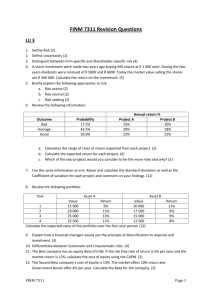

Ch 13, 14 Global Financing

advertisement

Eurocurrency Markets The Global Cost of Capital Global Equity Financing Global Debt Financing EUROCURRENCY MARKETS 2 Eurocurrencies • These are domestic currencies of one country on deposit in a second country – Example: a Eurodollar is a US dollar denominated deposit in a bank outside of the United States • Banks in which Eurocurrencies are deposited Eurobanks. • A Eurobank is a financial intermediary that simultaneously bids for time deposits and makes loans in a currency other than that of the country in which it located. • Eurobanks are major world banks that conducts a Eurocurrency business in addition to all other banking functions. • The Eurocurrency operation that qualifies a bank for the name “Eurobank” is in fact a department of a large commercial bank. 3 Eurocurrency Markets • Serve two valuable purposes: – Eurocurrency deposits are an efficient and convenient money market device for holding excess corporate liquidity – The Eurocurrency market is a major source of short-term bank loans to finance corporate working capital needs (including export and import financing) • A large international money market but “gently regulated” market, relatively free from governmental regulation and interference. – No reserve requirement – No deposit insurance 4 Eurocurrency Market U.S. internal credit market $ ¥ Japanese internal credit market Eurocurrencies external credit markets external credit markets £ U.K. internal credit market 5 Potential Confusion • Eurocurrencies deposits and loans in different currencies typically have “Euro” attached as a prefix; as in Eurodollars, Euroyen, Euromarks, and Europounds. • Don’t confuse Eurocurrencies with the European euro, the successor to the European currency unit. Euros are a currency. Eurocurrencies are deposits and loans in various currencies (including the euro). • Similarly, Eurobonds are NOT necessarily “bonds issued in euros.” – French corporate bond issued in France is not a Eurobond, although it is a euro bond--that is, a bond denominated in euros. 6 How the Eurocurrency is Created • Example: StarSpangle Corp., a manufacturer of bowls, has a time deposit maturing at Megasouth Bank in 2 business days, on Wed., August 27, 2013. • StarSpangle plans to invest the $1,000,000 principal of this time deposit in another time deposit for 1 year, and has been contacted by a German bank active in the Euromarkets, Volksbank, with an indication that they are paying 6.125% (6 1/8%) on 1 year Eurodollar time deposits. • Suppose this rate is better than on-going rate StarSpangle could get domestically. On Monday, August 25, 2013, StarSpangle agrees to deposit funds with Volksbank for 1 year. 7 Using Eurocurrency Deposits • Banks which take Eurocurrency deposits do so for several reasons: – To trade them in the interbank market. • Volksbank might redeposit the $1,000,000 it has just received with another bank, hopefully at a slightly higher interest rate. Banks active in the market stand ready to take deposits from other banks, and quote a bid rate, or to place deposits with other banks, and quote an offer rate. – To fund bank assets. • Volksbank might use the $1,000,000 it has acquired to fund a dollar loan to a German importer. 8 LIBOR • Eurocurrency Interest Rates: LIBOR – In the Eurocurrency market, the reference rate of interest is the London Interbank Offered Rate (LIBOR) – LIBOR is officially defined by the British Bankers Association (BBA). • U.S. dollar LIBOR is the mean of 16 multinational bank’s interbank offered rates as sampled by the BAA at 11 A.M. London time. – This rate is the most widely accepted rate of interest used in standardized quotations, loan agreements, and financial derivatives transactions. 9 U.S. Dollar-Denominated Interest Rates, June 2005 10 LIBOR (contd) • The Eurocurrency loan market has the narrow interest rate spread as small as 1% between the deposit rate and loan rate. • This is because the Eurocurrency market is a wholesale market, where deposits and loans are made in amounts of $500,000 or more. • Borrowers are usually large corporations or government entities that qualifies for low rates because of their credit standing. • Deposit rates are higher in the Eurocurrency markets because financial institutions offering Eurocurrency activities are not subject to many of the regulations and reserve requirements imposed on traditional domestic banks. • Also deposit insurance fees are not assessed on Eurocurrency. 