Sect 9-4 - Garnet Valley School District

advertisement

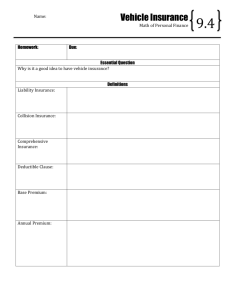

Chapter 9 Section 9-4 Vehicle Insurance Textbook: Mathematics w/Business Applications Workbook: Mathematics w/Business Applications Notes/Vocab: Liability Insurance-provides financial protection to the policyholder against claims for bodily injury and property damage as a result of an automobile accident. Combined coverage is often listed as 100/300/50. 100/300 refers to the bodily injury coverage and means that the insurance company: will pay up to $100,000 to any one person injured /$300,000 if more than one person is injured. 50-refers to property damage limit of $50,000 Collision insurance-pays for damage to the insured vehicle caused by a collision with another motor vehicle or an object such as a telephone pole. Comprehensive insurance- pays for damage to the insured vehicle from loses due to fire, vandalism, theft, and just about any cause other than a collision. Deductible clause-clause in an insurance policy that requires the insured to pay a certain amount to cover repairs before the insurance company pays. Ex.- $500 deductible clause –means that you must pay the first $500 of the repair bill. Total repair= $4400-$500 (you pay) =$3900 (insurance company pays this amount. Annual base premium- determines the cost of your vehicle insurance. Involves 3 factors: 1. The amount of insurance you carry 2. How old your vehicle is 3. The insurance-rating group depending on the size & value of your vehicle. Annual base premium= liability premium + collision premium + comprehensive premium Annual premium-amount you pay each year for insurance coverage. These factors determine your annual premium: 1. Cost of the annual base premium-depends on the amount & type of coverage you carry 2. Driver-rating factor-depends on your age, marital status, number of miles you drive each week, whether you drive a long distance to work, & if you use your vehicle for pleasure or business. **if several people drive your vehicle, insurance company uses the highest driver-rating factor among them to determine the annual premium. Tables are used to determine your basic premium** Annual premium = Annual base premium x driver-rating factor Example: *use figure 9-3 on pg. 351 Driver-rating factor is 3.10. Age, rating group is C, 14 Coverage: 50/100 bodily injury $50,000 property damage $50-deductible collision What is the annual base premium? What is the annual premium?