NIMF - List of similarities and differences (Marketing)

advertisement

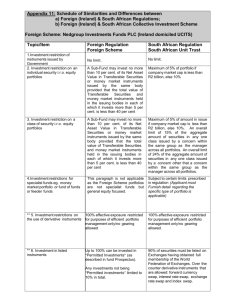

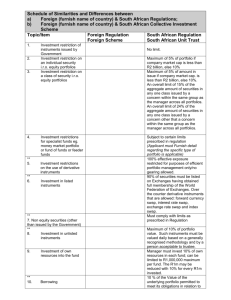

Appendix 11: Schedule of Similarities and Differences between a) Foreign (Ireland) & South African Regulations; b) Foreign (Ireland) & South African Collective Investment Scheme Foreign Scheme: Nedgroup Investments MultiFunds PLC (Ireland domiciled UCITS) Topic/Item Foreign Regulation Foreign Scheme South African Regulation South African Unit Trust No limit. No limit. A Sub-Fund may invest no more than 10 per cent. of its Net Asset Value in Transferable Securities or money market instruments issued by the same body provided that the total value of Transferable Securities and money market instruments held in the issuing bodies in each of which it invests more than 5 per cent. is less than 40 per cent Maximum of 5% of portfolio if company market cap is less than R2 billion, else 10% 3. Investment restriction on a class of security i.r.o. equity portfolios A Sub-Fund may invest no more than 10 per cent. of its Net Asset Value in Transferable Securities or money market instruments issued by the same body provided that the total value of Transferable Securities and money market instruments held in the issuing bodies in each of which it invests more than 5 per cent. is less than 40 per cent Maximum of 5% of amount in issue if company market cap is less than R2 billion, else 10%. An overall limit of 15% of the aggregate amount of securities in any one class issued by a concern within the same group as the manager across all portfolios. An overall limit of 24% of the aggregate amount of securities in any one class issued by a concern other that a concern within the same group as the manager across all portfolios. 4.Investment restrictions for specialist funds eg. money market portfolio or fund of funds or feeder funds Sub-Funds will invest in other collective investment schemes or “Acceptable Funds” as defined in the Prospectus, the Supplements and subject to certain limits prescribed in regulation. Subject to certain limits prescribed in regulation (Applicant must Furnish detail regarding the specific type of portfolio is applicable) 100% effective exposure restricted for purposes of efficient portfolio management only/no gearing allowed 100% effective exposure restricted for purposes of efficient portfolio management only/no gearing allowed. 1.Investment restriction of instruments issued by Government 2. Investment restriction on an individual security i.r.o. equity portfolios ** 5. Investment restrictions on the use of derivative instruments ** 6. Investment in listed instruments Sub-Funds will invest in other collective investment schemes as defined in the Prospectus, the Supplements and subject to certain limits prescribed in regulation. 90% of securities must be listed on Exchanges having obtained full membership of the World Federation of Exchanges. Over the counter derivative instruments that are allowed: forward currency swap, interest rate swap, exchange rate swap and index swap. **7. Non equity securities (other than issued by the Government) Sub-Funds will invest in other collective investment schemes as defined in the Prospectus, the Supplements and subject to certain limits prescribed in regulation. Must comply with limits as prescribed in Regulation **8. Investment in unlisted instruments Sub-Funds will invest in other collective investment schemes as defined in the Prospectus, the Supplements and subject to certain limits prescribed in regulation. Maximum of 10% of portfolio value. Such instruments must be valued daily based on a generally recognised methodology and by a person acceptable to trustee. 9.Investment of own resources into the fund No prescriptions. Scheme or investment manager does not invest own resources in its portfolios. Manager must invest 10% of own resources in each fund; can be limited to R1,000,000 maximum per fund. The R1m may be reduced with 10% for every R1m invested. ** 10. Borrowing 10% of Net Asset Value of Portfolio on a temporary basis to meet redemptions and for buying and sale transactions. 