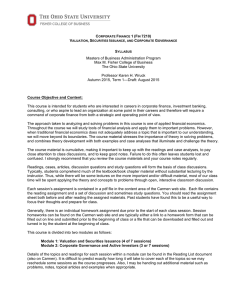

Tentative timeline

advertisement

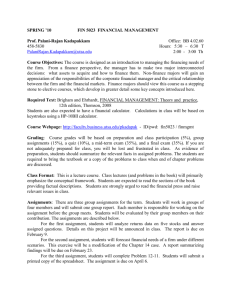

Syllabus Corporate Finance 7330 Prof. Nisan Langberg nlangberg@uh.edu Course Description This course offers a theoretical analysis of the decisions faced by corporate financial officers. In particular, both investment decisions (“capital budgeting”) and financial decisions (e.g., how to raise funds and how much to repay investors) are explored. Several more specialized topics may be covered if time permits, such as mergers and acquisitions, corporate governance and real options. My goal for this course is that at the end students will be able to apply state of the art techniques to solving the types of problems faced by managers making investment and financing decisions. Students will evaluate investment projects while taking into account uncertainty, tax consequences, and financing effects. Students will study the financial structure decision while taking into account taxes, bankruptcy costs, information signaling and conflicts of interest. Course Web Site Material will be posted on line. Students are encouraged to visit the class web site – specific URL will be provided in class. On the class web site students can find lecture notes beforehand – I recommend that students printout the class notes before they come to class each week. Also, handouts, announcements, and other class materials will be posted throughout the semester. Textbook The text book for the course is Corporate Finance by Jonathan Berk and Peter DeMarzo, Addison-Wesley, 1st or 2nd edition Another excellent text book is Principles of Corporate Finance by Richard Brealey, Stewart Myers, and Franklin Allen, McGraw-Hill, 8th edition (or higher), 2006 Most of the material covered in class can be found in the text book. The text book also contains numerous real life examples, exercise problems and additional topics in corporate finance that we will not cover in this course. Students might find the book useful for better understanding the material covered in class but also for in-depth coverage of other related topics. The text book is a good investment for all students that seek to work in the area of finance and have an interest in corporate finance. I have asked for the text book to be reserved in the library. Academic Honesty While encouraged to work in groups on homework assignments, I consider it a violation of academic honesty to sign one’s name to an assignment if the assignment was completed substantially by others. Homework Homework assignments are designed to practice the concepts that are covered in the lectures and in the readings. They also offer a chance for students to apply new concepts to more complicated situations than are appropriate for the lectures. It is recommended to work on the homework assignments in groups (of at most four people). Remember to visit the class web page to be current on the due dates. Late homework will not be accepted. If you are unable to attend class, you may submit homework via email any time prior to the beginning of class or you can slide it under my office door. If you send homework by email remember to write the homework and section numbers in the subject line. Office Hours I will hold office hours in my office upon appointment or you can approach me at the end of the class. I encourage you to email me any questions you may have to allow faster feedback. Grades The course grade will be based on homework assignments, discussion questions, and the case presentation (the breakdown by percentages will be provided in class). Discussion questions I will hand out discussion questions throughout the course. All discussion questions are answered via email and count as a bonus for the final grade. Course Outline A tentative time line is provided below. The actual material covered in class might change and the course might not eventually cover all the material intended due to time constraints. Tentative timeline Week July 11 July 18 July 25 August 1 Monday Wednesday Friday Topic: Introduction and Capital Budgeting Reading: Ch. 7 Topic: Capital structure in perfect capital markets (Modigliani Miller propositions) Reading: Ch. 14 Assignment: Discussion question DQ1 Topic: Practice questions (work in groups) Assignment: Homework 1&2 chapters 7/14 Topic: Capital structure with corporate tax and valuation of the Interest tax shield Reading: Ch. 15 Assignment: Discussion question DQ2 Homework 1&2 due Topic: Financial distress and the Asset substitution problem Reading: Ch. 16 Homework 3 due Topic: Capital Budgeting with Leverage Reading: Ch. 18 Assignment: Discussion question DQ3 Topic: Practice questions (work in groups) Assignment: Homework 3 chapters 15/18 Topic: Capital Budgeting and Leverage an example Reading: HBS case Whirlpool Europe Assignments: work in groups homework 4 chapter 16 Topic: work in groups Reading: HBS American Chemical Corporation Topic: Stock valuation exercise Reading: Ch. 9 Homework 4 due Topic: Student Presentations Assignment: HBS case American Chemical Corporation Case due