Park Inn by Radisson

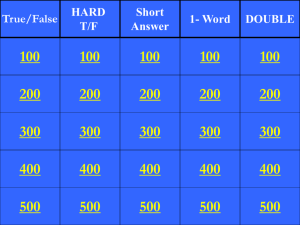

advertisement

Rezidor Hotel Group AB FY 2010 Mars 2011 Top 10 Hotels Players in Europe Rezidor ranks 5th in number of rooms, first on the upscale segment (with its brand Radisson Blu) As of Dec. 2010 Rank 2010 Hotel Network Group 1 Accor 2,368 h. 260 kr. 2 Best Western(1) 1,360 h. 93 kr. 3 Intercontinental 590 h. 92 kr. 4 Louvre Hotels 947 h. 67 kr. 5 Rezidor 276 h. 57 kr. 6 NH Hoteles 361 h. 52 kr. 7 Sol Melia 214 h. 47 kr. 8 TUI (1) 182 h. 46 kr. 9 Hilton Worldwide 193 h. 45 kr. 10 Whitbread PLC 592 h. 43 kr. Only Midscale (1) (1) Resort Resort (1) Only UK Sources: MKG Hospitality – Feb. 2011, Companies annual reports 2010 and corporate website 2 (1) Nb of rooms based on internal estimates Rezidor Hotel Group AB. Summary 3 1. Company overview Slide 3 2. Company organization Slide 4 3. Brands positioning Slide 5 4. Geographical breakdown Slide 6 5. Operating mode Slide 7 6. Group strategy Slide 8 7. Pipeline and lodging development Slide 10 8. Key figures Slide 11 9. SWOT analysis Slide 13 10. Company history Slide 14 11. Brands description Slide 15 Rezidor – Company profile FY 2010 segment # hotels # rooms Mid/Ups 1. Company overview 312 ADR OR 62.3% 99.5€ 66,375 Revpar 62€ Description Main Shareholders – Rezidor is a Hospitality Swedish company operating in the traditional lodging industry – Listed on the NASDAQ OMX Stockholm Exchange on November 2006 – Three main brands: Radisson Blu, Park Inn by Radisson and Hotel Missoni – Asset-light business model – 4,947 employees Owners – Fifth hotel player in Europe (in nb of rooms) – Radisson: largest upscale hotel brand, according to MKG – Segmented portfolio: Luxury/Lifestyle (Hotel Missoni), Upscale (Radisson Blu), Midscale (Park Inn by Radisson), Limited service (Country Inn) – Presence in 48 countries through EMEA Stake Float 49% Carlson Companies Nordea Investment Management Swedbank 50% 12% 7% – Radisson Blu and Park Inn by Radisson developed in EMEA under Master Franchise Agreements with Carlson Main Figures 2009 2010 Segmental Revenue and EBITDA 2011E Revenue 2012E 3% Financials (M€) Revenue % Change in Revenue EBITDA EBITDA margin Net Profit Net margin 677 786 871 942 -13.8% 16.1% 10.8% 8.2% 5 32 64 111 0.7% 4.1% 7.3% -28 -3 23 48 NA NA 2.6% 5.1% 3% Market Cap 55% 51% 23% 11.8% Nordic Europe(2) Western Europe Eastern Europe MEA 718 Network 286 60,646 312 66,375 M arket Data as o f A pril 28, 2011 4 Sources: Reuters as of 28 April 2011, Rezidor Annual Report 2010, Rezidor website 22% 43% Market Data (M€) Hotels Rooms EBITDA (1) Nordic Europe (2) Western Europe Eastern Europe MEA (1) Excluding Western Europe negative EBITDA (-€4.6m) (2) Incl. Denmark, Finland, Iceland, Norway and Sweden Rezidor – Company profile FY 2010 2. Company organization Group companies and legal structures Rezidor Hotel Group AB (Sweden) 100% shares and votes Rezidor Hotel Holding AB (Sweden) 100% shares and votes Rezidor Hospitality A/S (Denmark) 100% shares and votes 100% 100% Rezidor Hotels ApS Danmark (Denmark) 100% Rezidor Russia A/S (Denmark) Sources: Company reports 5 100% Rezidor Regent A/S (Denmark) 100% Rezidor Sweden AB (Sweden) 100% Rezidor Comerstone A/S (Denmark) 100% Rezidor Park ApS (Denmark) 100% Rezidor Hospitality Norway AS (Norway) Rezidor – Company profile FY 2010 Rezidor Loyalty Management A/S (Denmark) 100% Rezidor Country A/S (Denmark) 100% Rezidor Lifestyle A/S (Denmark) 3. Brand positioning Hotels / rooms / countries Luxury (% of room network) 1 h. / 136 r. / 1 c. Upscale (% of room network) 200 h. / 46,122 r. / 48 c. (2) Midscale (% of room network) 103 h. / 19,232 r. / 26 c. (1) Economy (% of