11 THE GLOBAL COST OF CAPITAL 12 Why Cost of Capital is Important • We know that the return earned on assets depends on the risk of those assets (risk and return trade-off) • Our cost of capital provides us with an indication of how the market views the risk of our assets • Knowing our cost of capital can also help us determine our discount rate for capital budgeting projects – The firm uses it to discount future cash flows from investment to be made by the firm. That is, it is a rate in computing NPV. • Managers need to earn at least the cost of capital to compensate our investors for the financing they have provided. 13 Optimal Financial Structure • Most finance theorists are now in agreement about whether an optimal financial structure exists for a firm, and if so, how it can be determined. • When taxes and bankruptcy costs are considered, a firm has an optimal financial structure determined by that particular mix of debt and equity that minimizes the firm’s cost of capital for a given level of business risk. • The following exhibit illustrates that as the debt ratio increases, the overall cost of capital (kWACC) decreases because of the heavier weight of low-cost (due to tax-deductibility) debt ([kd(1-t)] compared to high cost equity (ke). 14 Weighted Average Cost of Capital • A firm normally finds its weighted average cost of capital (WACC) by combining the cost of equity with the cost of debt in proportion to the relative weight of each in the firm’s optimal long-term financial structure: kWACC = ke(E/V) + kd(1-t)(D/V) kWACC = weighted average after-tax cost of capital ke = risk-adjusted cost of equity kd = before-tax cost of debt t = marginal tax rate E = market value of the firm’s equity D = market value of the firm’s debt V = total market value of the firm’s securities (D+E) 15 The Cost of Capital and Financial Structure 16 Global Cost and Availability of Capital • Global integration of capital markets has given many firms access to new and cheaper sources of funds beyond those available in their home markets. • A firm that must source its long-term debt and equity in a highly illiquid domestic securities market will probably have a relatively high cost of capital and will face limited availability of such capital which will, in turn, damage the overall competitiveness of the firm. • If a firm is located in a country with illiquid, small, and/or segmented capital markets, it can achieve this lower global cost and greater availability of capital by a properly designed and implemented strategy. • Firms resident in countries with segmented capital markets must devise a strategy to escape dependence on that market for their long-term debt and equity needs. 17 Dimensions of the Cost and Availability of Capital Strategy 18 Improving Market Liquidity by Going Globally • Market liquidity (observed by noting the degree to which a firm can issue a new security without depressing the existing market price) can affect a firm’s cost of capital. • In the domestic case, a firm’s marginal cost of capital will eventually increase as suppliers of capital become saturated with the firm’s securities. • In the multinational case, a firm is able to tap many capital markets above and beyond what would have been available in a domestic capital market only. – Raising funds in the Euromarkets – Selling security issues abroad – Tapping local capital markets through foreign subsidiaries 19 Overcoming Market Segmentation by Going Globally • Market Segmentation arises from imperfections in the financial markets that preclude the smooth transfer of capital • Fundamental Question: Are securities priced relative to returns in their domestic market, or are they priced relative to an international market return? • No clear answer - depends on the degree of integration of the market with the rest of the world 20 Market Segmentation • Capital market segmentation is caused mainly by: – Asymmetric information – Lack of transparency – High transaction costs – Political risks (e.g., government controls over local markets) – Corporate governance issues – Regulatory barriers – Other political risks 21 Lowering the Cost of Capital by Going Globally • Where Diversification Advantages Arise – Diversification by industry – the smaller the country, typically, the less the choices for sectoral diversification • Response – global sectoral funds – Diversification by country or geographic region – distance, cultural differences may reduce correlation among investments (and therefore reduce the cost of capital) • Response – country or regional funds – Diversification by state of economic development – emerging market country returns may not be completely correlated with fully developed markets • Response – emerging markets funds 22 Correlation Matrix for Developed Countries 23 The Case for International Diversification 24 Do MNEs Have a Higher or Lower WACC Than Their Domestic Counterparts? 