Document

advertisement

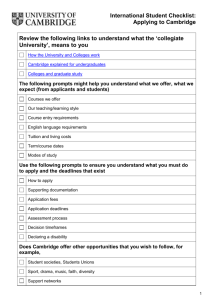

Contents General information History Shareholder structure & affiliates Corporate governance Positioning Bank today Regional network Our clients International cooperation Payment services & plastic cards Risk management Financial Indicators Key highlights Revenues, expenses, profit Liquidity Capital Assets Liabilities Contacts 3 4 5 6 7 8 9 10 11 12 13 14 15 16 19 22 2 History 1991 — On 15 May the National Bank of the Republic of Belarus registered Commercial Bank “Poisk” 1992 — The bank changed its legal status and was registered as Joint Stock Commercial Bank “Poisk” 1994 — The bank became a member of SWIFT communication system 2000 — Joint Stock Commercial Bank “Poisk” was renamed to OJSC “Bank “Poisk” 2004 — The bank received its current name OJSC Paritetbank 2005 — Paritetbank joined Reuters system 2006 — Paritetbank joined VISA International payment system 2007 — Internet banking system for individuals was introduced 2008 For the first time financial statements of the bank were prepared and audited in accordance with International Financial Reporting Standards Paritetbank was one of the first bank to join local Unified Settlement and Information Space (USIS) payment system Paritetbank in cooperation with MTS and BeSmart companies introduced iPay e-cash payment system 2009 Paritetbank joined national plastic card system BelCard The bank established and started to expand its payment terminal network Banking holding was created comprising LLC “Investment Company “Paritet” and CJSC “Mobile Payment” 2010 Mandate letter between Paritetbank, the National Bank of the Republic of Belarus and EBRD was signed. The bank moved to its new head office located at 61A Kiseleva str., Minsk. Paritetbank received a status of a principal member of the VISA International payment system 2011 Paritetbank celebrated its 20th anniversary in the financial services market Paritetbank tapped international capital marked and attracted a syndicated loan facility with a 1-year maturity. 3 Shareholder structure & affiliates As at 1 January, 2012 the major shareholder of the bank is the National Bank of the Republic of Belarus with 99,36% Other shareholders: 200 corporates with 0,41%; 2367 individuals with 0,23%. In 2009 OJSC Paritetbank took part in establishment of LLC «Investment company «Paritet» with 50% of the shareholder’s capital of the company. The major activity of the company is financial leasing of: cars; special vehicles; real estate; office equipment. Contacts: 220024, Republic of Belarus Minsk, Kizhevatova str., building 2 Tel/fax: +375 17 201 94 44 Mobile: + 375 44 755 50 00 e-mail: info@paritetinvest.by www.paritetinvest.by 4 Corporate governance Management Board Chairman of the Board Gorozhankin Vladislav Nikolaevich (+375 17) 283 26 11 Deputy Chairman of the Management Board Pankevich Dmitry Anatolievich (+ 375 17) 237 76 85 Deputy Chairman of the Management Board Slesarev Sergey Mikhailovich (+375 17) 237 76 85 Director of Corporate Business Department Poskrobka Sergey Vasilievich (+375 17) 237 76 89 Chief Accountant — Head of Department of Accounting and Reporting Abramenko Marina Mikhailovna (+375 17) 237 76 85 Head of Economic Planning Management Losiakova Galina Ivanovna (+375 17) 237 76 88 5 Positioning The position of OJSC Paritetbank in the banking system 01.01.2011 01.07.2011 01.01.2012 01.07.2012 01.01.2013 Shareholder capital 9 9 14 17 10 Equity 11 15 17 19 15 Liabilities/Assets 14 14 15 16 21 Total loans 13 13 13 18 19 Underperforming and rolled-over loans 18 24 16 18 20 Total deposits 13 13 15 15 19 According to latest estimates value of the OJSC Paritetbank is about $ 40 mln. 6 Regional network Paritetbank is present in all major cities of Belarus. The sales network consists of 20 outlets, 6 of which are located in Minsk. 7 Our clients Paritetbank delivers a wide range of banking services based on the best practices to both corporate and individual clients. We offer our customers present up-to-date technologies and tailor-made solutions. In the past years Paritetbank customer base increased substantially and as of January 2013 the number of its corporate clients exceeded 4,1 thousands. Our major clients: Naftan Minsktrans Vitebsk Oil Extraction Plant Bobruisk plant of tractor parts and units Beleximgarant Belprofsoyuzkurort BiznesStroyMir Urspectr Vitebskagroprodukt LIPLAST SPb Condor Premiertorg Gomelagrocomplect Avicenna 3,6 3 3,8 4,1 3,3 8 International cooperation Paritetbank enjoys a developed correspondent network which covers some of the major banks. 