Allowable P-card Purchases

advertisement

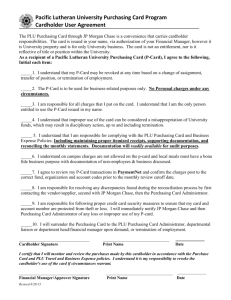

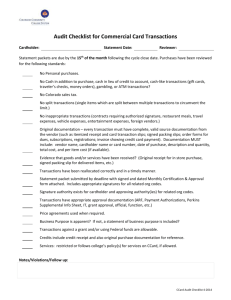

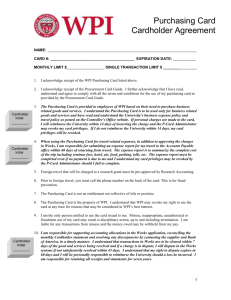

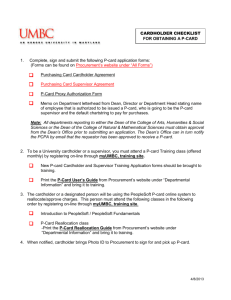

Department of Community Affairs Purchasing Card Cardholder Training 1 Introduction The objective of this State Purchasing Card training is to instruct cardholders on the proper usage of the State Purchasing Card (PCard). Periodically throughout this training session you will be required to answer questions that test your knowledge of the PCard program. Each question will need to be answered correctly before you are able to proceed with the training session. 2 AGENDA Part 1 – GENERAL INFORMATION Part 2 – TRAVELERS Part 3 - BUYERS 3 Part 1 – General Information The topics that will be covered are: The P-Card Program Cardholder General Responsibilities Information 4 P-card Program Allows each P-Card group to map out its own plan for using the card. Travel Buyer (Commodities and Service) Both (Buyer & Traveler) 5 The Purchasing Card Program The Purchasing Cards are restricted use, non-revolving credit cards issued to state employees for official state business only. It may be presented to any Merchant who accepts Visa. The Purchasing Card is the property of Bank of America and the state. Only YOU, the cardholder can use the card. 6 The Purchasing Card Program When possible, use Merchants that are nationwide. The Purchasing Card works like a personal credit card or corporate card, treat the card with care, respect and confidentiality. 7 How does the Purchasing Card Work? When you use your Purchasing Card, the vendor is paid electronically by Bank of America, usually within 72 hours. Bank of America then transfers the charge to our agency within FLAIR. (SAMAS) The Agency approval process authorizes FLAIR to create the appropriate disbursement transaction to repay Bank of America. 8 P-Card Program Each card is issued with transaction limits Single Purchase Per Day Per Month The limit is stated on the Cardholder Profile form that you and your supervisor signed. If your limit needs to be changed due to changes in your job duties or an unexpected agency event or emergency, your supervisor will be required to send an email to the Purchasing Card Administrator requesting the change in transactions limits. 9 P-Card Program Reasons for Decline Over allowable credit limits: Per transaction Daily Monthly Type of merchant being used. You may be unable to use certain Merchants as a result of conflict between Merchant codes assigned to your cardholder account and those assigned to the Vendor. Card is no longer active. 10 How does the Purchasing Card Work? All your transactions (charges & credits) are applied directly to your cost center and paid by the agency. When a zip code is required to complete a transaction, use zip code 32399. 11 Cardholder Responsibilities If the card is lost or stolen, the bank must be informed immediately. Be prepared to give your security code, which is your Mother’s maiden name. Do not order a replacement card, notify your Purchasing Card Administrator, who will order the replacement card for you. You may also need to comply with financial disclosure requirements, if you have been authorized for purchases over $1,000. Upon notification of Employment termination, discontinue using the card to allow sufficient time to turn in all your receipts. 12 Cardholder Responsibilities - continued Prior to making a purchase, remind the vendor of your Agency’s Tax Exempt status. The Agency’s Tax Exempt # is printed on the face of your Purchasing Card. A “Consumer’s Certificate of Exemption” card may be issued to you as well that indicates the Agency’s Tax Exempt number. Obtain, sign and forward receipts with a receiving date to your Agency within 3 working days of each transaction. Keep a copy of the receipt and submit the original to your reconciler. 13 Cardholder Responsibilities Identify disputed items and attempt to reach a resolution directly with the vendor. If the Vendor refuses to resolve the dispute, you must complete the “Commercial Card Claims Statement of Disputed Item” form within 60 days of the transaction date of the dispute and forward the completed form to the Purchasing Card Administrator. 14 Cardholder Responsibilities The same purchasing rules apply when using the card as when using other forms of procurement. You are expected to know and follow appropriate Florida statutes, state laws, and guidelines. 