Team Assignment 2 - Student Blogs @ VIU

advertisement

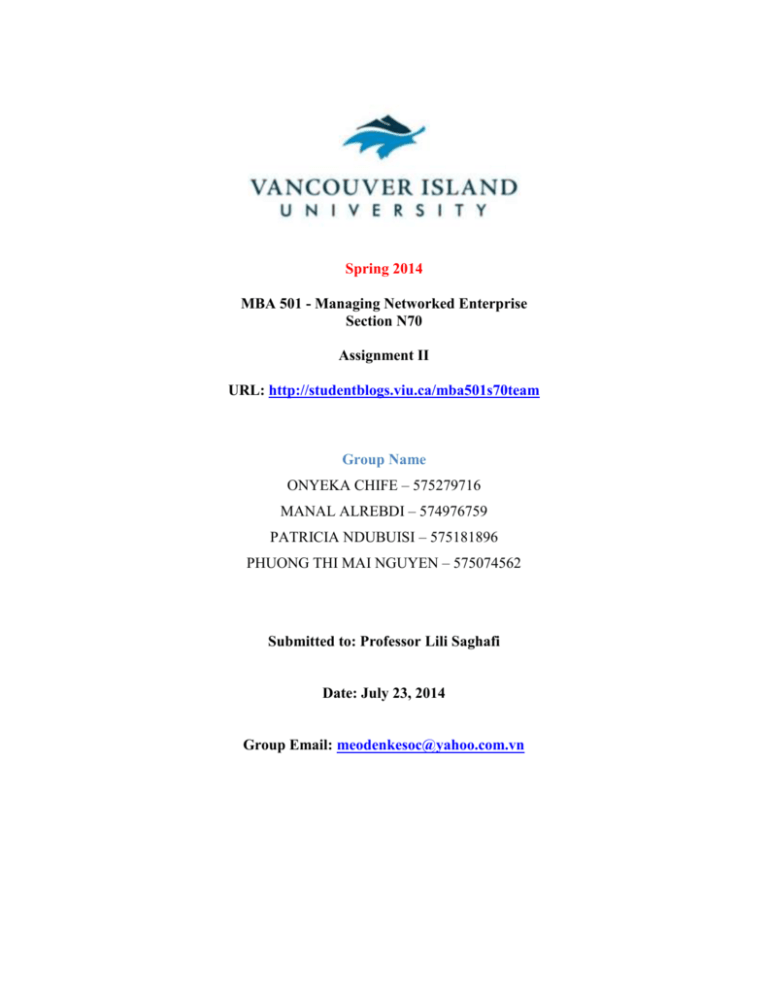

Spring 2014 MBA 501 - Managing Networked Enterprise Section N70 Assignment II URL: http://studentblogs.viu.ca/mba501s70team Group Name ONYEKA CHIFE – 575279716 MANAL ALREBDI – 574976759 PATRICIA NDUBUISI – 575181896 PHUONG THI MAI NGUYEN – 575074562 Submitted to: Professor Lili Saghafi Date: July 23, 2014 Group Email: meodenkesoc@yahoo.com.vn EXECUTIVE SUMMARY This paper is on FastTrack IT integration for the Sallie Mae Merger and Group USA, and the decision of the impact of IT integration decisions their workforce. The decision is the choice between Reston and Indianapolis for the new data center and the choice between the two home-grown loan servicing systems (class system and unity system). The former was primarily driven by cost, while the home-grown servicing systems was driven by technology decision. The factors that contributed to choice of the CIO were identified, as well as the location of the Indianapolis data center. The paper also identified the reasons of choosing the class system over the unity system, and the difference in the decision criteria for the loan service application choice and the packaged financials application choice. The paper further identified the mechanisms used by the IT organization to deal with the human resource management, the pros and cons of having the internal IT group manage the relocation of the data center and some of the ways in which the DCR team decreased the business and technology integration risk during the data center relocation. Finally, the paper discussed the communication strategies employed to communicate across team members and a Cost-Benefit analysis to determine the efficiency of the project. The second part of the paper illustrates the Context level and Zero level DFD Diagrams for their existing IT system. 2 Table of Contents EXECUTIVE SUMMARY ......................................................................................................................... 2 Part 1............................................................................................................................................................ 4 Question 1 ............................................................................................................................................. 4 Question 2 ............................................................................................................................................. 4 Question 3 ............................................................................................................................................. 5 Question 4 ............................................................................................................................................. 6 Question 5 ............................................................................................................................................. 7 Question 6 ............................................................................................................................................. 8 Question 7 ............................................................................................................................................. 8 The Cost-Benefit Analysis .................................................................................................................... 9 Part 2: DFD ............................................................................................................................................. 10 Zero Level ........................................................................................................................................... 10 Context ................................................................................................................................................ 12 Reference: ............................................................................................................................................... 13 3 Part 1 Question 1 What were some of the factors that contributed to the choice of the CIO and the Indianapolis data center location? According to the case, there were some factors that contributed to the choice of the CIO and the Indianapolis data center location ((Brown et al., 2011). Firstly, after conducting the cost benefit analysis for both locations in Reston and Indianapolis in order to come up with the decision on the best location for the IT headquarters, it was clearly observed that operating the data center in Indianapolis is much cheaper than in Reston area. Secondly, the IT personnel costs in Indianapolis are about 30% less than the Reston area. Also, due to significantly lower occupancy costs, choosing Indianapolis as a data center will bring the benefit of saving $2 million or more annually for the company. Lastly, as the Sallie Mae data center facility in Reston could be leased out at an attractive price (Brown et al., 2011), it supports the decision to locate IT headquarters in Indianapolis strongly and firmly. Furthermore, based on the current situation of many companies when it comes to the failure of merger and acquisition; more fail than succeed. Therefore, the