294a(skill based elective)

advertisement

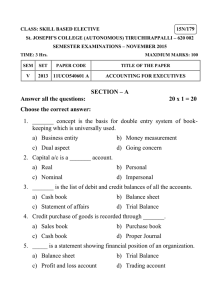

CLASS: U.G. SKILL BASED ELECTIVE – I 14N/294 St. JOSEPH’S COLLEGE (AUTONOMOUS) TIRUCHIRAPPALLI – 620 002 SEMESTER EXAMINATIONS – NOVEMBER 2014 TIME: 3 Hrs. MAXIMUM MARKS: 100 SEM SET PAPER CODE TITLE OF THE PAPER V 2012 11UCO540601A ACCOUNTING FOR EXECUTIVES SECTION – A Answer all the questions: 20 x 1 = 20 Choose the correct answer: 1. Cash a/c is a ______ account. a) Personal c) Real b) Representative personal d) Nominal 2. Which one of the following concepts states that a business is distinguished as a separate person from its owner? a) Business entity concept b) Money measurement concept c) Dual aspect concept d) Going concern concept 3. Which one of the following subsidiary books acts as a journal as well as a ledger a) Cash book b) Day book c) Invoice book d) Returns inward book 4. ______ is a list of balance of all the accounts and prepared at the end of the accounting period. a) Balance sheet b) Trial balance c) Profit and loss a/c d) Journal 5. Which one of the following is not debited to trading a/c? a) Purchase a/c b) Carriage inward a/c c) Wages a/c d) Carriage outward a/c Fill in the blanks: 6. 7. 8. ______ concept makes an assumption that business will go on forever. According to the rules of double entry system, debit ______ and credit ______ in the case of real accounts. Credit sales are recorded through ______ book. 9. In a trial balance, the total of debit balances must be equal to the total of ______ balances. 10. A ______ is a statement of assets and liabilities and prepared on a specified date. State True or False: 11. Capital is a personal account. 12. Purchase book is used to record all the cash and credit purchase of goods. 13. Nominal accounts include accounts of expenses and incomes. 14. Trial balance discloses all kinds of errors in book keeping. 15. Balance sheet is an account. Match the following: 16. Journal 17. Ledger - a) Nominal account - b) A statement 18. Subsidiary book - c) Return outward book 19. Trial balance - d) A main book 20. Profit and loss a/c - e) A book of primary entry SECTION – B Answer any FOUR questions: 21. Pass journal entries for the following transactions 4 x 20 = 80 2014 April 1 2 4 6 7 9 11 13 15 17 20 22 24 26 30 30 Started business with a capital of ` 2,00,000 Opened a bank account by depositing ` 1,50,000 Bought furniture and payment made in cash ` 20,000 Bought goods and payment made by cheque ` 50,000 Bought goods from Mary on credit ` 1,00,000 Sold goods for cash ` 35,000 Sold goods to Savita ` 1,25,000 Sold goods and cheque is received for the same ` 70,000 Goods returned by Savita ` 1,500 Goods returned to Mary ` 1,000 Paid Mary through cheque ` 6,000 and discount received from her ` 1,000 Received a cheque from Savita ` 75,000 and discount allowed to her ` 1,200 Paid wages ` 10,000 Paid rent ` 5,000 Cash withdrawn from office for personal use ` 6,000 Cash withdrawn from bank for office use ` 20,000 22. Record the following transactions in the journal and post them to the respective accounts in the ledger. 2014 June 1 Started business with a capital of ` 1,00,000 5 Goods bought from Sania on credit ` 75,000 10 Goods returned to Sania ` 500 15 Goods sold to Luka ` 1,00,000 17 Goods returned by Luka ` 750 20 Paid cash to Sania ` 50,000 discount received from her ` 500 25 Received cash from Luka ` 75,000 and discount allowed to her ` 1,000 23. Prepare a daybook and an invoice book from the following particulars and also post hem to the respective accounts in the ledger. 2014 June 1 Purchased 50 carpets from M/s Perumal and Co. at ` 100 each. Trade discount 10% 8 Sold 30 carpets to Rahim at ` 120 each. Trade discount 10% 14 Purchased 40 carpets from Palani trading co. at ` 90 each 20 Purchased 14 carpets from Tirupoor trading co. at ` 80 each 22 Sold 30 carpets to Ravi at ` 108 each 24 Sold 20 carpets for cash at ` 105 each 30 Bought 10 carpets for cash at ` 75 each 24. Prepare Trial Balance from the following balances of M/s Shankaran on 31-3-2014. ` Cash in hand 600 Capital 40,000 Salaries 28,000 Machinery 20,000 Purchase returns 2,000 Sales returns 1,000 Bad debts 400 Commission paid 2,200 Motor car 16,000 Insurance 800 Discount allowed 1,400 Sundry creditors 9,600 ` Cash at bank 9,400 Building 30,000 Rent 8,000 Purchases 1,48,000 Sales 2,80,000 Sundry debtors 30,000 Furniture 2,000 Rent and taxes 1,200 Opening stock 32,000 Discount received 1,000 General expenses 1,600 25. The following is the Trial Balance of Sundaram Picchai as on 31st March 2014. ` ` Opening stock 6,200 Creditors balance 82,920 Buildings 34,000 Sales 24,000 Furniture 2,000 Capital 6,000 Purchase 42,400 Bank loan 9,840 Salaries 4,400 Sundry creditors 840 Rent 1,200 Return outwards Miscellaneous expenses 1,000 Interest and Postage and stationery 1,080 dividend Wages 10,400 received 480 Freight on purchases 1,120 Carriage on sales 1,600 Repairs 1,800 Sundry debtors 12,000 Bad debts 240 Cash in hand 2,600 Return inwards 2,040 1,24,080 1,24,080 Closing stock ` 7,000. Prepare Trading and profit and loss a/c and a balance sheet as on 31.3.2014. **************