Ch 11

advertisement

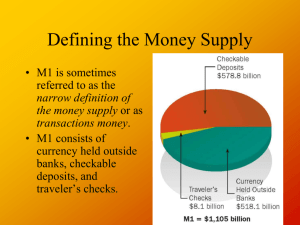

Ch. 11: Money and Banking James R. Russell, Ph.D., Professor of Economics & Management, Oral Roberts University ©2005 Thomson Business & Professional Publishing, A Division of Thomson Learning 1 Money Money: any good that is widely accepted for purposes of exchange and in the repayment of debts. Barter: exchanging goods and services for other goods and services without the use of money. 2 Functions of Money Medium of Exchange: anything that is generally acceptable in exchange for goods and services. Unit of Account: a common measure in which relative values are expressed. Store of Value: the ability of an item to hold value over time. 3 Money Versus Barter Making exchanges takes longer in a barter system – Finding what you want – Finding a double coincidence of wants Some goods are more readily accepted than other goods. Historically, goods that have evolved into money are: gold, silver, copper, cattle, rocks, and shells. 4 Money in a Prisoner Of War Camp R.A Radford, WWII POW Red Cross Packages cigarettes, toiletries, chocolate,cheese, canned meats, etc. Barter System Developed Cigarettes Evolved Into the Currency of Choice 5 Money, Leisure, and Output A money based economy frees up time spent looking for someone interested in your goods, who has something you want. A person’s standard of living is, to a degree, is dependent on the number and quality of goods he consumes and the amount of leisure he consumes. 6 What Gives Money its Value? Our money has value because of its general acceptability. We accept paper dollars because we know that other people will accept dollars later when we try to spend them. Money has value to people because it is widely accepted in exchange for other goods that are valuable. 7 M1 Money Supply M1: the narrow definition of the money supply or transactions money. M1 consists of: – currency held outside banks – checkable deposits – traveler’s checks Year M1 Money Supply (billions of dollars) 2000 $1,103 2001 $1,136 2002 $1,192 2003 $1,263 2004 $1,330 8 M2 Money Supply M1 Savings deposits (including money market deposit accounts) Small denomination time deposits Money market mutual funds (noninstitutional) Year M2 Money Supply (billions of dollars) 2000 $4,802 2001 $5,220 2002 $5,615 2003 $5,999 2004 $6,282 9 Where Do Credit Cards Fit In? A credit card is an instrument or document that makes it easier for the holder to obtain a loan. Credit card transactions shift around the existing quantity of money between various individuals and firms, but do not change the total money available. 10 Self-Test Why (not how) did money evolve out of a barter economy? If individuals remove funds from their checkable deposits and transfer them to their money market accounts, will M1 fall and M2 rise? Explain. How does money reduce the transaction costs of making exchanges? 11 How Banking Developed Early bankers used goldsmith’s warehouse receipts. Early bankers began to issue receipts for more gold than they had on hand. This was the beginning of fractional reserve banking. Fractional Reserve Banking: arrangement that allows banks to hold reserves equal to only a fraction of their deposit liabilities. 12 The Federal Reserve System The Federal Reserve System (the Fed): the central bank of the United States. The Fed is essentially a bank’s bank. The Fed’s chief function is to control the nation’s money supply. 13 The Money Creation Process: Definitions Bank Reserves: the sum of bank deposits at the Fed and vault cash. Required Reserve Ratio: a percentage of each dollar deposited that must be held on reserve. Required Reserves: the minimum amount of reserves a bank must hold against its checkable deposits. Excess Reserves: any reserves held beyond the required amount. 14 The Banking System and The Money Creation Process The Fed prints funds, and Bill deposits the funds in his bank. The Reserves of the bank increases, while the reserves of no other bank decreased. The banking system makes loans and in the process creates checkable deposits. By extending loans and creating checkable deposits, the banking industry has increased the money supply. 15 The Banking System and The Money Creation Process Bank A Assets Liabilities Reserves $1,000 Checkable deposits (Bill) $1,000 16 The Banking System and The Money Creation Process Bank A Assets Required Reserves Liabilities Checkable $100 deposits (Bill) Excess Reserves $900 $1,000 17 The Banking System and The Money Creation Process Bank A Assets Liabilities Required Reserves $100 Excess Reserves $900 Loans $900 See the next T-account 18 The Banking System and The Money Creation Process Bank A Assets See the previous Taccount Liabilities Checkable deposits (Bill) Checkable deposits (Jenny) $1,000 $900 19 The Banking System and The Money Creation Process Bank A Assets Required reserves Excess reserves Loans Liabilities $100 Checkable deposits (Bill) $1,000 $0 Checkable deposits $900 (Jenny) $0 20 The Banking System and The Money Creation Process Bank B Assets Liabilities Checkable deposits Reserves $900 (CD Retailer) $900 21 Exhibit 1: The Banking System Creates Checkable Deposits (Money) 22 The Banking System And The Money Expansion Process When the $9000 that bankers created in new checkable accounts is added to the $1000 the Fed initially printed, we see that $10,000 has been added to the money supply. Maximum change in checkable deposits = (1/r) x R where r = the required reserve ratio and R is the change in reserves resulting from the original injection of funds. Simple Deposit Multiplier: (1/r) 23 Why Maximum? No Cash Leakages And Zero Excess Reserves Assumptions: All monies were deposited in bank checking accounts. Every bank lent all its excess reserves, leaving every bank with zero excess reserves. Because we assumed no cash leakages and zero excess reserves, the change in checkable deposits is the maximum possible change. 24 Who Created What? The money expansion process has two major players: the Fed, and the Banking System. The maximum change in bankable deposits is equal to: (1/r) x ER, where ER is the excess reserves. 25 The Banking System and The Money Destruction Process Bank A Assets Liabilities - Checkable Reserves $1,000 deposits (Bill) -$1,000 26 The Banking System and The Money Destruction Process Bank B Assets Liabilities Checkable Reserves -$900 deposits -$900 27 Exhibit 2: The Money Expansion and Contraction Processes 28 Self-Test If a bank’s deposits equal $579 million and the required-reserve ratio is 9.5%, what dollar amount must the bank hold in reserve form? If the Fed creates $600 million in new reserves, what is the maximum change in checkable deposits that can occur if the required-reserve ratio is 10%? Bank A has $1.2 million in reserves and $10 million in deposits. The required-reserve ratio is 10%. If Bank A loses $200,000 in reserves, by what dollar amount is it reserve deficient? 29 Coming Up (Ch. 12): The Federal Reserve System 30