company has to deal with a lot of changes in the years prior to the merger regarding to the choice of the CIO because the CIO turnover had been high, making it difficult for the company to maintain a coherent IT architecture (Brown et al., 2011). Question 2 What were the reasons that the older loan servicing application (Class) was selected over the Unity system? Do you think the executive team made the right decision, and why? Even though the Unity system was better and more advanced than Sallie Mae’s Class system, the executive team made the decision to retain Sallie Mae’s Class system in order to keep risks at an acceptable level. Sallie Mae had triple the size of the student loan records of USA Group, selecting the Class system would make it easier to convert the loan records into a single system. 4 Another reason is that the class system would make a low impact on call volumes at servicing centers, as a result of the decreased number of customers that would experience the change in the system. The executive team made the right decision by choosing the Unity system based on the situation at hand, though the system used an older technology. Question 3 Why were the decision criteria different for the loan servicing application choice and the packaged financial application choice? The decision criteria was different because the loan servicing application choice and the packaged financial application choice requires relocating the data center which involves the movement of equipment, installation of selected software and data conversions (Brown et al., 2011). The internal IT leadership designed the integration schedule to fasttrack the IT integration plan which helped the organization achieve its merger goals of completing the data project relocation on time, without exceeding its budget and with minimal disruption to its operations and customers. The IT integration plan also considered the improvement of the IT infrastructure which was timely concluded with all students records combined on a mainframe. The IT leaders also anticipated the IT integration challenges by implementing PeopleSoft program (ERP- Enterprise Resource Planning application), e-mail and Internet consolidation, and full implementation of an advanced call center routing capability (Brown et al., 2011). The plan further included migrating to selected back-office application systems within a stipulated timeline and developing new functionality for call routing systems. 5 Question 4 What were some of the mechanisms used by the IT organization to deal with the human element of the merger? a) IT Leadership Team: The management had confidence on its experienced IT leaders by forming a team from the acquired firm, which was the first key approach towards executing an IT integration project. This strategy was adopted in order to reduce the integration risks. b) Continuation of existing project office structure: The existing office structure made it easier to create teams of people who are already used to the same culture, same working experience, shared project management approaches, communication channels and reporting mechanism. This was based on the successful track record of team members working together on complex systems projects under the same office structure. c) Avoiding the “holy war” syndrome: The “holy war” syndrome is where teams from the two merged companies are put up against each other to determine strengths and weaknesses of their own systems. However, Sallie Mae’s IT leaders avoided this syndrome and established the expectations of acceptance of the final decisions (Brown et al., 2011). d) Retention of key talents: In order to keep Reston-based staff as long as needed to acquire knowledge transfer, the company adopted the strategy to be open and honest about an individual’s long-term prospects. The company also offered a generous severance package, which renewed the loyalty of the employees and signaled that they were highly valued, even though some of them might be laid-off. e) Bonus Plan: Sallie Mae also implemented a bonus plan, which was tied to performance in evaluating both accomplishment and attitude. This enabled the company to retain the talents needed without disrupting business operations. 6 Question 5 What were the pros and cons of having the internal IT group manage the Data Center Relocation, with minimal consultant support? The pros and cons of having IT group manage the Data Center Relocation with minimal consultant support are as follows: Pros: As per the consultant’s report, the best-in-class IVR systems handled 18% of call but the internal IT group handled more than double the percentage of all calls. Evidences support the fact that for successful integration processes, intensive planning and collaboration of the team members is very important. The merger adopted Indianapolis-based team members who had a successful team and collaborative work record on complex projects. This gave way for easy creation of teams with good personal working relationships, project management approaches, pre-existing communication channels and reporting systems. The Internal group avoided the use of holy war by making best use of resources acquired from the merger and by establishing an expectation