Forget Taco Bell- Franchise Opportunities for

advertisement

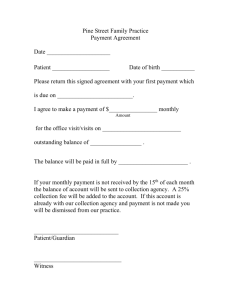

Derek C. McCalmont M.D., M.S. Management 35y.o. Retire at 50. Live to 100y.o. (die penniless) Inflation 3% Returns 5% Spend $150,000 $7,578,643 per ING Same Assumptions Plus Income $290,000 (inc. spouse) Savings $200000 IRA $500000 Contributions 5% Includes Social Sec. $5,116,378 per CNN IF- Portfolio returns 11.4% Likelihood- 21% http://cgi.money.cnn.com/tools/retirementpl anner/retirementplanner.jsp http://www.bloomberg.com/personalfinance/calculators/retirement/ http://money.msn.com/retirement/retiremen t-calculator.aspx http://www.schwab.com/public/schwab/inve sting/investment_help/retirement_planning/r etirement_calculator BIG! What Can We Do? Start A New Business! Coffee Donuts Medicine Franchise Opportunities Well over 3000 franchise businesses in U.S. with 2-10,000+ units. “Over 50 franchises are sold each day”Economic Outlook Top 106 Franchises= 9945 new units/yr. 10 largest franchise systems=%50.2 total sales Many offer multiple levels of investment/opportunity from different sized single units to multiple units. Bricks and Mortar vs. Home vs. Internet Who’s #1?- Quick Service Restaurants- Sandwiches (6), Frozen Yogurt (4) Senior Care (10) Commercial Cleaning- low start-up costs Janitorial Services- 3 in the top 10. Love at First Sight Since introduced in 1966, close to 6.5 billion Slurpee® drinks have been sold, almost enough for every person on the planet Franchise Fees- $0-$100,000+ Standard Royalty Fee- 6% of gross Advertising- $? Usually goes into a regional budget which may or may not benefit your location. Total Investment- $2000-$13.5 Million (Hampton Hotels) Business Plan- Needed to secure financing Detailed operating model- limited ability to adapt (Bigger the company, less variability) BrandTraining- None to months Franchisee support Software Minimal Info on-line Complete an information form (financial) Sign a non-disclosure Attend a “Discovery Day” Obtain a Franchise Disclosure Document Do your own industry research- all franchises predict growth of their industry- no different than any non-franchise business Governed by FTC rules Several Hundred pages long. Item 19: Financial Performance Representations”?” Multiple Locations only Only 4 markets available in the U.S. KK Factory Store- $1M Finances- $1M in liquid assets, $2M Net Worth. Franch. Fee $40-80K Royalty Fee 5.9% Total Inv. $310K-$771K Coffee makes up 60% of sales Margins on coffee “exceedingly high” Coffee>breakfast sandwichs>donuts IPO June 2011 $19…March 5, 2013 $38.15 270M Potential Customers 70% drink coffee= 189M Seattle has 1 coffee shop per 2,500 people Nationwide 24,000 to 1 Currently 12,750 shops (SBUX 6,700) Mature market 7,500-1 or 30,300 shops Regular customer is worth $700/yr. Franchise Fee $30,000 Initial Investment $176-$340K Royalty and Marketing 9.24% Net Sales per cup $3.24 Cups to break even 263 Assumes owner functions as manager AM shifts (assists with customers when busy) 363 cups/day = approx. $100k profit/yr. How many can you sell? Pro- Modest start-up costs Pro- High Margins! Pro- Relatively easy to learn operating model Pro- Growing market (? Less ideal locations) Con- Owner as manager (to start) Con- Employee turnover/training Con- Need multiple franchises to make economic sense for doctors Con- Retail experience helpful (but we have customer satisfaction experience). Open for 30+ years 8700 centers in the U.S. 85% Open 7 days/wk. Avg. 342 patients/wk. Over 150 Million Visits Annually 50% physician owned 21.7% Emergency Medicine Increased Access Lower Cost Improved Quality ? Only 57% of Americans with a PCP have access to same or next day appointments 63% report difficulty with access on nights, weekends or holidays. 20% of adults waited 6 days or more to see a doctor when they were sick in 2010 45,000 too few PCPs by 2020 Patient Centered Medical Home New accountability New IT “Enhanced Access” Expand office hours and accept more unscheduled patients vs. partnering for episodic UC visits. Avg. cost of an UC visit is slightly BELOW the average primary care visit ($155 vs. $165) Difference in cost between an UC and ED visit for the SAME DIAGNOSIS ($228-$583). 116.8M ED visits per year x 27.1% (est. 8-57% non-emergent)= 31.64M visits= cost savings $7.22B-$18.45B per annum. Does NOT include 30M newly insured with no place to go. (Suggests room for additional centers in areas already served) Fevers URIs Sprains/Strains Lacerations Contusions Back pain Most can treat fractures and give IV fluids Most have x-ray and lab processing onsite NOT freestanding EDs- Not equipped for life threatening conditions. NOT in-store retail clinics (broader scope of services and ages, primarily physician or physician/MLP staffed vs. MLPs alone). Many offer scheduled primary care visits and/or physical therapy. New Options Emerging Franchise Fee $55,000 Royalty Fee 6% of gross sales Initial Investment $526K-$715K (inc. FF) Net worth $750K, Liquid Investments $350K Multi-unit discounts available. Term- 15 years with 4 optional 5 year renewal terms. Advertising fees $1000/month spent in local market plus unspecified “ad fund” contributions when “deemed appropriate”. Founded 2005 by an EM physician Board Eligible/Board Certified physicians- no MLPs, no residents In-House pharmacy Lab and X-ray on-site Occupational Medicine Billing Services via “specialized approved” vendor Software System- Intake, scheduling, integrated payroll/benefit etc. No direct financing available. No prior industry experience required Training- 5 days at corporate headquarters (you pay travel/lodging) plus on-site training around opening, on-line learning modules, webinars etc. Support- Operations manual, periodic on-site visits, e-mail, phone, on-line support services website, hiring Assistance with licensing and credentialing Advertising materials Site selection Center design All Board Certified Emergency Physicians Offers Lab, CT, Ultrasound Accept Chest Pain, Abdominal Pain but no ambulances Open 8A-10P Online check-in Urgent Care co-pays www.urgencyroom.com Pro- We know the medicine Pro- Growing Market Pro- No overnight shifts/limited day shifts Pro- Modest volume (30 patients/day) is profitable Con- Significant start-up costs Con- Unpredictable future reimbursement Con- Focus is on building the business, not seeing patients. Con- Structured model (Often difficult for physicians) Questions?