Money and Banking

advertisement

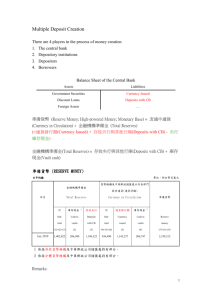

Money and the Banking System Ch 13: Pg 244-254 Ch 14: All Chap 13,14 Vocabulary Medium of exchange Unit of account Store of value Transactions demand Asset demand Total demand for money Fractional Reserve Banking System Liquidity Stocks Bonds Fiat money 2 What is Money Money works best when it meets these criteria: • • • • • Portable Durable Divisible Acceptable Stable 3 Functions of Money 1. Money serves as a medium of exchange: • 2. Money Serves as a unit of account: • 3. A medium of exchange is the property of money that exchange is made through the use of money. Unit of account is the property of money that prices are quoted in terms of money. Money serves as a store of value: • Store of value is the property of money that it preserves value until it is used in an exchange. 4 What Gives Money its Value? Our money has value because the government “says” it has value. We accept paper dollars because we know that other people will accept dollars later when we try to spend them. The dollar is NOT backed by gold or silver. Our currency is “fiat” money; or money by decree. Fiscal and Monetary Policies control the value of the dollar by controlling the supply. 5 Measuring Money in the U.S. Economy: M1 Money Supply Components of M1, January 2004 Currency held outside banks $ 665 billion Demand (checking) deposits 301 billion Other checkable deposits 313 billion Travelers’ checks 8 billion Total of M1 $1,287 billion Other checkable deposits 24% Travelers' checks 1% Currency 52% Demand deposits 23% M1 is very liquid (spendable). Other measures of the money supply are not as liquid. When we speak of money in economics, we are referring 6 to M1 Measuring Money in the U.S. Economy: M2/M3 Money Supply A broader definition of money, known as M2, includes assets that can be easily turned into M1. M2 includes: • M1 + savings accounts + money market accounts + certificates of deposit (CDs) valued at less than $100,000 + money market mutual fund accounts M3 is an additional measure which is composed of M2 + CD’s over $100,000 • Not as liquid as M1 or M2 There are several other money measures used by the Fed, but we will not cover them. Credit cards are loans and are NOT part of the money supply. 7 M1 and M2, August 2008 Current M1, M2 http://www.federalreserve.gov/relea ses/h6/current/ 9 What’s with All the Currency? $775.4 billion of currency in circulation. That’s $2,570 in cash for every man, woman, and child in the United States. How many people do you know who carry $2,570 in their wallets? Not many. So where is all that cash? Part of the answer is that it isn’t in individuals’ wallets: it’s in cash registers. Economists also believe that cash plays an important role in transactions that people want to keep hidden. Small businesses and the self-employed sometimes prefer to be paid in cash so they can avoid paying taxes by hiding income from the Internal Revenue Service. The most important reason for those huge currency holdings, however, is foreign use of dollars. The Federal Reserve estimates that 60% of U.S. currency is actually held outside the United States. The Banking System There was a wave of bank runs in the early 1930s. To bring the panic to an end Franklin Delano Roosevelt declared a national “bank holiday,” closing all banks for a week to give bank regulators time to close unhealthy banks and certify healthy ones. Since then, regulation has protected the United States and other wealthy countries against most bank runs. There are some limits on deposit insurance; in particular, currently only the first $250,000 of any bank account is insured. As a result, there can still be a rush out of a bank perceived as troubled. Bank Failures A Bank’s Balance Sheet (T-Chart) The balance sheet of a commercial bank shows how a bank raises and uses money: • Liabilities are the sources of funds for the bank. The bank is “liable” for returning funds to depositors. • Assets generate income for the bank. Loans are assets for the bank because a borrower must pay interest to the bank. • Owners’ equity refers to the funds that owners must place into the bank so it has some startup funds. 12 Balance Sheet for a Commercial Bank Reserves are assets that are not lent out. Required reserves are the fraction of banks’ deposits they are legally required to hold in their vaults or as deposits at the Fed. Excess reserves are any additional reserves that a bank chooses to hold beyond what is required. Excess + Required Reserves = Total Reserves When a customer makes a cash deposit, the bank’s reserves increase. Since the currency held by the public decreases but checking deposits increase, the money supply remains unchanged. 