room network) 2 h. / 133 r. / 2 c. Source: Rezidor Annual Report 2010 Full Service NB: 6 Regent hotels included in Other hotels in Annual Report 6 (1) 2 Country Inn hotels in EMEA (Germany and Austria) Limited Service Rezidor – Company profile FY 2010 4. Geographical breakdown Hotel and room network As of December 31st, 2010 312 h, 66,375 r Nordic Europe 20% 56h 12,945r 23% Eastern Europe 44% 160 h 29,406r Western Europe 13% Share of global X% network (in nb of r) 7 Source: Rezidor Annual Report 2010 Middle-East, Africa & Others Rezidor – Company profile FY 2010 36 h 8,953r 60 h 15,071r 5. Operating mode 2002 2010 133 h. / 28,900 r. 312 h. / 66,375 r. 1% 20% 29% 29% 54% 41% +37,745 rooms +130% over 8 years Owned Source: Rezidor Annual Report 2002 & 2010 8 Leased Managed Rezidor – Company profile FY 2010 Franchised 26% 6. Group strategy Important developments of the year Brand strategy Park Inn by Radisson – New name launched in Q2 2010 – Link with Radisson’s brand image to enhance further growth Sale of Regent – Positive effect of M€ 5.7 M&A – Management services still provided to Regent hotels after sale Development strategy Portfolio agreement in the Baltics – Agreement to re-brand 10 Reval hotels (ca 2,400 rooms) in the Baltics to Radisson Blu and Park Inn – Agreement to strengthen Rezidor’s position in the key markets Riga, Tallinn and Vilnius Ownership Carlson’s shareholding – Carlson, Rezidor’s major shareholder, has increased its shareholding to 50.03% of the registered shares in May 2010 Source: Rezidor Annual Report 2010 9 Rezidor – Company profile FY 2010 6. Group strategy Strategic axes Margin improvement: EBITDA target margin of 12% – Tight cost control (following the cost reduction program of 2009) – Substantial increase in cash flow in 2010 allows increase in maintenance Capex – Fixed-lease structure to be maintained in Western Europe Asset light strategy – Increasing proportion of managed and franchised hotels (95% of the pipeline vs. 74% of the actual portfolio) – Hotels conversions privileged in some specific markets such as UK, Germany and Russia for Park Inn brand, while Radisson Blu expansion mainly through new builds Focus on expansion of core brands: Radisson Blu, Park Inn by Radisson – Disposal of peripheral assets: sale of Regent luxury brand to Formosa in April 2010 – Key priority to boost brand awareness as a mean to increase RevPar penetration: new name for Park Inn followed by a major new marketing and sales campaign in 2011, mainly in UK Expansion plans in emerging countries – Focus on Russia/CIS and Africa: strong economic growth, undersupply or old inventory combined with high room demand and low operating costs – Emerging markets represent over 70% of the pipeline (vs. 36% of rooms in operation) – Radisson Blu: key to entering new markets, Park Inn usually following the footsteps of Radisson Blu – Rezidor is considering to enter the economic segment in Middle East, Russia and Africa under a new brand*. 10 Sources: Rezidor Annual Report 2010 *Press review as of March, 2011 Rezidor – Company profile FY 2010 7. Pipeline and lodging development Business Development in 2010 • Openings: +7,173 r. (32 h.) • Closings: -1,444 r. (6 h.) • Net evolution: +5,279 r. (+9,4%) Pipeline 2011-2015 : 21,493 additional rooms (32% of the current network), incl. 8100 new rooms signed in 2010 Per region Per brand Per contract type 3% 9% 37% 8% 4% 20% 34% 63% 88% 34% Nordic Europe Radisson Leased Western Europe Park Inn Managed Eastern Europe Missoni Franchised Two core brands: Radisson Blu and Park Inn by Radisson +95% current pipeline managed & franchised MEA Focus on Eastern Europe and MEA Source: Rezidor Annual Report 2010 11 Rezidor – Company profile FY 2010 8. Key figures P&L evolution & forecasts Financials (in M€) Revenue 2003A 390 2004A 499 2005A 587 2006A 707 2007A 785 2008A 785 2009A 677 2010A 786 2011E 871 % Change in Revenue EBITDA NA 27,9% 17,6% 20,4% 11,0% 0,0% -13,8% 16,1% 10,8% (12) 21 44 51 81 70 5 32 64 111 NA 4,2% 7,5% 7,2% 10,3% 8,9% 0,7% 4,1% 7,3% 11,8% (33) 4 18 21 46 26 (28) (3) 23 48 NA 0,8% 3,1% 3,0% 5,9% 3,3% NA NA 2,6% 5,1% EBITDA margin Net Profit 2012E CAGR 2003-2010 942 10,5% Net margin 8,2% NA NA So urces: co mpany repo rts and Reuters co nsensus estimates as o f M arch 16, 2011 1 000 15% 900 13% 800 11% 700 9% 600 7% 500 5% 400 3% 300 200 1% 100 -1% 0 -3% 2003A 2004A 2005A 2006A 2007A Revenue 12 2008A 2009A 2010A EBITDA margin Rezidor – Company profile FY 2010 2011E 2012E Net margin 9. SWOT analysis Strength Weaknesses – Strong support of the worldwide group Carlson, which owns 50.1% of the company – Large product range, from midscale to luxury – Large brand awareness in Scandinavia – Leadership in Scandinavia – Good business model (upscale with maximum pricing power, strong operating leverage, no debt, well positioned to win management contracts) – – – – Geographical footprint limited to EMEA Expensive lease commitments Dependence on Carlson Poor business control, especially as Rezidor pursues an aggressive growth plan – Bad ratings in customer satisfaction surveys – Difficulties in securing new hotel contracts or keeping/prolonging maturing contracts Opportunities Threats – Improving business mix (asset light management contracts) – Well positioned for recovery, thanks to costs measures implemented in 2009 – Growing share of the branded hotels trend for conversion from unbranded to branded hotels – Strong room rollout potential – Central and Eastern Europe as one of the world’s fastest emerging travel markets Source: Broker research, June 2010 13 – Intense competition, with a large number of players, especially in Europe Rezidor – Company profile FY 2010 10. Company history 14 2010 Sale of Regent Hotels to Formosa 2009 Radisson SAS becomes Radisson Blu 2006 Rezidor goes public on the Stockholm Stock Exchange 2005 Hotel Missoni is launched, in partnership with the Italian fashion brand of the same name 2002 Multi brand franchised master agreement, adding 3 other Carlson’s brands to Rezidor Portfolio: Regent, Park Inn and Country Inn 2001 SAS International Hotel becomes Rezidor 1994 First master franchise agreement with Carlson Radisson SAS is born 1980 First hotel outside Scandinavia: SAS Hotel Kuwait 1960 Scandinavian Airlines founds the company SAS International Hotels by opening its first hotel, the SAS Royal Hotel in Copenhagen Source: Rezidor Website Rezidor – Company profile FY 2010 11. Brands description Hotel Missoni Full Service Radisson Park Inn by Radisson Limited Service 15 Source: Rezidor Annual Report 2010 Country Inn Rezidor – Company profile FY 2010 11. Brands description Full service – Hotel Missoni Overview Network Full service, upper upscale brand Network ►Focusing on lifestyle and design aspects ►License agreement with the italian fashion house of the same name ►Woldwide licensing agreement ►First Hotel opening in 2009 ►2 hotels, 305 r. (incl. newly opened Missoni Kuwait City) ►Pipeline = 3 hotels / 508 rooms Locations Main competitors ► Fashionable cities as well as in up-and-coming resort areas ► So by Sofitel, W, Morgans, Malmaison, Bulgari, Armani ►Geographical breakdown ►Worldwide, with a focus on Europe and the Middle East ►Two hotels operated in Edinburgh and Kuwait ►Future openings include Oman, South Africa, Brazil 16 Source: Rezidor Website Rezidor – Company profile FY 2010 11. Brands description Full service – Radisson Blu Overview Network Full service, upscale brand Network ►Largest Rezidor hotel brand ►Largest upscale hotel brand in Europe ►Ranging from small boutique hotels to major city landmarks ►Managed / Leased contracts ►Trademark of Carlson, master franchise agreement with Carlson until 2032, with the option to extend the agreement until 2052 ►200 hotels / 46,122 rooms in operation = 230 rooms per hotel on average ►Pipeline: 52 hotels / 12,922 rooms Locations ► Mainly located in city centers, leisure resorts and airports New architecture and design policy ►Rebranded as Radisson Blu in 2009 Key figures FY 2010 FY 2009 ►ADR: €110.3 ► ADR: €105.95 ►RevPar: €70.5 ►RevPar: €65.9 ►Occupancy Rate: 63.9% ►Occupancy Rate: 62.2% Main competitors ► Pullman, Hilton, Marriott H&R, Sheraton 17 Source: Rezidor Annual Report 2010, Rezidor Website Rezidor – Company profile FY 2010 11. Brands description Full service – Park Inn (1/2) Overview Network Full service, midscale brand Network ►New name to be used from January 2011: Park Inn by Radisson ►Mainly operated under franchise agreements ►Targeted markets: UK, Germany and Russia (growth mainly driven by conversion) ►Trademark of Carlson, master franchise agreement with Carlson until 2032, with the option to extend the agreement until 2052 Key figures FY 2010 ►87 hotels / 16,121 rooms in operation = 185 rooms per hotel on average ►Pipeline = 51 hotels / 9,408 rooms Locations ►City centers, suburban locations and transport terminals FY 2009 ► ADR: €63.8 ►ADR: €64.5 ►RevPar: €33.6 ►RevPar: €37.5 ►Occupancy Rate: 58.0% ►Occupancy Rate: 52.6% Main competitors ► Novotel, Scandic, Holiday Inn 18 Source: Rezidor Annual Report 2010, Rezidor Website Rezidor – Company profile FY 2010 11. Brands description Park Inn (2/2) : affiliation brand strategy case study Park Inn by Radisson is a “fresh and energetic” midscale hotel brand (119 hotels / 85% in Europe) Relaunched in 2003, stand-alone brand until 2010, when an affiliation to Radisson was decided (starting Jan 2011) New name is in line with Rezidor decision to focus its dvlp on its two core brands, Radisson and Park Inn Objectives : The link with Radisson and its great strength and reputation will allow Park Inn to grow faster and to increase the brand awareness. But no repositioning / upgrade seems to be planned. Implementation Plan : – The rebranding process will start in Park Inn’s key home market, the United Kingdom, before extending the process across Europe, Middle East and Africa. – The transition of Park Inn hotels to Park Inn by Radisson will be completed by the end of 2011. – First Park Inn by Radisson in Brazil, developed by Atlantica Hotels International Pipeline1 : 41 in EMEA, 3 in North America , 2 in APAC (India), 2 in Latin America 2000 • Carlson acquires the Park Inn brand from Olympus Hospitality Group 19 1 2002 • Carlson signs a master franchise agreement with The Rezidor Hotel Group to develop Park Inn in EMEA Lodging Econometrics Q4 2010 2003 • Rezidor relaunches Park Inn. First hotel in Berlin 2010 • Rebranding operation to Park Inn by Radisson to enhance further growth 11. Brands description Limited service – Country Inn Overview Network Limited service, economy brand Network ► Brand under development, currently under review by Rezidor ►Trademark of Carlson, master franchise agreement with Carlson until 2032, with the option to extend the agreement until 2052 ►2 hotels / 133 rooms in operation Geographical Breakdown Main competitors ►Germany ►Austria ► Ibis 20 Source: Rezidor Annual Report 2010, Rezidor Website Rezidor – Company profile FY 2010