Secured Borrowing

advertisement

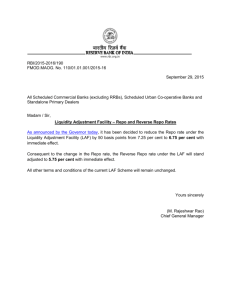

To: Restricted Asset (E) Subgroup From: Julie Gann (NAIC Staff) Re: Repurchase Agreement Disclosures – Proposed Disclosures – Secured Borrowing Date: November 9, 2015 – Exposed for Comment until Jan. 29, 2016 On the May 13, 2015 conference call of the Restricted Asset (E) Subgroup, the chair suggested collecting additional information regarding repurchase agreements prior to considering potential accounting revisions. Additionally, in response to questions submitted after an industry education session, the ACLI indicated support for regulators to collect data from insurers on repurchase agreements through disclosure or other means. This memorandum presents proposed disclosure templates for repurchase and reverse repurchase agreements. The proposed disclosures detailed in this memorandum were drafted after reviewing the following: Proposed data elements and definitions, from the November 2014 FSB Consultative Document, “Standards and Processes for Global Securities Financing Data Collection and Aggregation.” http://www.financialstabilityboard.org/wp-content/uploads/Global-SFT-Data-StandardsConsultative-Document.pdf Disclosure information reflected within ASU 2014-11—Transfers and Servicing, Repurchase-toMaturity Transactions, Repurchase Financings, and Disclosures (ASU 2014-11). Office of Financial Research Working Paper – “Reference Guide to U.S. Repo and Securities Lending Markets” Dated Sept. 9, 2015. Currently, only templates have been proposed to capture information. After these templates (and the data components are discussed), revisions will be considered, as needed to reference the disclosures in SSAP No. 103—Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. Staff Note – Although a review of the FSB data capturing elements is detailed within a separate memo, very few of these points have been incorporated within the draft templates. Rather, the templates are more in line with statutory reporting elements. The separate memo detailing the FSB elements are provided in case regulators and interested parties would like to consider their inclusion for statutory accounting / reporting purposes. Exposure Documents Include (separate memorandums): Templates 1-2 – Repurchase Transactions (Cash Taker) Accounted as Secured Borrowings Templates 3-4 – Reverse Repurchase Transactions (Cash Provider) Accounted as Secured Borrowings Proposed Disclosure from ASU 2014-11- All Repo / Reverse Repo Transactions (Please see related documents for proposed disclosure templates for transactions accounted for as sales, and for a review of the FSB data components.) 1 Review of Existing Disclosures in SSAP No. 103: Existing statutory accounting data-captured disclosures related to repurchase agreements appear to focus on accepted collateral, and the aggregate amount of collateral reinvested. The existing data-captured disclosures identify the aggregate amount of collateral received, broken down by when it would be contractually-required to be returned, as well as the aggregate amortized cost and fair value if collateral has been reinvested (also broken down by when it would be contractually required to be returned). (This disclosure detail is reported in the aggregate within Note 5(E). These disclosures are similar to the one proposed by ASU 2014-11, but do not include the security type. As a side note, Schedule DL – Detail of reinvested collateral assets – currently only applies to securities lending transactions.) Although other disclosure elements may be currently referenced in SSAP No. 103, they are satisfied through narrative summaries (not data captured), or through the annual statement investment codes (e.g., investments coded as subject to repurchase agreement). Due to the nature of narrative disclosures, and some inherent limitations with investment schedules, information is not easily obtainable by regulators regarding repurchase and reverse repurchase activity allowing for an aggregate assessment of financial statement impact. Proposed Disclosure Elements for Repurchase & Reverse Repurchase Agreements: In response to comments on improving the information available to regulators on repurchase and reverse repurchase transactions, preliminary data templates have been drafted for Subgroup consideration. Utilizing the proposed concepts for data collection by the FSB, there are separate templates depending on whether the transaction (from the reporting entity’s standpoint) is a repo or reverse