of graciously accepting the final decision, which enabled them to progress during the IT integration planning stage. Sallie Mae’s approach on openness and honesty, the offer of severance package and bonuses helped retain the key talents required for business operations. Cons: Effective integrated projects need to be anchored in rationality by credible leadership, common direction and obliging deadlines. For this, placing the IT leadership team properly is essential but at Sallie Mae the IT leadership was announced soon after the merger was confirmed which operated on a fast track approach. They did not consider the risks that could be associated with the merger. According to the paper, it was noted that the critical activity to integration is retention of key talents. But at Sallie Mae the CIO selection created lot of imbalance on the Reston side. The key challenge in this was to retain the Restonbased staff as long as required for physical moves and data transfer. 7 Question 6 What were some of the ways that the DCR team decreased the business and technology integration risks during the Data Center Relocation? Some of the ways that DCR team has used to decrease the business and technology integration risks during the Data Center Relocation can be considered an effective method. One major risk is the need for extensive manual review during the conversion process and the fact that the current system is servicing a population with little financial management experience (Brown et al., 2011), DCR suggested to add new Web functionality and to complete the implementation of an advanced call-center capability for the Class system in the second year of the new merged company. Also, adopting the PeopleSoft modules, which is an Enterprise Resource Planning application for finance and human resources is another way. Besides, in order to retain IT staffs after the company announced that they would move to Indianapolis, generous severance packages and retention bonuses were offered to in order to retain talents until the merger is complete (Brown et al., 2011). In addition, three different strategies (Asset Swap, Push/Pull strategy and Swing method) were used to install computer equipment. This was in order to decrease integration risks by minimizing the hardware assets that would be physically moved from Reston to Indianapolis. Finally, the DASD storage which is a new vendor to reduce redundancies, is built to handle the company storage needs more effectively and reduce the maintenance risk as well as minimize the business impact (Brown et al., 2011). Question 7 What were some of the ways that communications across team members were achieved? The company maintained the project office structure by allowing team members work together on complex systems project as team members are already used to the same structure. Team members worked successful by helping each other on difficult projects as they shared the same management methods (Brown et al., 2011). The company also had an open and honest approach regarding the employees’ long-term prospects with the company. 8 IT leadership team was swiftly incorporated in order to drive the integration of business operations. This enabled the team leaders to communicate the company’s goal to their team members. Furthermore, the company made communication easier for the experienced people to communicate with the management by removing bureaucratic channels. The Cost-Benefit Analysis Adding up the expenses and profits, and also valuing the intangible costs and benefits was used to calculate the Return On Investment (ROI) analysis for the project. The ROI formula: Necessary assumptions made in order to estimate a good judgment. Benefits: The occupancy cost saving of $2 million was assumed to be a feasible benefit available and was taken to be the initial cost if increased by 40%. The consultant role saving of $3.5 million was added as a benefit to analysis, since the company as saved the amount. The report mentioned that the Reston Sallie Mae data center could be leased at an attractive price, which will add to the revenue of the company. It was estimated to leased at $1 million. This sums up all the benefits to a total of $6.3 million. Costs: The target was to reduce cost by 40%, this increases the occupancy cost saving by 40% which gives a total cost of $2.8 million as the initial cost for the merge. The target reduction of headcounts by 25% means that some employees will be will be sacked and have to be paid off too. An assumption was made that it will cost 25% of the initial cost of $2.8 million to pay off the workers, which is $0.7 million (25% of 2.8). Since the company is experiencing change in management, operations, and strategic areas, it is estimated that the company might lose about $1 million (contingency cost) in revenue for the first phase of the management changes. 9 ROI = $6.3 mil−$4.5mil $4.5 mil = 0.4 or 40% From the assumptions, the ROI was estimated at 40%, which implies that the investment or the merger agreement will yield a return of 40%. Part 2: DFD Zero Level 10 11 Context 12 Reference: Brown, C., DeHayes, D., Hoffer, J., Martin, E. and Perkins, W. (2011). Managing Information Technology. 7th ed. Prentice Hall, pp.628-633. 13