Accounting

advertisement

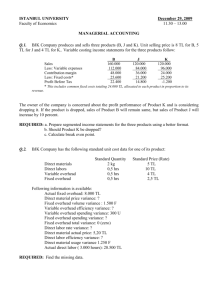

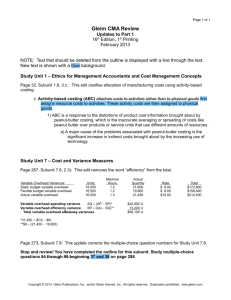

Problem- 4 (Material & Labour) The following details relating to the product ‘X’ during the month March, 2011 are available. You are required to compute: i. Material Price Variance. ii. Material Usage Variance. iii.Material Cost Variance iv.Labour Rate Variance. v. Labour Efficiency Variance. vi.Labour Cost Variance. Contd… You are also required to reconcile the standard and actual cost with help of such variances. Standard Cost per unit: Material 50 Kg. @ ` 40 per kg. Labour 400 hrs. @ ` 1.00 per kg. Actual Cost for the month: Material 4,900 Kg. @ ` 42 per kg. Labour 39,600 hrs. @ ` 1.10 per kg. Actual production – 100 units Problem -5 (Labour & Variable Overhead) The following information has been extracted from the books of Goru Enterprises which is using standard costing system: Actual output Direct wages paid Standard hours Labour efficiency variance Standard variable overhead Actual variable overhead 9,000 units 1,10,000 hours at ` 22 per hour, of which 5,000 hours, being idle time, were not recorded in production 10 hours per unit ` 3,75,000 (A) ` 150 per unit ` 16,00,000 You are required to calculate: (i) Idle time variance; (ii) Variable overhead expenditure variance; (iii) Total variable overhead variance and (iv) Variable overhead efficiency variance. Problem -6 (Fixed Overheads) AKASH LTD. operates a system of Standard Costing. The company has normal monthly machine hour capacity of 100 machines working 8 hours per day for 25 working days in the month of April 2014. i. The Standard time required to manufacture one unit of products is 4 hours. The Budgeted fixed overhead was 1,50,000. ii. In the month of April 2014, the company actually worked for 24 days for average 750 machine – hours per day. Contd… (iii)The Actual production was, 4,500 units, and the actual fixed overhead was 1,60,000. You are required to compute: A. Fixed overhead efficiency variance B. Fixed overhead capacity variance C. Fixed overhead calendar variance D. Fixed overhead expenditure variance E. Fixed overhead volume variance F. Fixed overhead cost variance. Problem – 7 (Overheads) The following budget was prepared for the overhead of Department X: Fixed overhead Variable overhead Machine hours Standard hours of production Budget for period ` 5,600 ` 10,400 1,600 1,600 After the period the actual results were: Total overhead Machine hours Standard hours produced ` 17,400 1,630 1,590 You are required to calculate the overhead variances for the period. Contd… At the end of the period, a price of ` 3.00 was agreed to have been an efficient buying price in the period. The standard costing system shows a direct material total variance of ` 8,800 made up of:Material usage variance ` 2,000 (A) Material Price Variance ` 16,800 (A) Management wishes to distinguish between controllable and uncontrollable effects on performance.