25 Optimal Financial Structure and the MNE • The domestic theory of optimal financial structures needs to be modified by four more variables in order to accommodate the case of the MNE. • These variables include: – Availability of capital – Diversification of cash flows – Foreign exchange risk – Expectations of international portfolio investors 26 Optimal Financial Structure and the MNE • Availability of capital: – A multinational firm’s marginal cost of capital is constant for considerable ranges of its capital budget – This statement is not true for most small domestic firms (as they do not have equal access to national capital markets), nor for MNEs located in countries that have illiquid capital markets (unless they have gained a global cost and availability of capital) 27 Optimal Financial Structure and the MNE • Diversification of cash flows: – The theoretical possibility exists that multinational firms are in a better position than domestic firms to support higher debt ratios because their cash flows are diversified internationally – As returns are not perfectly correlated between countries, an MNE might be able to achieve a reduction in cash flow variability (much in the same way as portfolio investors who diversify their security holdings globally) 28 Optimal Financial Structure and the MNE • Foreign exchange risk: – When a firm issues foreign currency denominated debt, its effective cost equals the after-tax cost of repaying the principal and interest in terms of the firm’s own currency – This amount includes the nominal cost of principal and interest in foreign currency terms, adjusted for any foreign exchange gains or losses – If a foreign currency is appreciated, it takes more domestic currency to pay off the foreign currency debt. 29 Optimal Financial Structure and the MNE • Expectations of International Portfolio Investors: – The key to gaining a global cost and availability of capital is attracting and retaining international portfolio investors – If a firm wants to raise capital in global markets, it must adopt global norms that are close to the US and UK norms as these markets represent the most liquid and unsegmented markets 30 Financial Structure of Foreign Subsidiaries • In addition to choosing an appropriate financial structure for foreign subsidiaries, financial managers of MNEs must choose among alternative sources of funds to finance the foreign subsidiary. • These funds can be either internal to the MNE or external to the MNE. • Ideally the choice should minimize the cost of external funds (after adjusting for foreign exchange risk) and should choose internal sources in order to minimize worldwide taxes and political risk. • Simultaneously, the firm should ensure that managerial motivation in the foreign subsidiaries is geared toward minimizing the firm’s worldwide cost of capital 31 Internal Financing of the Foreign Subsidiary 32 External Financing of the Foreign Subsidiary 33 Calculation of Trident’s Weighted Average Cost of Capital 34 Cost of Debt • The normal procedure for measuring the cost of debt requires a forecast of interest rates for the next few years, the proportions of various classes of debt the firm expects to use, and the corporate income tax rate. • The interest costs of different debt components are then averaged (according to their proportion). • The before-tax average, kd, is then adjusted for corporate income taxes by multiplying it by the expression (1-tax rate), to obtain kd(1-t), the weighted average after-tax cost of debt. 35 Cost of Equity • The capital asset pricing model (CAPM) approach is to define the cost of equity for a firm by the following formula: ke = krf + βj(km – krf) ke = expected (required) rate of return on equity krf = rate of interest on risk-free bonds (Treasury bonds, for example) βj = coefficient of systematic risk for the firm km = expected (required) rate of return on the market portfolio of stocks 36 International CAPM (ICAPM) • ICAPM assumes the financial markets are global, not just domestic. • Our WACC equation adjusts for new opportunities: keglobal = krfg + βjg(kmg – krfg) • The risk-free rate is unlikely to change much, but beta easily could change. 37 Estimating the Global Cost of Equity for Nestlé (Switzerland) 38 Cost of Equity • While the field of finance does agree that a cost of equity calculation should be forward-looking, practitioners typically use historical evidence as a basis for their forward-looking projections. • While the CAPM is widely accepted as the preferred method of calculating the cost of equity for a firm, there is rising debate over what numerical values should be used in its application (especially the equity risk premium). • This risk premium is the average annual return of the market expected by investors over and above riskless debt, the term (km – krf). • The equity risk premium varies internationally. 