10 % of the Value of the underlying portfolio permitted to meet its obligations in relation to the administration of a scheme relating to settlement of buying and sale transactions and repurchase or cancellation of participatory interests. Leveraging/Gearing 11. Markets/Exchanges 11.1 Listed 11.2 OTC Markets** No leverage/gearing allowed for in portfolios as set out in each portfolio Leverage/Gearing not allowed supplement to the Prospectus Sub-Funds will invest in other collective investment schemes as defined in the Prospectus, the Supplements and subject to certain limits prescribed in regulation. 90% of exchanges must have been granted full membership of the World Federation of Exchanges, the rest must follow due diligence guidelines as prescribed by Regulation Not allowed ** 12 Expenses/Charges 12.1 Costs to investors Full disclosure in Prospectus and Addendums thereto 12.2 Charges against income of the portfolio. Full disclosure in Prospectus and Addendums thereto 13. Determination of market value of investments See Prospectus for valuation of assets 14 Risk factors See Prospectus for description of risk factors **15. Capped or not capped Not capped ** 16. Redemption (repurchase) Redemptions daily, details for of participatory interests redemptions are disclosed in the Scheme Prospectus 17. Independent Trustee/custodian ** 18. Taxation of Portfolio Full disclosure in Deed and a notice to unit holders of change Brokerage, MST, VAT, stamp duties, taxes, audit fee, bank charges, trustee/custodian fees, other levies or taxes service charge and share creation fees payable to the Registrar of Companies Fair market price, or as determined by stockbroker Not capped Legally obliged to redeem at same day’s or previous day’s price as determined in Deed The Custodian and the Trustee/custodian must be Administrator of the scheme is completely independent within the same group of companies (i.e. Citibank group). No taxation of income in the portfolio No taxation Interest and dividend portion taxable in the hands of the individual No Irish interest or dividend (incl. withholding) taxes applicable for South African shareholders Interest and dividends (dividend withholding tax introduced on 1 April 2012) are taxable. ** 19 Taxation of unitholders 19.1 Income - Dividends - Interest For the Income Multifund only there are distribution and accumulation classes of shares. 19.2 Capital gains No Irish capital gains tax applicable for South African shareholders South African shareholders are subject to South African tax laws regarding income (dividends, interest) distributions and capital gains. Capital gains tax introduced on 1 October 2001 ** 20. Interval at which participatory interests are priced Daily Daily 21. Distributions For the Income Multifund there are distribution and accumulation classes of shares. The distribution class pays quarterly distributions. All income distributed regularly or reinvested at option of the investor For the Balanced and Growth Multifunds there is no distribution of income (i.e. all income stay within the portfolio as part of NAV) ** 22. Switching Allowed – charges differ Allowed – charges differ ** 23. Pledging of securities (See 10) The Directors have determined that securities will not be pledged for investment purposes Allowed only for purposes of borrowing (refer to borrowing in par 10 above) Allowed only for purposes of short term borrowing. ** 24. Scrip lending Although allowed for under “permitted investments” the fund will not enter into securities lending transactions Allowed, may not exceed 50% of market value the portfolio, plus other conditions as prescribed in Deed. The fund will not enter into securities borrowing transactions Not allowed ** 25. Certificates, if issued and needed for redemption Shares will be in non-certificated and registered form. Issued on request 26. Reporting to supervisory authority Requirement to report quarterly and annually in addition to adhoc reporting eg reporting of breaches 27.Inspection powers by supervisory authority Yes ** 28. Reporting to investors Semi-annual (unaudited) and annual (audited) financial statements. ** 29. Legal structure if different from trust Open Ended Investment Company Scrip borrowing Quarterly and annually Yes Annually Collective Investment Scheme, whether trust based or Open Ended Investment Company 30.Interest earned on funds pending investment and r edemption ** 31. Any other material difference No interest is earned on funds pending investment and redemption Interest paid to clients