Where Angles Fear to Tread:

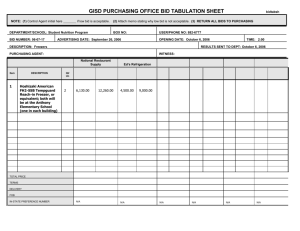

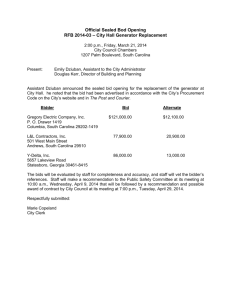

advertisement

Where Angels Fear to Tread: Maystar, Bradscot and correcting simple errors in arithmetic John Smith, MGS Legal Services ALOC Conference Nov. 2012 A fundamental principle in procurement law is that there has to be certainty as to price. In our practice price is entered on the Rate Bid Form. The question that we all get and dread is : ”There is a problem with the Rate Bid Form, what can we do?” • The most common problem is multiple prices. • The causes for multiple prices can range from pure confusion to pure mathematics. • Pure Confusion: variety of numbers listed which are unrelated • Pure Mathematics: errors where the error can be corrected by a matter of simple arithmetic recalculation or extension • Courts are reluctant to approve correction in the case of pure confusion; more willing to allow correction in the case of pure mathematics • The following slide is an example of what can result from confusion over pricing. • • • • • • • • • • • • Town of Newmarket will not appeal Maystar decision Newmarket and Maystar settle on damages claim NEWMARKET, Ontario, November 11, 2009 - On September 24, 2009, the Ontario Court of Appeal dismissed the Town of Newmarket's appeal regarding the May 6, 2008 Ontario Superior Court ruling involving Maystar General Contractors Inc. (Maystar). In a recent meeting, the Town of Newmarket Council decided not to appeal the Court of Appeal's decision, but rather to work towards a settlement with Maystar for damages. The Town of Newmarket negotiated a total settlement with Maystar for $2.5 million dollars, including damages and legal fees. "To avoid any further legal fees and contain costs, we felt it was in our best interest to negotiate a settlement with Maystar," says Newmarket Mayor, Tony Van Bynen. "We could have faced significantly higher legal damages." In September 2005, the Town received four bids from developers for the construction of the now-completed Magna Centre, including bids from Maystar and Bondfield. Maystar had the lowest unofficial bid of $35.5 million. During the evaluation process, the Town's consultants advised the Town that the Bondfield bid contained an arithmetic error on the GST calculation. When corrected, Bondfield had the lowest bid at $35.3 million. In December 2005, Maystar commenced a court application against the Town of Newmarket for breach of contract. On May 6, 2008, Justice Laurence Pattillo ruled in favour of Maystar. On May 27, 2008, Council decided to appeal the May 6 Ontario Superior Court decision. The Court of Appeal dismissed the appeal on the basis that the Town accepted a non-compliant bid. View the full decision from the Court of Appeal for more information. "The Town made its decision based on clear recommendations for the award of the tender," says Chief Administrative Officer, Bob Shelton. Unfortunately, the courts saw it differently, but did identify the difficult position the Town was in and that the Town acted in good faith." "We made our decisions in the best interest of our residents and our Town's future, says Mayor Tony Van Bynen. "We're glad to finally put this behind us. We have a state-of-the-art recreation complex, which our community has enjoyed for the past four years. With all things considered, we feel we have received a great deal of value from these facilities." Costs will be absorbed in the Town's 2009 budget. -30Media contact: Wanda Bennett, Manager of Corporate Communications Tel: 905-953-5300, ext. 2041 ? E-mail: wbennett@newmarket.ca • How did this happen? • It all started with a case called Bradscot (MCL) Ltd. v. Hamilton Wentworth Catholic District School Board (1999) 42 OR (3d) 723 • Bidder quoted the following prices: • 1) $17,720,000.00-Stipulated Price • 2) $1,240,000.00-GST • 3) $18,460,400.00-Total Bid Price (Stipulated price + GST) All of these figures are incorrectly calculated. • The Court found that there was no uncertainty that the Stipulated Price was the relevant price and the bid was compliant. • In the Town of Newmarket case, the following facts presented: • Bidder quoted these figures: • 1) $33,000,528.00-Stipulated Price • 2) $2,346,960.00-GST • 3) $35,874,960.00-Total Bid Price (GST+ Stipulated Price) • All of these figures are incorrectly calculated. • The legal advice to Newmarket, based on the Bradscot decision was to accept the Stipulated Price. • The Court found there was uncertainty as to price. Was the correct price the Stipulated Price or the Total Bid Price? The bid was found to be non compliant. • How does the Court distinguish Maystar from Bradscot ? • Court looked at the procurement documents, found that the Bradscot language was much clearer when describing which figure was to represent the bid price. • It found that the Stipulated Price was clearly the bid price and the GST and Total Bid Price were superfluous to the document. • The language in the RFP in Bradscot is: • • 2. I/WE OF BONDFIELD CONSTRUCTION COMPANY (1983)LIMITED (Firm Name) • Agree to supply all necessary labour, materials, plant, equipment and services • including specified allowances for the complete execution of the WORK, INCLUDING ALL TRADES, specified herein including Addenda numbered 1 to 7 inclusive. • AGREE to Complete the Work in accordance with the requirements