Best Practices on the Use of Purchasing Cards

advertisement

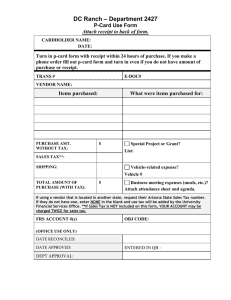

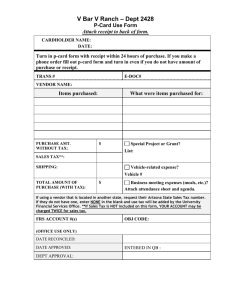

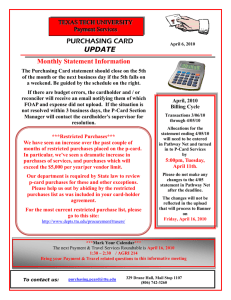

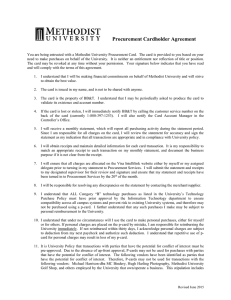

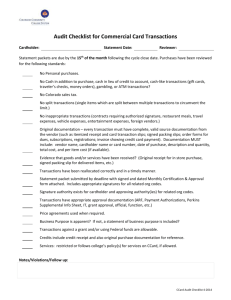

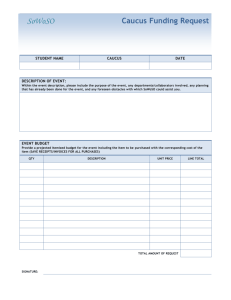

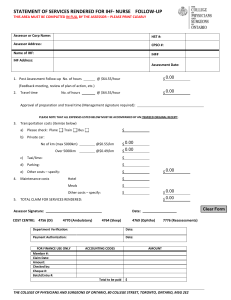

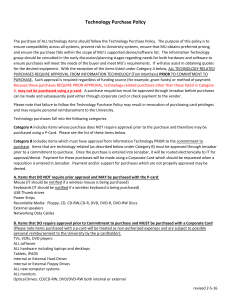

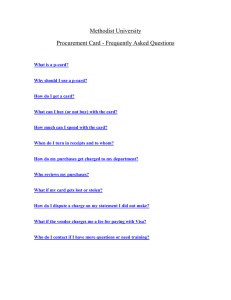

P-CARD BEST PRACTICES AND COMMON PITFALLS Frances Guzman Deputy Director for Business Operations and Finance Support Region One Education Service Center fguzman@esc1.net © 2012, Region One Education Service Center REASONS FOR STARTING PROGRAM o o o o o o o o o Tight controls over who/what/where and HOW much employees can purchase Reduced paperwork resulting in lower cost per transaction Simplifies buying process Reduces check volume On-Line purchases Removed need for petty cash in schools Hotel/Airfare reservations Vendors that don’t accept district Purchase Orders Rebates on purchases © 2012, Region One Education Service Center BEST PRACTICES District Policy/Procedures Manual on the use of credit cards Users must read and sign an agreement before receiving their card Handbook given to all cardholders during training session that outlines safeguards When a Purchase Order is required for purchases using the P-card Those cases where a Purchase Order is not used (limited) - for example individual travel related expenses o In most cases a credit card receipt or billing statement is not sufficient documentation; an itemized receipt should be obtained - exceptions: gas receipts which should include the amount of fuel disbursed and the vehicle license number o If district vehicles are being fueled using a P-card then a vehicle log should be maintained that includes mileage, date, fuel amount and cost o Employees should be aware personal expenses should not be charged to the district’s credit card other than authorized, reimbursable expenses related to district travel o o o o © 2012, Region One Education Service Center BEST PRACTICES District Policy/Procedures Manual on the use of credit cards (cont.) o A good policy is when the employee checks out a credit card they must return with receipt(s) and PO copy if warranted or be responsible for the charge o Credit limits and restrictions - Gift Cards, personal purchases, PayPal, ATMs o P-cards can be set to accept or restrict certain Merchant Category Codes (MCC) – example: restrict access to ATMs o Sales tax is not allowed except for restaurant/gas/out of state purchases; vendor must credit back the sales tax o Specific transactions governed by specific requirements, example – Restaurants (itemized receipt, no sales tax, no gratuity, no alcohol) o How to handle disputes, returns, credits o Handling fraudulent activity o Processing transactions – proper budgets, receipts/invoices, approvals o End of year processing – 1099s, P-card cutoff © 2012, Region One Education Service Center QUESTIONS? Lori A. Ramos Purchasing Coordinator Region One Education Service Center laramos@esc1.net Marc David Garcia Purchasing Specialist Region One Education Service Center mdgarcia@esc1.net © 2012, Region One Education Service Center