Financial Analysis, Planning and Forecasting

advertisement

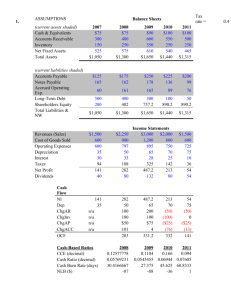

Financial Analysis, Planning and Forecasting Theory and Application Chapter 20 Cash, Marketable Securities, and Inventory Management By Alice C. Lee San Francisco State University John C. Lee J.P. Morgan Chase Cheng F. Lee Rutgers University Outline 20.1 Introduction 20.2 The Baumol and Miller-Orr model 20.3 Cash management systems 20.4 Credit lines and bank relations 20.5 Marketable securities management 20.6 Inventory Management 20.7 Summary Appendix 20A. Derivation of equation 20-1 20.1 Introduction 20.2 The Baumol and Miller-Orr model Baumol’s EOQ model Miller-Orr model 20.2 The Baumol and Miller-Orr model EOQ C Figure 20-1 2 FT k (20-1) 20.2 The Baumol and Miller-Orr model Figure 20-2 20.2 The Baumol and Miller-Orr model 2 $120 $1,560,000 C $55,857 .12 C $55,857 $27,928.50 2 2 20.2 The Baumol and Miller-Orr model Figure 20-3 20.2 The Baumol and Miller-Orr model 3 F 2 S 3 4 k 1 3 (20-2) S R L 3 (20-3) H SL (20-4) 4R L ACB 3 (20-5) 20.2 The Baumol and Miller-Orr model 3 20 9, 000, 000 spread 3 4 .000329 1 3 $22, 293 upper limit = lower limit + spread = $20,000+$22,293 = $42,293 22,293 return point = 20,000 + $ 27, 431 3 average cash balance = 4 $27, 431 $20,000 3 $ 29,908 20.3 Cash management systems Float Cash collection and transference systems Cash transference mechanism and scheduling 20.3 Cash management systems Figure 20-4 20.3 Cash management systems Figure 20-5 Source: Stone and Hill, 1980. 20.3 Cash management systems Figure 20-6 Source: Stone and Hill, 1980. 20.4 Credit lines and bank relations Credit Bank lines relations 20.4 Credit lines and bank relations $112,000 14% $800,000 .14 $200, 000 3.5% $800,000 $112,000 $28,000 17.5% $800,000 elective interest cost = interest expense + implicit interest expense line of credit limit - compensating balances 20.5 Marketable securities management Investment criteria for surplus cash balances Types of marketable securities Hedging considerations 20.5 Marketable securities management n bond price = t=1 fixed interest payment 1+ί t principal 1+ί n $10,000 - price 365 days annual yield price days to maturity $10, 000 9,500 365 .1055 9,500 182 20.5 Marketable securities management put hedge ratio = 1 - call hedge ratio = 1 - N d1 ln P E rt t 2 2 t (20-6) 20.6 Inventory Management Inventory Loans Economic order quantity 20.6 Inventory Management 2SO Q C Q (20-7) 2 50,000 200 1,000 units 20 20.7 Summary Chapter 20 has examined various aspects of cash and marketable security management. Two techniques were discussed that can assist in the estimation of an optimal level or range for the cash balance; these were Baumol’s model and the Miller-Orr model. To make the cash collection system more efficient, the firm can choose from various methods for collecting or transferring cash and deciding when to transfer it. Such cost minimization is ideal for linear programming applications. 20.7 Summary The credit line offers the firm a means of handling cash variations caused by seasonal effects or unanticipated events. Establishing good bank relations is an important feature for any cash management system. However, bank services do take on a cost, typically in the form of compensating balances. While credit lines can be a good investment for a bank, they can have detrimental effects on the bank’s liquidity that could intensify any maturity gap problems. Efficient cash management ensures that surplus balances are invested in marketable securities that meet minimum standards for certainty of principal, maturity, liquidity, and yield. In Chapter 20, we considered the hedge decision from the cash manager’s perspective and gave various examples of hedging applications. Optimal inventory management was also briefly discussed. Appendix 20A. Derivation of equation 20-1 total costs = holding cost + transaction cost C T = k F 2 C total cost C k T F 0 2 2 C k FT 2 FT ;C 2 2 C k (20A-1) (20A-2)