A History Of People Helping People

advertisement

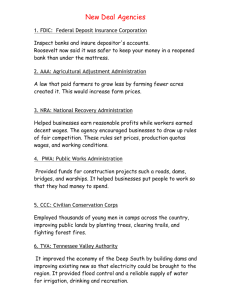

The Credit Union Movement: A History Of People Helping People What Is A Credit Union? • Cooperative financial institution where people conduct financial transactions • Members pool their assets to provide funds for loans and a variety of other financial services • NOT a bank • Not driven by profit Credit Union Motto: Not for profit, Not for charity, But for service The Core Characteristics Of Credit Unions: • Owned by their members • Only serve members from defined fields – such as where they work, live, or worship • Operate democratically: one member-one vote • Not-for-profit – credit unions do not make money for anyone but their members • Provide financial products and services to improve the quality of life for the benefit of their members • Return would-be profits to members in the form of lower rates on loans and higher dividends on savings products A World-Wide System Centered On The Member World Council of Credit Unions US Central CUNA, Inc. League CUNA Mutual State Corporate Chapter Credit Union Member How It All Began: • Our roots are in the cooperative movement • Organized in Rochdale, England in 1844 • Goal: Service to members • The credit union idea caught on in Canada in 1901 • The United States followed in 1908 Credit Union Timeline 1850 People’s Bank in Germany 1901 Start of 1st credit union in North America 1953 1969 U.S. credit unions peak at 23,000+ 1st CUNA creates World Extension Division (later CUNA International) 1908 1934 credit union organized in Manchester, New Hampshire Credit Union National Association (CUNA) is formed 1970 1996 Today World Council of Credit Unions formed CUNA’s board adopt Renewal Project, changes governance structure More than 89 million Americans are credit union members 1st 1935 CUNA Mutual is formed European Cooperatives All that remains today of the original Toad Lane in Rochdale---now a conservation area with the original Rochdale Pioneers' store as a museum. • A group of weavers in Rochdale, England established the Rochdale Society of Equitable Pioneers in 1844. • They sold shares to members to raise capital to buy goods at lower than retail prices, and then they sold the goods at a savings to members. Hermann Schulze-Delitzsch (Shoolts’-eh-Day’-litch) • • • • Founded the first credit society in 1850 in Germany. After some trial and error, the initial “loan association” came to closely resemble the credit unions of today. Spent the rest of his life organizing “people’s banks.” Only nine years after launching his first credit cooperative, there were 183 people’s banks with 18,000 members in the German provinces of East Prussia and Saxony. Hermann Schulze-Delitzsch (1808-1883) Friedrich W. Raiffeisen (Rt’-ft-sen) • Considered the “father of the credit union movement.” • In 1846 organized the Heddesdorf CU in Germany. • Founded rural cooperatives (loan societies) to aid poor farmers. • Organized the first central banking association to meet the liquidity needs of member credit societies. • Formed 425 credit societies. (1818-1888) Alphonse Desjardins (Day-zhar-dan’) • Alphonse Desjardins (1854-1920) • • •Desjardins house and first Canadian Credit Union. •Third time ever a Canadian 10-cent coin commemorates a significant historic event. • A reporter outraged by testimony about lending money with an interest rate. Operated the first financial cooperative in Canada out of his home. First deposit was 10 cents, but within six years, the credit union made loans totaling $200,000 without losing a penny. He continued to organize many credit unions in Canada. By 1914, there were 150 cooperatives. Edward A. Filene • While traveling in 1907, he discovered financial cooperatives operating in small villages in India. • Provided the vision and financial support that made the growth of credit unions possible in the United States. • Personally contributed more than $1 million (that would be comparable to donating over $20.5 million today). Edward A. Filene (1860-1937) Roy Bergengren (Ber-gin-gren) • In 1920, Filene hired Massachusetts attorney, Roy Bergengren, to help seek increased state and federal legislation to promote credit unions. • Director and co-organizer of the Credit Union National Extension Bureau (CUNEB) in 1921. • Helped launch U.S. movement’s involvement in international development. (1879-1955) The Bridge - CU Magazine • The Bridge (now Credit Union Magazine) – a members’ magazine that served as the official voice of the movement – was first published in 1924. • The magazine has evolved from a four-page, black-andwhite pamphlet to a four-color monthly with more than 1,200 pages a year. • Today, CU Magazine has the largest circulation in the credit union industry. Federal Credit Union Act • In 1934, Congress passed a federal credit union act which permitted credit unions to be organized anywhere in the United States. • The legislation allowed credit unions to incorporate under either state or federal law, a system of dual chartering that persists today. • President Franklin D. Roosevelt signed the Federal Credit Union Act into law in June 1934. CUNA Is Formed • In 1934, the credit union idea spread so fast that credit unions and leagues recognized the need for a national organization. • The Credit Union National Association (CUNA) was formed as a confederation of state leagues at a meeting in Estes Park, Colo. • CUNA replaced the Credit Union National Extension Bureau and Roy Bergengren became CUNA's first managing director. CUNA Mutual • CUNA tackled its first task: Insurance for credit unions and members. • In 1935, CUNA created the CUNA Mutual Insurance Society to provide for those needs. • Developed a loan protection insurance policy and then life