repo, and proposes to capture information on transactions that originated (Flow Data), as well as detail on outstanding transactions as of reporting dates (Position Data) and outstanding collateral. “Flow data” is proposed to reflect “settled” transactions. The term “settled” is used by the FSB to reflect trades where the spot leg is satisfied. The spot leg is the first part of the repo transaction; therefore this disclosure shall reflect the initiation of repos – when the buyer first provides cash to the seller of security. *** Inquiry – Comments on the above definition for “flow data” is requested. In staff’s view, the intent of the “flow” data is to capture the initiation / origination of new repo trades. It is not necessarily intended to capture the “renewal” of existing repo agreements. Is the information above sufficient to capture the intent, and is the guidance consistent with market terminology for consistent completion? “Position data” is proposed to reflect the aggregate total of all outstanding repurchase / reverse repurchase agreements. “Collateral” data information is proposed to reflect the aggregate total of all outstanding collateral repurchase / reverse repurchase agreements. Although the FSB is proposing monthly reporting of data, the proposed templates have been drafted to allow for quarterly disclosures that would build throughout the year. Also., the templates propose the collection of aggregate information, however, individual reporting for separate repurchase agreements could be considered. *** Inquiry – As the FSB is proposing monthly collection, would it be easier for the statutory disclosures to mirror a monthly breakdown (by quarter) for “flow” reporting? For example, the number of repo trades could be divided by month and reported at the end of each quarter. Also, although not requested as part of these disclosure templates, reporting entities are expected to have information on individual transactions if requested by regulators. As such, would it be beneficial to have draft templates available for that purpose? 2 Under current SAP (and GAAP), repurchase transactions can be classified as “secured borrowings” or “sales” based on the nature of the transaction. As such, separate templates are drafted for both types of transactions. However, based on information received, a vast number of repo transactions are classified as “secured borrowings”, with limited (if any) repurchase transactions accounted for as “sales”. If desired, consideration could occur on whether all repurchase agreements should follow the “secured borrowing” approach. It is anticipated that reporting entities would only complete the templates that were relevant to their transactions. For example, if the company only engaged in transactions where they were the “cash taker” and they all qualified for accounting as secured borrowing transactions, then, under this proposal, only templates 1-2 would need to be completed. *** Inquiry – The draft templates currently focus on repurchase / reverse repurchase agreements solely by the reporting entity. Information / comments on the ability for holding company / pooling / multiple-party repo agreements is requested. If these transactions can occur, what additional disclosure information is needed? Also, as detailed in the templates, the repo maturity is proposed to mirror the FSB categories which include: Open – No maturity, Overnight, 2 Days to 1 Month, Greater than 1 month to 3 months, Greater than 3 months, to 1 year, and greater than 1 year. For Flow Data, this would reflect the original maturity, and for Position Data, this would reflect the Residual Maturity. *** Inquiry – Information / comments on the categories for “Repo Maturity” is specifically requested. Particularly, is additional information necessary to ensure consistent classification of similar contracts by different reporting entities? As additional information, the following excerpt was taken from the Sept. 9, 2015 “Reference Guide to U.S. Repo and Securities Lending Markets” from the Office of Financial Research: Tenor is also an important characteristic for understanding and monitoring the repo market. The majority of repo trades are for a fixed term, such as overnight, one week, or one month. However, other tenor arrangements are possible. For example, repo trades can be open, evergreen, callable or putable, extendible, floating rate, and convertible. Open trades are rolled over each day, keeping all aspects of the repo fixed except for the rate. Each