15 Cardholder Responsibilities Cardholder Profile Information: Must be completed with all the required information and signatures before a card can be ordered. Cardholder Agreement: Must be signed and dated after you have received your purchasing card training and your p-card. 16 Cardholder Responsibilities If a cardholder makes a reservation and the trip is canceled, it is the cardholder’s responsibility to cancel the reservation. If a receipt is lost or the cardholder can’t obtain a receipt, the cardholder must complete the, “Replacement Receipt” form, and have the form signed by their supervisor. 17 Cardholder Responsibilities When your card is about to expire, Bank of America will automatically mail a replacement card to the Purchasing Card Administrator. You should submit your old card to the Purchasing Card Administrator, who will destroy your old card and issue the new one to you. 18 Part 2 – TRAVELERS The topics that will be covered are: General information Cardholder Responsibilities Prohibited P-Card purchases Allowable P-Card purchases Receipt Requirements Timeframes Required Paperwork and Forms Penalties for Improper Use 19 General Information Intended use - Official State Business ONLY traveler purchasing card transactions must be in compliance with Section 112.061, F.S. Traveler may decline or accept the P-Card. When declined, traveler will not be eligible for … travel advances or use of DCA’s central billing accounts. 20 Cardholder Responsibilities Travel Voucher must be submitted to resolve any outstanding advances prior to receipt of your P-Card. Have you previously used DCA Central Billing Accounts . . . Alpha? If so, have them change your ID in their system to reflect that future charges will be placed on your PCard. . . . Avis? If so, have them change your Wizard ID in their system to reflect that future charges will be placed on your P-Card. 21 Prohibited P-card Purchases FOOD/MEALS TOLLS and Associated Fees VALET PARKING (non-mandatory) FUEL, except for a rental vehicle in your name for official state business Hotel charges other than room cost and mandatory hotel parking 22 Prohibited P-Card Purchases Cash advances from ATM machines Cash refunds for returns Non-business or Personal Items Laundry Internet or Telephone Charges Maps Supplies 23 Allowable P-card Purchases Transportation Airfare Charges Responsibility of traveler to find the most economical fare possible. If you book your flight over the phone or on-line, make sure to get a print out of your confirmation and receipt. 24 Allowable P-card Purchases Transportation Avis Car Rentals Reservations for vehicles should be made using the AVIS contract - Class B compact car. Any upgrade requires … pre-approval from your supervisor and written justification when your receipt is submitted for processing. 25 Allowable P-card Purchases Transportation Avis Car Rentals – Fuel The P-Card may be used for fuel purchases only for Avis Car Rentals, while on official state business. The receipt for fuel purchases must show vendor name, price per gallon, total gallons, and total cost of fuel purchased. If a Zip Code is requested, use 32399. 26 Allowable P-card Purchases LODGING Cost of the Room ONLY REMEMBER: Non-mandatory charges are not allowed. . . Some examples: non-mandatory valet parking, room service, phone charges, internet charges, hotel restaurant charges, safe charges, or movies; must be charged to your personal card or paid with cash; Request that non-mandatory charges be put on a separate invoice/receipt from any other charges 27 Allowable P-card Purchases Parking Airport Parking Mandatory parking at hotels 28 Allowable P-Card Purchases Registration Fees for Conference/Convention If this charge is denied . . . The problem may be the vendor merchant code Contact the Purchasing Card Administrator for further direction Charges must be pre-approved An approved “Authorization to Incur Travel Expenses” form must be submitted with your receipt for processing 29 Receipt Requirements It is required that . . . Original receipts are submitted to the agency Every receipt must be legible in order to audit and process the charges. (Reference - Department of Financial Services - Reference Guide for State Expenditures, Purchasing Card Transactions) 30 Receipt Requirements Receipt must clearly reflect . . description of goods or services acquired, number of units and cost per unit. When the vendor uses a statement/invoice as a receipt . . . it must provide the same info as a receipt, clearly indicate a “0” balance and reference as a Visa payment. 31 Receipt Requirements All receipts must be signed and dated by the cardholder per Section 215.422, F.S., to indicate the receipt, inspection and acceptance of the goods or services Acronyms and non-standard abbreviations for programs or organizational units within an agency should not be used in the supporting documentation unless an explanation is also included. 