savings insurance. • CUNA Mutual Insurance Society is the parent organization of all the companies that comprise the CUNA Mutual Group. CUNA Mutual • Today: – CUNA Mutual Group is the leading provider of financial services to credit unions and their members worldwide – 5,500 employees worldwide, with more than 2,000 in Madison, Wisconsin • Product offerings: – Lending: cost-effective methods to improve CU lending – Investment management: to create financial strength and stability for CUs and their members – Employee benefits: to help recruit and retain the right people with benefits packages, tools, and support – Protection: provides insurance, risk management, and innovative solutions – Members: offers CUs insurance and investment needs for their members Growth Around The Globe • In 1954, CUNA established an international services department (World Extension) to extend its reach beyond North America. There was, as yet, no central worldwide organization of credit unions. • This changed in May 1964, when CUNA revised its charter to become CUNA International, taking under its wing credit unions and associations in Canada, Latin America, and elsewhere. Credit Union Bill • November 1963: President John F. Kennedy signs the CU Bill into law on International CU Day. The bill allows federal credit unions greater operating flexibility. • Also, CUNA prepares to change its name to CUNA International, in recognition of its overseas responsibilities. Soon after, President Kennedy was assassinated on Nov. 22, 1963. WOCCU • The rapid growth of credit unions in other parts of the world and in emerging nations led to the creation of the World Council of Credit Unions in 1970. CUNA once again became a national organization and joined confederations in Canada, Africa, Asia, Australia, Latin America, and the Caribbean as members of the World Council. • National and regional confederations concentrate on development and guidance of credit unions in their areas; the World Council emphasizes overall progress and continuing unity of the worldwide movement. Organizational Expansion • In 1970, the National Credit Union Administration (NCUA) was created to charter and supervise federal credit unions, and the National Credit Union Share Insurance Fund (NCUSIF) was organized to insure credit union deposits. • In the independent credit union spirit, the NCUSIF was created without tax dollars and capitalized solely by credit unions. Opportunity And Challenge • The 1980s began with double-digit inflation, a recession, and high interest rates. Despite all that, the credit union movement continued to grow. • The number of credit unions dropped in the 1980s, which was the result of company-sponsored credit unions going out of business or mergers of smaller credit unions with larger ones. • Assets grew steadily, rising at about 20% each year. Operation Grassroots • In the early 1990s, banker attacks were countered by Operation Grassroots, a fight-back campaign that culminated in February 1991 with a rally that drew almost 13,000 credit union supporters to the Capitol Mall in Washington, D.C. Consumer Choice • • • • July 1996: the D.C. Court of Appeals ruled against NCUA’s policy allowing credit unions to serve multiple common bonds in one field of membership. The credit union movement rallied support once again, calling the effort The Credit Union Campaign for Consumer Choice. The campaign was successful in gaining a Supreme Court hearing on the field of membership issue. The passage of H.R.1151, the Credit Union Membership Access Act, was absolutely essential. H.R. 1151 • Aug. 7, 1998, President Clinton signed The Credit Union Membership Access Act (H.R. 1151). • This once again allowed federal credit unions to reach out to new members, such as small businesses and lowincome communities, that had been locked out by the narrow U.S. Supreme Court ruling. The Credit Union System CUNA-Affiliated Credit Unions Leagues and League Service Corporations Corporate Credit Unions Credit Union National Association (CUNA) Association of Corporate Credit Unions (ACCU) CUNA-related organizations U.S. Central World Council of Credit Unions (WOCCU) CUNA Mutual Credit Unions Vs. Other Financial Institutions Credit Union • Not-for-profit cooperatives • Owned by members • Operated by mostly volunteer boards • Charge lower and fewer service fees • Pay higher saving rates • Charge lower loan rates Other Financial Institutions • For-profit corporations • Owned by outside stockholders • Controlled by paid boards • Charge higher and more service fees • Pay lower saving rates • Charge higher loan rates Fun Credit Union Facts Did you know: – More than 1 of every 3 adults in the United States belongs to a credit union? – In the last 35 years, the number of members has more than tripled: • 1970 = 23 million members • Today = over 89 million members The Credit Union Way Credit unions were founded for humble reasons: – Give people a place to save – Give people a place to borrow at a reasonable cost As times change, so do credit unions. When new financial service needs surface, credit unions find ways to satisfy their members’ needs. Credit unions remember their mission! Definitions Common bond: Group sharing certain characteristics that set them apart from the general public and give them some common interest. Cooperative: Business voluntarily owned and controlled by its members, and operated for and by them on a nonprofit or cost basis. It is organized and incorporated to engage in economic activities with certain ideals of democracy, social consciousness, and human relations. Field of membership: Group of people who qualify as members of a credit union, limited by the law to those who have a common bond. Test your credit union history knowledge! THE END