Syllabus - Leigh Community Schools

advertisement

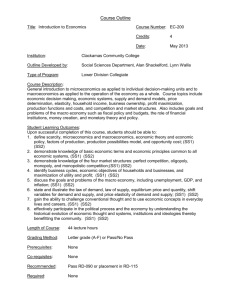

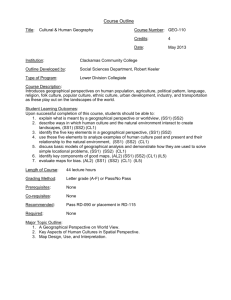

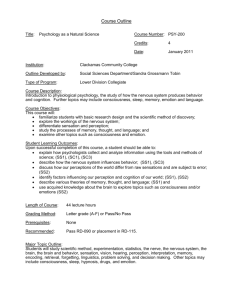

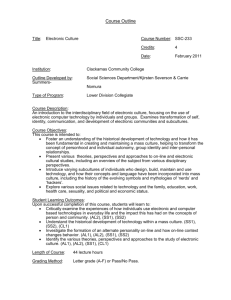

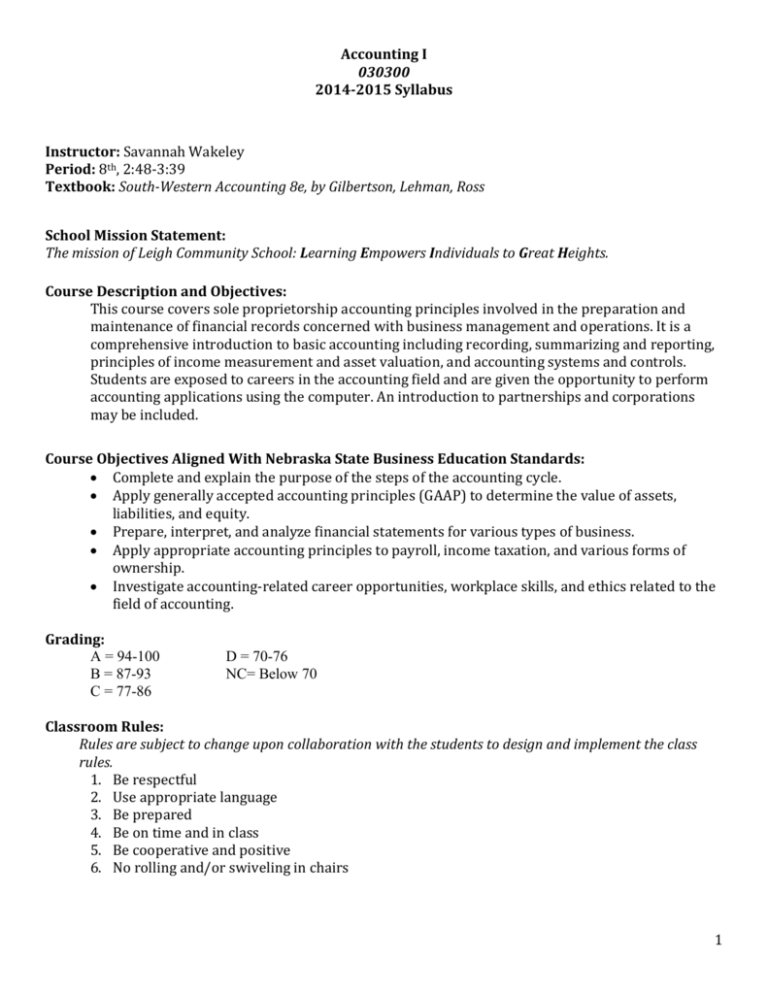

Accounting I 030300 2014-2015 Syllabus Instructor: Savannah Wakeley Period: 8th, 2:48-3:39 Textbook: South-Western Accounting 8e, by Gilbertson, Lehman, Ross School Mission Statement: The mission of Leigh Community School: Learning Empowers Individuals to Great Heights. Course Description and Objectives: This course covers sole proprietorship accounting principles involved in the preparation and maintenance of financial records concerned with business management and operations. It is a comprehensive introduction to basic accounting including recording, summarizing and reporting, principles of income measurement and asset valuation, and accounting systems and controls. Students are exposed to careers in the accounting field and are given the opportunity to perform accounting applications using the computer. An introduction to partnerships and corporations may be included. Course Objectives Aligned With Nebraska State Business Education Standards: Complete and explain the purpose of the steps of the accounting cycle. Apply generally accepted accounting principles (GAAP) to determine the value of assets, liabilities, and equity. Prepare, interpret, and analyze financial statements for various types of business. Apply appropriate accounting principles to payroll, income taxation, and various forms of ownership. Investigate accounting-related career opportunities, workplace skills, and ethics related to the field of accounting. Grading: A = 94-100 B = 87-93 C = 77-86 D = 70-76 NC= Below 70 Classroom Rules: Rules are subject to change upon collaboration with the students to design and implement the class rules. 1. Be respectful 2. Use appropriate language 3. Be prepared 4. Be on time and in class 5. Be cooperative and positive 6. No rolling and/or swiveling in chairs 1 Course Curriculum Sole Proprietorship 1. Starting a Proprietorship: Changes that affect the accounting equation SS1, SS2 a. The accounting equation b. How business activities change the accounting equation c. How transactions change owner’s equity 2. Analyzing transactions into debit and credit parts SS1 SS2 a. Using T accounts b. Analyzing how transactions affect accounts c. Analyzing how transactions affect owner’s equity accounts 3. Journalizing transactions SS1, SS2 a. Journals, source documents, and recording entries in a journal b. Journalizing buying insurance, buying on account, and paying on account c. Journalizing transactions that affect owner’s equity and receiving cash on account d. Proving and ruling a journal 4. Posting to a general ledger SS1, SS2 a. Preparing a chart of accounts b. Posting separate amounts from a journal to a general ledger c. Posting column totals from a journal to general ledger d. Completed accounting forms and making correcting entries 5. Cash control systems SS1, SS2 a. Checking accounts b. Bank reconciliation c. Dishonored checks and electronic banking d. Petty cash 6. Work sheet for a service business