, need not be and for that matter cannot be members of futures or options

exchange. A non-member has to deal in futures exchange through member only. This

provides a member the role of a broker. His existence as a broker takes the benefits of the

futures and options exchange to the entire economy all transactions are done in the name of

the member who is also responsible for final settlement and delivery. This activity of a

member is price risk free because he is not taking any position in his account, but his other

risk is clients default risk. He cannot default in his obligation to the clearing house, even if

client defaults. So, this risk premium is also inbuilt in brokerage recharges. More and more

involvement of non-members in hedging and speculation in futures and options market will

increase brokerage business for member and more volume in turn reduces the brokerage.

Thus more and more participation of traders other than members gives liquidity and depth to

the futures and options market. Members can attract involvement of other by providing

efficient services at a reasonable cost. In the absence of well functioning broking houses, the

futures exchange can only function as a club.

5.] MARKET MAKERS AND JOBBERS –

Even in organised futures exchange, every deal cannot get the counter party

immediately. It is here the jobber or market maker plays his role. They are the members of

the exchange who takes the purchase or sale by other members in their books and then square

off on the same day or the next day. They quote their bid-ask rate regularly. The difference

between bid and ask is known as bid-ask spread. When volatility in price is more, the spread

increases since jobbers price risk increases. In less volatile market, it is less. Generally,

jobbers carry limited risk. Even by incurring loss, they square off their position as early as

possible. Since they decide the market price considering the demand and supply of the

commodity or asset, they are also known as market makers. Their role is more important in

the exchange where outcry system of trading is present. A buyer or seller of a particular

futures or option contract can approach that particular jobbing counter and quotes for

executing deals. In automated screen based trading best buy and sell rates are displayed on

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

38

DERIVATIVES IN INDIA

screen, so the role of jobber to some extent. In any case, jobbers provide liquidity and

volume to any futures and option market.

C.} INSTITUTIONAL FRAMEWORK :

6.] EXCHANGE –

Exchange provides buyers and sellers of futures and option contract necessary

infrastructure to trade. In outcry system, exchange has trading pit where members and their

representatives assemble during a fixed trading period and execute transactions. In online

trading system, exchange provide access to members and make available real time

information online and also allow them to execute their orders. For derivative market to be

successful exchange plays a very important role, there may be separate exchange for

financial instruments and commodities or common exchange for both commodities and

financial assets.

7.] CLEARING HOUSE –

A clearing house performs clearing of transactions executed in futures and

option exchanges. Clearing house may be a separate company or it can be a division of

exchange. It guarantees the performance of the contracts and for this purpose clearing house

becomes counter party to each contract. Transactions are between members and clearing

house. Clearing house ensures solvency of the members by putting various limits on him.

Further, clearing house devises a good managing system to ensure performance of contract

even in volatile market. This provides confidence of people in futures and option exchange.

Therefore, it is an important institution for futures and option market.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

39

DERIVATIVES IN INDIA

8.] CUSTODIAN / WARE HOUSE –

Futures and options contracts do not generally result into delivery but there

has to be smooth and standard delivery mechanism to ensure proper functioning of market. In

stock index futures and options which are cash settled contracts, the issue of delivery may not

arise, but it would be there in stock futures or options, commodity futures and options and

interest rates futures. In the absence of proper custodian or warehouse mechanism, delivery

of financial assets and commodities will be a cumbersome task and futures prices will not

reflect the equilibrium price for convergence of cash price and futures price on maturity,

custodian and warehouse are very relevant.

9.] BANK FOR FUND MOVEMENTS –

Futures and options contracts are daily settled for which large fund movement

from members to clearing house and back is necessary. This can be smoothly handled if a

bank works in association with a clearing house. Bank can make daily accounting entries in

the accounts of members and facilitate daily settlement a routine affair. This also reduces a

possibility of any fraud or misappropriation of fund by any market intermediary.