39 Equity Risk Premiums around the World, 1900–2002 40 Alternative Estimates of Cost of Equity for a Hypothetical U.S. Firm Assuming β = 1 and krf = 4% 41 Cost of Equity Arithmetic vs. Geometric Returns • There is less debate regarding the use of arithmetic returns over geometric returns. • The arithmetic mean is simply the average of the annual percentage changes, while the geometric man is the compounded growth rate from beginning to the end, without paying attention to the specific path taken in between. – The arithmetic average return answers the question: “What was your return in an average year over a particular period?” – The geometric average return answers the question: “What was your average compound return per year over a particular period?” • Arithmetic returns capture the year-to-year volatility in markets; geometric returns do not. • For this reason, most practitioners prefer the arithmetic measurement. 42 SOURCING EQUITY GLOBALLY 43 The Global Sources of Funds for International Firms • Sources of funds for international firms – Internal – retained earnings – External – debt/equity/loans/hybrids • The financing mix around the world – Firms use different capital structures globally – Internal capital generally utilized first – Equity and bond markets dominate the U.S.: • Most U.S companies tend to go public and raise capital in the marketplace. – Bond market dominates in Japan – Loans dominate in Europe: • Most European corporations tend to maintain private ownership, are undercapitalized and tend to rely on bank financing. 44 Sources of Long-Term Capital for a Multinational Corporation 45 Market Capitalization of the World Market • At year-end 2009, total market capitalization of the world’s equity markets stood at $48,713 billion. • Of this amount, 81 percent is accounted for by market capitalization of major equity markets from 29 developed countries. • The other 19% is accounted for by market capitalization of developing countries in emerging markets: – – – – Latin America Asia Eastern Europe Mideast/Africa 46 World Stock Market Capitalization 47 Market Capitalization as a Percentage of GDP 48 Recent Cross-Border Alliances of Stock Exchanges • Euronext represents the successful merger between Paris, Amsterdam, Brussels and Lisbon. • In 2007… – NYSE and Euronext merged. – Deutsche Boerse purchased 5% of the Bombay Stock Exchange. – Tokyo Stock Exchange announced an alliance with NYSE and the London Stock Exchange. 49 Designing a Strategy to Source Equity Globally • To implement the goal of gaining access to global capital markets a firm must begin by designing a strategy that will ultimately attract international investors. • Most firms raise their initial capital in their own domestic market. • However, most firms that have only raised capital in their domestic market are not well known enough to attract foreign investors. • Incremental steps to bridge this gap include conducting an international bond offering and/or cross-listing equity shares on more highly liquid foreign stock exchanges. 50 Crosslisting on Foreign Stock Exchanges 1. Reasons for Cross-listing 2. Barriers to Cross-listing 3. American Depositary Receipts 51 Reasons for Cross-Listing • To improve the liquidity of existing shares and to create a liquid secondary market for any new equity issues in the market – Liquidity refers to how quickly an asset can be sold without a major price concession • Increase its share price by attracting foreign investors and overcoming mis-pricing in a segmented and illiquid home capital market • To increase firm’s visibility to and acceptance by customers, suppliers, creditors, and/or host governments • To establish a secondary market for shares used in acquisitions in the host country • To create a secondary market for shares for use in options and other incentives for local managers and workers. 52 Barriers to Cross-Listing and Selling Equity Abroad • The most serious barriers of cross-listing includes the cost associated with the listing on the exchange such as – Listing fees – The future commitment to providing full and transparent disclosure of operating results and balance sheets – Increase cost of a continuous program of investor relations. • However, the worldwide trend toward requiring fuller, more transparent, and more standardized financial disclosure of operating results and balance sheet positions may have the desirable effect of lowering the cost of equity capital. 