Schedule of Similarities and Differences between

advertisement

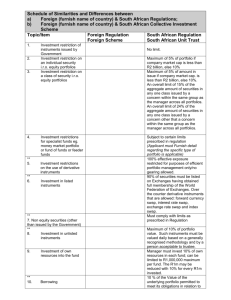

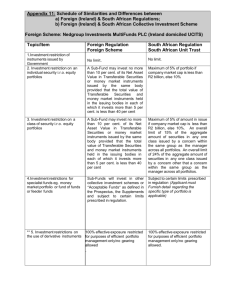

Appendix 11: Schedule of Similarities and Differences between a) Foreign (Ireland) & South African Regulations; b) Foreign (Ireland) & South African Collective Investment Scheme Foreign Scheme: Nedgroup Investments Funds PLC (Ireland domiciled UCITS) Topic/Item Foreign Regulation Foreign Scheme South African Regulation South African Unit Trust No limit. No limit. A Sub-Fund may invest no more than 10 per cent. of its Net Asset Value in Transferable Securities or money market instruments issued by the same body provided that the total value of Transferable Securities and money market instruments held in the issuing bodies in each of which it invests more than 5 per cent. is less than 40 per cent Maximum of 5% of portfolio if company market cap is less than R2 billion, else 10% 3. Investment restriction on a class of security i.r.o. equity portfolios A Sub-Fund may invest no more than 10 per cent. of its Net Asset Value in Transferable Securities or money market instruments issued by the same body provided that the total value of Transferable Securities and money market instruments held in the issuing bodies in each of which it invests more than 5 per cent. is less than 40 per cent Maximum of 5% of amount in issue if company market cap is less than R2 billion, else 10%. An overall limit of 15% of the aggregate amount of securities in any one class issued by a concern within the same group as the manager across all portfolios. An overall limit of 24% of the aggregate amount of securities in any one class issued by a concern other that a concern within the same group as the manager across all portfolios. 4.Investment restrictions for specialist funds eg. money market portfolio or fund of funds or feeder funds This paragraph is not applicable as the Foreign Scheme portfolios are not specialist funds but general equity focused. Subject to certain limits prescribed in regulation (Applicant must Furnish detail regarding the specific type of portfolio is applicable) ** 5. Investment restrictions on the use of derivative instruments 100% effective exposure restricted for purposes of efficient portfolio management only/no gearing allowed 100% effective exposure restricted for purposes of efficient portfolio management only/no gearing allowed. ** 6. Investment in listed instruments Up to 100% can be invested in “Permitted Investments” (as described in fund Prospectus). 90% of securities must be listed on Exchanges having obtained full membership of the World Federation of Exchanges. Over the counter derivative instruments that are allowed: forward currency swap, interest rate swap, exchange rate swap and index swap. 1.Investment restriction of instruments issued by Government 2. Investment restriction on an individual security i.r.o. equity portfolios Any investments not being “Permitted investments” limited to 10% in total. **7. Non equity securities (other than issued by the Government) Must comply with limits as prescribed in Regulation and Prospectus with Supplements. Must comply with limits as prescribed in Regulation **8. Investment in unlisted instruments Maximum of 10% of portfolio value. Maximum of 10% of portfolio value. Such instruments must be valued daily based on a generally recognised methodology and by a person acceptable to trustee. 9.Investment of own resources into the fund No prescriptions. Scheme or investment manger does not invest own resources in its portfolios. Manager must invest 10% of own resources in each fund; can be limited to R1,000,000 maximum per fund. The R1m may be reduced with 10% for every R1m invested. ** 10. Borrowing 10% of Net Asset Value of Portfolio on a temporary basis to meet redemptions and for buying and sale transactions. 10 % of the Value of the underlying portfolio permitted to meet its obligations in relation to the administration of a scheme relating to settlement of buying and sale transactions and repurchase or cancellation of participatory interests. Leveraging/Gearing 11. No leverage/gearing allowed for in portfolios as set out in each portfolio supplement to the Prospectus Leverage/Gearing not allowed Markets/Exchanges 11.1 Listed See Appendix 1 to the Prospectus for complete list 11.2 See Appendix 1 to the Prospectus for complete list Not allowed Full disclosure in Deed and a notice to unit holders of change OTC Markets** 90% of exchanges must have been granted full membership of the World Federation of Exchanges, the rest must follow due diligence guidelines as prescribed by Regulation ** 12 Expenses/Charges 12.1 Costs to investors Full disclosure in latest Prospectus 12.2 Charges against income of the portfolio. Full disclosure in latest Prospectus 13. Determination of market value of investments See Prospectus for valuations of assets 14 Risk factors See Prospectus for full risk disclosures **15. Capped or not capped Not capped Brokerage, MST, VAT, stamp duties, taxes, audit fee, bank charges, trustee/custodian fees, other levies or taxes service charge and share creation fees payable to the Registrar of Companies Fair market price, or as determined by stockbroker Not capped ** 16. Redemption (repurchase) Redemptions daily, details for of participatory interests redemptions are disclosed in the Scheme Prospectus 17. Independent Trustee/custodian ** 18. Taxation of Portfolio Legally obliged to redeem at same day’s or previous day’s price as determined in Deed The Custodian and the Trustee/custodian must be Administrator of the scheme is completely independent within the same group of companies (i.e. Citibank group). No taxation of income in the portfolio No taxation Interest and dividend portion taxable in the hands of the individual No Irish interest or dividend (incl. withholding) taxes applicable for South African shareholders Interest and dividends (dividend withholding tax introduced on 1 April 2012) are taxable. There is no distribution of income for Sub-Funds of the scheme (i.e. all income stay within the portfolio as part of NAV) Capital gains tax introduced on 1 October 2001 ** 19 Taxation of unitholders 19.1 19.2 Income - Dividends - Interest Capital gains No Irish capital gains tax applicable for South African shareholders South African shareholders are subject to South African tax laws regarding capital gains. ** 20. Interval at which participatory interests are priced Daily Daily 21. Distributions There is no distribution of income for Sub-Funds of the scheme (i.e. all income stay within the portfolio as part of NAV) All income distributed regularly or reinvested at option of the investor ** 22. Switching Allowed Allowed – charges differ ** 23. Pledging of securities (See 10) The Directors have determined that securities will not be pledged for investment purposes Allowed only for purposes of borrowing (refer to borrowing in par 10 above) Allowed only for purposes of short term borrowing. ** 24. Scrip lending Although allowed for under “permitted investments” the fund will not enter into securities lending transactions Allowed, may not exceed 50% of market value the portfolio, plus other conditions as prescribed in Deed. The fund will not enter into securities borrowing transactions Not allowed ** 25. Certificates, if issued and needed for redemption Shares will be in non-certificated and registered form. Issued on request 26. Reporting to supervisory authority Requirement to report quarterly and annually in addition to adhoc reporting eg reporting of breaches 27.Inspection powers by supervisory authority Yes ** 28. Reporting to investors Quarterly and annual audited financial statements refer to prospectus page 52 9.1 ** 29. Legal structure if different from trust Open Ended Investment Company 30.Interest earned on funds pending investment and r edemption No interest is earned on funds pending investment and redemption ** 31. Any other material difference Global Flexible Sub Fund may invest in below investment grade and unrated bonds subject to issuer and other investment restrictions limits as per UCITS regulations. Disclosed in relevant portfolio supplement as required by Ireland regulator. Scrip borrowing Quarterly and annually Yes Annually Collective Investment Scheme, whether trust based or Open Ended Investment Company Interest paid to clients