13 How Banks Create Money ? Let’s assume that banks are required to keep 10% of their deposits as required reserves. The required reserved ratio is the ratio of reserves a bank must retain based upon its deposits. After a customer makes a $1,000 deposit, the bank’s balance sheet changes as follows, assuming they loan out their new excess reserves.: 14 The Process of Money Creation First Bank of Hollywood makes a $900 loan which is used to open a checking account in the Second Bank of Burbank, with a balance of $900. The Second bank of Burbank makes loans in the amount of $810, which are deposited in the Third Bank of Venice, and so on. 15 The Process of Money Creation The increase in the money supply, M1, resulting from the increase in the $1,000 deposit equals $10,000 - $1,000 = $9,000.—next slide 16 How the Money Multiplier Works The original $1,000 cash deposit has created checking account balances equal to: $1,000 + $900 + $810 + $729 + $656.10 +.…= $10,000 The general formula for deposit creation is: 1 increase in checking account balances x initial deposit reserve ratio Increase in checking account balances = 1/0.1 x 1000 = 10 x 1000 = $10,000 • The increase in the money supply, M1, resulting from the increase in the $1,000 deposit equals $10,000 - $1,000 = $9,000. 17 How the Money Multiplier Works The money multiplier shows the total increase in checking account deposits for any initial cash deposit. The formula for the multiplier is: 1 reserve ratio The initial cash deposit triggers additional rounds of deposits and lending by banks, which leads to a multiple expansion of deposits. 18 How the Money Multiplier Works Assumptions: All monies were deposited in bank checking accounts. Every bank lent all its excess reserves, leaving every bank with zero excess reserves. Because we assumed no cash leakages and zero excess reserves, the change in checkable deposits (increase in money supply) is the maximum possible change. 19 How the Money Multiplier Works in Reverse The money multiplier also works in reverse. Assuming a reserve ratio of 10%, a withdrawal of $1,000 reduces reserves by $100, and results in $900 less the bank will have to lend out. It is important to note that when one individual writes a check to another, and the other deposits the check in the bank, the money supply will not change. Instead, the expansion in one bank’s reserves will offset the contraction in the reserves of the other. Likewise if cash is deposited into a checking account, the money supply (M1) will not change. 20 The Money Expansion and Contraction Processes 21 Demand for Money (M1) DO NOT confuse Demand for Money with the Loanable Funds Market (from Chapter 12) Transaction Demand • Money used daily • Not dependant upon interest Asset Demand • Money used to purchase assets (stocks, bonds, etc) • Affected by interest rates Transaction + Asset = Total Demand 22 THE DEMAND FOR MONEY 7.5 5 2.5 Dt 0 50 100 150 200 250 300 Amount of money demanded (billions of dollars) Rate of interest, i (percent) Rate of interest, i (percent) 10 Asset Demand, Da = Rate of interest, i (percent) + Transactions Demand, Dt 10 7.5 5 2.5 Da 0 50 100 150 200 250 300 Amount of money demanded (billions of dollars) Total demand for money, Dm 10 7.5 5 2.5 0 Dm 50 100 150 200 250 300 Amount of money demanded (billions of dollars) 23 The interest rate referred to is the Federal Funds rate. Rate of interest, i (percent) THE MONEY MARKET Sm 10 Suppose the money supply is decreased from $200 billion, Sm, $150 billion Sm1. ie to See next slide) 7.5 5 Dm 2.5 0 0 50 100 150 200 250 300 Amount of money demanded (billions of dollars) 24 Rate of interest, i (percent) THE MONEY MARKET Sm1 Sm 10 7.5 ie 5 Dm 2.5 0 As the money supply decreases, the interest rate increases from 5% to 7.5% 0 50 100 150 200 250 300 Amount of money demanded (billions of dollars) 25 Interest Rates and Bond Prices Bonds are promises to pay money in the future. Bonds are loans. The price of a bond one year from now is the promised payment divided by 1 plus the interest rate. For example, a bond that promises to pay $106 a year, with an interest rate is 6% per year, would cost today: $106 price of bond 1 $100 (1 0.06) • In other words, if you can invest at 6% per year, you would be willing to pay $100 today for a promised payment of $106 next year. 26 Bond prices change in the opposite direction of interest rates Promised Payment $106 price of bond Int. Rate 6% Promised Payment Interest Rate $106 4% $106 $106 $100 price of bond 1 1 $101.92 (1 0.06) (1 0.04) • When the interest rate falls from 6% to 4%, you have to pay $101.92 today to have $106 next year. And if the interest rate rose to 8%, for example, you would pay only $98.15. 27 How Bond Prices Affect Money Supply If money supply decreases; interest rates increase; people sell bonds to get money; # of bonds increase; cost of bonds decrease and the lower cost creates a higher yield Banks increase interest rates to compete with bonds; higher interest rates leads to higher deposits/savings This process is reversed if money supply increases 28 Treasury Rates 10 Year Treasury Rate 29