32 Timeframes Department of Financial Services and Bank of America (BOA) timeframes: Payment is due to BOA within 10 days Clock starts when your card is charged A signed “Authorization to Incur Travel Expenses” form and the receipts must be sent to your Approver within three business days. Timely compliance at each level of the approval process is very important. 33 Required Paperwork and Forms Monthly P-Card Reconciliation Report is submitted to the General Accounting Office for processing Original P-Card receipts for each cardholder are attached to this report by your approver or division liaison Purchasing card transactions must be supported by itemized merchant/vendor sales receipts (i.e., documentation that identifies items purchased and amount paid for each item). Purchasing card transactions are post-audited by the Bureau of Auditing for compliance with applicable guidelines and disbursement rules and regulations 34 Required Paperwork and Forms Complete the Voucher for Reimbursement of Travel Expenses form See your division liaison for assistance in completing this form Voucher for Reimbursement of Travel Expenses must include the original receipts of the allowable travel expenses to be reimbursed, and a copy of the receipts for charges made to your PCard 35 Penalties for Improper Use The cardholder is responsible for . . . proper use of the P-Card in accordance with state law and agency policies and procedures. reimbursing the state if charges are determined to be Unauthorized/Invalid/Prohibited Misuse of the P-Card may result in . . . suspension of the card possible disciplinary action 36 Penalties for Improper Use If P-Card is revoked, the employee will . . . be responsible for paying all travel expenses out of pocket and not be eligible for advances or use of DCA central billing accounts. 37 The Purchasing Card has been a great success, so do your part and let’s keep it successful! Questions and Answers Any travel questions? 38 Part 3 – BUYERS The topics that will be covered are: Levels of Approvers Prohibited Charges Allowable Charges 39 Level of Approvers Level 1 – Cardholder-Approve the charges made on their P-Card. (Varies between travel charges and commodity charges.) Level 2 - 7 – Division Approvers-The line of approvers assigned to a single cardholder who review the receipts and any supporting documentation. Level 8 – General Accounting 40 General Accounting: The 008 Approver This Approver level is required and is the final approver. The General Accounting Office will reconcile/audit the charge to ensure proper financial data is used. Charge is approved by the General Accounting Office and then an EFT payment is sent to Bank of America by DFS. 41 Prohibited Charges Cash advances from ATM machines Cash refunds for returns Non-business or Personal Items OCO (Operating Capital Outlay) Items Employee Moving expenses Gasoline & petroleum products-Employees on official travel business may purchase fuel only with the P-Card when using a rental vehicle. Tolls Services $35,000 & above (Including Manpower) Perquisites 42 More Prohibited Purchases Per Rule 69I-40.103, F.A.C., expenditures from state funds for the items listed are prohibited unless “expressly provided by law”: (a) Congratulatory telegrams. (b) Flowers and/or telegraphic condolences. (c) Presentment of plaques for outstanding service. (d) Entertainment for visiting dignitaries. (e) Refreshments such as coffee and doughnuts. (f) Decorative items (globe, statues, potted plants, picture frames, etc). (h) Greeting Cards, per Section 286.27, F.S. 43 Allowable Charges: Business-Related Purchases Only BUYERS Purchase of Commodities Repairs & maintenance-Not Allowed for personal owned or rental vehicles. Training registrations Newspaper ads (Personal items must never be purchased using the P-Card.) 44 The Purchasing Card has been a great success, so do your part and let’s keep it successful! Cardholders are encouraged to: 1. Use Minority merchants. 2. Use vendor’s registered in MFMP. 3. Purchase commodities that are made from recycled materials. 45 Contacts PURCHASING Steve Schmidt Purchasing Administrator stephen.schmidt@dca.state.fl. us (850) 922-1622 (Fax) 922-2979 Christine Savage, Supervisor Budget & Revenue Manager (850) 922-1658 General Accounting Nancy Quaney General Accounting Manager nancy.quaney@dca.state.fl.us (850)922-1717 DEM Finance Pat Smith, Supervisor Finance Manager (850)413-9875 Pat.smith@em.myflorida.co Michelle Riley, DEM P-card Administrator (850)413-9944 Michelle.riley@em.myflorida.com46