53 American Depositary Receipts (ADRs) • American depository receipts (ADRs) are negotiable certificates issued by a bank to represent the underlying shares of foreign stock, which are held in trust at a foreign custodian bank, • Represents foreign shares that are deposited with a U.S. bank which in turn issues ADRs in the name of the foreign company. • Traded in the United States and denominated in US dollars. • The price of a ADR generally tracks the price of the foreign security in its home market, adjusted for the ratio of ADRs to foreign company shares. • In the U.S, there are some 450 foreign companies listed on NYSE, representing over 10% of NYSE transaction volume. 54 Mechanics of American Depositary Receipts (ADRs) 55 Mechanics of Issuance of ADRs NYSE NASDAQ OTC U.S. Broker Broker orders shares for new ADR Foreign Broker Depository issues new ADR Foreign broker deposits shares Depository Depository receives confirmation of share deposit Broker buys existing ADR Delivery Place order ADR Investor Custodian Foreign broker buys shares Foreign Exchange 56 Types of ADRs 57 Volvo ADR • A good example of a familiar firm that trades in the U.S. as an ADR is Volvo AB, the Swedish car maker. • Volvo trades in the U.S. on the NASDAQ under the ticker VOLVY. – The depository institution is JPMorgan ADR Group. – The custodian is a Swedish firm, S E Banken Custody. • Of course, Volvo also trades on the Stockholm Stock Exchange under the ticker VOLVB. 58 Valuation of ADRs • For most ADRs, the price quoted by market makers is simply the home price of the share adjusted by the exchange rate. • Sold, registered, and transferred in the US in the same manner as any share of stock with each ADR representing some multiple of the underlying foreign share (allowing for ADR pricing to resemble conventional US share pricing between $20 and $50 per share). • ADRs can be exchanged for the underlying foreign shares, or vice versa, so arbitrage keeps foreign and US prices of any given share the same after adjusting for transfer costs. • Since the ADR market is less liquid, a large bid-ask spread is added. 59 ADRs - Advantages • Easy, direct, and cost efficient investment in foreign firms. – ADRs are traded during US trading hours. – Significant savings in trading costs and custody fees for US investors. – ADRs are issued in registered form, not bearer form. – For some ADRs issued by emerging market companies execution costs may be lower on U.S. than on local markets. – Simplification of payment of dividends and taxes on dividends. – Some ADRs issued by emerging market companies have larger trading volume on NYSE than in their home market. 60 ADRs – Advantages (contd) • Classified as a U.S. domestic security even though it represents ownership of a foreign security. • Dollar price reflects local price movements adjusted for change in the exchange rate. Arbitrage between the ADR and the underlying stock keeps prices in the two markets synchronized. • ADRs allow adjustment of the trading unit to an attractive trading range (see next slide). 61 Using the ADR to Create a Favorable Trading Range for a Stock • Example: Besto Corp. in the UK trades at GBP 2.00 per share. At the current exchange rate of $1.90/GBP, the share would trade at $3.80 per share. • One ADR is set to equal ten shares in Besto. The price of the ADR is • 10 x $3.80 = $38.00/ADR 62 ADRs - Disadvantages • Only a limited number of companies have issued ADRs and represent only a small proportion of foreign market capitalization. – Tend to be large companies in home country and thus do not offer full international diversification benefit. • The foreign company must provide detailed financial information to the sponsor bank, which is a burden to the company who is not familiar with U.S. security regulation. 63 Share of the Ten Largest Listed Companies in the National Market Capitalization 64 Execution Costs in Basis Points 65 ADRs - Summary • This is an excellent way to buy shares in a foreign company while realizing any dividends and capital gains in U.S. dollars. • However, ADRs do not eliminate the currency and economic risks for the underlying shares in another country. – For example, dividend payments in euros would be converted to U.S. dollars, net of conversion expenses and foreign taxes and in accordance with the deposit agreement. • For individuals, ADRs are an easy and cost-effective way to buy shares in a foreign company. – They save money by reducing administration costs and avoiding foreign taxes on each transaction. • Foreign entities like ADRs because they get more U.S. exposure, allowing them to tap into the wealthy North American equities markets. • In return, the foreign company must provide detailed financial information to the sponsor bank. 66 Top 10 Most Widely Held DRs 67 Global Registered Shares (GRSs) • While ADRs are quoted only in US dollars and traded only in the US, Global Registered Shares (GRSs) can be traded on equity exchanges around the globe in a variety of currencies • Simultaneously listed on several national markets. • Give firms access to a larger base of new capital. • London has proved to be very popular markets for depositary receipts. 