day, however, either counterparty has the option of not rolling over the trade, implying that the effective tenor of open trades is overnight. Evergreen trades are long-term contracts with an option of either counterparty being able to discontinue the trade with an agreed-upon notice period. For example, a one-year repo with a 30-day evergreen option implies that at any point within the one-year term of the repo either counterparty can invoke the option to discontinue the trade with a 30-day notice. The implication is that such a repo effectively has a 30-day maturity structure. Finally, call and put repos are trades where one of the counterparties has the right to discontinue the repo, with an agreed-upon notice period. 3 Template 1 & Template 2 - Repurchase Transaction – Cash Taker – Secured Borrowing These templates are proposed to be completed by all insurers engaging in repo transactions in which they are the “cash taker” (selling securities) through a repurchase agreement accounted for as a secured borrowing. Template 1 – Aggregate Overview of Transactions: 1. Number of Repo Trades – Divided by bilateral and tri-party contracts. 2. Repo Maturity – For Flow Data, this would reflect the number of contracts by original maturity, and for Position Data, this would reflect the number of contracts by Residual Maturity. The categories mirror the FSB proposed categories, which include: Open – No maturity, Overnight, 2 Days to 1 Month, Greater than 1 month to 3 months, Greater than 3 months, to 1 year, and greater than 1 year. 3. Securities Sold Under Repo – Secured Borrowing – Aggregate total of the BACV and Fair Value of securities sold under a repo still reflected on the financial statements. Additionally, the total BACV of nonadmitted securities (per the current quarter F/S) sold under a repo. 4. Collateral Received – Secured Borrowing – Aggregate cash received and the fair value of securities received under repo transactions. (This template does not propose detail for the reinvesting of collateral assets. It is anticipated that an expansion of Schedule DL would be considered to include reinvested repurchase agreement collateral.) 5. Liability to Return Collateral – Secured Borrowing – Template proposes to capture the total recognized liability to return collateral. This should include all cash received as well as the fair value of securities received as collateral that have been sold by the reporting entity. 6. Counterparty and Jurisdiction – Fair value of securities sold under repo agreements per counterparty and identification of the counterparty jurisdiction. This is proposed to include all jurisdictions, including the U.S. (Total fair value reported should agree to #3 – Securities Sold under Repo.) 7. Default – Aggregate fair value of securities “sold” under repo agreements that resulted in default. (In the event of a default for a secured borrowing repo, the cash taker derecognizes the securities from their balance sheet, and eliminates the obligation to return the cash collateral.) 8. Repo Policy - Info regarding the reasons the entity is engaging in repos. Template 2 – Aggregate Securities Sold & Collateral Received with Repurchase Transactions 1. Securities Sold Under Repo - Secured Borrowing – Reflects securities still reported on the financial statements. Flow Data and Position Data should reflect the BACV and Fair Value of all securities sold under repo transactions, by NAIC designation (or equivalent) as well as the BACV of the security nonadmitted on the prior (Flow Data) and current (Position Data) financial statement. (Flow data should reflect amounts at initial transaction, the position data should reflect amounts as of the reporting date.) These assets should be coded as “Assets Subject to Repurchase Agreements” in the financial statement schedules and included as “restricted assets” in the SSAP No. 1 disclosure and general interrogatories. (Should agree to the “Securities Sold Under Repo – Secured Borrowing” on Overview Template.) 2. Cash & Non-Cash Collateral Received – Secured Borrowing – Reflects the cash and the fair value of securities received for repurchase agreements, as well as whether the securities would qualify as admitted assets. Cash received is recognized, but securities are not reflected on the financial statements. (Totals should agree to the “Collateral Received – Secured Borrowing” on Overview Template.) 