1. United States of America USD DEUTSCHE BANK TRUST COMPANY AMERICAS New York 2. Germany EUR JPY VTB BANK (DEUTSCHLAND) AG Frankfurt am Main EUR CNY COMMERZBANK AG Frankfurt am Main EUR DEUTSCHE BANK AG Frankfurt am Main 3. Austria EUR USD EUR VTB BANK (AUSTRIA) AG RAIFFEISEN BANK INTERNATIONAL AG Vienna Vienna 4. Latvia LVL CITADELE BANKA Riga 5. Poland PLN BRE BANK S.A. Warsaw 6. Russian Federation Our team addresses our clients’ needs and offers competitive and tailor-made trade finance products: Export and Import Letters of Credits Guarantees RUB SBERBANK Moscow RUB NOVIKOMBANK Moscow RUB JSC VTB BANK St. Petersburg RUB GAZPROMBANK Moscow RUB PROMSVYAZBANK Moscow 7. Ukraine UAH EUR USD PRIVATBANK Dnepropetrovsk 9 Payment services and plastic cards Bank plastic cards JSC Paritetbank has been a Visa International Associate Member since 2005. In 2011 the bank began to settle with the payment system independently as a Principal Member. In 2009 JSC Paritetbank became a member of the local payment system BelKart. The bank provides issuing and acquiring of BelKart magnetic-stripe cards (BelKart-M) in ATMs, cash advance outlets, unattended payment terminals and POS terminals. The customers are offered the following card products: Debit cards: BelKart-M – local payment cards intended for use within the Republic of Belarus; VISA Electron VISA Electron Instant VISA Classic VISA Gold VISA Virtuon Multi-account VISA Electron, VISA Electron Instant, VISA Classic, VISA Gold cards Visa Business commercial cards Credit cards: Visa Electron, Visa Electron Instant with revolving and non-revolving credit limit JSC Paritetbank cardholders are offered advanced distant banking channels and other supplement services: ATM and unattended payment terminal network; Internet Banking (including “Direct debit” service); Mobile Banking (SMS Banking); SMS notification on card transactions; on-line purchases of goods and services (e-commerce); overdraft facility; transfer of deposit interest to a card account. JSC Paritetbank terminal network for acceptance of payment cards includes 15 ATMs, 20 unattended payment terminals with Cash-In device, 43 terminals in cash advance outlets, 23 payment terminals at points of service. Bank’s ATMs and cash advance outlets provide cash advance for Visa and BelKart cards issued by any banks. Payment cards issued by the bank are accepted in the terminal network of any Visa or BelKart member bank. 10 Risk management The risk management system of the Bank predetermines the management strategy, procedures for detection, evaluation (assessment), monitoring and control of varied risk types. It is based on the regulatory requirements and recommendations of the National Bank of the Republic of Belarus, suggestions of Basel Committee on Banking Supervision. The Risk Management System is based on the continuous process of risk identification, analysis, assessment, optimization, monitoring and control, further adequacy assessment regarding the applied risk management methods. The risk management activity is carried out using the system approach based on the principles of risk awareness, delineation of the powers with regard to risk initiation, evaluation and acceptance. Risk detecting is fulfilled on a regular basis considering the dynamic change of external and internal environment. General control of the risk management shall be carried out by the Bank’s Management and the Supervisory Board. Risk management strategy is based on observance of break-even activity principles and directed to optimum relationship between profitability of business directions of the bank’s activity and level of assumed risks. The risk management strategy is aimed at usage of the entire range of instruments available and methods of risk decrease and restriction. A set of documents clearly scheduling the processes and procedures for risk management was developed in the bank: Credit; Market; Liquidity risk; Operational and reputational. The Bank develops procedures and arrangements for prevention and preclusion of stress