68 Global Registered Shares • The merger of Daimler Benz AG and Chrysler Corporation in November 1998 created DaimlerChrysler AG, a German firm. The merger simultaneously created a new type of equity share, called Global Registered Shares (GRSs). • GRSs are traded globally, unlike ADRs, which are traded on foreign markets. • The company was renamed Daimler AG in October 2007 when it spun off Chrysler. The primary exchanges for Daimler GRSs are the Frankfurt Stock Exchange and the NYSE; however, they are traded on a total of 20 exchanges worldwide. • The shares are fully fungible—a GRS purchased on one exchange can be sold on another. They trade in both U.S. dollars and euro. 69 SOURCING DEBT GLOBALLY 70 Three Major International Debt Markets and Instruments 71 International Debt Markets • Bank loans and syndications: – International bank loans have traditionally been sourced in the Eurocurrency markets, there is a narrow interest rate spread between deposit and loan rates of less than 1%. – Eurocredits are bank loans to MNEs, sovereign governments, international institutions, and banks denominated in Eurocurrencies and extended by banks in countries other than the country in whose currency the loan is denominated. – The syndication of loans has enabled banks to spread the risk of very large loans among a number of banks (this is significant for MNEs as they usually need credit in an amount larger than a single bank’s loan limit). 72 International Debt Markets • The Euronote market: – Euronotes and Euronote facilities are short to medium in term and are either underwritten and non-underwritten – Euro-commercial paper is a short-term debt obligation of a corporation or bank (usually denominated in US dollars) – Euro medium-term notes is a new entrant to the world’s debt markets, which bridges the gap between Eurocommercial paper and a longer-term and less flexible international bond 73 International Debt Markets • The International Bond Market – Euro Bond • Denominated in one or more currencies • Traded in external markets outside the borders of the countries issuing the currencies • Euro bonds are not necessarily restricted to bonds sold in Euroland. – GM issues a dollar denominated bonds in Germany or Japan – US. dollar Eurobonds, yen Eurobonds, Swiss frac Eurobonds – Foreign Bond • • • • Issued in domestic market by a foreign borrower Denominated in domestic currency Marketed to domestic residents Regulated by domestic authorities – Yankee bonds: Toyota issues a dollar denominated bonds in U.S. – Samurai bonds: IBM issues a Yen denominated bonds in Japan 74 Types of Long-Term Debt Instruments • Straight fixed-rate issues – coupon fixed – Zero coupon bonds or coupon • Floating-rate notes – coupon based on base rate such as LIBOR or Euribor • Equity-related bonds – Convertible bond – convertible into a number of shares of equity – Warrant – grants the bondholder the right to purchase a certain amount of common stock at a specified price 75 Euro Bond • Underwritten by a multinational syndicate of banks • Issued by borrowers on the unregulated (or gently regulated) external capital markets outside the borders of the countries issuing the currencies. • The major types of instruments are: – Straight bonds with fixed coupons – Floating-rate notes (FRNs) with a coupon indexed on a short-term interest rate – Bonds with some equity feature (convertibles). • The euro is the major currency of issuance, followed by the dollar. 76 Characteristics of Euro Bond • Absence of regulatory interference – National governments often impose tight controls on foreign issuers of securities denominated in local currencies. However, governments in general have less stringent limitations for securities denominated in foreign currencies and sold within their markets (no SEC registration or waiting period). • Less stringent disclosure – Disclosure requirements less stringent than those of the SEC • Favorable tax status – Eurobonds offer tax anonymity and flexibility. Interest paid on Eurobonds is generally not subject to an income withholding tax 77 Characteristics of Euro Bond • Legal and Fiscal Aspects: – Bearer form (e.g., Eurobonds). • The bearer of the bond is