4 Template 1: REPURCHASE TRANSACTION – CASH TAKER – OVERVIEW OF SECURED BORROWING TRANSACTIONS FLOW DATA – NEW REPO TRANSACTIONS POSITION DATA – ALL OUTSTANDING REPOS First Quarter Second Quarter Third Quarter Fourth Quarter First Quarter Second Quarter Third Quarter Fourth Quarter 1. # of Repo Trades Bilateral Tri-Party 2. Original (Flow) & Residual Maturity Open – No maturity Overnight 2 Days to 1 Month > 1 Month to 3 Months > 3 Months to 1 Year > 1 Year 3. Securities “Sold” Under Repo – Secured Borrowing BACV Nonadmitted – Subset Fair Value See Template 2 for Aggregate Detail by Type of Security (Page 4 provides information to complete the template.) 4. Collateral Received – Secured Borrowing Cash Securities (FV) See Template 2 for Aggregate Detail by Type of Security (Page 4 provides information to complete the template.) 5. Liability to Return Collateral – Secured Borrowing (Total) Cash (Collateral - All) Securities Collateral (FV) (Only if Sold) (Page 4 provides information to complete the template.) 6. Counterparty & Jurisdiction: Allocate the FV of securities sold / outstanding by counterparty and identify the Jurisdiction. (e.g., US, Bahamas, Canada) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) 7. Default: Identify the FV of securities sold / outstanding for which the repo agreement defaulted: 8. Repo Policy: Identify main reasons for repo – (e.g., short-term financing (liquidity), yield a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) 5 enhancement, etc. 6 Template 2: REPURCHASE TRANSACTION – CASH TAKER – INVESTMENT CATEGORY DETAIL – SECURED BORROWING FLOW DATA – NEW REPO TRANSACTIONS POSITION DATA – OUTSTANDING REPOS NAIC Designation NAIC Designation None 1 2 3 4 5 6 Nonadmitted None 1 2 3 4 5 6 Nonadmitted (Page 4 provides information to complete the template.) 1. Securities Sold Under Repo Secured Borrowing Bonds – BACV Bonds FV LB & SS – BACV LB & SS – FV Preferred Stock – BACV Preferred Stock – FV Common Stock Mortgage Loans – BACV Mortgage Loans – FV Real Estate – BACV Real Estate – FV Derivatives – BACV Derivatives – FV Other Invested Assets – BACV Other Invested Assets – FV Total Assets - BACV Total Assets - FV NOTE: All asset classes are shown above, but it is anticipated that only those involved with repo transactions would be included by the insurer. 2. Cash & Non-Cash Collateral Received - Secured Borrowing None 1 2 3 4 5 6 Does Not Qualify as Admitted None 1 2 3 4 5 6 Cash Bonds FV LB & SS – FV Preferred Stock – FV Common Stock Mortgage Loans – FV Real Estate – FV Derivatives – FV Other Invested Assets – FV Total Collateral Assets – FV NOTE: It is anticipated that cash would be the majority of collateral. Although all asset classes are shown, they would only be included if received by the insurer. 7 Does Not Qualify as Admitted Template 3 & Template 4 – Reverse Repurchase Transactions – Cash Provider – Secured Borrowing Template 3 – Reverse Repurchase Transaction – Cash Provider – Overview 1. Number of Repo Trades – Divided by Bilateral and Tri-Party contracts. 2. Repo Maturity – For Flow Data, this would reflect the original maturity, and for Position Data, this would reflect the Residual Maturity. The categories mirror the FSB proposed categories, which include: Open – No maturity, Overnight, 2 Days to 1 Month, Greater than 1 month to 3 months, Greater than 3 months, to 1 year, and greater than 1 year. 3. Fair Value of Securities Purchased – Aggregate fair value of securities acquired under reverse repo agreements. For flow data, reflects the fair value at the time of initial transaction, and position data reflects the fair value for all acquired securities from outstanding repo agreements as of the reporting date. 4. Collateral Provided – Secured Borrowing – Flow Data - Amount of cash and the BACV and Fair Value of securities provided to acquire securities under a repo agreement. If securities are provided, the schedule should also identify the BACV of securities that were nonadmitted in the prior financial statements. For Position Data – The information shall be an aggregate of collateral provided for all outstanding repo agreements, with cash reflecting the total cash provided, and any securities provided reflecting the BACV (if assets are still shown on financial statements) and the Fair Value for all securities provided as of the reporting date. (Securities provided as collateral under reverse-repurchase agreements shall be coded as “Assets Subject to Reverse Repurchase Agreements” in the financial statement schedules and included in the SSAP No. 1 disclosure and general interrogatories.) 