SS1, SS2 a. Creating a work sheet b. Planning adjusting entries on a work sheet c. Extending financial statement information on a work sheet d. Finding and correcting errors on the work sheet 7. Financial statements for a proprietorship SS1, SS2, SS3 a. Preparing an income statement b. Balance sheet information on a work sheet 8. Recording adjusting and closing entries for a service business SS1, SS2, SS3 a. Recording adjusting entries b. Recording closing entries c. Preparing a post-closing trial balance Corporation 9. Journalizing purchases and cash payments SS1, SS2, SS3 a. Journalizing purchases using a purchases journal b. Journalizing cash payments using a cash payments journal c. Performing additional cash payments journal operations d. Journalizing other transactions using a general journal 10. Journalizing sales and cash receipts using special journals SS1, SS2, SS3 a. Journalizing sales on account using a sales journal b. Journalizing cash receipts using a cash receipts journal c. Recording transactions using a general journal 11. Posting to a general and subsidiary ledgers SS1, SS2, SS3 a. Posting to an accounts payable ledger b. Posting to an accounts receivable ledger c. Posting from journals to a general ledger d. Posting special journal totals to a general ledger e. Correcting errors in subsidiary ledger accounts 12. Preparing payroll records SS1, SS2, SS3, SS4 a. Preparing payroll time cards b. Determining payroll tax withholding c. Preparing payroll records d. Preparing payroll checks 13. Payroll accounting, taxes, and reports SS1, SS2, SS3, SS4 a. Recording a payroll b. Recording employer payroll taxes c. Reporting withholding and payroll taxes d. Paying withholding and payroll taxes 14. Distributing dividends and preparing a work sheet for a SS1, SS2, SS3, SS4 merchandising business a. Distributing corporate earnings to stockholders b. Beginning an 8-column work sheet for a merchandising business c. Planning and recording a merchandise inventory adjustment d. Planning and recording an allowance for uncollectible accounts adjustment e. Planning and recording depreciation adjustments f. Calculating Federal Income Tax and completing a work sheet 15. Financial statements for a corporation SS1, SS2, SS3, SS4 a. Preparing an income statement b. Analyzing an income statement c. Preparing a statement of stockholders’ equity d. Preparing a balance sheet 16. Recording adjusting and closing entries for a corporation SS1, SS2, SS3, SS4 a. Recording adjusting entries b. Recording closing entries for income statement accounts c. Preparing a post-closing trial balance 17. Accounting for uncollectible accounts receivable SS1, SS2, SS3, SS4 a. Uncollectible accounts b. Writing off and collecting uncollectible accounts receivable 18. Accounting for plant assets and depreciation SS1, SS2, SS3, SS4 a. Buying plant assets and paying property tax b. Calculating depreciation expense c. Journalizing depreciation expense d. Disposing of plant assets e. Declining-balance method of depreciation 19. Accounting for inventory SS1, SS2, SS3, SS4 a. Determining the quantity of merchandise inventory b. Determining the cost of merchandise inventory c. Estimating inventory