10.] REGULATORY FRAMEWORK –

A regulator creates confidence in the market besides providing Level playing

field to all concerned, for foreign exchange and money market, RBI is the regulatory

authority so it can take initiative in starting futures and options trade in currency and interest

rates. For capital market, SEBI is playing a lead role, along with physical market in stocks, it

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

40

DERIVATIVES IN INDIA

will also regulate the stock index futures to be started very soon in India. The approach and

outlook of regulator directly affects the strength and volume in the market. For commodities,

Forward Market Commission is working for settling up national National Commodity

Exchange.

3.2 ROLE OF DERIVATIVES :

Derivative markets help investors in many different ways :

1.] RISK MANAGEMENT –

Futures and options contract can be used for altering the risk of investing in

spot market. For instance, consider an investor who owns an asset. He will always be worried

that the price may fall before he can sell the asset. He can protect himself by selling a futures

contract, or by buying a Put option. If the spot price falls, the short hedgers will gain in the

futures market, as you will see later. This will help offset their losses in the spot market.

Similarly, if the spot price falls below the exercise price, the put option can always be

exercised.

Derivatives markets help to reallocate risk among investors. A person who

wants to reduce risk, can transfer some of that risk to a person who wants to take more risk.

Consider a risk-averse individual. He can obviously reduce risk by hedging. When he does

so, the opposite position in the market may be taken by a speculator who wishes to take more

risk. Since people can alter their risk exposure using futures and options, derivatives markets

help in the raising of capital. As an investor, you can always invest in an asset and then

change its risk to a level that is more acceptable to you by using derivatives.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

41

DERIVATIVES IN INDIA

2.] PRICE DISCOVERY –

Price discovery refers to the markets ability to determine true equilibrium

prices. Futures prices are believed to contain information about future spot prices and help in

disseminating such information. As we have seen, futures markets provide a low cost trading

mechanism. Thus information pertaining to supply and demand easily percolates into such

markets. Accurate prices are essential for ensuring the correct allocation of resources in a

free market economy. Options markets provide information about the volatility or risk of the

underlying asset.

3.] OPERATIONAL ADVANTAGES –

As opposed to spot markets, derivatives markets involve lower transaction

costs. Secondly, they offer greater liquidity. Large spot transactions can often lead to

significant price changes. However, futures markets tend to be more liquid than spot markets,

because herein you can take large positions by depositing relatively small margins.

Consequently, a large position in derivatives markets is relatively easier to take and has less

of a price impact as opposed to a transaction of the same magnitude in the spot market.

Finally, it is easier to take a short position in derivatives markets than it is to sell short in spot

markets.

4.] MARKET EFFICIENCY –

The availability of derivatives makes markets more efficient; spot, futures

and options markets are inextricably linked. Since it is easier and cheaper to trade in

derivatives, it is possible to exploit arbitrage opportunities quickly and to keep prices in

alignment. Hence these markets help to ensure that prices reflect true values.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

42

DERIVATIVES IN INDIA

5.] EASE OF SPECULATION –

Derivative markets provide speculators with a cheaper alternative to engaging

in spot transactions. Also, the amount of capital required to take a comparable position is less

in this case. This is important because facilitation of speculation is critical for ensuring free

and fair markets. Speculators always take calculated risks. A speculator will accept a level of

risk only if he is convinced that the associated expected return, is commensurate with the risk

that he is taking.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

43

DERIVATIVES IN INDIA

3.3 HOW BANKS USE DERIVATIVES :

ASSET LIABILITY MANAGEMENT Banks have traditionally taken deposits from their customers and put those deposits to work

as loans. Because the deposits and the loans are dominated in the same currency, this activity

has no associated foreign exchange risk. But it does limit banks to lending to customers

which need to borrow in the currencies which the banks have available on deposits.