situations, operation plan in case of critical circumstances for continued operation of the bank for the purpose of the threat avoidance in relation to realization of outer and inner risk factors. The system of internal control in the Bank includes the control of the prevention and suppression activities related to the laundering of proceeds from crime and terrorist financing, which minimizes the risks (operational, credit, legal, risk of loss of goodwill) arising from the danger of theft of the bank, the seizure of money and other property located in the bank, or confiscation of bank funds and other property of clients, which may lead to direct financial loss as a bank, and indirect - loss of confidence by investors and customers, the outflow funds of depositors and creditors, denial of interbank resources to prosecute oversight, tax and law enforcement agencies. 11 Key highlights Despite a challenging market environment in the economy of the Republic of Belarus during 2012 the bank retained its profitability and enhanced it. Overview of key financials mln BYR. 01.01.2013 01.01.2012 Profit, running total 21 070,6 Net interest income, running total 67 301,0 Net fee & commission income, running total 20 803,8 11 171,3 +88,6% 39 916,5 +68,6% 11 008,8 +89,0% ROE 11,0 8,0% +3,0 п.п. ROA 2,0 1.3% +0,7 п.п. 12 Revenues, expenses, profit 230,4 287.7 21.1 13.5 66.4 80.3 8.7 11.2 266.6 219.2 66,8 57.7 13 Liquidity Maintenance of a strong liquidity position is one the priority tasks of the bank. A high share of liquid assets and stable performance of the prudential ratios regulated by the National Bank of the Republic of Belarus ensure financial stability of the bank. Ratio 01.01.2013 01.07.2012 01.01.2012 01.07.2011 Instant liquidity, % (not less than 20%) 1 658,0 2 403.1 2 614.4 494.3 Current liquidity, % (not less than 70%) 387,9 1 231.2 425.5 192.5 Short-term liquidity, % (not less than 1.0) 5,7 4.7 4.1 1.9 14 Capital structure 01.01.2013 bln. BYR Equity 1. Core capital (Tier I capital) 216,64 2. Additional Tier II capital 69,77 3. Additional Tier III capital 0,00 Equity 286,42 Capital adequacy Paritetbank supports adequate capitalization level significantly above the prudential requirements of the National Bank of the Republic of Belarus 01.07.2011 01.01.2012 01.07.2012 01.01.2013 Capital adequacy ratio, % (not less than 8%) 23.3 23.2 30.7 38,4 Core capital adequacy ratio, % (not less than 4%) 18.2 16.8 17.8 23,8 15 Assets 01.07.2011 01.01.2012 01.07.2012 01.01.2013 Cash 22.89 34.71 37.77 39.26 Cash with the National Bank 258.60 459.11 361.41 342.13 Loans and advances to other banks 66.45 80.02 94.89 Securities 30.27 14.60 53.79 6.03 Loans to customers 441.58 455.86 391.07 506.69 Fixed and intangible assets 40.74 80.31 81.41 79.86 871.14 1 139.96 1 030.06 1 024.83 TOTAL assets 36.16 16 Credit portfolio 120.8 113.9 120.7 97.6 98.7 393.3 346.6 326.4 297.9 279.8 17 Credit quality 01.07.2011 01.01.2012 01.07.2012 01.01.2013 1.5 1.3 3.4 3.7 Impaired loans to loans to customers, % 0.1 0.9 1.2 0.5 Asset loss provision, bln. BYR 8.06 11.71 10.35 12.79 Loan loss provision, bln. BYR 7.38 11.17 9.75 12.32 Impaired assets to RWA, % no more than 8% 18 Liabilities 01.07.2011 01.01.2012 01.07.2012 01.01.2013 Due to the National Bank 131.80 132.72 81.11 82.24 Due to other banks 121.36 152.34 71.88 26.22 Due to customers 388.23 616.99 650.54 622.66 Securities issued by the bank 87.16 46.66 28.87 0.0 Other liabilities 5.19 6.79 3.73 3.95 733.75 955.51 836.13 735.07 TOTAL liabilities 19 Current accounts 1813 1698 1413 1493 1170 4024 3719 2943 3269 3501 Current accounts balances, bln BYR 01.01.2011 01.07.2011 01.01.2012 01.07.2012 01.01.2013 Total current accounts balance - BYR - foreign currency 29.03 33.96 43.88 59.32 77,38 25.59 27.59 35.77 48.12 65,09 3.44 6.37 8.11 11.20 12,29 20 Deposits, bln BYR 326 27 124.3 10.3 15.4 125.3 388.2 26.4 355.8 44.1 126 9.8 40.3 149.4 89.8 115.4 63.7 70.2 30.25 82.2 21 CONTACTS Address: 61A Kiseleva Str., 220002, Minsk, Republic of Belarus Telephone: +375 17 288-49-49 Fax: +375 17 288-63-32 Email info@paritetbank.by SWIFT: POIS BY 2X Telex: 252455 RANET.BY, 300 283 RANET.BY Reuters Dealing: PARI .................................................................................................................................................................... 22