5. Recognized Receivable to Return Cash Provided –Receivable recognized for the return of cash collateral. (Receivables are not recognized for securities provided as collateral as those securities are not generally derecognized by the reporting entity.) 6. Recognized Liability to Return Purchased Securities – If securities acquired under a reverse repurchase agreement (secured borrowing) are sold, the reporting entity shall recognize an obligation to return the securities. The template separates reverse repurchase securities sold acquired with cash or securities. (This bifurcation is needed to identify whether additional restricted assets should be recognized.) 7. Counterparty and Jurisdiction – Fair value of securities acquired under reverse repo agreements per counterparty and identification of the counterparty’s jurisdiction. This is proposed to include all jurisdictions, including the U.S. (Total fair value reported should agree to #3 – Fair Value of Securities Purchased.) 8. Default –Fair value of securities “purchased” under repo agreements that resulted in default. (In the event of a default for a secured borrowing repo, the cash provider recognizes the securities on their balance sheet, and derecognizes the collateral / collateral receivable.) 9. Repo Policy - Info regarding the reasons the entity is engaging in repos. Template 4 – Reverse Repurchase Transaction – Cash Provider – Investment Breakdown (Page 21) This template provides the BACV and fair value of the securities “acquired” under a repurchase agreement in accordance with statutory financial statement categories and related NAIC designation (or equivalent). The template also identifies whether the securities acquired would qualify as admitted assets, and if the asset has 8 been sold. These categories are different from what the FSB will likely collect, but in-line with statutory reporting categories. 1. Securities Acquired Under Repo - Secured Borrowing – Fair value of securities acquired, not recognized on the financial statements. Flow Data and Position Data should reflect the Fair Value of all securities acquired under reverse repo transactions, by NAIC designation (or equivalent), as well as whether the acquired security does not qualify as an admitted asset, and if the acquired security has been sold by the reporting entity. (Items identified as “sold” would include the settlement of short sales.) (Flow data would reflect the fair value as of the transaction date, the position data would reflect the fair value as of the reporting date.) 2. Restricted Assets – BACV and Fair Value for securities designated as restricted within the financial statements for the obligation to return securities acquired with cash collateral through a reverse repo and sold by the reporting entity. These investments should be coded as “Assets Subject to Reverse Repurchase Agreement” in the financial statements schedules and included in the SSAP No. 1 disclosure and general interrogatories. The amount coded as restricted should agree to the fair value of the recognized forward repurchase commitment. Note –If a reverse repo was acquired with non-cash collateral, the securities provided as collateral would be retained on the reporting entity’s financial statements and coded as restricted assets. If the securities acquired were sold, an obligation to return the securities would be recognized, but assets would already be identified as restricted for the reverse repo transaction. If a reverse repo was acquired with cash (which is believed to be more frequent), the cash provided is removed from the financial statements, and a receivable is recognized for the return of cash collateral. (The party receiving the cash would recognize a liability for the return.) If the acquired repo asset was sold, the reporting entity would need to recognize a liability to return the repo asset. In these situations, it is proposed that assets be identified as restricted to satisfy this obligation. 