Statement of Accounts - Greater Manchester Fire and Rescue Service

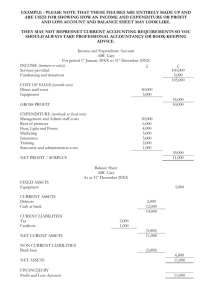

advertisement