If a bank is asked to lend to a customer in a currency other than one of those it has on

deposits it creates a currency exposure for the bank. Suppose a customer wants to borrow

EUROS from a US Bank for 5 years and that the US bank has no natural source of EUROS.

It is possible for the banks to cover this exposure in the forward market by selling EUROS

forwards and buying US dollars. The transaction costs associated with this, in particular the

bid / offer spread in the medium term foreign exchange forward market, would make the

resultant cost of the loan prohibitively expensive for the borrower.

Currency swaps provide an economic alternative to this problem for banks. In order to cover

the exposure created by a loan to a customer in EUROS funded by a bank’s deposit in US

dollar, a bank could receive fixed rate US dollars in a currency swap and pay fixed rate

EUROS.

One of the consequences of the development of the currency swap market is that banks now

often make much more competitive medium term forward foreign exchange prices than they

used to. Most banks quote forward foreign exchange and currency swap prices from the same

desk and increases liquidity in the latter has improved liquidity in the former.

Banks

therefore, need no longer restrict their lending activities to the currencies in which they have

natural deposits. They are free to fund themselves in the most competitively priced currency

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

44

DERIVATIVES IN INDIA

and to lend to their customers in the currency of the customer’s preference, using a currency

swap as an asset and liability matching tool

The “Normal yield curve”, reflects that it is much easier for banks to borrow at the short end

of the curve than the long end. This means that banks can fund themselves much more

effectively in the inter bank market in maturities such as the overnight, tom / next (overnight

from tomorrow, or tomorrow to the next day), spot / next, one week, one month, three

months and six months than they can in maturities such as five years or 20 years.

With the development of the swaps market it is possible for banks to satisfy their customers

demands for fixed rate funding while ensuring that the banks assets and liabilities are

matched. Suppose a bank has a customer who needs 5 years fixed rate funds. Let us say that

the bank finances in this loan in the interbank market at 3 month LIBOR. The bank now has

a 3 month liability and a 5 year asset (Figure 1).

The bank is short floating rate interest at 3 month LIBOR and long fixed rate interest at the rate

at which it lends to its customer. This is called the asset liability mismatch. So in order to hedge

its position the banks needs to match its exposure to 3 month LIBOR by receiving on a floating

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

45

DERIVATIVES IN INDIA

rate basis in an interest rate swap, and match its exposure on a fixed rate basis by paying a fixed

rate in a interest rate swap. This is a hedge which is ideally suited to an interest rate swap which

the bank receives a floating rare of interest and pays a fixed rare (Figure 2).

This structure has the benefit for the bank that it eliminates the bank’s exposure to interest

rate risk. The bank can no longer profit from a fall in interest rates but it cannot lose money

on its asset and liability mismatch as a result of an increase in rates. The bank will make or

lose money based on its pricing of the credit risk in the transaction and its overall loan

exposure rather than on its ability to forecast interest rates. Hence the interest rate swaps

provide banks with an opportunity to change their risks from interest rate to credit.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

46

DERIVATIVES IN INDIA

CONCLUSION

RBI should play a greater role in supporting derivatives.

Derivatives market should be developed in order to keep it at par with other

derivative markets in the world.

Speculation should be discouraged.

There must be more derivative instruments aimed at individual investors.

SEBI should conduct seminars regarding the use of derivatives to educate

individual investors.

SACHIN YADAV __________________________________________ TYBFM(2010-2011)

47

DERIVATIVES IN INDIA

BIBLIOGRAPHY :

BOOKS

Futures markets – Sunil. K. Parameswaran

Understanding futures market – Robert. W. Klob

Derivatives Market in India – Susan Thomas

Financial Derivatives – V. K. Bhalla

Financial Services and Markets – Dr. S. Guruswamy

Futures and Options – D. C. Gardner

WEBLIOGRAPHY :

Websites:

http//www.cxotoday.com

http//www.indiainfoline.com

http//www.indiamart.com

SACHIN YADAV __________________________________________ TYBFM(2010-2011)