9 Template 3: REVERSE REPURCHASE TRANSACTION – CASH PROVIDER – SECURED BORROWING OVERVIEW First Quarter 1. # of Repo Trades Bilateral Tri-Party 2. Original (Flow) / Residual Repo Maturity Open – No maturity Overnight 2 Days to 1 Month > 1 Month to 3 Months > 3 Months to 1 Year > 1 Year 3. FV of Securities Purchased under Repo FLOW DATA – NEW REPO TRANSACTIONS Second Quarter Third Quarter Fourth Quarter First Quarter POSITION DATA – ALL OUTSTANDING REPOS Second Quarter Third Quarter Fourth Quarter See Template 4 for Aggregate Detail by Type of Security (Pages 7-8 provide information to complete the template.) Secured Borrowing Sale Secured Borrowing: 4. Collateral Provided – Secured Borrowing Cash Securities (FV) Securities (BACV) Nonadmitted 5. Receivable for Return of Cash Collateral 6. Recognized Liability to Return Purchased Securities (only if acquired Repo securities were sold) Repo securities sold acquired with cash collateral Repo securities sold acquired with security collateral 7. Counterparty & Jurisdiction: Allocate the FV of securities sold / outstanding by counterparty and identify the Jurisdiction. (e.g., US, Bahamas, Canada) 8. Default: Identify the FV of securities sold / outstanding for which the repo agreement is in default: 9. Policy for Repo: Identify main reasons for repo – (e.g., shortsales, derivative collateral, leverage, etc.) See Template 4 for Aggregate Detail by Type of Security (Pages 7-8 provide information to complete the template.) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) a) b) c) d) 10 Template 4: REVERSE REPURCHASE TRANSACTION – CASH PROVIDER – SECURED BORROWING FLOW DATA – NEW REPO TRANSACTIONS POSITION DATA – OUTSTANDING REPOS Equivalent NAIC Designation Equivalent NAIC Designation None 1 2 3 4 5 6 Does not Acquired None 1 2 3 4 5 6 Does not Qualify as Security Qualify as Admitted Sold Admitted 1. Securities Acquired Under Repo- Secured Borrowing Bonds FV LB & SS - FV Preferred Stock – FV Common Stock Mortgage Loans - FV Real Estate – FV Derivatives – FV Other Invested Assets - FV Total Assets - FV FV of Sold Securities (Obligation to Return) (Pages 7-8 provide information to complete the template.) NOTE: All asset classes are shown above, but it is anticipated that only those involved with the reverse-repo transactions would be included by the insurer. 2. Restricted Assets Allocation to reflect the Securities Acquired with Cash Collateral under Reverse Repo and Sold. Bonds – BACV Bonds FV LB & SS - BACV LB & SS - FV Preferred Stock – BACV Preferred Stock – FV Common Stock Mortgage Loans - BACV Mortgage Loans - FV Real Estate - BACV Real Estate – FV Derivatives - BACV Derivatives – FV Other Invested Assets - BACV Other Invested Assets - FV Total Assets - BACV Total Assets - FV 11 Acquired Security Sold NOTE: All asset classes are shown above, but it is anticipated that only those involved with the reverse-repo transactions would be included by the insurer. 12 Proposed Disclosure from ASU 2014-11 The FASB decided to require disclosure of the carrying amount of the entity’s gross obligation related to repurchase transactions, and repurchase-tomaturity transactions, disaggregated on the underlying pledged collateral. As noted by the FASB, in cases in which collateral pledged in a recognized financial asset, the transferred financial assets are not available for an entity’s use and the funding connected to the collateral pledged exposes the entity to certain risks. The type of collateral pledged, and volume of those transactions can significantly change the entity’s risk profile. This disclosure is very similar to what is already data-captured in Note 5E, but expanded to include the class of collateral pledged to mirror the disclosure in ASU 2014-11. Secured Borrowing Disclosures – Collateral Pledged and Risk to the Transferor: Note – GAAP disclosures are also applicable to securities lending. For purposes of this discussion, only a header for repurchase agreements is shown. It is anticipated that this data would replace the information currently captured within Note 5E(3). The current SAP disclosure also has information bucketed between 31-60 days, however, unless there is a preference for that information, it is proposed to mirror the GAAP disclosure. Propose to adopt disclosure from ASU 2014-11 in paragraph ASC 860-30-50-7: 1. 2. 3. Disaggregation of gross obligation by the class of collateral pledged. Remaining contractual maturity of repurchase agreements. Discussion of potential risks associated with the agreements and related collateral pledged, including obligations arising from a decline in the fair value of the collateral pledged and how those risks are managed. Repurchase Agreements and Repurchase to Maturity Transactions US Treasury and Agency Securities State and Municipal Securities Asset-Backed Securities Corporate Securities Equity Securities Non-US Sovereign Debt Loans Other Total Total Borrowings Overnight and Continuous Remaining Contractual Maturity of the Agreements Up to 30 Days 30-90 Days Greater than 90 Days Gross Amount of Recognized Liabilities for Repurchase Agreements 13 Total