of the Contract documents • including applicable Provincial Sales Tax for the Basic Stipulated Sum of: • SEVENTEEN MILLION SEVEN HUNDRED TWENTY THOUSAND • ($17,720,00) Canadian Dollars • • • • 3. TENDER AMOUNT SUMMARY AND GST X .1 BASIC Stipulated Sum Tender Amount: $17,200,000 (same as above) • .2 7% Federal GST to be added to Basic Stipulated • Sum Tender Amount: $ 1,240,000 • .3 OVERALL Stipulated Sum Tender Amount: $18,460,400 • (Line 3.1 + Line 3.2 = Line 3.3) • While the language in Maystar procurement documents is less clear. • The language is as follows: • 1.1 …Stipulated Price of "Thirty-three million Five Hundred twenty-eight " ($33,000,528.00) Dollars in lawful money of Canada, included in which are all Provincial Sales and Excise taxes, customs duties, freight, exchange, and all other charges, except Goods and Services Tax (GST). • 1.1.1: …Goods and Services Tax (GST): "Two million Three Hundred Forty-six Thousand Nine Hundred sixty" ($2,346,960.00) Dollars • 1.1.2: The total cost of the work (Stipulated Price + GST) is: • "Thirty-five million eight hundred Seventy-four Thousand nine hundred sixty." ($ 35,874,960.00) Dollars • In Maystar the court was unable to place the price figures in any order of importance. • The paragraph containing the pricing showed no obvious order of importance. • The language of the procurement contained references to “Total Bid Price” for various purposes which, to the court, meant that the Total Bid Price was essential to the bid. • The court found there were two potential answers, either the Stipulated Price or the Total Bid Price. • Since the GST calculation did not relate to either price, there was no way of recalculating in order to confirm one price, which left the court with two potential prices and uncertainty of price. • Pure Mathematics • Whitehorse (City) v. Ketza Construction Corp., [2009] Y.J. No. 174 • Ketza submitted the following figures • 1) $863,053.00- Total all items • 2) $52152.65-GST • 3) $915,205.65-Total Tender Price • This is a pure mathematics case. • The GST is not 5% of the Total All Items price, but the Total Tender Price is the sum of the GST and the Total All Items price. This is a clear mistake which can be corrected by a mathematical calculation. • The procurement documents said Total Tender Price would be used for price comparison. • Court dealt with this by saying that mathematical correction was permissible, because it was an accepted practice and was not unfair to any party • Privilege Clause In this case, the rfp document contained the usual privilege clause which warned the bidder the lowest bid would not necessarily be the winner and that it could accept a bid that was in the City’s best interest. However, the rfp document did not contain the other common privilege clause that permitted the purchaser to waive irregularities and informalities. The court found that since the addition of ;”..in the City’s best interest” was sufficient to justify the mathematical correction. • Now for a Pure confusion case: Vachon Construction Ltd. v. Cariboo (Regional District),[1996] B.C.J. No. 1409 (C.A.) The Rate Bid Form described the price in words as: “four hundred and eighty eight thousand four hundred and fifty dollars.” Following those words appeared the bracketed figure $492,450.00. • The purchaser called the bidder to confirm which was the correct bid. • The court found that the bid was uncertain because of the discrepancy between the description of prices and there was nothing the purchaser could do to correct the error without rendering the bid non compliant. • Here is a pure mathematics example: Foundation Building West Inc. v. Vancouver (City of) [1995] B.C.J. No. 861 Bidder was required to present 26 prices and a total price. The 26 prices were correct, but the addition of the total price was incorrect. • The bidder notified the purchaser of the mistake prior to the close of tenders, although not in compliance with the method of communication provided for in the tender documents. • The purchaser told the bidder that it corrected mathematical errors as a matter of course, although this was not specified in the tender documents. • The court found that it was not unreasonable for a purchaser to have a policy of correcting mathematical errors, even if the tender documents did not specifically provide for this. As long as this policy was applied to all bidders, the court saw no reason to declare the bid non compliant. • Privilege Clause • As in the Whitehorse decision above, the court looked at the privilege clause. • Unlike Whitehorse, the privilege clause contained language that specifically allowed the purchaser to waive any non compliance with the tender documents, specifications or conditions. • The Court relied upon the privileged clause to the extent that the error was a mere informality and all bidders would receive the same treatment. • This case characterizes an error of pure mathematics as an example of substantial compliance as contemplated in this passage from The Queen (Ontario) et al. v. Ron Engineering & Construction Eastern Ltd. (1981), 119 D.L.R. (3d) 267 (S.C.C.): • “It would be anomalous indeed if the march forward to a construction contract could be halted by a simple omission to insert in the appropriate blank in the contract the numbers of weeks already specified by the contractor in its tender.”