assumed to be its legal owner. • Provide confidentiality of ownership. – Registered form (e.g., In the United States, owners must be registered in the issuer’s books) • Allows for easier transfer of interest payments and amortization. • Tax aspects – Avoiding double taxation was a major impetus behind the development of the international (Eurobond) market. – To attract foreign investors in their government bonds, most countries eliminate withholding taxes on foreign investment in their domestic bond markets. • Rating aspects – Traditionally unrated, but now almost all issues are rated by Moody’s and Standard & Poor’s 78 Withholding Taxes • Prior to 1984, the United States required a 30 percent withholding tax on interest paid to nonresidents who held U.S. government or U.S. corporate bonds. • The repeal of this tax led to a substantial shift in the relative yields on U.S. government and Eurodollar bonds. • This lends credence to the notion that market participants react to tax code changes. 79 International Bond Tombstone 80 Front Cover of the Offering Memorandum of the Hertz Junk Bond Issue Source: Courtesy Hertz Corporation 81 Hertz’s December 2005 Junk Bond Issues 82 Foreign Bond • Bonds issued by foreign borrowers on the regulated domestic capital markets of major developed countries for local investors. • Denominated in domestic currency and regulated by domestic authorities • Underwritten by a syndicate composed of members from a single country, sold principally within that country, and denominated in the currency of that country. The issuer, however, is from another country. – Yankee bonds: Toyota issues a dollar denominated bonds in U.S. – Samurai bonds: IBM issues a Yen denominated bonds in Japan – Rembrandt bonds (in the Netherlands), Matador bonds (in Spain), Bulldog bonds (in the UK) 83 Bearer Bonds and Registered Bonds • Bearer bonds are bonds with no registered owner. As such they offer anonymity, but they also offer the same risk of loss as currency. • Registered bonds are bonds where the owner’s name is registered with the issuer. • U.S. security laws require Yankee bonds sold to U.S. citizens to be registered, and to meet the requirements of the SEC, just like U.S. domestic bonds. • Many borrowers find this level of regulation burdensome and prefer to raise U.S. dollars in the Eurobond market. – Eurobonds sold in the primary market in the United States may not be sold to U.S. citizens. – Of course, a U.S. citizen could buy a Eurobond on the secondary market. 84 The World’s Bond Markets: A Statistical Perspective • The total market value of the world’s bond markets are about 50% larger than the world’s equity markets. • Size of world bond market is estimated to be $66 trillion at the start of 2007. • The U.S. dollar, the euro, the pound sterling, and the yen are the four currencies in which the majority of domestic and international bonds are denominated. • More domestic bonds than international bonds are denominated in the dollar (39 percent versus 36.2 percent) and the yen (17.9 percent versus 2.7 percent), while more international bonds than domestic bonds are denominated in the euro (47.5 percent versus 22.3 percent) and the pound sterling (8.2 percent versus 2.4 percent). 85 The World’s Bond Markets: A Statistical Perspective • Currency of denomination – – – – Dollar has been the dominant currency Euro is now the dominant currency Also pound, yen and Swiss franc Dual-currency bond • Issued and paying currency in one currency but paying back principal in another • Interest rate often higher • Combination between straight bond and long-term forward contract • Whether it is a good investment depends on movement of forex rate 86 Amounts of Domestic and International Bonds Outstanding Currency Domestic Percent International Percent Total Percent U.S. $ 25,064.1 39.0% 7,129.20 36.2% 34,493.6 38.2% Euro € 14,293.3 22.3% 12,387.6 47.5% 26,680.9 29.5% 1,559.5 2.4% 2,145.6 8.2% 3,705.1 4.1% Yen ¥ 11,521.5 17.9% 693.9 2.7% 12,215.4 13.5% Other 11,783.0 18.3% 1,422.5 5.5% 13,205.5 14.6% Total 64,221.9 100% 26,078.5 100% 90,300.4 100% Pound £ (As of Year-End 2009 in Billions of U.S. Dollars) 87 Domestic and International Bonds Outstanding 100 90 80 70 Domestic 50 International 40 Total Percentage 60 30 20 10 0 U.S. dollar Euro Pound (As of Year0End 2009 in Billions of U.S. Dollars) Yen Other Total Market Capitalization of International Bonds Total $17.6 trillion 89 The Size and Structure of the World Bond Market (in billions of U.S. dollars) 90 The Size and Structure of the World Bond Market (in billions of U.S. dollars) (cont.) 91 Top Arrangers of International Debt 92 The Internationalization of the World Bond Market 93